Excise Tax Forms

Employment Tax Forms

Information Returns

Extension Forms

Business Tax Forms

FinCEN BOIR

General

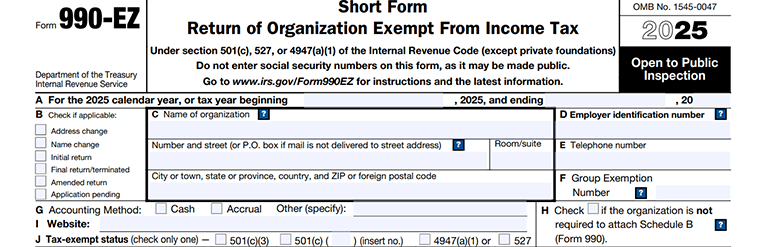

What is IRS Form 990-EZ?

IRS Form 990-EZ, officially titled " Short Form Return of Organization Exempt From Income Tax," is a simplified tax return designed for smaller tax-exempt organizations with gross receipts less than $200,000 and total assets less than $500,000 at the end of their tax year.

Form 990-EZ provides information on the organization's mission, programs, and finances, offering transparency to the public and the IRS about its operations.

File your 990 series returns fast with TaxZerone and get 10% off—use code TZOTE10 at checkout!

We support tax years 2025, 2024, and 2023.

Who must File Form 990-EZ?

To file Form 990-EZ, your exempt organization must meet the following criteria:

- Tax-Exempt Status: You must hold a valid tax-exempt status under sections 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except for private foundations).

- Gross Receipts and Assets: Your organization's gross receipts for the year must be less than $200,000, and your total assets at the end of the tax year must be less than $500,000.

When is Form 990-EZ due?

Exempt organizations must file Form 990-EZ on the 15th day of the 5th month after the organization's tax year ends. For calendar year filers, this means Form 990-EZ is due on May 15th of the following year.

However, if the due date falls on a weekend or a legal holiday, the filing deadline is extended to the next business day. Extensions can be requested if needed.

Worried about not being able to file your 990 return on time?

E-file Form 8868 and get an extension of up to 6 months to file your 990-EZ return.

Form 990-EZ penalty

The IRS imposes penalties based on the organization's annual gross receipts:

Organizations With Gross Receipts of $1,309,500 or Less

- The penalty is $25 per day for each day the return is late.

- The maximum penalty is the lesser of $13,000 or 5% of the organization’s gross receipts for the year.

Organizations With Gross Receipts Over $1,309,500

- The penalty increases to $130 per day.

- The maximum penalty for a single return is $65,000.

Don't risk penalties!

Be proactive! E-file your 990-EZ ahead of the deadline.

Form 990-EZ Instructions - How to fill out?

Let's see a complete instruction guide on how to fill out Form 990-EZ.

Organization Details

This section requires information about your organization, including name, address, accounting method, tax-exempt status, and tax period.

Item A - Tax period.

This section collects information about your organization's tax period.

Select the calendar year option if your organization follows a calendar tax year (January 01 - December 31)

If your organization follows a fiscal tax year, choose the Tax Period Begin Date and Tax Period End Date.

Item B - Applicable Checkboxes

Check the appropriate boxes to indicate changes on the current return compared with the previously filed 990-EZ return.

Address Change - Check the box if the organization changed its address and didn't report the change on the previously filed Form 990-EZ.

Final Return - Check the box if the organization has terminated its existence or ceased to be a Section 501(a) or Section 527 organization and is filing its final return as an exempt organization or Section 4947(a)(1) trust. You may also need to attach Schedule N along with this final 990-EZ return.

Name Change - Check the box if the organization changed its legal name (not its “DBA” name) and didn't report the change on the previously filed 990-EZ return.

You must also attach supporting documents for the name change based on your organization's type.

Amended Return - Check the box if the organization is filing an amended return for the tax year to amend the previously filed return for the same tax year.

You must also attach Schedule O and explain which parts, schedules, or attachments of Form 990-EZ were amended and describe those amendments.

Initial Return - Check the box if the organization is filing Form 990-EZ return for the first time and hasn't previously filed any 990 return.

Application Pending - Check the box if the organization has either filed a Form 1023, 1023-EZ, 1024, or 1024-A with the IRS and is awaiting a response, or claims tax-exempt status under section 501(a) but hasn't filed Form 1023, 1023-EZ, 1024, or 1024-A to be recognized as tax-exempt by the IRS.

If this box is checked, you must complete all parts of Form 990-EZ and any required schedules.

Item C - Organization's name and address

Enter the legal name of your organization and its operating address. If the organization operates outside the United States, check the Foreign Address checkbox and enter the address with the country name and postal code.

Item D - Organization's EIN

Enter the Employer Identification Number (EIN) provided for your organization.

If the filing organization has more than one EIN and hasn't been advised which to use, send notice to

Department of the Treasury

Internal Revenue Service Center

Ogden, UT 84201-0027

Item F - Group Exemption Number

Group Exemption Number (GEN) is a number assigned by the IRS to the central/parent organization of a group that has a group exemption letter.

If the organization is included in a group exemption, enter the group exemption number.

Item G - Accounting Method

An accounting method is a practice followed by taxpayers or preparers to report the revenue and expenses of an organization for the tax year.

Choose your organization's accounting method - Cash, Accrual, or Other. If Other is selected, please explain that accounting method.

Item H - Schedule B (Form 990)

Check the box if your organization isn't required to file Schedule B.

