Form 990-T Instructions

Excise Tax Forms

Employment Tax Forms

Information Returns

Extension Forms

FinCEN BOIR

General

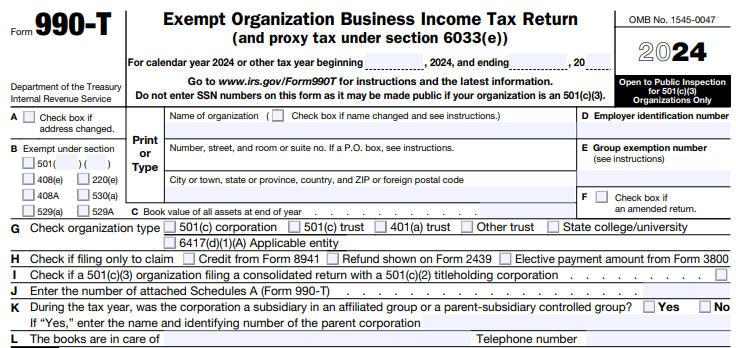

The following information is required to complete and file IRS Form 990-T:

- The organization's name, EIN, address, and phone number.

- Relevant information on any address changes, name changes, or amended returns.

- Group exemption number.

- Organization's tax-exempt status.

- If you are only filing Form 990-T to claim a credit from Form 8941 and/or to claim a refund shown on Form 2439, be sure to provide the relevant details.

- Form of organization.

- The fair market value of all assets at the end of the year.

- Schedule A details attached with Form 990-T.

Items A through L

Item A - Address Change

If the organization has changed its address since it last filed a return, check item A.

If a change in address occurs after the return is filed, you must user Form 8822-B, Change of Address or Responsible Party — Business, to notify the IRS of the new address

Item B - Tax Exemption

Check the box under which the organization receives its tax exemption.

- Qualified pension, profit-sharing, and stock bonus plans should check the 501 box and enter “a” between the first set of parentheses. Do not make an entry in the space between the second parentheses.

- For other organizations exempt under section 501, check the box for 501 and enter the section that describes their tax-exempt status, for example, 501(c)(3).

- For tax-exempt organizations that don't receive their exemption under section 501, use the following guide.

| IF you are a | THEN check this box |

|---|---|

| IRA, SEP, or SIMPLE | 408(e) |

| Roth IRA | 408A |

| Archer MSA | 220(e) |

| Coverdell ESA | 530(a) |

| Qualified State Tuition Program | 529(a) |

| Qualified ABLE Program | 529A |

Public colleges and universities that have not obtained recognition of exemption under section 501(c)(3), and section 6417(d)(1)(A) applicable entities that are not described in section 501(a) should not check any box in item B.

Item C - Enter here the total of the end-of-year assets from the organization's books of account.

Item D - Employer identification number

Enter your organisation’s employer identification number (EIN).

An EIN may be applied for in one of the following ways.

- Online. Go to IRS.gov/EIN. The EIN is issued immediately once the application information is validated.

- By mailing or faxing Form SS-4, Application for Employer Identification Number.

Item E - Group exemption number

If the organization is covered by a group exemption, enter the group exemption number.

Item F - Amended Return

Check the box if the organization previously filed a Form 990-T return with the IRS for a tax year and is now filing another return for the same tax year to amend the previously filed return.

Item G - Organization type

Check the box that describes your organization to the best

- Check the box for "6417(d)(1)(A) Applicable entity" only if no other checkbox on this line applies.

- “Other trust” includes IRAs, SEPs, SIMPLEs, Roth IRAs, Coverdell ESAs, and Archer MSAs.

- “Other trust” includes IRAs, SEPs, SIMPLEs, Roth IRAs, Coverdell ESAs, and Archer MSAs.

Item H - Check the box if you're filing Form 990-T only to claim a credit from Form 8941, to claim a refund shown on Form 2439, or to claim the elective payment election amount from Form 3800.

Item I - Check if you are a 501(c)(3) organization filing a consolidated return with a 501(c)(2) title holding corporation.

Item J - Schedule A

Enter the total number of Schedules A attached to Form 990-T. An organization with one or more unrelated trades or businesses will complete a separate Schedule A for each unrelated trade or business.

Item K - Check “Yes” box if your organization is a corporation and either (1) or (2) below applies.

- The corporation is a subsidiary in an affiliated group (defined in section 1504) but isn't filing a consolidated return for the tax year with that group.

