Form 1099-R Instructions

Excise Tax Forms

Employment Tax Forms

Exempt Org. Forms

Extension Forms

FinCEN BOIR

General

What is IRS Form 1099-R?

IRS Form 1099-R is a tax form used to report distributions from

- Pensions

- Annuities

- Retirement or profit-sharing plans

- IRAs

- Insurance contracts

- Other similar financial products

Individuals who are retired or who left a job where they had a retirement plan may receive these distributions. This helps the IRS track retirement income and ensures that individuals report them on their tax returns

Who needs to file Form 1099-R?

Form 1099-R must be filed when distributions of $10 or more are made from:

- Retirement plans

- Certain insurance contracts

The following entities are responsible for filing this form:

- Retirement plan administrators

- Financial institutions

- Insurance companies

- Government agencies

When is the Form 1099-R due date?

Payers must be aware of two important deadlines related to Form 1099-R:

Filing deadline with the IRS

The deadline for payers to submit Form 1099-R to the IRS depends on the filing method:

- Electronic filing deadline: March 31, 2025

If you are e-filing Form 1099-R with the IRS, the deadline is March 31st of the year following the tax year for which the form is being issued. - Paper filing deadline: February 28, 2025

If you are filing Form 1099-R with the IRS using traditional paper methods, the deadline is February 28th of the year following the tax year for which the form is issued.

Avoid the stress of last-minute 1099-R deadlines.

E-file with TaxZerone now and enjoy hassle-free IRS compliance and peace of mind.

Recipient copies deadline: January 31, 2025

Payers must share copies of Form 1099-R to recipients by January 31st of the year following the relevant tax year. This allows recipients to accurately file their tax returns on time.

Missing these deadlines or providing incorrect information on Form 1099-R can lead to IRS penalties. To avoid potential penalties, payers should take steps to ensure that Form 1099-R is filed and distributed both accurately and on time.

Form 1099-R penalty

If you miss filing Form 1099-R within the deadline, the IRS will impose a penalty. Here are the Form 1099-R penalty rates:

| Days late | Penalty per return |

|---|---|

| Up to 30 days | $60 |

| 31 days late through August 1 | $130 |

| After August 1 or not filed | $330 |

| Intentional disregard | $660 |

Why risk penalties?

E-file your 1099-R forms ahead of the deadline with TaxZerone.

Form 1099-R Instructions - How to fill out?

Let's see line-by-line instructions on how to fill out Form 1099-R.

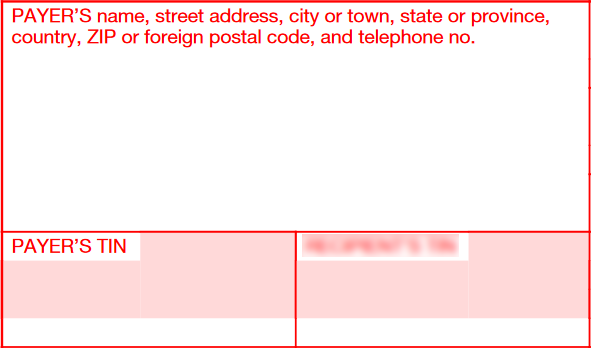

Payer details

Enter your name or business name, complete address, and TIN (SSN if you're an individual; EIN if you're a business).

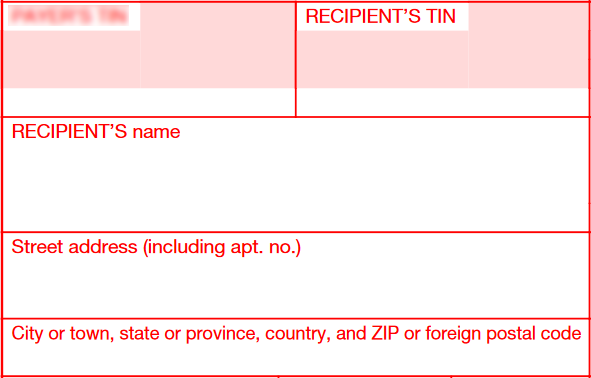

Recipient details

Enter the recipient’s name, complete address, and TIN (SSN for an individual; EIN for a business).

Box 1: Gross Distribution

Enter the total distribution amount before any tax or other deductions were withheld. Include:

- Direct rollovers

- IRA direct payments to employer plans

- Recharacterized IRA contributions

- Roth IRA conversions

- Premiums for life/other insurance paid by trustee/custodian

Also include distributions to participants from governmental section 457(b) plans. However, for early redemptions of certificate of deposit (CD) held in a trust, report only the net amount distributed after penalties/fees.

Box 2a: Taxable Amount

Enter the taxable portion of the distribution in Box 2a. However, if you cannot reasonably obtain the data to calculate the taxable amount, leave this box blank.

