Form 1099-S Instructions

Excise Tax Forms

Employment Tax Forms

Exempt Org. Forms

Extension Forms

FinCEN BOIR

General

What is IRS Form 1099-S?

Form 1099-S, also known as "Proceeds from Real Estate Transactions," is a tax document used to report the gross proceeds from the sale or exchange of real estate. If you are a real estate agent, broker, or closing agent and you facilitate a real estate transaction worth $600 or more, you are required to file a Form 1099-S.

This form is submitted to the IRS and a copy is provided to the seller to report the sale proceeds.

Who needs to file Form 1099-S?

The responsibility to file Form 1099-S lies with the person or entity that handles the closing of the real estate transaction. This can include:

- Real estate brokers and agents

- Title companies

- Attorneys

- Escrow companies

- Mortgage lenders

Generally, the closing agent or entity will take care of the filing. If you are involved in a real estate transaction, make sure that Form 1099-S is filed correctly to comply with IRS regulations and avoid penalties.

When is the Form 1099-S due date?

Filers must be aware of two important deadlines related to Form 1099-S:

Filing deadline with the IRS

The deadline for filers to submit Form 1099-S to the IRS depends on the filing method:

- Electronic filing deadline: March 31, 2025

If you are e-filing Form 1099-S with the IRS, the deadline is March 31st of the year following the tax year for which the form is being issued. - Paper filing deadline: February 28, 2025

If you are filing Form 1099-S with the IRS using traditional paper methods, the deadline is February 28th of the year following the tax year for which the form is issued.

Avoid the stress of last-minute 1099-S deadlines.

E-file with TaxZerone now and enjoy hassle-free IRS compliance and peace of mind.

Transferor copies deadline: January 31, 2025

Filers must share copies of Form 1099-S to transferors by January 31st of the year following the relevant tax year. This allows transferors to accurately file their tax returns on time.

Missing these deadlines or providing incorrect information on Form 1099-S can lead to IRS penalties. To avoid potential penalties, filers should take steps to ensure that Form 1099-S is filed and distributed both accurately and on time.

Form 1099-S penalty

If you miss filing Form 1099-S within the deadline, the IRS will impose a penalty. Here are the Form 1099-S penalty rates:

| Days late | Penalty per return |

|---|---|

| Up to 30 days | $60 |

| 31 days late through August 1 | $130 |

| After August 1 or not filed | $330 |

| Intentional disregard | $660 |

Why risk penalties?

E-file your 1099-S forms ahead of the deadline with TaxZerone.

Form 1099-S Instructions - How to fill out?

Let's see line-by-line instructions on how to fill out Form 1099-S.

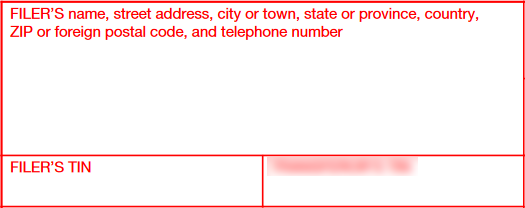

Filer details

Enter your name, complete address, and TIN (SSN if you're an individual; EIN if you're a business).

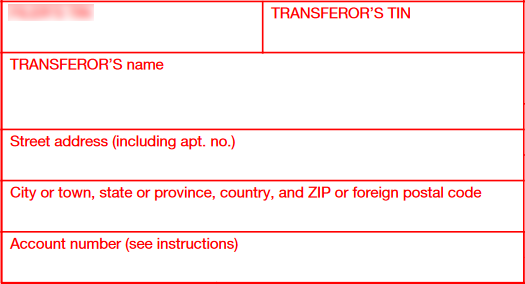

Transferor details

Enter the transferor’s name, complete address, and TIN (SSN for an individual; EIN for a business).

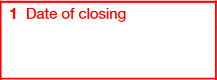

Box 1: Date of Closing

Enter the date when the real estate transaction was finalized. This date depends on the document used:

- If using a Closing Disclosure: The closing date is the same as the Closing Disclosure date.

- If not using a Closing Disclosure: The closing date is whichever comes first:

- The date when the property title transfers to the new owner, or

- The date when the financial responsibilities and benefits of ownership shift to the buyer (also called the transferee).

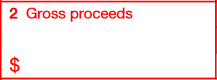

Box 2: Gross Proceeds

Enter the total amount received from the sale or exchange of real estate. This includes:

- Cash received or to be received by the seller (transferor)

- The principal amount of any note payable to the seller

- Any note or mortgage paid off at settlement

- Any liability assumed by the buyer (transferee) or attached to the property

For contingent payment transactions, include the maximum determinable proceeds.

Special cases:

- Like-kind exchange with no reportable proceeds: Enter -0- (zero) in box 2 and mark the checkbox in box 4

Do not include:

- Value of property or services received by the seller

- Separately stated cash received for personal property (e.g., draperies, appliances)

Box 3: Property Identification

Enter one of the following to identify the property:

- Complete address:

- Street number and name

- City

- State

- ZIP code

- Legal description (if the address is not sufficient):

- Include details such as section, lot, and block numbers

Special cases:

- Timber royalties: Enter "Timber royalties"

- Lump-sum timber payments: Enter "Lump-sum timber payment"

Box 4: Non-Cash Consideration

Check this box if:

The seller (transferor) received or will receive any of the following as part of the payment for the property:

- Property (other than cash)

- Services

- Cash payments

- Items treated as cash when calculating gross proceeds

To mark this box: Enter an "X" in the checkbox in Box 4.