- The corporation is a subsidiary in a parent-subsidiary controlled group (defined in section 1563).

Excluded member

If the corporation is an "excluded member" of a controlled group (see section 1563(b)(2)), it is still considered a member of a controlled group for purposes of item K.

Item L - Enter here the name and address of the person who has the organization's books and records and the telephone number at which they can be reached.

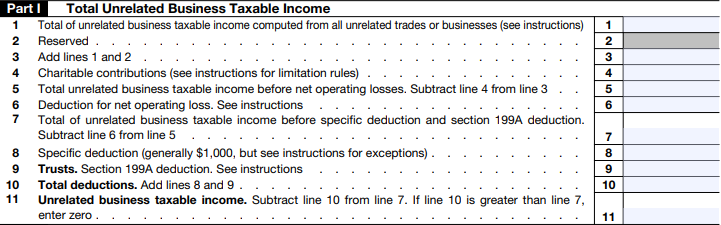

Part I - Total Unrelated Business Taxable Income

Line 1 - Enter here the sum of the positive amounts from all Schedules A (Form 990-T), Part II, line 18.

However, don’t include any amount from Schedule A (Form 990-T), Part II, line 18, that is less than zero in the computation of total unrelated trade or business income reported on Part I, line 1.

Line 2 - This line is reserved. Do not enter any amount on this line.

Line 3 - Add lines 1 and 2 and enter the sum value here

Line 4 - Charitable Contributions

Enter contributions or gifts actually paid within the tax year to or for the use of charitable and governmental organizations described in section 170(c). Also, enter any unused contributions carried over from earlier years.

Line 5 - Subtract line 4 from line 3. The difference value is the Total unrelated business taxable income before net operating losses.

Line 6 - Deduction for Net Operating Loss Arising in Tax Years Beginning Before 2018

Enter the smaller of (a) the amount of NOL arising in tax years beginning before January 1, 2018, or (b) the amount shown on Part I, line 1.

Line 7 - Subtract line 6 from line 5. The difference value is the Total of unrelated business taxable income before specific deduction and section 199A deduction

Line 8 - Specific Deduction

A specific deduction of $1,000 is allowed except for computing the NOL and the net operating loss deduction under section 172.

An organization can usually claim only one $1,000 deduction for all its unrelated businesses.

However, a diocese, religious province, or church associationcan claim one $1,000 deduction for each local unit (like a parish or district) if the units are not separately incorporated.

- The deduction for each unit is the smaller of $1,000 or the unit’s gross unrelated business income.

- If claiming more than $1,000 total, you must attach a list showing each unit’s name, income, and deduction.

Line 9 - Trusts

Section 199A Deduction (For trust filers only)

If you are a trust filing Form 990-T and have unrelated business income, you may have Qualified Business Income (QBI) and may be allowed a QBI deduction under section 199A.

For purposes of calculating the QBI deduction, the taxable income before the QBI deduction is the amount reported on Part I, line 7, minus the amount reported on Part I, line 8.

Line 10 - Total deductions

Add lines 8 and 9 and enter the sum value in this line.

Line 11 - Unrelated business taxable income

Subtract line 10 from line 7. If line 10 is greater than line 7, enter zero in this line.

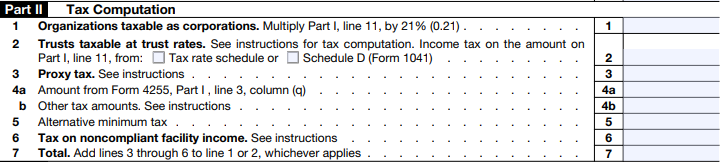

Part II - Tax Computation

Line 1 - Organizations taxable as corporations.

Multiply Part I, line 11, by 21% (0.21) and enter the value in this line.

Line 2 - Trusts taxable at trust rates.

Trusts exempt under section 501(a) are taxed like regular trusts using trust tax rates. This also applies to employee trusts under section 401(a).

- Most trusts calculate tax on UBTI (Unrelated Business Taxable Income) using the Tax Rate Schedule for Trusts.

- If using the schedule, enter the tax on Part II, line 2 of Form 990-T and check the "Tax rate schedule" box.

- If the trust qualifies for special rates on capital gains and dividends, use Schedule D (Form 1041) instead. Enter that tax on Part II, line 2 and check the "Schedule D" box, attaching Schedule D.