Enter 0 (zero) in Box 2a for any of the following non-taxable situations:

- Direct rollovers from a qualified plan, 403(b), or 457(b) plan to another such plan or traditional IRA (except IRA revocations)

- Direct rollovers from a Roth account to a Roth IRA

- Traditional, SEP, or SIMPLE IRA amounts directly transferred to an employer plan

- IRA recharacterizations

- Non-taxable 1035 exchanges of insurance/annuity contracts

- Non-taxable charges against cash value to purchase qualified long-term care insurance

Box 2b: Total Distribution

"Taxable amount not determined" checkbox:

- Check this box if you cannot determine the taxable amount of the distribution.

- This often applies when the distribution includes after-tax contributions or if it's unclear whether an exception to the early distribution penalty applies.

- If you check this box, you should leave Box 2a (Taxable amount) blank.

"Total distribution" checkbox:

- Check this box if this is the final distribution from the plan or account.

- It indicates that no further distributions are expected from this plan for this participant.

- This is often used for lump-sum distributions or when an account is being closed out entirely.

Box 3: Capital Gain (Included in Box 2a)

If any portion of the taxable amount in Box 2a is taxable as a capital gain, enter that capital gain amount in Box 3.

For charitable gift annuities:

- Report the total annuity distribution for the year in Box 1

- Report the taxable portion in Box 2a

- Report any capital gain amount in Box 3

- Report any nontaxable amount in Box 5

- Enter Code F in Box 7

Advise the annuity recipient if any amount in Box 3 is:

- Subject to the 28% rate for collectibles

- An unrecaptured section 1250 gain

Box 4: Federal income tax withheld

Report any federal income tax withheld from payments reported.

Box 5: Employee Contributions/Designated Roth Contributions or Insurance Premiums

Enter any of the following amounts the employee can receive tax-free this year, even if they exceed the amount in Box 1:

- Designated Roth account contributions or after-tax contributions made by/for the employee in prior years

- Employer contributions considered as employee contributions under section 72(f)

- Cost of life insurance protection premiums taxed to the employee in previous years (only if the life insurance contract itself is distributed)

- Premiums paid for commercial annuities

DO NOT include:

- Designated Roth account contributions already taxed

- Elective deferrals

- Contributions to a retirement plan that were not after-tax

Box 6: Net Unrealized Appreciation (NUA) in Employer's Securities

Use this box if you received a distribution from a qualified plan, excluding a designated Roth account, that includes securities from your employer's corporation, subsidiary, or parent company, and you can calculate the Net Unrealized Appreciation (NUA) in these securities.

If the distribution is a lump-sum, enter the total NUA in employer securities. If it's not a lump-sum distribution, only enter the NUA in employer securities that stem from employee contributions.

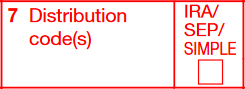

Box 7: Distribution Code(s)

Check the box labeled IRA/SEP/SIMPLE if the distribution comes from a traditional IRA, SEP IRA, or SIMPLE IRA. Do not check this box for distributions from a Roth IRA or for an IRA recharacterization.

Enter the relevant code(s) in box 7. Use Table 1 to find the correct code(s) for any amounts listed on Form 1099-R. Pay close attention to the codes and enter them accurately because the IRS relies on them to determine if the distribution has been properly reported. Incorrect codes could lead to incorrect tax assessments by the IRS.

Box 8: Other

Enter the current value of an annuity contract within a lump-sum distribution. Exclude this value from boxes 1 and 2a.

To calculate the annuity contract value, determine the current actuarial value, subtracting the excess of the employee's contributions over the distributed cash and property (excluding the annuity).

If the annuity is part of a lump-sum distribution for multiple recipients, also enter the percentage of the total annuity represented by each Form 1099-R in box 8. Additionally, record any reductions in investment value against the cash value of an annuity or life insurance contract due to charges or payments for qualified long-term care insurance in box 8. Ensure this value is not below zero.

Box 9a: Your Percentage of Total Distribution

For a total distribution made to multiple individuals, enter the percentage received by the person listed on Form 1099-R. You don't need to fill out this box for IRA distributions or direct rollovers.

Box 9b: Total Employee Contributions

It's optional to enter the total employee contributions or designated Roth contributions in this box. However, providing this information might be useful for the recipient.

If you decide to report the total employee contributions or designated Roth contributions, don't include any amounts already recovered tax-free in previous years. If it's a total distribution, report these contributions in box 5 instead of box 9b.

Box 10: Amount Allocable to IRR Within 5 Years

Write down the portion of the distribution that relates to an Individual Retirement Account (IRR) made within the five-year period starting from the first day of the year of the rollover. DO NOT fill out this box if an exception under section 72(t) is applicable.

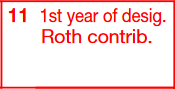

Box 11: First Year of Designated Roth Contributions

Enter the first year of the five-tax-year period. This is the year when the recipient initially established the designated Roth account.

Box 12: FATCA Filing Requirement Checkbox

Check this box if you are a

- Financial Institution (FFI) reporting a U.S. account, such as a cash value insurance or annuity contract, following the requirements of section 6047(d).

- U.S. payer reporting on Form 1099-R to fulfill your obligation for reporting on a U.S. account for chapter 4 purposes, as outlined in Regulations section 1.1471-4(d)(2)(iii)(A).