Item I - Website

Enter your organization's website name and include the website link. If the organization doesn't maintain a website, enter “N/A” (not applicable).

Item J - Tax-Exempt Status

Tax-exempt status provides an organization with complete relief from paying taxes. In Item J, choose the organization's tax-exempt status.

If the organization is exempt under section 501(c) (other than 501(c)(3)), check the 501(c) box and insert the appropriate subsection number within the parentheses (for example, “2” for a 501(c)(2) organization).

Item K - Form of Organization

A Legal Entity Form includes corporations, trusts, unincorporated associations, and other entities (for example, partnerships and limited liability companies (LLCs)) with legal rights and responsibilities, including tax filings.

Choose the organization's legal entity; whether it's a Corporation, Trust, Association, or Other. If Other is selected, please explain that form of organization.

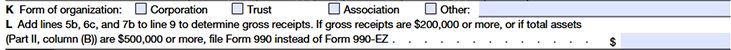

Item L - Determining Gross Receipts

This line determines the organization's gross receipts. The sum of lines 5b, 6c, and 7b to line 9 will be calculated here as the organization's gross receipts.

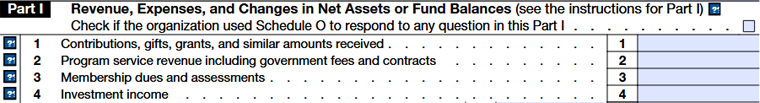

Part I - Revenue, Expenses, and Changes in Net Assets or Fund Balances

Line 1 - Contributions, Gifts, Grants, and Similar Amounts Received

In line 1, enter the gross contributions, gifts, grants, and bequests that the organization received from individuals, trusts, corporations, estates, affiliates, foundations, public charities, and other exempt organizations, or raised by an outside professional fundraiser.

Line 2 - Program Service Revenue Including Government Fees and Contracts

In line 2, enter the total program service revenue (exempt function income) the organization received for the tax year.

Line 3 - Membership Dues and Assessments

In line 3 enter the members' and affiliates' dues and assessments that aren't considered contributions received by the organization.

The membership benefits can be subscriptions to publications; newsletters (other than one about the organization's activities only); free or reduced-rate admissions to events sponsored by the organization; use of the organization's facilities; and discounts on articles or services that both members and nonmembers can buy.

Line 4 - Investment Income

Enter in line 4 the income earned by the organization from interest payments, gross rents, dividends and interest from securities, and other investment incomes.

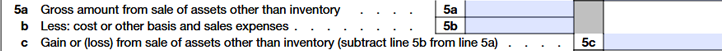

Line 5a to 5c - Gains (or Losses) From Sale of Assets Other Than Inventory

Lines 5a - Gross amount From Sale of Assets Other Than Inventory

In Line 5, enter the gross amount from all sales of securities and sales of all other types of investments (real estate, royalty interests, or partnership interests), as well as sales of all other noninventory assets (program-related investments and fixed assets used by the organization in its related and unrelated activities).

Line 5b - Less: Cost Or Other Basis And Sales Expenses

For Line 5b, total the cost or other basis (less depreciation) and selling expenses and enter the result in Line 5b.

Line 5c - Gains (or Losses) From Sale of Assets Other Than Inventory

Subtract Line 5b from Line 5a and enter the value in Line 5c. This value will be the Net Gains (or Losses) From Sale of Assets Other Than Inventory.

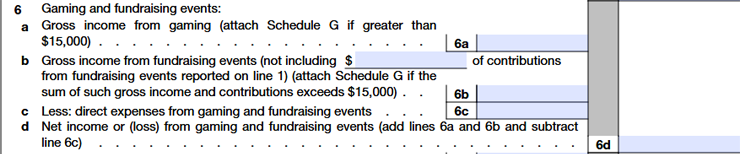

Line 6a to 6d - Gaming and Fundraising Events

Line 6a - Gross Income from Gaming Events

In line 6a, report the gross income the organization earned from gaming activities. Also, report in this line the gross income from all gaming activities (other than gaming that is incidental to a fundraising event such as a dinner/dance).

You must attach Schedule G (Supplemental Information Regarding Fundraising or Gaming Activities) if the gross income reported in line 6a exceeds $15,000.

Line 6b - Gross Income from Fundraising Events

In line 6b, enter all fundraising events and activities, such as dinners, dances, carnivals, concerts, sports events, auctions, and door-to-door sales of merchandise.

You must attach Schedule G (Supplemental Information Regarding Fundraising or Gaming Activities) if the gross income reported in line 6a exceeds $15,000.

Line 6c - Direct Expenses from Gaming And Fundraising Events

In line 6c, enter the direct expenses related to gaming activities and direct expenses attributable to the organization's provision of goods or services from which it derived gross income at a fundraising event.

Line 6d - Net Income or (Loss) From Gaming and Fundraising Events

To calculate the amount in line 6d, add lines 6a and 6b and subtract it from line 6c. This will the organization's net income or (loss) from gaming and fundraising events

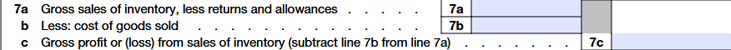

Line 7a - Sales of Inventory

Report in line 7a the gross sales (less returns and allowances) of inventory items.

Inventory items generally refer to all the things, goods, merchandise, and materials held by the organization for selling in the market to earn a profit.

Line 7b - Cost of Goods Sold

On line 7b, report the cost of goods sold related to sales of inventory items reported in line 7a.

The usual items included in the cost of goods sold are direct and indirect labor, materials and supplies consumed, freight-in, and a proportion of overhead expenses.

