Form W-2c Instructions

Excise Tax Forms

Employment Tax Forms

Exempt Org. Forms

Extension Forms

Business Tax Forms

FinCEN BOIR

General

What is IRS Form W-2c?

Form W-2c, the "Corrected Wage and Tax Statement," is used to fix errors on previously submitted Form W-2. Employers can use Form W-2c to correct inaccuracies in the wage and tax information they reported to employees and the IRS.

When is the due date for filing Form W-2c?

There is no specific deadline for filing Form W-2c. However, it is important to correct any errors in your returns as soon as they are identified. Additionally, promptly send corrected copies to your recipients.

What information can be corrected on Form W-2c?

You can correct the following information reported on Form W-2:

- Tax year

- Employer Identification Number (EIN)

- Employee name and SSN

- Employee earnings and tax withholdings:

- Wages, tips, and other compensation

- Federal income tax withheld

- Social security wages

- Medicare tax withheld and Medicare wages and tips

- Allocated tips

- State and local information

Reported any of the information mentioned above incorrectly on Form W-2? E-file Form W-2c with TaxZerone now.

Instructions to file Form W-2c

Let's see line-by-line instructions on how to fill out Form W-2c.

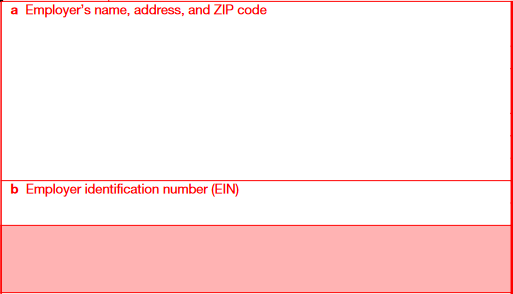

Employer details

Enter the employer's name, complete address, and EIN.

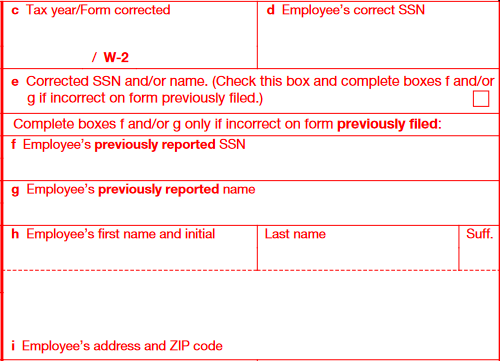

Employee details

- Box c: Enter the tax year for which the form is corrected

- Box d: Enter the employee’s correct SSN

- Box e: Check this box only if you are correcting the employee’s name or SSN

- Box f: Enter the SSN that you have reported in the previously filed return

- Box g: Enter the employee name that you have reported in the previously filed return

- Box h: Enter the employee’s correct name

- Box i: Enter the employee’s address and ZIP code

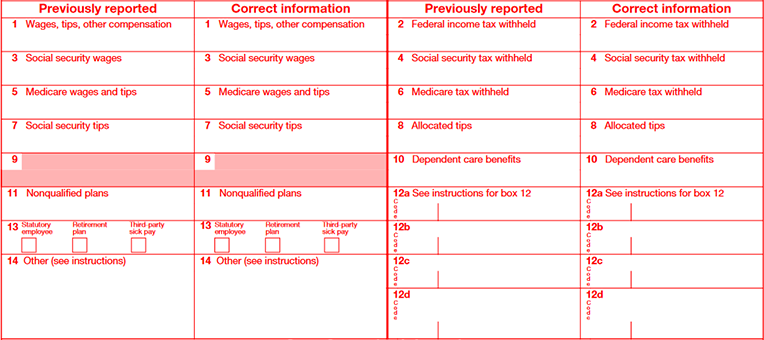

Boxes 1 to 14

Enter the previously reported amount and the correct amount in the respective boxes.

If you are not sure how to fill out previously reported amount boxes, refer to our Form W-2 instructions.

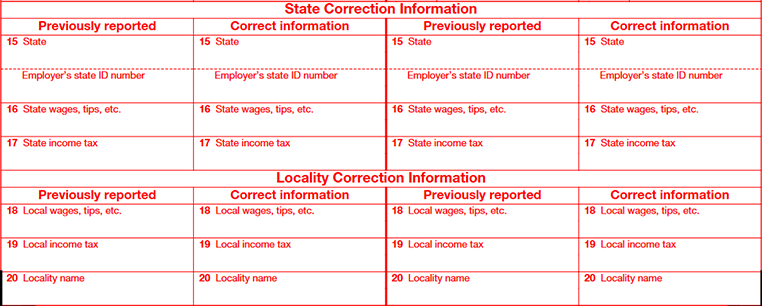

Boxes 15 to 20

If you want to correct any details related to state and locality, report those in the respective boxes.

How to file Form W-2c?

You can file W-2c Form through online e-filing and traditional paper filing.

Form W-2c E-filing (recommended)

The IRS recommends e-filing your W-2c for faster processing. Plus, you'll get instant notifications when they're processed. With TaxZerone, you can fill out your W-2c in just a few clicks, review and submit it, and share recipient copies easily.

Benefits of e-filing:

- Faster processing and reduced errors

- Simpler, more streamlined experience

- Instant notifications upon form processing

- Secure transmission of sensitive data

Choose e-filing for a smooth and efficient W-2c filing experience.

Paper filing

If you choose to paper-file Form W-2c, here are the steps you need to follow:

- Download and print Form W-2c from the IRS website.

- Fill out:

- Recipient details (name, address, SSN, compensation)

- Your business information

- Mail the completed form to SSA

- Send a copy to each recipient

Important notes:

- Mail early to ensure timely arrival

- Always provide copies to recipients for their tax reporting

Form W-2c mailing address

If you have chosen to file Form W-2c by paper, send the completed form to the mailing address below:

Social Security Administration,

Direct Operations Center,

P.O. Box 3333,

Wilkes-Barre, PA 18767-3333

How to e-file Form W-2c with TaxZerone?

Follow the steps below to e-file Form W-2c using TaxZerone.

Step 1: Fill out Form W-2c with previously reported and correct information.

Step 2: Review & transmit the return

Step 3: Send the recipient copy

Why choose TaxZerone to e-file Form W-2c?

When you choose to e-file Form W-2c with TaxZerone, you can:

- Catch any errors before you submit.

- Upload multiple forms and finish in a flash.

- Share recipient copies by email instantly

- Share recipient copies in a secure portal—ZeroneVault—where employees can download them anytime, anywhere.

- Enjoy the industry's best price, starting at just $0.59 per form.