Form 1099-K Instructions

Excise Tax Forms

Employment Tax Forms

Exempt Org. Forms

Extension Forms

FinCEN BOIR

General

What is IRS Form 1099-K?

IRS Form 1099-K reports payments received through reportable payment card transactions and/or settlement of third-party network transactions.

These payments can come from various sources, including:

- Credit, debit, or stored value cards, such as gift cards (payment cards)

- Payment apps or online marketplaces, which are also known as third-party settlement organizations.

Who needs to file Form 1099-K?

Form 1099-K must be completed and submitted annually to the IRS by payment card companies, payment apps, and online marketplaces. If your business meets the following criteria within a calendar year, you must file Form 1099-K:

- Receives payments exceeding $20,000.

- Has more than 200 transactions through credit cards or third-party payment networks.

When is the Form 1099-K due date?

Payers must be aware of two important deadlines related to Form 1099-K:

Filing deadline with the IRS

The deadline for payers to submit Form 1099-K to the IRS depends on the filing method:

- Electronic filing deadline: March 31, 2025

If you are e-filing Form 1099-K with the IRS, the deadline is March 31st of the year following the tax year for which the form is being issued. - Paper filing deadline: February 28, 2025

If you are filing Form 1099-K with the IRS using traditional paper methods, the deadline is February 28th of the year following the tax year for which the form is issued.

Avoid the stress of last-minute 1099-K deadlines.

E-file with TaxZerone now and enjoy hassle-free IRS compliance and peace of mind.

Payee copies deadline: January 31, 2025

Filers must deliver copies of Form 1099-K to payees by January 31st of the year following the relevant tax year. This allows payees to accurately file their tax returns on time.

Missing these deadlines or providing incorrect information on Form 1099-K can lead to IRS penalties. To avoid potential penalties, filers should take steps to ensure that Form 1099-K is filed and distributed both accurately and on time.

Form 1099-K penalty

If you miss filing Form 1099-K within the deadline, the IRS will impose a penalty. Here are the Form 1099-K penalty rates:

| Days late | Penalty per return |

|---|---|

| Up to 30 days | $60 |

| 31 days late through August 1 | $130 |

| After August 1 or not filed | $330 |

| Intentional disregard | $660 |

Why risk penalties?

E-file your 1099-K forms ahead of the deadline with TaxZerone.

Form 1099-K Instructions - How to fill out?

Let's see line-by-line instructions on how to fill out Form 1099-K.

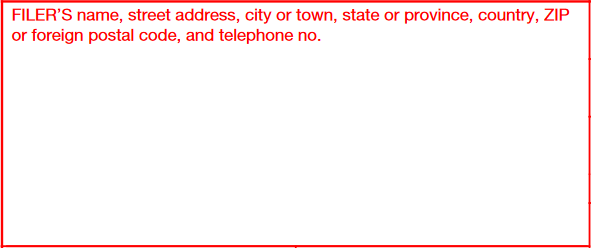

Filer details

Enter your name or business name, and complete address.

Filer’s TIN

Enter the filer’s TIN (EIN) of the entity with the filing requirement.

Payee’s TIN

Enter the payee’s TIN (EIN / SSN / ATIN / ITIN).

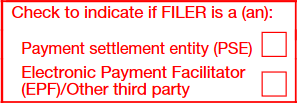

FILER Checkboxes

Check the

- first box if the entity with the filing requirement (payer) is a PSE.

- second (bottom) box if the entity with the filing requirement (payer) is an EPF or other third party.

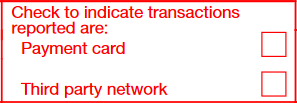

Transactions Reported Checkboxes

Check the

- first box if you are reporting payment card transactions.

- second box if you are reporting third-party network transactions.

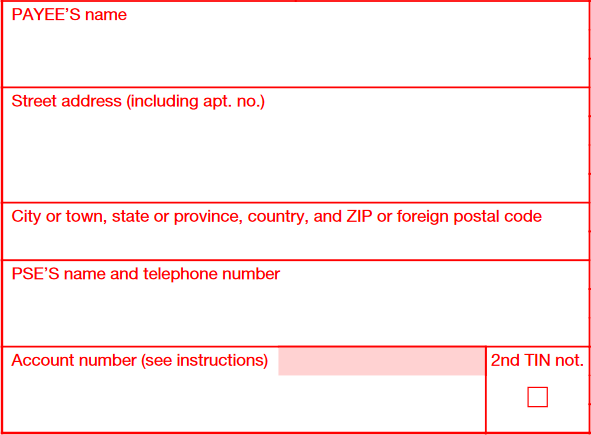

Payee details

Enter the recipient’s name and complete address.

- PSE’S name and telephone number: If the entity with the filing requirement (filer) is an EPF or other third party, enter the PSE's name and telephone number. The telephone number must allow a payee to reach a person knowledgeable about the payments reported on the form.

- Account number: You must provide the account number if you have multiple accounts for the same recipient and filing more than one Form 1099-K for that recipient.

- 2nd TIN not: If the IRS has notified you two times within the last 3 years that the payee provided an incorrect TIN, you can enter an "X " in this box. By doing so, the IRS will stop sending you further notices about this account's TIN.

Box 1a: Gross Payment Card/Third Party Network Transactions

Enter the total dollar amount of all payment card and third-party network transactions for the calendar year before any deductions or adjustments. This is the sum of the full charge amounts for each transaction involving each payee, determined on the transaction dates, without subtracting any credits, fees, refunds, discounts, shipping charges, or other amounts.