Line 3 - Proxy tax

Most exempt organizations (except 501(c)(3) groups) must report lobbying expenses on Form 990. If they don't properly notify members about the part of dues used for lobbying or political activities, they must pay a proxy tax.

- To pay it: enter the tax on Part II, line 3 of the form and attach a calculation statement.

- The proxy tax is 21% of the amount not disclosed in the notices.

- No deductions are allowed.

- See Form 990 instructions and Rev. Proc. 98-19 for details and exceptions.

Line 4a - Enter the amount from Form 4255, Part I, line 3, column (q).

This line is intended to capture any positive tax amount that doesn’t have a specific line. An MeF (Internet filing) dependency (attachment) captures the detail. Use line 4 to report tax amounts not reported on a specific line in Part II (excluding tax deferred under section 1294, which is included on Part III, line 4).

Use this line to report:

- The base erosion minimum tax from Form 8991 (for certain large corporations making payments to foreign affiliates).

- Tax and interest from a nonqualified withdrawal from a capital construction fund.

- The deferred tax on an excess distribution from a passive foreign investment company (PFIC) (from Form 8621).

- Any tax increase from a partner's audit adjustments(reported using Form 8978).

(If there’s a decrease, report it separately in Part III.)

Unless otherwise indicated, when reporting deferred tax on line 4, don't include interest on the tax amount. Instead, report such interest as an “other amount due” on Part III, line 3. For example, interest on tax deferred under section 1291(c)(1), determined under section 1291(c)(3) is reported on Part III, line 3.

How to report. Attach a statement to Part II, line 4, showing (a) a brief description of the type of tax, and (b) the amount. For example, if the organization is reporting $100 of tax due from an increase in tax attributable to a partner's audit liability (Form 8978), the attachment would show “Form 8978” and “$100.”

Line 5 - Alternative minimum tax

- Organizations liable for tax on unrelated business taxable income may be liable for alternative minimum tax.

- Trusts attach Schedule I, Alternative Minimum Tax–Estate and Trusts, and enter any tax from Schedule I on this line.

- Corporations may need to complete Form 4626, Alterative Minimum Tax–Corporation, and enter any tax from Form 4626 on this line. You may need to file Form 4626 with your tax year 2024 Form 990-T.

Line 6 - Tax on Noncompliant Facility Income

If a hospital doesn7apos;t meet certain rules, it has to pay a separate income tax on that facility’s income. This is different from the excise tax reported on Form 4720 for not completing a community health needs assessment.

Line 7 - Add Part II, lines 3, 4, 5, and 6, to Part II, line 1 or 2, whichever applies and enter the sum value in this line.

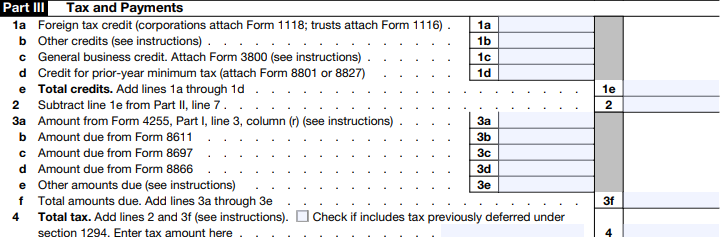

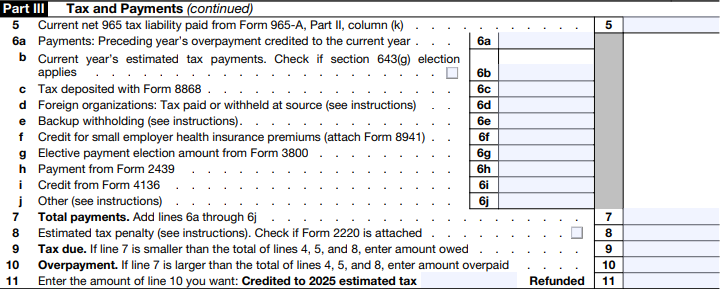

Part III - Tax and Payments

Line 1a - Foreign tax credit

- Corporations. See Form 1118, Foreign Tax Credit—Corporations, for an explanation of when a corporation can claim this credit for payment of income tax to a foreign country or U.S. possession.

- Trusts. See Form 1116, Foreign Tax Credit (Individual, Estate, or Trust), for rules on how the trust computes the foreign tax credit.

Complete the form that applies to the organization and attach the form to Form 990-T. Enter the credit on this line.