Line 7c - Gross Profit Or (Loss) From Sales of Inventory

To calculate the amount in line 7c, subtract line 7b from line 7a. This will be the organization's gross profit or (loss) from inventory sales.

Line 8 - Other Revenue

Report in line 8 the total income received by the organization from all sources that wasn't reported on lines 1 to 7.

Examples of line 8 income are interest on notes receivable not held as investments or as program-related investments (defined in the line 2 instructions); interest on loans to officers, directors, trustees, key employees, and other employees; and royalties that aren't investment income or program service revenue.

You must also attach Schedule O (Supplemental Information) and provide a detailed explanation of all the income reported in line 8.

Line 9 - Total Revenue

To calculate the total revenue amount in line 9, add lines 1, 2, 3, 4, 5c, 6d, 7c, and 8. The added amount will be the organization's total revenue for the tax year.

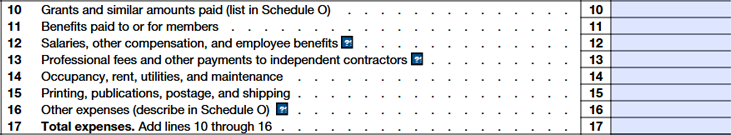

Line 10 - Grants and Similar Amounts Paid

Report in line 10 the amount of actual grants and similar amounts your organization paid to individuals and organizations. Examples of grants include scholarships, fellowships, and research grants to individuals.

However, do not include in line 10 the administrative expenses, purchases of goods or services from affiliates, and membership dues paid to another organization.

Line 11 - Benefits Paid to or for Members

If your organization provides benefits to members or dependents (such as organizations exempt under section 501(c) (8), (9), or (17)), enter that amount paid as benefits in line 11.

Line 12 - Salaries, Other Compensation, and Employee Benefits

Report in line 12 the total salaries and wages paid to all officers and employees and payments made to directors and trustees, including compensation reported on Forms W-2 and 1099.

Also include all other forms of income and benefits received from the organization during the tax year, such as the employer's share of deferrals (for unfunded plans) and contributions the organization paid to qualified and nonqualified pension and deferred compensation plans, and the employer's share of contributions to employee benefit programs (such as insurance, health, and welfare programs) that aren't an incidental part of a pension plan.

Line 13 - Professional Fees and Other Payments to Independent Contractors

Enter the total amount of legal, accounting, auditing, other professional fees, and related expenses charged by outside firms and individuals who aren't employees (independent contractors) of the organization.

Line 14 - Occupancy, Rent, Utilities, and Maintenance

Enter in line 14 the total amount paid or incurred for the use of office space or other facilities. This includes rent, mortgage interest; heat, light, power, and other utilities; outside janitorial services; real estate taxes and property insurance attributable to rental property; and similar expenses.

Line 15 - Printing, Publications, Postage, and Shipping

Report in line 15, the printing and related costs of producing the filing organization's newsletters, leaflets, films, and other informational materials, as well as the cost of outside mailing services.

Also, include the cost of any purchased publications as well as postage and shipping costs not reportable on lines 5b, 6c, or 7b.

Line 16 - Other Expenses

Report in line 16 the expenses that aren't reportable on lines 10 to 15.

For example, expenses such as penalties, fines, and judgments; unrelated business income taxes; insurance, interest, depreciation, and real estate taxes not reported as occupancy expenses; travel and transportation costs; and expenses for conferences, conventions, and meetings can be reported in this line.

You must attach also Schedule O (Supplemental Information) and provide a detailed explanation of all the expenses reported in line 16.

Line 17 - Total Expenses

To calculate the total expenses in line 17, add lines 10 through 16. The total amount will be the organization's total expenses for the tax year.

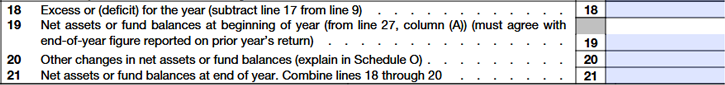

Line 18 - Excess or (Deficit) for the Year

To calculate the excess or deficit amount, calculate the difference between lines 9 and 17 and enter the difference in line 18.

If line 17 is more than line 9, enter the difference in parentheses or as a negative number with a minus sign.

Line 19 - Net Assets or Fund Balances at Beginning of Year

Enter on line 19 the end-of-year amount from the balance sheet on the prior-year return. The amount entered must agree with the Net assets or fund balances at beginning of year (from line 27, column (A))

Line 20 - Other Changes in Net Assets or Fund Balances

To complete line 20, explain in Schedule O (Form 990) any changes in net assets or fund balances between the beginning and end of the organization's tax year that aren't accounted for by the amount on line 18.

Line 21 - Net Assets or Fund Balances at the End of the Year

To calculate net assets or fund balances at the end of the year, add lines 18 through 20. The total amount will be the organization's total net assets or fund balances for the year.

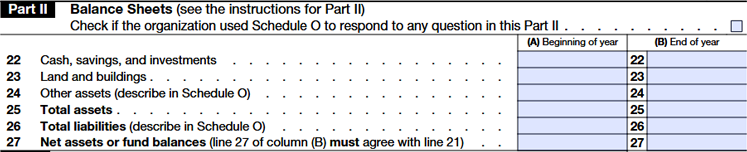

Part II - Balance Sheets

Line 22 - Cash, savings, and investments

In line 22, enter income earned by the organization in all interest and non-interest-bearing accounts.