Box 1b: Card Not Present Transactions

Enter the total dollar amount of all payment card and third-party network transactions for the calendar year where the physical card was not present. This includes online orders, phone orders, and catalog orders. Report the full charge amounts before any deductions or adjustments like credits, fees, refunds, discounts, or shipping charges. Use the transaction dates to determine the amounts.

Box 2: Merchant Category Code

Enter the 4-digit Merchant Category Code (MCC) that classifies the type of business the payee operates for the payment card transactions you are reporting on Form 1099-K. If you use a classification system other than MCCs, select the MCC that best describes the payee's primary business activity.

Box 3: Number of Payment Transactions

Enter the number of payment transactions processed through the payment card/third-party payer network.

Box 4: Federal income tax withheld

Report any federal income tax withheld from payments reported.

Boxes 5a–5l

Enter the gross amount of the total reportable payment transactions for each month of the calendar year.

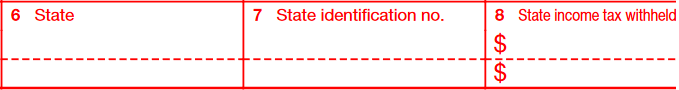

Box 6–8: State information

Box 6: Enter the 2-letter state abbreviation for the state

Box 7: Enter the state identification number

Box 8: Report any state income tax withheld from the payment

How to File Form 1099-K

You can file Form 1099-K, either electronically or by mail.

Electronic Filing (E-filing)

E-filing is the IRS-recommended method due to its efficiency, accuracy, and quick processing notifications.

To e-file Form 1099-K, you can use an IRS-authorized e-file service provider, such as TaxZerone. TaxZerone simplifies the e-filing process and allows you to complete it within minutes. Here's how it works:

- Enter the required information, including:

- Payer's name, address, and TIN

- Recipient's name, address, and TIN

- Transaction details

- Review all entered information for accuracy.

- Transmit the form securely to the IRS.

- Provide a copy to the recipient.

Paper filing

While less efficient, paper filing remains an option for those who prefer it. Here are the steps for paper filing:

Steps for paper filing:

- Download Form 1099-K from the official IRS website.

- Print the form.

- Complete all required fields using black ink. This includes:

- Payer's information

- Recipient's information

- Transaction details

- Make a copy for your records.

- Mail the original form to the IRS address specified in the Form 1099 General Instructions. The address varies based on your state. Refer to the Where to send Form 1099-K - Mailing address section to get the address for your state.

- Send a copy to the recipient by February 15th of the year following the reportable transaction.

Important considerations for paper filing

- Mail forms several weeks before the deadline to ensure timely arrival.

- Use certified mail for proof of timely filing.

- Ensure all copies are legible.

Alternatively, you can file Form 1099-K electronically for faster processing and delivery, reducing the risk of delays or lost forms.

Where to send Form 1099-K - Mailing address

If you prefer paper filing, the mailing address for Form 1099-K varies depending on your business location. Below is a table summarizing the mailing address for Form 1099-K:

| If your business operates in or your legal residence is… | Mail Form 1099-K to… |

|---|---|

| Alabama, Arizona, Arkansas, Delaware, Florida, Georgia, Kentucky, Maine, Massachusetts, Mississippi, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Texas, Vermont, Virginia | Internal Revenue Service Austin Submission Processing Center P.O. Box 149213 Austin, TX 78714 |

| Alaska, Colorado, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Montana, Nebraska, Nevada, North Dakota, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Utah, Washington, Wisconsin, Wyoming | Department of the Treasury IRS Submission Processing Center P.O. Box 219256 Kansas City, MO 64121-9256 |

| California, Connecticut, District of Columbia, Louisiana, Maryland, Pennsylvania, Rhode Island, West Virginia | Department of the Treasury IRS Submission Processing Center 1973 North Rulon White Blvd. Ogden, UT 84201 |

| Outside the United States | Internal Revenue Service, Austin Submission Processing Center, P.O. Box 149213, Austin, TX 78714 |

How to E-File Form 1099-K with TaxZerone

Before you start e-filing Form 1099-K, ensure you have all the necessary information to facilitate a smooth and efficient filing experience. Here’s what you need to gather:

Required information for filing Form 1099-K:

- Filer details

- Payee details

- Indication of whether you're a payment settlement entity (PSE) or electronic payment facilitator (EPF)/other third-party

- Gross amount of payment card/third party network transactions

- Card Not Present transactions

- Number of payment transactions

- Total reportable transactions for each month

- Federal and state income tax withheld if any

Steps to e-file Form 1099-K using TaxZerone:

Step 1: Complete Form 1099-K

Open Form 1099-K and fill out the necessary fields with the information you have gathered.

Step 2: Review and transmit the return

Carefully review all the entered information to ensure accuracy. Once verified, transmit the completed Form 1099-K to the IRS.

Step 3: Provide the payee copy

After successfully transmitting the form to the IRS, send a copy of the completed Form 1099-K to the recipient.

Benefits of E-Filing Form 1099-K with TaxZerone

E-filing Form 1099-K with TaxZerone offers several advantages:

- IRS Form Validations: TaxZerone's system checks your returns for errors or missing information, ensuring accuracy before submission.

- Email Recipient Copies: Conveniently send recipient copies of Form 1099-K via email, eliminating the need for manual mailing.

- Secure Portal Access (ZeroneVault): Recipients can access their return copies anytime, anywhere through the secure ZeroneVault portal.

- Competitive Pricing: TaxZerone offers industry-leading pricing, with rates starting as low as $0.59 per form, making it affordable for businesses of all sizes.

By using TaxZerone's e-filing solution, you can streamline your Form 1099-K filing, save time, reduce errors, and provide a better experience for your recipients.