Line 1b - Other credits

Use this line to report nonrefundable credits that aren’t listed elsewhere in Part III, line 1. Attach a statement showing the form and credit amount.

Examples of such credits:

- Qualified Electric Vehicle Credit from prior years (Form 8834, line 7 — attach Form 8834).

- Credit for holders of tax credit bonds (Form 8912, line 12).

- Decrease in taxes due from partnership adjustments (Form 8978, line 14 — attach

Form 8978).

Line 1c - General Business Credit

Enter the organization's total general business credit (excluding the work opportunity credit, the employee retention credit, the empowerment zone employment credit, and the credit for employer differential wage payments).

The organization is required to file Form 3800, General Business Credit, to claim any business credit. For a list of credits, see Form 3800. Include the allowable credit from Form 3800, Part II, line 38, on Form 990-T, Part III, line 1c.

Line 1d - Credit for prior-year minimum tax

Use Form 8801 to figure the minimum tax credit and any carryforwards of that credit for trusts. For corporations, use Form 8827.

Line 1d - Credit for prior-year minimum tax

Use Form 8801 to figure the minimum tax credit and any carryforwards of that credit for trusts. For corporations, use Form 8827.

Line 1e - Total Credits

Add lines 1a through 1d and enter the sum value in this line.

Line 2 - Subtract line 1e from Part II, line 7 and enter the difference here.

Line 3a - Enter the amount from Form 4255, Part I, line 3, column (r).

Line 3b - If the corporation got a low-income housing credit but later disposed of the property or reduced its qualified basis without following proper steps, it might owe a tax. Use Form 8611 to calculate it.

Line 3c - If the corporation used the percentage-of-completion method for long-term contracts, it may owe or get interest back. Use Form 8697 to figure it out.

Line 3d - If the corporation used the income forecast method to depreciate property, it may owe or get interest back. Use Form 8866 to figure it out.

Line 3e - Other Amounts

If the organization has extra amounts due (like certain types of interest or tax from shipping activities), they should be included in Part III, line 3. Check the “Other” box and attach a statement explaining the details.

Examples include:

- Interest on deferred taxes from installment sales of time-shares, residential lots, or nondealer installment obligations.

- Interest on deferred gains.

- Tax on income from qualifying shipping activities (use Form 8902).

How to report - If the organization checks "Other" on Part III, line 3e, they must attach a statement that:

- Shows how each amount was calculated.

- Lists:

- the related Code section or form number,

- the type of tax or interest, and

- the amount.

- Example:

- “Section 30 — QEV recapture tax — $100.”

Line 4 - Total Tax

Include any deferred tax on the termination of a section 1294 election applicable to shareholders in a qualified electing fund (QEF) in the amount entered on Part III, line 4. See Form 8621, Part VI, and How to report, later.

Subtract from the total entered on Part III, line 4, any deferred tax on the corporation's share of undistributed earnings of a QEF. See Form 8621, Part III.

How to report

Attach a statement showing the computation of each item included in, or subtracted from, the total on Part III, line 4. Specify (a) the applicable Code section, (b) the type of tax, and (c) the amount of tax.

Line 5 - Section 965

Corporation:

- After 2021, corporations no longer report new Section 965(a) inclusions

- If paying Section 965 tax in installments, attach Form 965-B to Form 990-T.

- Pay the current installment separately (using a special voucher sent by mail).

- Do not include this payment in Part III (Tax and Payments) of Form 990-T.

Trust

- If a trust has current-year Section 965 tax, report it on line 5 using Form 965-A.

- If paying installments (but no new liability), attach Form 965-A but do not include the installment in Part III (same as corporations).

Line 6a Payments - Enter here the preceding year’s overpayment credited to the current year.

Line 6b - Estimated Tax Payments

Enter the total estimated tax payments made for the tax year.

If an organization is the beneficiary of a trust, and the trust makes a section 643(g) election to credit its estimated tax payments to its beneficiaries, include the organization's share of the estimated tax payments in the total amount entered here. Also, attach a statement showing the amount of the section 643(g) credit amount.

Line 6c - Enter the tax deposited with Form 8868.

Line 6d - Foreign Organizations

Enter the amount of U.S. tax withheld on UBTI (Unrelated Business Taxable Income) that isn't connected to a U.S. trade or business. Attach Form 1042-S or a similar form to show proof of the withheld tax reported on Part III, line 6d.