Income from the book value of securities held as investments, and all other investment holdings including land and buildings held for investment must be reported on Part I, Line 4 and program-related investments must be reported on Part I, Line 2

Line 23 - Lands and Buildings

In line 23, enter the Book Value* (cost or other basis less accumulated depreciation) of all land and buildings owned by the organization and not held for investment.

*Book Value denotes the value of an asset according to its books or accounts, as reflected on its financial statements.

Line 24 - Other Assets

In line 24, enter the total amount of other assets such as accounts receivable, inventories, prepaid expenses, and the organization's share of assets in any joint ventures, LLCs, and other entities treated as a partnership for federal tax purposes.

Also, include a description of the assets in Schedule O (Supplemental Information) and attach it along with Form 990-EZ.

Line 25 - Total Assets

In line 25 Column (A) enter the amount of the beginning-of-year total assets

Line 26 - Total Liabilities

In line 26, enter the organization's total liabilities recorded for the tax year. It can be accounts payable, grants payable, mortgages or other loans payable, and deferred revenue (revenue received but not yet earned).

Also, include a description of the liabilities in Schedule O (Supplemental Information) and attach it along with Form 990-EZ.

Line 27 - Net assets or fund balances

To determine net assets in line 27, you must subtract line 26 (total liabilities) from line 25 (total assets), and enter that amount in line 27.

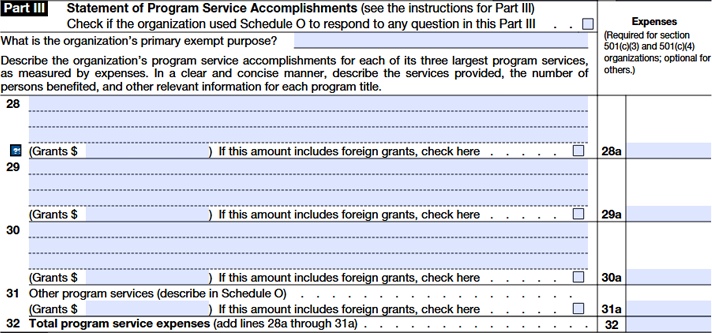

Part III - Statement of Program Service Accomplishments

This part collects information about the program service accomplishments made by your organization.

Provide a detailed explanation about the organization's program service accomplishments for each of its three largest program services in lines 28, 29, and 30, and enter the expenses spent on lines 28a, 29a, and 30a respectively.

Also include the services provided, the number of persons benefited, and other relevant information for each program title.

In case your organization has other program services to report, it can be reported in line 31. The organization is required to attach Schedule O (Supplemental Information) and provide a brief explanation of the program services.

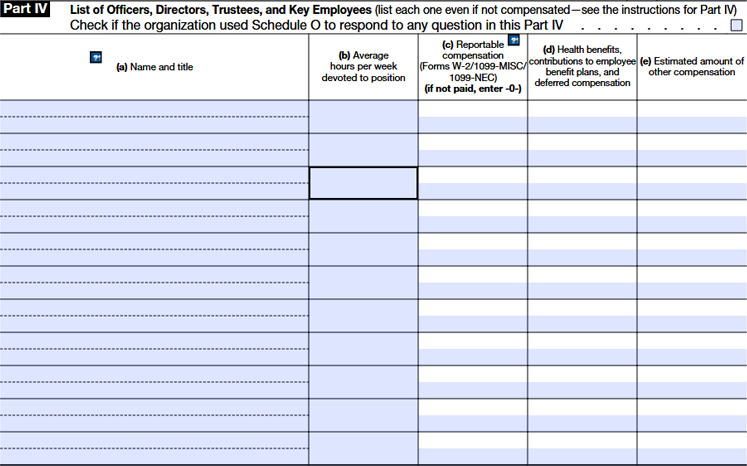

Part IV - List of Officers, Directors, Trustees, and Key Employees

This part requires information about any individual who was an officer, director, trustee, or key employee (defined below) of the organization at any time during the organization's tax year, even if they didn't receive any compensation from the organization.

Part IV consists of 5 columns that collect information about the organization's key employees

Column (a) Name and title

Enter the person's name and the title or position with the organization at the bottom of the row. If the person had more than one title or position, list all (for instance, president and director).

Column (b) Average hours per week devoted to position

For each person listed in column (a), report an estimate of the average hours per week the person devoted to the organization during the year. Enter “-0-” if applicable.

Column (c) Reportable compensation (Forms W-2/1099-MISC/ 1099-NEC) (if not paid, enter -0-)

In this column, enter the person's reportable compensation. The reportable compensation varies based on the person's position in the organization.

- For officers and other key employees—amounts required to be reported in box 1 or 5 of Form W-2 (whichever amount is greater);

- For directors and individual trustees—amounts required to be reported in box 1 of Form 1099-NEC and/or box 6 of Form 1099-MISC for director services and other independent contractor services to the organization, plus box 1 or 5 of Form W-2 (whichever amount is greater) if also compensated as an officer or employee; and

- For institutional trustees (such as banks or trust companies)—fees for services paid under a contractual agreement or statutory entitlement.

Column (d) Health benefits, contributions to employee benefit plans, and deferred compensation

In column d, report the person's deferred compensation and benefits.

Column (e) Estimated amount of other compensation

Here, enter both taxable and nontaxable fringe benefits but don't include compensation reported in columns (c) or (d) or the following

- Working condition fringe benefits that are described in section 132(d).

- Expense reimbursements and allowances under an accountable plan are described in Regulations section 1.62-2(c)(2).

- De minimis fringe benefits that are described in section 132(e).

