E-File Extension Form 8809 for Tax Year 2024

Get a 30-day extension to file W-2, 1099, ACA forms, and more for the 2024 tax year. File Form 8809 online with TaxZerone to quickly extend your filing deadline and avoid penalties.

Complete in 3 easy steps.

File IRS Form 8809 online for as low as just $4.99

Extend your 2024 tax filing deadline with a quick and simple online process

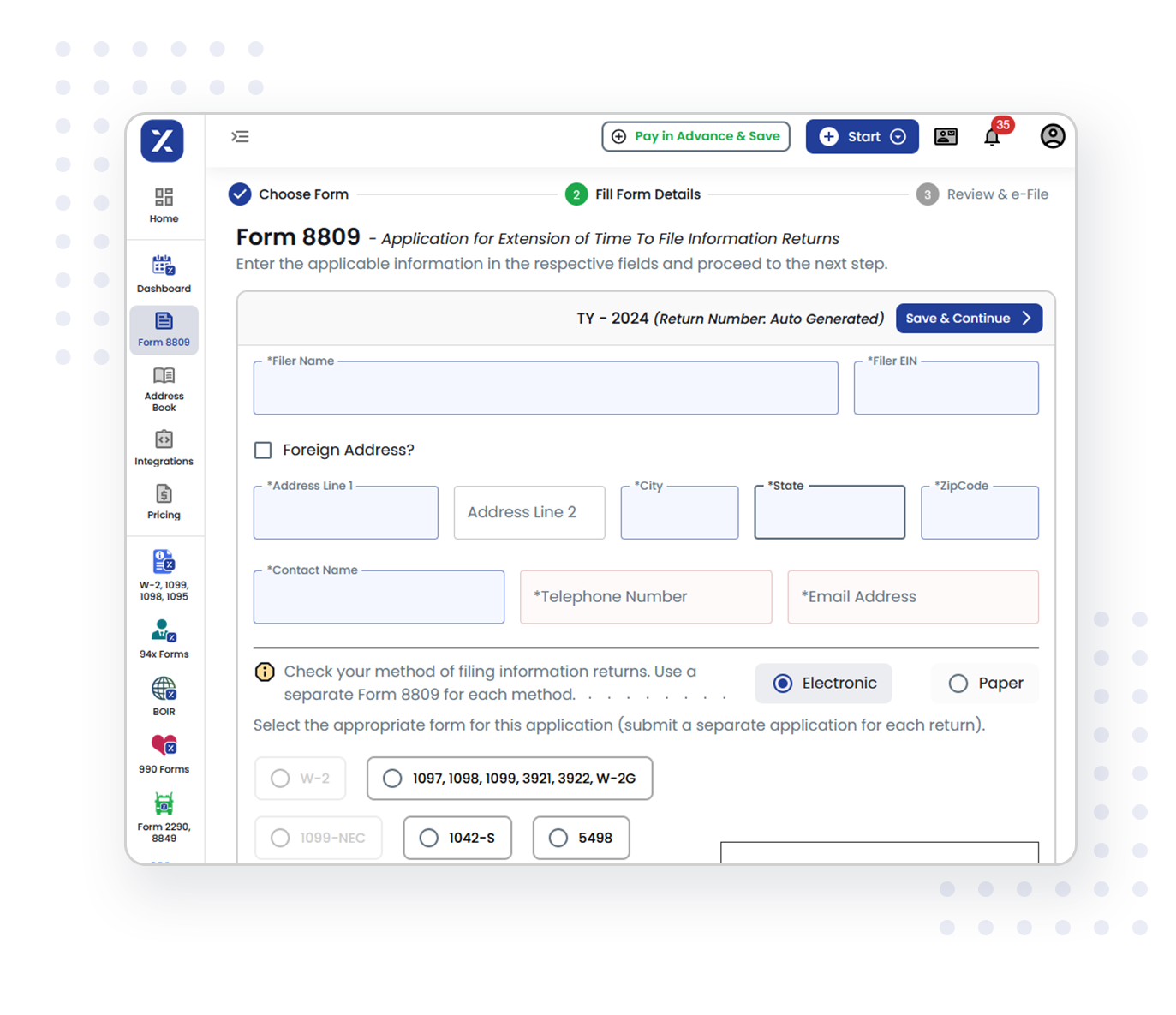

How to File Form 8809 Electronically for the 2024 Tax Year Using TaxZerone

Enter Payer/Filer Information

Enter the required details for the payer/filer, including their name, EIN, and business address.

Choose Your Required Tax Form

Select the specific information tax form you want to file (e.g., W-2, 1099, 5498, etc.), ensuring it matches the form for which you requested an extension.

Transmit the Return to the IRS

Review your details and submit your form online through TaxZerone. The system will process your IRS filing and confirm once it is complete.

Complete these steps with TaxZerone to request an extension and avoid penalties.

Complete in 3 Quick Steps

Forms you can extend using Form 8809 on TaxZerone

How TaxZerone Makes Filing Form 8809 Online Simple

Make Your 8809 Filing Quick and Easy with TaxZerone’s User-Friendly Features

IRS-authorized

File your Form 8809 with an

IRS-approved e-file service provider, so you can feel confident knowing your extension request will be accepted by the IRS, leaving you stress-free.

E-file in Minutes

Complete your Form 8809 e-filing in under 5 minutes! Just follow 3 easy steps, and your extension request will be filed.

File From Anywhere

Easily file your extension from any location using our cloud-based software.

Simplified Filing

With our step-by-step Form 8809 instructions, you can easily request your extension in just a few clicks. Assistance is available throughout the process.

Receive Instant Updates

Get real-time notifications on your extension status as soon as the IRS processes your Form 8809.

Free Resubmission

In case the IRS rejects your Form 8809 extension, you can quickly fix any mistakes and resend it without any additional cost.

Hear from Satisfied Small Business Owners

TaxZerone Made Filing So Much Easier!

- Keidy Torna

- Marian Eichlin

- Emily Oldham

File Your Extension with Confidence

Business owners trust TaxZerone for a fast, secure, and hassle-free filing process.

Start today to ensure you meet your deadlines with ease!

FAQs on Form 8868

1. What is Form 8809?

2. When is Form 8809 due?

Form 8809 is due by the original deadline for the information returns you are requesting an extension for. Typically, this is January 31 for forms reporting payments to individuals, or February 28 (paper) or March 31(electronic filing) for other returns. Form 8809 must be filed by the original due date to request a 30-day extension for filing.

3. When is Form 8809 due for different tax forms?

4. Do I need to submit any additional forms with Form 8809?

No, you do not need to submit any additional forms when filing Form 8809. It is an independent form used specifically to request an extension for filing information returns. Just ensure that you submit Form 8809 before the original filing due date for the extension to be granted.

5. Does 8809 apply to extending the time for recipient copies?

No. 8809 is for requesting an extension to file information returns with the IRS. It doesn't apply to extending the deadline for providing recipient copies.