Box 5: Foreign Transferor Indicator

Check this box if the seller (transferor) is a foreign person, which includes:

- Nonresident alien

- Foreign partnership

- Foreign estate

- Foreign trust

To mark this box: Enter an "X" in the checkbox in Box 5.

Important note: If this box is checked, there may be tax withholding requirements for properties sold by a foreign transferor.

Box 6: Buyer's Share of Prepaid Real Estate Tax

For residential real estate transactions:

- Enter the amount of prepaid real estate tax that is allocated to the buyer.

- Do not report real estate taxes paid in arrears (after the due date).

- Use the information from the Closing Disclosure or a similar form provided at closing.

Example calculation:

- Property sold: Residential

- Local tax system: Annual real estate tax paid in advance

- Total tax paid by seller for the year: $1,200

- Sale timing: End of the 9th month of the tax year.

- Buyer's share: 3 months (25% of the year)

- Amount to report in Box 6: $300 ($1,200 × 25%)

How to File Form 1099-S

You can file Form 1099-S, either online filing or by postal mail.

Electronic Filing (E-filing)

The IRS recommends filers prefer e-filing due to its efficiency, accuracy, and quick processing notifications. To e-file Form 1099-S, use an IRS-authorized e-file service provider like TaxZerone.

Here's how to e-file Form 1099-S:

- Enter the required information:

- Filer’s name, address, and TIN

- Transferor’s name, address, and TIN

- Gross proceeds

- Review the entered information:

- Ensure all details are correct and complete.

- Transmit the form to the IRS:

- Send the form securely through the e-file service.

- Share a copy with the transferor:

- Provide a copy of the form to the transferor.

Paper filing

While less efficient, paper filing is still an option. Follow these steps to file Form 1099-S on paper:

- Download Form 1099-S:

- Visit the official IRS website (www.irs.gov) to download the form.

- Print the form.

- Complete the form:

- Use black ink to fill out all required fields, including:

- Filer’s information

- Transferor’s information

- Gross proceeds

- Make a copy:

- Keep a copy for your records.

- Mail the original form:

- Send the original form to the IRS address specified in the Form 1099 General Instructions. The address varies based on your state. Refer to the "Where to Send Form 1099-S - Mailing Address" section to find the correct address for your state.

- Send a copy to the transferor:

- Provide a copy to the transferor by January 31st of the year following the reportable transaction.

Important considerations for paper filing:

- Mail forms early to ensure timely arrival before the deadline.

- Use certified mail for proof of timely filing

- Ensure all copies are legible.

Alternatively, you can file Form 1099-S electronically for faster processing and delivery, reducing the risk of delays or lost forms.

Where to send Form 1099-S - Mailing address

If you prefer paper filing, the mailing address for Form 1099-S varies depending on your business location. Below is a table summarizing the mailing address for Form 1099-S:

| If your business operates in or your legal residence is… | Mail Form 1099-S to… |

|---|---|

| Alabama, Arizona, Arkansas, Delaware, Florida, Georgia, Kentucky, Maine, Massachusetts, Mississippi, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Texas, Vermont, Virginia | Internal Revenue Service Austin Submission Processing Center P.O. Box 149213 Austin, TX 78714 |

| Alaska, Colorado, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Montana, Nebraska, Nevada, North Dakota, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Utah, Washington, Wisconsin, Wyoming | Department of the Treasury IRS Submission Processing Center P.O. Box 219256 Kansas City, MO 64121-9256 |

| California, Connecticut, District of Columbia, Louisiana, Maryland, Pennsylvania, Rhode Island, West Virginia | Department of the Treasury IRS Submission Processing Center 1973 North Rulon White Blvd. Ogden, UT 84201 |

| Outside the United States | Internal Revenue Service, Austin Submission Processing Center, P.O. Box 149213, Austin, TX 78714 |

How to E-File Form 1099-S with TaxZerone

Before you start e-filing Form 1099-S, ensure you have all the necessary information to facilitate a smooth and efficient filing experience. Here’s what you need to gather:

Required information for filing Form 1099-S:

- Filer details

- Transfer or details

- Property information including closing date, gross proceeds, and address.

Steps to e-file Form 1099-S using TaxZerone:

Step 1: Complete Form 1099-S

Open Form 1099-S and fill out the necessary fields with the information you have gathered.

Step 2: Review and transmit the return

Carefully review all the entered information to ensure accuracy. Once verified, transmit the completed Form 1099-S to the IRS.

Step 3: Provide the transferor copy

After successfully transmitting the form to the IRS, share a copy of the completed Form 1099-S to the transferor.

Benefits of E-Filing Form 1099-S with TaxZerone

E-filing Form 1099-S with TaxZerone offers several advantages, including:

- IRS form validations: Automated checks for errors or missing information to reduce the chances of rejection. submission.

- Email transferor copies: Share transferor copies of Form 1099-S via email and eliminate the need for manual mailing.

- Secure portal access (ZeroneVault): Debtors can access their return copies anytime, anywhere through the secure ZeroneVault portal.

- Competitive pricing: Industry-leading rates, starting as low as $0.59 per form.

By e-filing with TaxZerone, you can simplify your Form 1099-S filing, save time, and reduce errors.