Excise Tax Forms

Employment Tax Forms

Exempt Org. Forms

Extension Forms

Business Tax Forms

FinCEN BOIR

General

Form 1098-T, Tuition Statement, is an information report used by the student or their parent or guardian to claim a tax credit while filing Form 1040 or 1040-SR. This form should be filed by the eligible educational institution with the IRS for every student enrolled in the institution. Student copies should be sent to each student. Additionally, if the student claimed a refund or reimbursement using insurance, the insurer must file Form 1098-T with the IRS and furnish a copy to the student.

Eligible educational institutions

The accredited public, nonprofit, and private postsecondary institutions that provide valid accredited degrees or certificates and the institution is eligible to participate in the Department of Education’s student aid programs.

Details required to file form 1098-T

- Qualified tuition and related expenses

- Reimbursements or refunds

- Scholarships or grants (optional)

Expenses That Do Not Qualify as Tuition Expenses

- Expenses covered for the course or education regarding sports, games, or hobbies unless it is part of the degree or certification program

- Expenses cover student health fees, transportation, and personal, living, or family expenses.

Important dates in filing form 1098-T

To IRS

- E-Filing: The IRS encourages the institution to file form 1098-T using the electronic filing method. Electronic filing of form 1098-T is mandatory if the institute files more than 10 information returns.

Deadline for the Tax year 2025 : March 31, 2026

- Paper filing: Institutions can file using the paper filing method if they are filing less than 10 information returns for the tax year.

Deadline for the Tax year 2025 : March 2, 2026

To Student

An institution should send the student copy to each student enrolled in the institution before the deadline.

Deadline for the Tax year 2025: February 2, 2026

👉 For detailed information on 1098 t deadline and related penalties, visit our 1098-T Due Date page.

Step by Step instructions to file form 1098-T

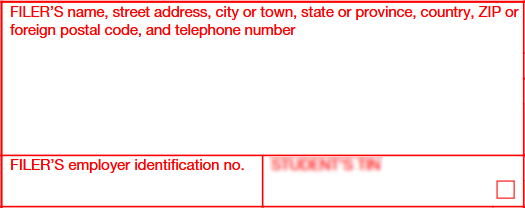

Step 1: Enter the Filer’s details

Enter the filer’s name, address, and telephone number along with the Filier Employer’s Identification Number. Mostly the filer of form 1098-T is an institution or authorized person who collects tuition and other related expenses on behalf of the institution.

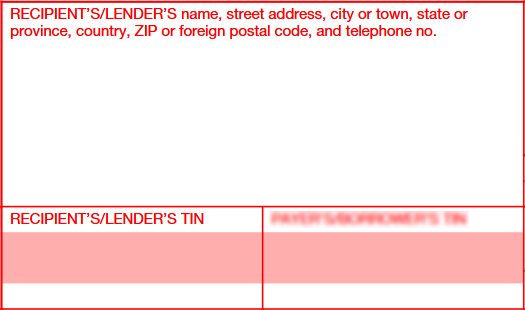

Step 2: Enter the student's details

Check the Student’s TIN box if the institution has obtained the student's SSN or other Tax identification Number using form W-9s or through Financial aid application.

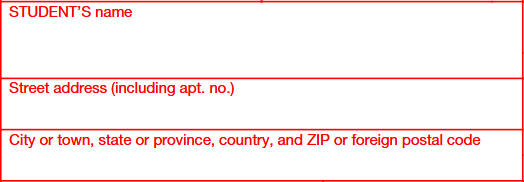

Enter the student’s name, and address if it is a permanent or long-term address. Temporary addresses can be provided only when there is no permanent address.

If the institute has more than one account with the same student, the account number along with the service provider name must be entered. The IRS recommends that institutions mention the account number even though there is only one account between them.

Step 3: Student Tuition fee details

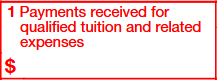

Box 1: Payments Received for Qualified Tuition and Related Expenses

Enter the total qualified tuition fees received for the tax year. Do not deduct scholarship payments or grants from this amount. However, subtract any refunds or reimbursements issued during the same period. Additionally, include any overdue payments collected this year for a prior tax year

Box 2 & 3: Reserved

Box 2 an d 3 require no details as it is reserved for future use.

Box 4: Adjustments Made for a Prior Year

Enter the amount refunded or reimbursed in the tax year for the previous overpayment of tuition fees or other expenses made after 2002 and also the reductions in charges made for qualified tuition and related expenses made during the tax year that were reported for any previous year after 2002.

Box 5: Scholarships or Grants

Enter the amount the institution administered and processed as scholarships or grants for the student eligible tuition fees and other related expenses. The scholarship includes all third-party payments received for the expense of the student generally like the Department of Veterans Affairs, the Department of Defense, civic and religious organizations, and nonprofit entities.

Box 6: Adjustments to Scholarships or Grants for a Prior Year

Enter the reduction in the amount of scholarship or grant that needs to be reported for the previous tax year after 2002.

Box 7: Checkbox for Amounts for an Academic Period Beginning in January Through March of 2026

Check the box if you have made any payment for the eligible tuition fees and related expenses for the academic year starting between January and March 2025.

Box 8: Check if at Least Half-Time Student

Check the box if the student is at least a half-time student. The half-time students will only have half the part of the workload of the full academic year and the workload should exceed the standards set by the Department of Education.

Box 9: Check if a Graduate Student

Check the box if the student is enrolled in a graduate-level degree or certification program or leads to graduate-level credentials.

Box 10: Insurance Contract Reimbursements or Refunds

Check the box if the student received any insurance refund or reimbursement concerning the qualified tuition fees or related expenses.

Ready to simplify form 1098-T filing?

File form 1098-T at affordable cost of $2.59/per form

Save more by filing big!

File form 1098-T in bulk and see the pricing go down to $0.59/per form