Line 6e - Backup Withholding

If your organization is exempt but was wrongly subject to backup withholding (because the payer didn’t have your correct tax ID), you can claim a credit for the withheld amount by reporting it on this line.

Line 6f - Credit for Small Employer Health Insurance Premiums

A tax-exempt organization under section 501(c) can claim a refundable credit for part of the health insurance premiums it pays for employees. To get the credit, the organization must file Form 8941 and keep records to support the amount claimed.

- Fill in the heading (the area above Part I) except items J and K. Check the box for “Credit from Form 8941” in item H .

- Enter -0- on Part I, line 11, and Part III, line 4.

- Enter the credit from Form 8941, line 20, on Part III, line 6f.

- Complete Part III, lines 7, 10, and 11, and the signature area.

Line 6g - Elective Payment Election

Enter here the total net elective payment election amount from Form 3800, Part III, line 6, column (j).

Line 6h - Tax on Undistributed Long-Term Capital Gain by RIC or Reit

Enter the tax paid by a regulated investment company (RIC) or real estate investment trust (REIT) on any undistributed long-term capital gains. You need to attach each Form 2439 you received from the RIC or REIT where you hold shares. If you're filing a composite Form 990-T, refer to the "Composite Form 990-T" section for specific instructions.

Line 6i - Credit for Federal Excise Tax Paid on Fuels

If your organization paid a federal excise tax on certain fuels and qualify for any of the credits listed below, attach Form 4136 to your return and enter the total credit on line 6i.

- The biodiesel or renewable diesel mixture credit.

- The alternative fuel credit.

- A credit for certain nontaxable uses (or sales) of fuel during your income tax year.

- A credit for blending a diesel-water fuels emulsion.

- A credit for exporting dyed fuels or gasoline blendstocks.

- Substainable aviation fuel (SAF) credit.

Line 6j - Other Credits

For other credits, check the “Other” box and provide the following information:

- The number of the form used to calculate the credit, or the code section that establishes the credit,

- A brief description of the credit, and

- The amount of the credit.

If necessary, provide information required to claim a specific credit in Part V, Supplemental Information.

Other credits may include the following:

- The credit for ozone-deleting chemicals. Include any credit the organization is claiming under section 4682(g) for taxes paid on chemicals under as propellants in metered-dose inhalers.

- The amount of current year net section 965 tax liability, For a trust, this amount will be from Form 956-A, Part I, column (d), line 4.

Line 7 - Total payments

Add lines 6a through 6j and enter the sum value in this line.

Line 8 - Estimated Tax Penalty

Use Form 2220 to check if your organization owes a penalty for underpaying estimated taxes. Normally, you don’t need to file it because the IRS will calculate any penalty. But you must complete and attach Form 2220 if:

- You’re using the annualized income or seasonal installment method, or

- You’re a large organization using last year’s tax to figure your first payment.

If you attach Form 2220, check the box on Form 990-T, Part III, line 8, and enter the penalty amount there.

Line 9 - Tax Due

You must pay the tax in full when the return is filed. You may pay by EFTPS. For more information about EFTPS, see Electronic Deposit Requirement, earlier. Also, you may pay by credit or debit card.

Line 10 - Overpayment

If line 7 is larger than the total of lines 4, 5, and 8, enter here the amount overpaid.

Line 11 - Enter the amount of line 10 you want: Credited to 2025 estimated tax.

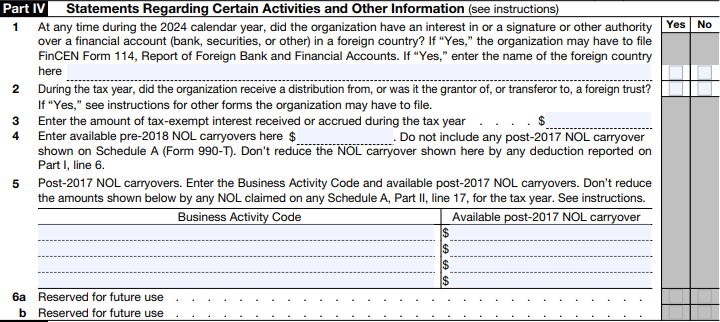

Part IV - Statements Regarding Certain Activities and Other Information

Line 1 - Check “Yes” if either item (1) or (2) below applies.

