Excise Tax Forms

Employment Tax Forms

Exempt Org. Forms

Extension Forms

Business Tax Forms

FinCEN BOIR

General

Form 1098, Mortgage Interest Statement, is a tax form used to report mortgage interest received in the tax year by the lender. The lender should file Form 1098 to the IRS if the mortgage interest is more than $600. It is the annual tax information return form.

Who should file form 1098?

A person or entity involved in a trade or business that receives mortgage interest must file Form 1098 to report the interest received. The IRS requires mandatory filing of Form 1098 for interest received in a tax year if it exceeds $600. Voluntary filing of Form 1098 can be done even if the mortgage interest is less than $600.

Important dates in Form 1098

File Form 1098 before the deadline to avoid IRS penalties and stay compliant. It is also important to send Borrower copy to the borrower of the mortgage.

Filing With IRS

- E-Filing deadline: March 31, 2026

Electronic filing of Form 1098 with the IRS should be done before March 31, 2026, for the tax year 2025. You must file electronically if you file 10 or more information in a tax year - Paper filing deadline: March 2, 2026

Paper filing of form 1098 with The IRS should be done before March 2, 2026, for the tax year 2025.

Sending copies to Borrowers/Payers

The lender should send a copy of Form 1098 to the Borrower before February 2, 2026, for the tax year 2025. This applies to both paper and E-filing of form 1098.

File form 1098 with TaxZerone and send borrower/payer copies

using Zeronevault

Information needs to be reported in Form 1098

Form 1098 reports information including:

- Mortgage interest including points

- Mortgage insurance premium

- Reimbursements of overpaid interest

Penalties

- Failure to E-file: If there are more than 10 information returns that need to be filed for a tax year, e-filing is mandatory. Failure will lead to $340 per return.

- Failure to file before the deadline: The IRS has a deadline to file Form 1098 and the late filing penalty can go from • $60 per information return up to $4,098,500 per year and the upper limit for small business penalties is $1,366,000 per year.

- Failure to file correct information: The information in form 1098 is wrongly entered and can accumulate penalties if it is not corrected before the deadline. The penalty is the same as failure to file before the deadline.

Why Risk penalties?

File now with TaxZerone and stay IRS-compliant

Guide to file form 1098

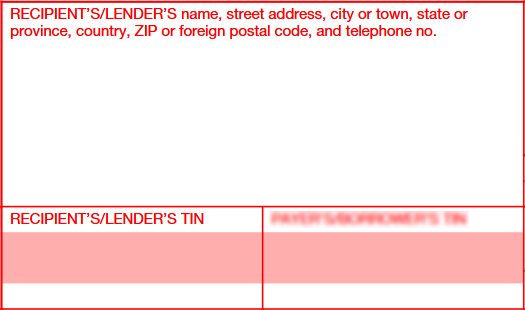

Lender/Recipient details

Enter the lender/Recipient's name, address, telephone number, and EIN if the lender is an entity or SSN if the filer is an individual.

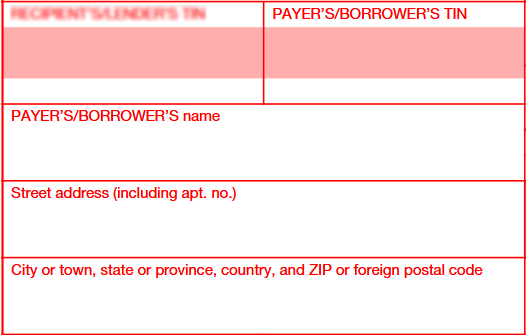

Borrower/Payer details and account number

Enter the Borrower(Payer) tax identification number mostly SSN, name, address

Enter the account number if the lender has multiple mortgage accounts with the borrower as the lender needs to file more than one Form 1098

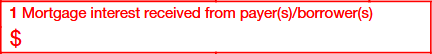

Box 1: Mortgage interest received form payer(s)/borrower(s)

Enter the interest paid by the borrower on the mortgage during the tax year excluding points. This payment includes interest on a mortgage, a home equity loan, or a line of credit or credit card loan secured by the property.

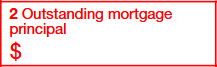

Box 2: Outstanding Mortgage principal

Enter the remaining amount that needs to be paid as a mortgage at the end of the tax year.

Box 3: Mortgage Origination date

Enter the date when the mortgage document is signed between the lender and the borrower.

Box 4: Refund of Overpaid Interest

Enter the refund issued for the overpayment of the interest or the credit for the overpayment of interest in the previous year

Box 5: Mortgage Insurance Premiums

Enter the insurance premium paid during the tax year including prepaid premium.

Box 6: Points Paid on Purchase of Principal Residence

Enter the points paid on the purchase of the borrower's principal residence

Box 7: Address of Property Securing Mortgage

Check the box, if the Borrower's current address and the address of the property at which the mortgage is secured are the same

Box 8: Address or description of property securing mortgage

If you didn’t check Box 7, enter the address of the property for which the mortgage is secured

Box 9: Number of Mortgaged Properties

If there is more than one property bought using the mortgage being reported, enter the number of properties.

Box 10: Other

Enter the details the filer wishes to convey to the borrower. For Example, the collection agent can specify the name of the person for whom you collected the interest and real estate tax.

Box 11: Mortgage Acquisition Date

Enter the mortgage acquisition date if the mortgage is acquired on the tax year else leave the box blank.

TaxZerone makes filing form 1098 Simple, Secure, and affordable

File your Form 1098 form at just $2.49/each form

The more you file the more you save

The cost can go down up to $0.59/each form when you file in bulk