1095-C/1094-C Instructions

Learn about Form 1095-C/1094-C and file using the instructions provided

Excise Tax Forms

Employment Tax Forms

Exempt Org. Forms

Extension Forms

Business Tax Forms

FinCEN BOIR

General

All Applicable Large Employers should report the health coverage offered by the employer to the employee and the enrollment status of employees in the health coverage. This report should be filed to the IRS using forms 1095-C and 1094-C and send the employee copy of form 1095-C to the respective employees.

Applicable Large Employer

An Applicable Large Employer (ALE) is an organization that is legally required to provide health coverage to its employees under the Affordable Care Act (ACA). A company or entity qualifies as an ALE if it has at least 50 full-time employees, including full-time equivalent employees, during the previous calendar year. This classification determines the employer’s responsibilities regarding health insurance coverage and reporting requirements.

Full-time Equivalent Employees

An employee who works fewer than 120 hours in a month is not classified as a full-time employee. However, their hours contribute to the calculation of Full-Time Equivalent (FTE) employees for the entity. To determine the number of FTE employees, the total hours worked by non-full-time employees in a month is divided by 120.

Who needs to File Form 1095-C?

All Applicable Large Employers (ALEs) are required to file Form 1095-C along with Form 1094-C as part of their reporting obligations under the Affordable Care Act (ACA). Form 1095-C must be provided to each eligible employee, as it serves as a crucial document for individuals when filing their federal tax returns. Employees need this form to determine their eligibility for the Premium Tax Credit while completing Form 1040. Additionally, the IRS uses the information on these forms to verify employer compliance with ACA regulations.

Important dates for filing

- File with IRS (paper)

Employers filing less than 10 information returns for a tax year can file form 1095-C/1094-C using the paper filing methodDeadline for the Tax year 2025 : March 02, 2026

- File with the IRS (Electronic Filing)

Employers are advised to file forms 1095-C and 1094-C using electronic filing(E-Filing) for easy filing and faster processingDeadline for the Tax year 2025 : March 31, 2026

- Send Recipient copies

The employer must provide form 1095-C electronically or through paper to the respective employee before the deadline to stay compliant with IRS regulationDeadline for the Tax year 2025 : March 3, 2026

Taxzerone encourages ALE to submit their forms using electronic filing methods and send recipient copies using ZeroneVault for secure processing.

Form 1095-C Penalty:

If the employer fails to file Form 1095-C within the deadline, the IRS will impose a penalty for failure to file and failure to provide correct information to the employee. The penalty starts at $330 for each return and has an upper limit of $3,987,000 for a calendar year.

Avoid the last-minute rush and penalty. Start your Form 1095-C Electronic filing with us!

Instructions to file Form 1095-C along with 1094-C

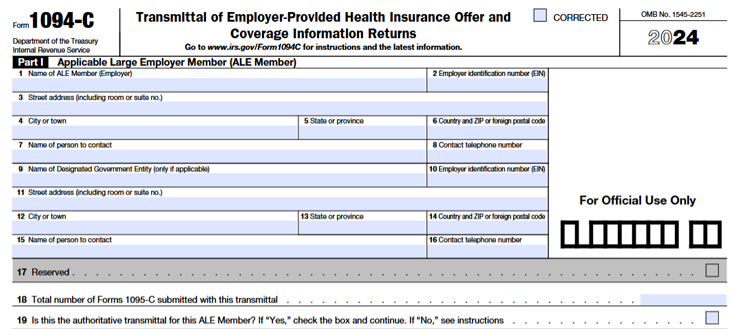

Form 1094-C: Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Return

Part I - Applicable Large Employer Member (ALE Member)

Line 1: Enter the name of the Applicable Large Employer.

Line 2: Enter the nine-digit Employer Identification Number (EIN) of the Applicable Large Employer. SSN should not be entered and EIN should be entered along with the dash

Line 3 through Line 6: Enter the street address, city, state, country, and Zip code of the employer. Verify that this address matches the ALE member address on form 1095-C.

Line 7: Enter the responsible person's name for responding to queries from the IRS regarding to filing of forms 1094-C and 1095-C.

Line 8: Enter the Responsible Person's phone number for answering IRS queries

Line 9: Enter the name of DGE, if a DGE is filing on behalf of the ALE member.

Line 10: Enter the DGE’s Employer Identification Number (EIN).

Line 11 to 14: Enter the DGE’s street address, city, state, country, and zip code.

Line 15 to 16: Enter the name and phone number of the person to contact who will respond to any inquiries on your behalf to the IRS about the information reported on or the filing of Form 1094-C.

Line 17: Reserved for future use

Line 18: Enter the total number of Form 1095-C you plan to submit along with the transmittal Form 1094-C.

Line 19: Check the box if this Form 1094-C transmittal is the Authoritative Transmittal and complete Part II, Part III, and Part IV. otherwise, leave this section blank and go to the signature portion.

