Form 1099-SA Instructions

Excise Tax Forms

Employment Tax Forms

Exempt Org. Forms

Extension Forms

FinCEN BOIR

General

What is IRS Form 1099-SA?

Form 1099-SA, "Distributions From an HSA, Archer MSA, or Medicare Advantage MSA" is used to report the distributions made from these health savings accounts to the account holder. Its primary purpose is to inform the IRS about the amounts withdrawn from these accounts during the year.

Who can file Form 1099-SA?

If you are a trustee or custodian of a health savings account (HSA), Archer MSA, or Medicare Advantage MSA, you are responsible for filing Form 1099-SA. This means that if you manage these accounts and a holder withdraws $600 or more in a calendar year, you must file a Form 1099-SA for each account holder.

Here is a breakdown of who typically files Form 1099-SA:

- Banks that offer HSAs

- Insurance companies that administer HSAs

- Other financial institutions that act as HSA custodians

It is important to note that the account holder does not file Form 1099-SA themselves. Instead, they will receive a copy of the form you file for their tax records.

When is the Form 1099-SA due date?

There are two key deadlines related to Form 1099-SA that trustees/payers must be aware of:

Filing deadline with IRS

The deadline for trustees/payers to file Form 1099-SA with the IRS depends on the filing method:

- E-filing deadline: March 31, 2025

If you’re e-filing the Form 1099-SA to the IRS, the deadline is March 31st of the year following the tax year for which the form is being issued. - Paper filing deadline: February 28th, 2025

If you’re filing Form 1099-SA with the IRS using traditional paper filing methods, the deadline is earlier — February 28th of the year following the tax year for which the form is being issued.

Avoid the last-minute 1099-SA deadline stress

E-file with TaxZerone now for easy IRS compliance and peace of mind.

Recipient copies deadline: January 31, 2025

Trustees/payers are required to provide copies of Form 1099-SA to the recipients (individuals or entities that received interest payments) by January 31st of the year following the tax year for which the form is being issued. This ensures that recipients have the necessary information to accurately report their interest income when filing their tax returns.

It is crucial for payers to meet these deadlines to avoid potential penalties from the IRS for failure to file Form 1099-SA accurately and on time. Penalties may be imposed for late filing, failure to provide recipient copies, or reporting incorrect information on the form.

Form 1099-SA penalty

If you miss filing Form 1099-SA within the deadline, the IRS will impose a penalty for each missed return. Below is the breakdown of Form 1099-SA penalties:

| Days late | Penalty per return |

|---|---|

| Up to 30 days | $60 |

| 31 days late through August 1 | $130 |

| After August 1 or not filed | $330 |

| Intentional disregard | $660 |

Why risk penalties?

Choose TaxZerone to e-file your 1099-SA forms ahead of the deadline.

Form 1099-SA Instructions - How to fill out?

Let's see line-by-line instructions on how to fill out Form 1099-SA.

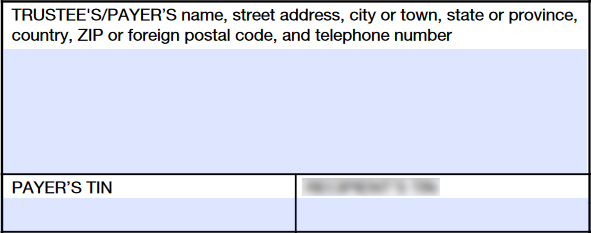

Trustee/Payer details

Enter your name, complete address, and TIN (SSN if you're an individual; EIN if you're a business).

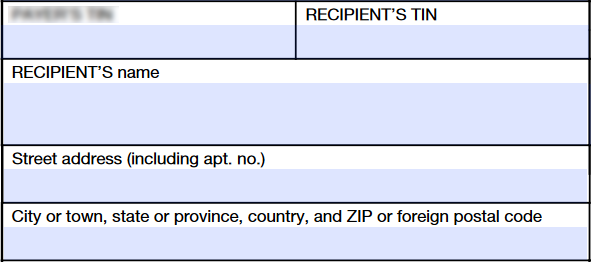

Recipient details

Enter the recipient’s name, complete address, and TIN (SSN for an individual; EIN for a business).

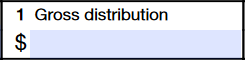

Box 1: Gross Distribution

- Enter the total distribution amount.

- Include any earnings reported separately in box 2.

- You don't need to calculate the taxable portion of the distribution.

Important notes:

- Never report a negative amount in box 1.

- Don't include the following as distributions:

- Withdrawal of excess employer contributions (and their earnings) returned to an employer from an employee's HSA.

- Excess MA MSA contributions returned to the Secretary of Health and Human Services or their representative.

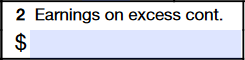

Box 2: Earnings on Excess Contributions

- Enter the total earnings distributed with any excess HSA or Archer MSA contributions returned by the due date of the account holder's tax return.

- Include this amount in Box 1 as well.