However, you can include amounts that the recipients must report as income on their separate income tax returns.

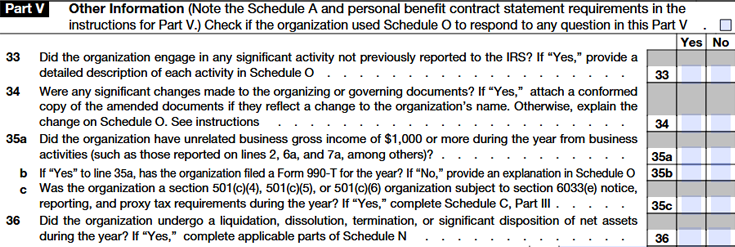

Part V - Other Information

Line 33 - Change in Activities

Select “Yes” if the organization engaged in any significant activity for the tax year that was not previously reported to the IRS. Also, provide a detailed description of each activity in Schedule O (Supplemental Information).

However, If the organization has never filed a Form 990-EZ, select “No” on line 33.

Line 34 - Changes in Organizing or Governing Documents

Select "Yes" if the organization made any significant changes to the organizing or governing documents. Also, attach a conformed copy of the amended documents if they reflect a change to the organization's name and describe the significant changes on Schedule O (Supplemental Information).

Lines 35a and 35b - Unrelated Business Income

Select "Yes" in line 35a if the organization has an unrelated business gross income of $1,000 or more during the year from business activities that were reported on lines 2, 6a, and 7a.

If you have selected “Yes” in line 35a, and filed Form 990-T for the tax year, select “Yes” in line 35b. If not, select “No” and explain in Schedule O (Supplemental Information)

Line 35c - Section 6033(e) Tax for Lobbying Expenditures

Select "Yes" if the organization comes under section 501(c)(4), 501(c)(5), or 501(c)(6) organization subject to section 6033(e) notice, reporting, and proxy tax requirements during the year, and complete Schedule C, Part III and attach it along with the Form 990-EZ return.

If the organization selects “No” to line 35c, it is certifying that it wasn't subject to the notice and reporting requirements of section 6033(e) and that the organization had no lobbying and political expenditures potentially subject to the proxy tax.

Line 36 - Liquidation, Dissolution, Termination, or Significant Disposition of Net Assets

Select “Yes” if the organization underwent a liquidation, dissolution, termination, or significant disposition of net assets during the year and attach applicable parts of Schedule N (Liquidation, Termination, Dissolution, or Significant Disposition of Assets)

A “significant disposition of net assets” is a sale, exchange, disposition, or other transfer of more than 25% of the FMV of the organization's net assets during the year, regardless of whether the organization received full or adequate consideration.

A significant disposition of net assets involves:

- One or more dispositions during the organization's tax year amounting to more than 25% of the FMV of the organization's assets as of the beginning of its tax year; or

- One of a series of related dispositions or events commenced in a prior year that, when combined, comprise more than 25% of the FMV of the organization's assets as of the beginning of the tax year when the first disposition of net assets occurred. Whether a series of related dispositions is a significant disposition of net assets depends on the facts and circumstances in each case

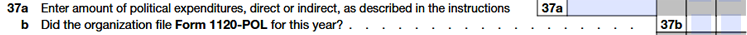

Line 37 - Expenditures for Political Purposes

In line 37a, enter the amount of political expenditures; direct or indirect made by the organization for the tax year.

Political expenditures are intended to influence the selection, nomination, election, or appointment of anyone to a federal, state, or local public office, or office in a political organization, or the election of Presidential or Vice Presidential electors.

It includes a payment, distribution, loan, advance, deposit, gift of money, or anything of value. It also includes a contract, promise, or agreement to make an expenditure, whether or not legally enforceable.

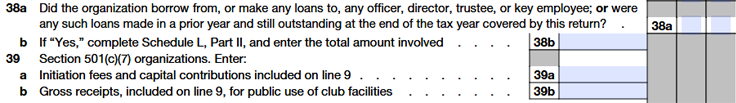

Line 38 - Loans to or From Officers, Directors, Trustees, and Key Employees

Select "Yes" in line 38a if the organization borrows from, or makes any loans to, any officer, director, trustee, or key employee; or were any such loans made in a prior year and still outstanding at the end of the tax year covered by this return.

Report any interest expense paid to an officer, director, trustee, or key employee on line 16 (except for mortgage interest reportable on line 14) and any interest income paid by an officer, director, trustee, or key employee on line 8.

If selected Yes in line 38a, complete Schedule L, Part II, and enter in line 38b the total amount involved.

Line 39 - Section 501(c)(7) Organizations

On line 39a, enter the capital contributions, initiation fees, and unusual amounts of income not included in figuring gross receipts to determine the exempt status of section 501(c)(7) organizations.

On line 39b, the gross receipts for public use of club facilities are gross receipts (as defined above for 501(c)(7) exemption purposes) derived from the use of the organization's facilities by persons other than members, spouses of members, dependents of members, or guests of members.

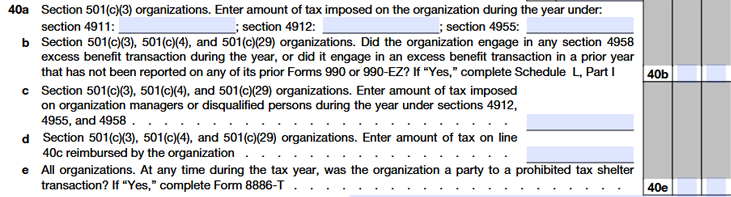

Line 40a - Section 501(c)(3) Organizations: Disclosure of Excise Taxes Imposed Under Section 4911, 4912, or 4955

If your organization comes under Section 501(c)(3), it must disclose any excise tax imposed during the year under Section 4911 (excess lobbying expenditures); 4912 (disqualifying lobbying expenditures); or, unless abated, 4955 (political expenditures).