- At any time during the year the organization had an interest in or signature or other authority over a financial account in a foreign country (such as a bank account, securities account, or other financial account); and

- The combined value of the accounts was more than $10,000 at any time during the year; and

- The accounts were not with a U.S. military banking facility operated by a U.S. financial institution.

- The organization owns more than 50% of the stock in any corporation that would answer “Yes” to item (1).

If the “Yes” box is checked, write the name of the foreign country or countries. If the list of foreign country names will not fit in the available space, continue the list in Part V, Supplemental Information.

Check if the organization has control over or an interest in a foreign financial account. If it does, file FinCEN Form 114 (FBAR) electronically through the BSA E-Filing System — not with Form 990-T, since it's not a tax form.

Line 2 - The organization may be required to file Form 3520, Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts, if either of the following applies.

- It directly or indirectly transferred money or property to a foreign trust. For this purpose, any U.S. person who created a foreign trust is considered a transferor.

- It is treated as the owner of any part of the assets of a foreign trust under the grantor trust rules.

Line 3 - Report any tax-exempt interest received or accrued in the space provided. Include any exempt-interest dividends received as a shareholder in a mutual fund or other RIC.

Line 4 - Use line 4 to show the amount of the NOL carryover to the tax year from tax years prior to 2018 (“pre-2018 NOL”), even if some of the loss is used to offset income on this return. The amount to enter is the total of all pre-2018 NOLs generated in any year prior to 2018, and not used to offset income (either as a carryback or carryover) to a tax year prior to 2024.

However, do not reduce the amount by any NOL deduction reported on Part I, line 6.

Line 5 - In this line, list each NOL (Net Operating Loss) from separate trades or businesses after 2017.

- In the first column, write the business activity code for each business.

- In the second column, write the full unused NOL amount for each business (from after 2017 and before 2024).

- Important:

- Include all businesses, even if you didn’t file a Schedule A for them this year.

- Report the total available NOL — don't reduce it by what you’re using this year.

Also, if a business activity code changes, special rules apply for its NOLs (check the "Separate Trades or Businesses" section for details).

Lines 6a and 6b - are reserved for future use.

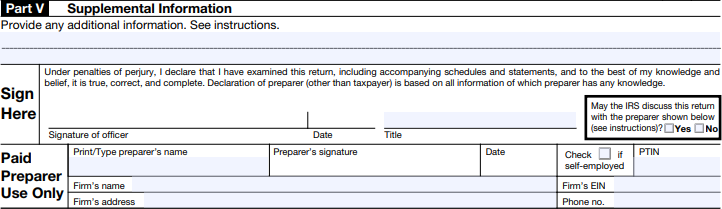

Part V - Supplemental Information

Use Part V to provide the IRS with narrative information required for responses to specific questions on Form 990-T, and to explain the organization’s operations or responses to various questions.

Signature

Corporations: The return must be signed and dated by a corporate officer (e.g., president, treasurer, or tax officer). If a receiver, trustee, or assignee is filing, they must sign too.

Trusts: The return must be signed and dated by the fiduciary or an authorized officer. If there are multiple fiduciaries, any one of them can sign.

IRA Trusts (Special Rule): Trustees can use a facsimile (stamped) signature if they

- Send a signed letter to the IRS confirming the use of the facsimile.

- List all returns with trust names and EINs.

- Make no changes to the return after signing (except correcting math errors)

- Keep a manually signed copy of the letter and corrections for IRS inspection.

Paid preparer

Anyone who is paid to prepare the return must sign the return, list the preparer taxpayer identification number (PTIN), and fill in the other blanks in the Paid Preparer Use Only area unless that person is paid for preparation as part of their duties as your employee

The paid preparer must:

- Sign the return in the space provided for the preparer's signature;

- Include their Preparer Tax Identification Number (PTIN); and

- Give a copy of the return to the organization.

Paid Preparer Authorization

If the organization checks "Yes" in the signature section, it allows the IRS to discuss the return with the individual paid preparer who signed it (not the whole firm). The IRS can:

- Ask the preparer for missing info,

- Give updates about processing, refund, or payment,

- Talk about certain notices (like math errors).

Limits

The preparer can't get refunds, make decisions for the organization, or represent it before the IRS. The permission ends automatically by the due date of next year’s Form 990-T and can't be revoked early. For broader authorization, see IRS Pub. 947, Practice Before the IRS and Power of Attorney.

Looking to file Form 990-T online?

File your IRS Form 990-T electronically through TaxZerone for just $129.99 per return.