Form 1098-E Instructions

Essential information and instructions required for filing form 1098-E

Excise Tax Forms

Employment Tax Forms

Exempt Org. Forms

Extension Forms

Business Tax Forms

FinCEN BOIR

General

Form 1098-E, Student Loan Interest Statement, is an information return submitted by a lender to report the interest income received on the Qualified student loan provided. This is the annual form that needs to be filed by the lender if the lender receives more than $600 as interest from the student loan provided.

Who needs to file form 1098-E?

The financial institution, government agencies, educational institution, or any other individual who receives more than $600 in interest from a student loan is required to file Form 1098-E with the IRS. Additionally, they must provide a copy to the student who took out the loan. If there is more than one individual is connected with the loan, the first individual to receive the interest amount should file the form 1098-E.

Qualified Student loan

A qualified student loan is a loan certified by the student to be used solely for educational expenses. It must be recognized by the federal, state, or local government, or postsecondary educational institution, or be at least subsidized, guaranteed, or financed specifically for educational purposes.

Revolving accounts

Interest paid on a revolving account such as a credit card account for the sole purpose of educational expenses should be reported under form 1098-E. This reporting is essential only when the borrower certifies the amount is used only for the qualified educational expenses. The lender need not verify the student's actual spending of the money.

Important dates for filing form 1098-E

File Form 1098-E before the deadline to avoid IRS penalties and stay compliant with IRS tax standards.

Filing To IRS

- E-Filing: IRS encourages lenders to file form 1098-E using electronic filing methods for efficient and faster filing and processing. E-filing is mandatory if the lender needs to file more than 10 information returns in a tax year.

Deadline for the Tax year 2025 : March 31, 2026

- Paper filing: File form 1098-E using paper filing only if you have to file less than 10 information returns to be filed for the tax year.

Deadline for the Tax year 2025 : March 2, 2026

Sending Borrower copy

The lender should issue the borrower copy to the student before the deadline to avoid penalties and compliance issues. Lender filing using E-filing and paper filing methods both need to send the borrower copy.

Deadline for the Tax year 2025 : February 2, 2026

Step-by-step instructions to file form 1098-E

Follow the steps to file form 1098-E

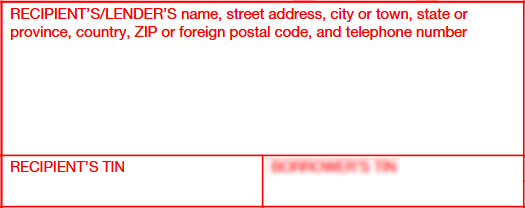

Step 1: Lenders Detail

Enter the Name, address, and telephone number of the filer the lender along with the lender/recipient Tax Identification Number.

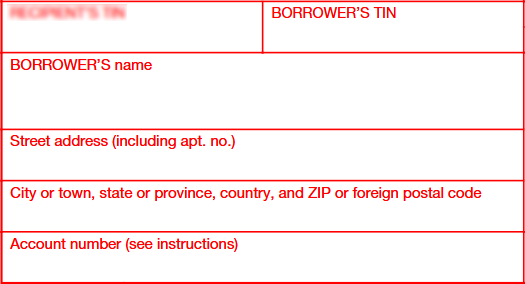

Step 2: Borrower Details

Enter the name of the borrower (here it is the student who acquired the student loan), address, and Tax Identification Number of the borrower. The account number is required if the lender has multiple accounts with the borrower and needs to file a separate 1098-E form for each account.

Step 3: Student Loan interest details

Box 1: Student Loan Interest Received by Lender

Enter the amount of interest received from the student loan, which includes capitalized interest and charges for the usage or delay(forbearance) of the loan and the loan should be originated on or after September 1, 2004.

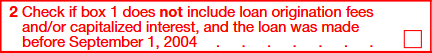

Box 2: Checkbox

Check this box if there is a loan originated before September 1, 2004, and the capitalized interest or charges are not reported in Box 1.

File form 1098-E With TaxZerone

Affordable filing starts at $2.49/per form

File in Bulk, Save more

Filing per form can go down up to $0.59