Line 40b - Section 501(c)(3), 501(c)(4), and 501(c)(29) Organizations: Disclosure of Section 4958 Excess Benefit Transactions and Excise Taxes

Select "Yes" if the organization became aware, before filing this return, that it engaged in an excess benefit transaction with a disqualified person in the current tax year or a prior year, and if the transaction hasn't been reported on any of the organization's prior Form 990-EZ.

Also, complete Schedule L, Part I, and attach it along with the 990-EZ return.

Line 40c - Taxes Imposed on Organization Managers or Disqualified Persons

If your organization comes under Section 501(c)(3), 501(c)(4), and 501(c)(29), enter in line 40c the amount of taxes imposed on organization managers and/or disqualified persons under sections 4912, 4955, and 4958, unless abated.

Line 40d - Taxes Reimbursed by the Organization

If your organization comes under Section 501(c)(3), 501(c)(4), and 501(c)(29), enter the amount of tax on line 40c that was reimbursed by the organization.

Any reimbursement of the excise tax liability of a disqualified person or organization manager will be treated as an excess benefit unless:

- The organization treats the reimbursement as compensation during the year the reimbursement is made; and

- The total compensation to that person, including the reimbursement, is reasonable.

Line 40e - Tax on Prohibited Tax Shelter Transactions

Select “Yes” if the organization was a party to a prohibited tax shelter transaction as described in section 4965(e) at any time during the organization's tax year.

You must complete Form 8886-T, Disclosure by Tax-Exempt Entity Regarding Prohibited Tax Shelter Transaction, and may also have to file Form 4720 and pay excise tax imposed by section 4965.

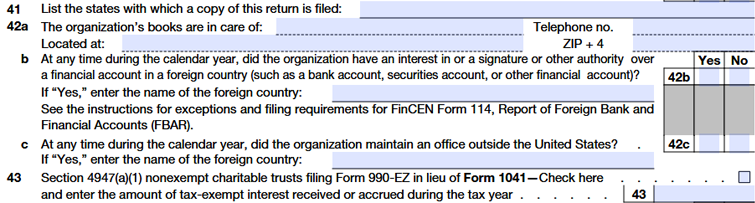

Line 41 - List of States

On this line, provide the names of states with which a copy of this return is filed.

Line 42a - Location of Books and Records

On line 42a, provide the name of the person who possesses the organization's books and records.

Line 42b - Foreign Financial Accounts

Select “Yes” in line 42b if either any one of the two conditions applies

- At any time during the calendar year ending with or within the organization's tax year, the organization had an interest in, or signature or other authority over, a financial account in a foreign country (such as a bank account, securities account, or other financial account); and

- The combined value of the accounts was more than $10,000 at any time during the calendar year; and

- The accounts weren't with a U.S. military banking facility operated by a U.S. financial institution.

- The organization owns more than 50% of the stock in any corporation that would answer “Yes” to item 1 above.

If “Yes,” enter the name of the foreign country or countries, and continue on Schedule O if more space is needed. Also, file FinCEN Form 114, Report of Foreign Bank and Financial Accounts (FBAR), electronically with the Department of the Treasury using FinCEN's BSA E-Filing System.

Line 43 - Section 4947(a)(1) Nonexempt Charitable Trusts

If you're a Section 4947(a)(1) nonexempt charitable trust filing Form 990-EZ instead of Form 1041, check the box and enter the amount of tax-exempt interest received or accrued during the tax year.

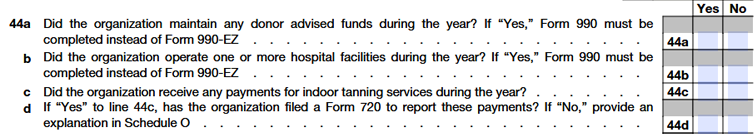

Line 44a - Donor Advised Funds

Select “Yes” if the organization maintained any donor-advised funds during the year. If yes, the organization must file Form 990 instead of Form 990-EZ.

A “donor advised fund” is a fund or account:

- That is separately identified by reference to contributions of a donor or donors,

- That is owned and controlled by a sponsoring organization, and

- Over which the donor or donor advisor has or reasonably expects to have advisory privileges in the distribution or investment of amounts held in the donor advised fund or account because of the donor's status as a donor.

Line 44b - Hospital Facilities

Select “Yes” if the organization operated one or more hospital facilities during the tax year. If yes, the organization must file Form 990 instead of Form 990-EZ.

A “hospital facility” is a facility that is required to be licensed, registered, or similarly recognized by a state as a hospital. This includes a hospital that is operated through a disregarded entity or joint venture treated as a partnership for federal tax purposes.

However, it doesn't include hospitals that are located outside the United States or hospitals that are operated by entities organized as separate legal entities from the organization that are treated as corporations for federal tax purposes.

Lines 44c and 44d - Payments for Indoor Tanning Services

Select “Yes” for line 44c if the organization received any payments during the year for indoor tanning services.