- For all other distributions, report earnings only in Box 1.

Box 3: Distribution Code

Enter the appropriate code from the list below to indicate the type of distribution.

Distribution Codes for Distributions From HSAs, Archer MSAs, and Medicare Advantage MSAs

| 1- Normal distributions |

|

| 2- Excess contributions |

|

| 3- Disability |

|

| 4- Death distribution (other than code 6) |

|

| 5- Prohibited transaction |

|

| 6 - Death distribution after year of death to a nonspouse beneficiary |

|

Box 4: FMV on Date of Death

Enter the FMV of the account on the date of death.

Box 5: Checkbox

Check the box to indicate if this distribution was from an HSA, Archer MSA, or MA MSA.

How to file Form 1099-SA?

Form 1099-SA can be filed electronically or by postal mail.

Form 1099-SA electronic filing (E-filing)

The IRS recommends e-filing Form 1099-SA as the process is efficient and straightforward. E-filing offers the advantage of receiving notifications promptly after the IRS processes your submission.

To e-file Form 1099-SA, you can choose an IRS-authorized e-file service provider, such as TaxZerone.

With TaxZerone, the e-filing process is streamlined and can be completed within minutes. You simply need to fill out the form, review the information, transmit it to the IRS electronically, and provide the recipient's copy.

Paper filing

If you prefer to file Form 1099-SA via traditional paper methods, here are the steps to follow:

- Download and print Form 1099-SA from the IRS website (www.irs.gov).

- Complete the required fields, including the recipient's name, address, TIN, and distribution amount. Also, provide your business name, address, and TIN.

- Mail the completed paper form to the IRS at the address specified in the 1099 instructions. Refer to the "Where to Send Form 1099-SA - Mailing Address" section to find the correct address for your state.

- Send a copy of the 1099-SA to the recipient by January 31st for their tax reporting purposes.

Important considerations for paper filing:

- Mail the forms several weeks before the deadline to ensure timely arrival at the IRS.

- You are required to provide a copy of the 1099-SA to the recipient for accurate tax reporting on their part.

- Paper filing involves printing, mailing, and tracking forms. As an alternative, you can choose to file 1099-SA forms electronically for faster processing and delivery.

Where to send Form 1099-SA - Mailing address

If you prefer paper filing, the mailing address for Form 1099-SA varies depending on your business location. Below is a table summarizing the mailing address for Form 1099-SA:

| If your business operates in or your legal residence is… | Mail Form 1099-SA to… |

|---|---|

| Alabama, Arizona, Arkansas, Delaware, Florida, Georgia, Kentucky, Maine, Massachusetts, Mississippi, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Texas, Vermont, Virginia | Internal Revenue Service Austin Submission Processing Center P.O. Box 149213 Austin, TX 78714 |

| Alaska, Colorado, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Montana, Nebraska, Nevada, North Dakota, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Utah, Washington, Wisconsin, Wyoming | Department of the Treasury IRS Submission Processing Center P.O. Box 219256 Kansas City, MO 64121-9256 |

| California, Connecticut, District of Columbia, Louisiana, Maryland, Pennsylvania, Rhode Island, West Virginia | Department of the Treasury IRS Submission Processing Center 1973 North Rulon White Blvd. Ogden, UT 84201 |

| Outside the United States | Internal Revenue Service, Austin Submission Processing Center, P.O. Box 149213, Austin, TX 78714 |

How to e-file Form 1099-SA with TaxZerone

Before initiating the e-filing process for Form 1099-SA, it's essential to have all the necessary information ready to ensure a smooth and efficient filing experience. Here's what you'll need:

Required information for filing Form 1099-SA:

- Account holder info: Name, address, Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Withdrawal details: Amount withdrawn in the year (if it's $600 or more) and any medical expense codes (if applicable)

Once you have gathered all the required information, you can proceed with the e-filing process using TaxZerone in three simple steps:

Step 1: Complete Form 1099-SA

Fill out the form with the necessary details, including payer and recipient information, gross distribution, and distribution code.

Step 2: Review and transmit the return

Carefully review the information entered to ensure accuracy, and then transmit the completed Form 1099-SA to the IRS electronically.

Step 3: Provide the recipient copy

After transmitting the form to the IRS, send a copy of the completed Form 1099-SA to the recipient for their tax reporting purposes.

Benefits of e-filing Form 1099-SA with TaxZerone

When you choose to e-file Form 1099-SA with TaxZerone, you can enjoy the following advantages:

- IRS form validations: Ensure accuracy by checking your returns for potential errors or missing information.

- Email recipient copies: Conveniently send recipient copies via email.

- Secure portal access (ZeroneVault): Provide recipients with secure access to their return copies anytime, anywhere, through the ZeroneVault portal.

- Competitive pricing: Enjoy industry-leading pricing, with rates as low as $0.59 per form.

By leveraging TaxZerone's e-filing solution, you can streamline the Form 1099-SA filing process, ensuring accuracy, efficiency, and compliance with IRS requirements.