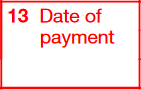

Box 13: Date of Payment

Enter here the date payment was made for reportable death benefits under section 6050Y.

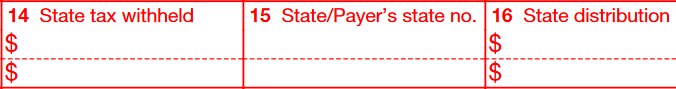

Boxes 14–16: State information

Box 14: Report any state income tax withheld from the payment

Box 15: Enter the 2-letter state abbreviation and payer's ID number for that state

Box 16: Enter the amount of the state distribution

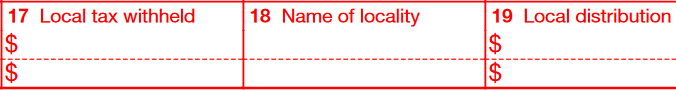

Boxes 17–19: Local tax information

Box 17: Report any local income tax withheld from the payment

Box 18: Enter the name of the locality

Box 19: Enter the amount of the local distribution

How to File Form 1099-R

You can file Form 1099-R, either electronically or by mail.

Electronic Filing (E-filing)

The IRS recommends e-filing for its efficiency, accuracy, and quick processing notifications. To e-file Form 1099-R, use an IRS-authorized e-file service provider like TaxZerone.

Here's how to e-file Form 1099-R:

- Enter the required information, including:

- Payer's name, address, and TIN

- Recipient's name, address, and TIN

- Distribution details

- Review all entered information.

- Transmit the form to the IRS securely.

- Share a copy to the recipient.

Paper filing

While less efficient, paper filing remains an option for those who prefer it. Here are the steps for paper filing:

Steps for paper filing:

- Download Form 1099-R from the official IRS website (www.irs.gov).

- Print the form.

- Complete all required fields using black ink. This includes:

- Payer's information

- Recipient's information

- Distribution details

- Make a copy for your records.

- Mail the original form to the IRS address specified in the Form 1099 General Instructions. The address varies based on your state. Refer to the Where to send Form 1099-R - Mailing address section to get the address for your state.

- Send a copy to the recipient by February 15th of the year following the reportable transaction.

Important considerations for paper filing

- Mail forms earlier before the deadline to ensure timely arrival.

- Use certified mail for proof of timely filing.

- Ensure all copies are legible.

Alternatively, you can file Form 1099-R electronically for faster processing and delivery, reducing the risk of delays or lost forms.

Where to send Form 1099-R - Mailing address

If you prefer paper filing, the mailing address for Form 1099-R varies depending on your business location. Below is a table summarizing the mailing address for Form 1099-R:

| If your business operates in or your legal residence is… | Mail Form 1099-R to… |

|---|---|

| Alabama, Arizona, Arkansas, Delaware, Florida, Georgia, Kentucky, Maine, Massachusetts, Mississippi, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Texas, Vermont, Virginia | Internal Revenue Service Austin Submission Processing Center P.O. Box 149213 Austin, TX 78714 |

| Alaska, Colorado, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Montana, Nebraska, Nevada, North Dakota, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Utah, Washington, Wisconsin, Wyoming | Department of the Treasury IRS Submission Processing Center P.O. Box 219256 Kansas City, MO 64121-9256 |

| California, Connecticut, District of Columbia, Louisiana, Maryland, Pennsylvania, Rhode Island, West Virginia | Department of the Treasury IRS Submission Processing Center 1973 North Rulon White Blvd. Ogden, UT 84201 |

| Outside the United States | Internal Revenue Service, Austin Submission Processing Center, P.O. Box 149213, Austin, TX 78714 |

How to E-File Form 1099-R with TaxZerone

Before you start e-filing Form 1099-R, ensure you have all the necessary information to facilitate a smooth and efficient filing experience. Here’s what you need to gather:

Required information for filing Form 1099-R:

- Payer details

- Recipient details

- Gross distribution amount

- Taxable amount

- Federal income tax withheld

- Type of distribution

Steps to e-file Form 1099-R using TaxZerone:

Step 1: Complete Form 1099-R

Open Form 1099-R and fill out the necessary fields with the information you have gathered.

Step 2: Review and transmit the return

Carefully review all the entered information to ensure accuracy. Once verified, transmit the completed Form 1099-R to the IRS.

Step 3: Provide the recipient copy

After successfully transmitting the form to the IRS, share a copy of the completed Form 1099-R to the recipient.

Benefits of E-Filing Form 1099-R with TaxZerone

E-filing Form 1099-R with TaxZerone offers several advantages. Here are some of the best benefits:

- IRS Form Validations: Automated checks for your returns for errors or missing information to ensure accuracy before submission.

- Email Recipient Copies: Share recipient copies of Form 1099-R by email and eliminate the need for manual mailing.

- Secure Portal Access (ZeroneVault):Let your recipients access their return copies anytime, anywhere through the secure ZeroneVault portal.

- Competitive Pricing: Industry-leading pricing, with rates starting as low as $0.59 per form.

By e-filing with TaxZerone, you can streamline your Form 1099-R filing, save time, reduce errors, and provide a better experience for your recipients.