If “Yes” is selected in line 44c, select "Yes" in line 44d if you the organization filed Form 720 to report the payments received for indoor tanning services. If “No,” explain Schedule O (Supplemental Information)

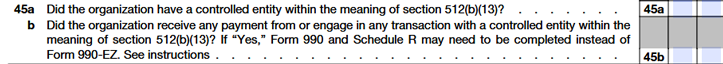

Line 45a - Section 512(b)(13) Controlled Entity

Select “Yes” if the organization had a controlled entity within the meaning of section 512(b)(13) during the tax year.

A “controlled entity within the meaning of section 512(b)(13)” may be a stock or nonstock corporation, association, partnership, LLC, or trust of which the controlling organization owns more than 50% of:

- The stock of a corporation (measured by voting power or value),

- The profits or capital interest in a partnership, or

- The beneficial interest in a trust or other entity.

Line 45b - Transactions With a Section 512(b) (13) Controlled Entity

Select "Yes" if the organization received any payment from or engaged in any transaction with a controlled entity within the meaning of section 512(b)(13)

If “Yes,” the organization must file Form 990 and Schedule R (Related Organizations and Unrelated Partnerships) instead of Form 990-EZ.

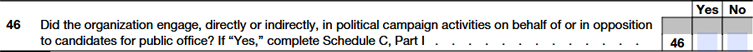

Line 46 - Political Campaign Activities

Select "Yes" if the organization engaged, directly or indirectly, in political campaign activities on behalf of or in opposition to candidates for public office.

If yes, complete the applicable parts on Schedule C (Political Campaign and Lobbying Activities), Part I, and attach it along with your 990-EZ return.

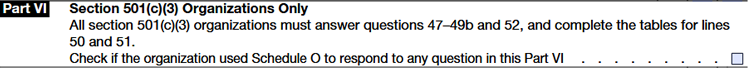

Part VI - Section 501(c)(3) Organizations Only

All section 501(c)(3) organizations (including, for purposes of Form 990-EZ, section 4947(a)(1) nonexempt charitable trusts) must complete Part VI.

So if your organization falls under Section 501(c)(3), you must answer questions 47–49b and 52, and complete the tables for lines 50 and 51.

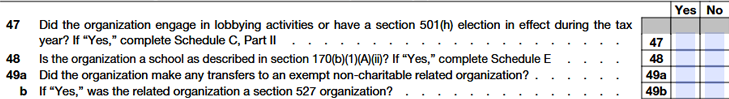

Line 47 - Lobbying Activities

Select Yes if your organization engaged in lobbying activities or has a section 501(h) election in effect during the tax year.

The organization must complete Schedule C (Political Campaign and Lobbying Activities), Part II-A, regardless of whether they engaged in lobbying activities during the tax year.

Line 48 - Schools

Select Yes if your organization is described as a school in section 170(b)(1)(A)(ii) and complete Schedule E (Schools).

Line 49 - Transfers to Exempt Non-Charitable Related Organizations

Select “Yes” in line 49a if the organization made any transfer to a related organization that is exempt other than a 501(c)(3) organization, such as a related 501(c)(4) organization or a related 527 political organization.

The transfer the organization made can be anything of value (cash, other assets, services, use of property, etc.) to the exempt non-charitable related organization, whether or not for adequate consideration.

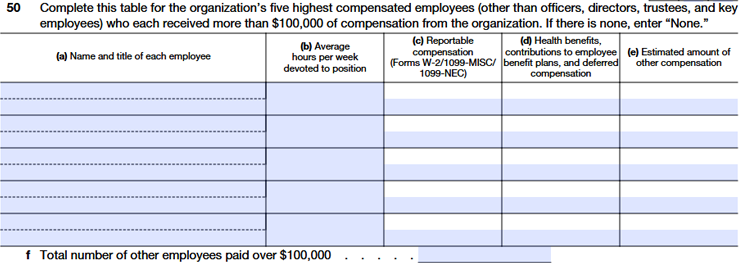

Line 50 - Five Highest Compensated Employees Over $100,000

If your organization has employees (other than officers, directors, trustees, and key employees as defined in the Part IV instructions, earlier) with the highest annual compensation of over $100,000, provide the details of the first five highly compensated employees and complete line 50.

Column (a) Name and title of each employee

Enter the employee's name and the title or position with the organization at the bottom of the row.

Column (b) Average hours per week devoted to position

For each employee listed in column (a), report an estimate of the average hours per week they devoted to the organization during the year.

Column (c) Reportable compensation (Forms W-2/1099-MISC/ 1099-NEC)

In column c, enter the employee's reportable compensation.

Column (d) Health benefits, contributions to employee benefit plans, and deferred compensation

In column d, report the employee’s deferred compensation and benefits.

Column (e) Estimated amount of other compensation

In column e, enter the employee's estimated amount of other compensation.

On line 50f, enter the number of other employees (other than officers, directors, trustees, and key employees) with annual compensation over $100,000 who weren't individually listed on line 50.

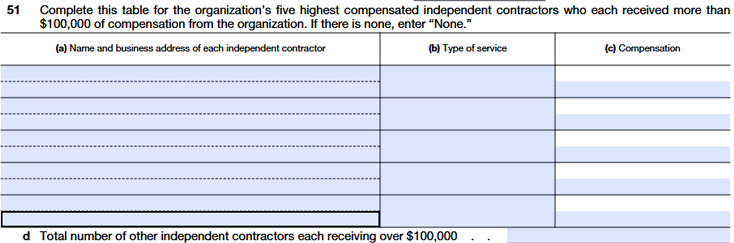

Line 51 - Five Highest Compensated Independent Contractors Over $100,000

If your organization has independent contractors who received more than $100,000 in compensation for services, whether professional services or other services, from the organization, provide the details of the first five highly compensated employees and complete line 51.

On line 51d, enter the number of other independent contractors receiving over $100,000 who weren't individually listed on line 51.

Column (a) Name and business address of each independent contractor

Enter the independent contractor's name and business address at the bottom of the row.

Column (b) Type of service

Here, enter details of the services provided by the independent contractors.

Column (c) Compensation

Enter here the amount of compensation the organization paid, whether reported in box 1 of Form 1099-NEC and/or box 6 of Form 1099-MISC or paid under the parties' agreement or applicable state law, for the calendar year ending with or within the organization's tax year.

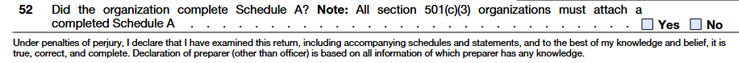

Line 52 - Schedule A

Select Yes if the organization comes under section 501(c)(3) organization, and complete and attach Schedule A (Public Charity Status and Public Support).

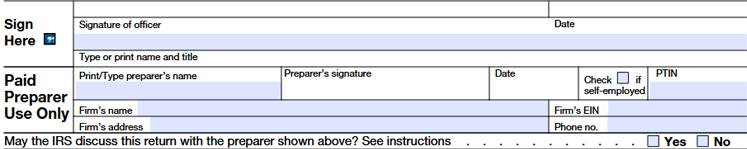

Signature Block

After completing the return, it must be signed by the current president, vice president, treasurer, assistant treasurer, chief accounting officer, or other corporate officer (such as tax officer) who is authorized to sign as of the date this return is filed.

Paid Preparer

This section is for the Paid preparer who was paid to prepare the return.

If you're a paid preparer, you must sign the return, list the preparer taxpayer identification number (PTIN), and fill in the other blanks in the Paid Preparer Use Only area.

The paid preparer must:

- Sign the return in the space provided for the preparer's signature;

- Enter the preparer's information (including the preparer’s PTIN and the preparer firm’s EIN, if applicable); and

- Give a copy of the return to the organization.

How to file Form 990-EZ?

You have two options to file your Form 990-EZ return with the IRS - efficient e-filing or traditional paper filing.

Form 990-EZ E-filing (recommended)

The IRS recommends e-filing your 990-EZ for a faster and simpler experience. In addition, you'll get instant notifications when they're processed by the IRS

Choosing an IRS-authorized e-file provider like TaxZerone makes your entire e-file process smoother. With just a few clicks, you can fill out your 990-EZ return, review it, and transmit it to the IRS.

It's that quick and easy! Choose e-filing for a smooth and efficient 990-EZ filing experience.

Paper filing

If you choose to paper-file Form 990-EZ, here are the steps you need to follow

- Obtain the Form: Download and print Form 990-EZ from the IRS website.

- Complete Form: Fill out each section of Form 990-EZ, providing accurate information about your organization's activities, finances, governance, and compliance with tax laws. Use the instructions provided by the IRS to guide you through the process.

- Attach Schedules if Necessary: Depending on your organization's activities and financial transactions, you may need to attach additional schedules or supporting documents to Form 990-EZ.

- Calculate and Include Payment: If your organization owes taxes based on the information provided on Form 990-EZ, calculate the amount owed and include payment with the submission. Payments can be made by check or money order payable to the "United States Treasury."

- Sign and Date the Form: The form must be signed and dated by an authorized individual within the organization, such as the president, treasurer, or another authorized officer.

- Mail the Form: Once completed, mail the signed Form 990-EZ and any accompanying documents to the IRS mailing address.

- Keep Copies for Your Records: Make copies of the completed Form 990-EZ and all supporting documents for your organization's records. These documents may be needed for future reference or in the event of an audit.

Where to send Form 990-EZ Mailing address

Send a paper copy of Form 990-EZ to the mailing address mentioned below:

Department of the Treasury,

Internal Revenue Service Center,

Ogden, UT 84201-0027.

If your organization’s principal business, office, or agency is located in a foreign country or a U.S. possession, mail the form to:

Internal Revenue Service Center,

P.O. Box 409101,

Ogden, UT 84409.

How to e-file Form 990-EZ?

E-filing your Form 990-EZ takes just 3 steps! To make it even faster, gather all the necessary information (like employee details and compensation amounts) before you start. That way, you can complete your filing process in no time.

Information required to file Form 990-EZ

Organization's details, EIN, tax year, accounting method, and exempt status

Once you have this information ready, you can follow the steps below to e-file Form 990-EZ using TaxZerone.

Step 1 - Enter the required information, such as your organization's details, EIN, tax year, accounting method, and exempt status.

Step 2 - Complete all the parts provided in the form and attach the required schedules.

Step 3 - Review the information you provided in the form, check and rectify the errors if any, and transmit the Form 990-EZ return to the IRS.

E-file Form 990-EZ with TaxZerone

When you choose to e-file Form 990-EZ with TaxZerone, you can enjoy benefits such as

- IRS-authorized: File your 990-EZ return through an IRS-authorized e-file service provider.

- IRS form validations: catch any errors before you submit.

- Easy E-filing: Simple navigating and a user-friendly interface to e-file Form 990-EZ within minutes.

- Secure E-filing: Your 990-EZ return will be submitted securely to the IRS.

- Top value: Enjoy the industry's best price, starting at just $89.99 per return.

File Form 990-EZ with TaxZerone

Stay compliant and save time by e-filing your Form 990-EZ securely and effortlessly!