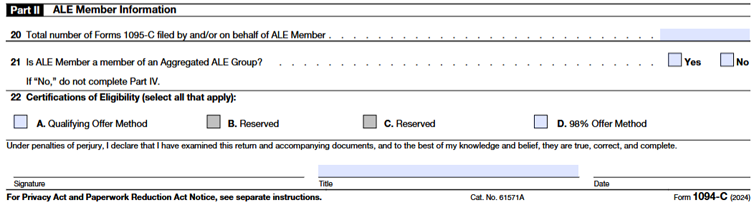

Part II - ALE Member Information:

Line 20: Enter the total number of Forms 1095-C that will be submitted by or on behalf of the ALE Member. This count should include all Forms 1095-C associated with this transmittal, covering individuals enrolled in the employer-sponsored, self-insured plan (if applicable), as well as any additional Forms 1095-C filed with a separate transmittal by or for the ALE Member.

Line 21: Check the “yes” box if you are an ALE member of an aggregated ALE Group during any month of the calendar year.

- If you selected "Yes," you should also fill out column (d) of Part III, "Aggregated Group Indicator," and Part IV.

- If you selected "No", do not fill out column (d) of Part III, "Aggregated Group Indicator,", and Part IV.

Line 22:

- Check the ‘Qualifying Offer Method’ if the employer offers the Qualifying medical coverage to the employee and their dependent, but the employee didn’t take the offered coverage.

- Check the ‘98% Offer Method’ if the employer offers Minimum Essential Coverage for at least 98% of the employees.

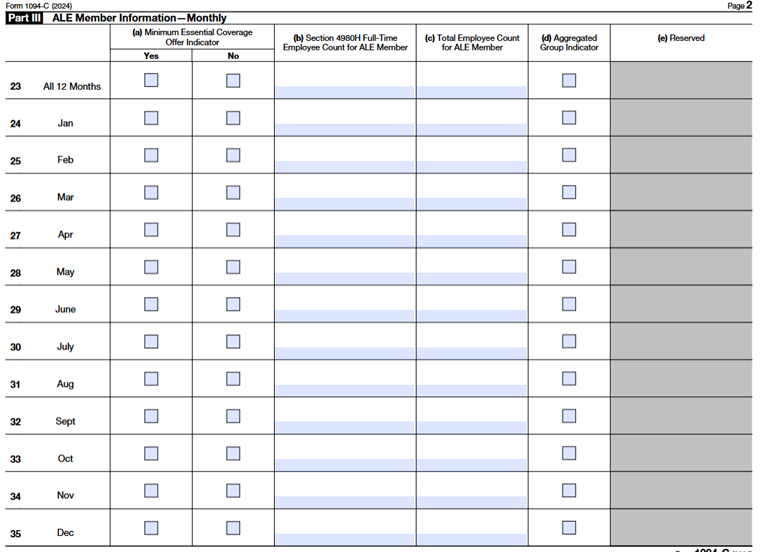

Part III - ALE Member Information—Monthly

Line 23 to 35:

Column(a)

- On line 23 Select “Yes” for “All 12 Months” if the ALE Member provided minimum essential coverage, including an individual coverage HRA, to at least 95% of its full-time employees and their dependents for the complete calendar year. If the employer failed to provide the mentioned coverage Select “No” for “All 12 Months”.

- For each applicable calendar month, Select the "Yes" checkbox if the ALE Member-provided at least 95% of its full-time employees and their dependents with minimum essential coverage.

- For each applicable calendar month, Select the "No" checkbox if the ALE Member failed to provide at least 95% of its full-time employees and their dependents with minimum essential coverage.

Column(b)

- Enter the total number of full-time working employees for ALE members The total number of employees should not include employees in the Limited Non-Assessment Period.

Column(c)

- Enter the total number of working employees including full-time employees, non-full-time employees, employees who are in a Limited Non-Assessment Period,

Column(d)

- Check the box in line 23 if the ALE was an aggregate member for the entire 12 months, or select the specific month's box from 24 to 35 during which the ALE was an aggregate member.

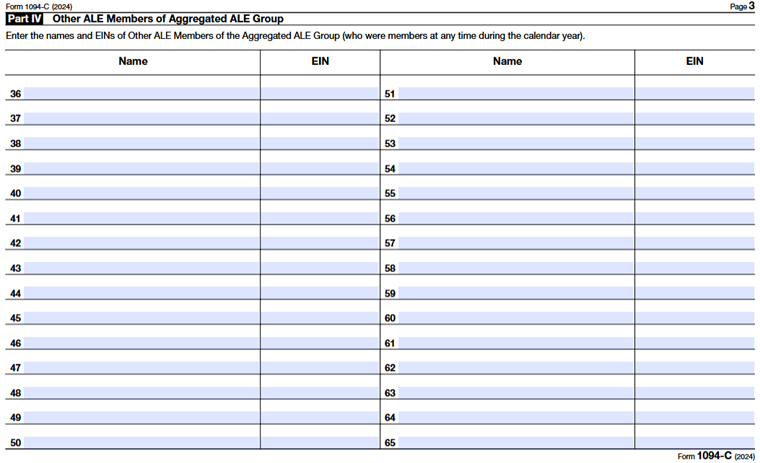

Part IV - Other ALE Members of Aggregated ALE Group

Line 36 to 65: Enter the other ALE member7apos;s Names and Employer Identification Numbers (EIN) of the aggregated ALE group during the calendar year.

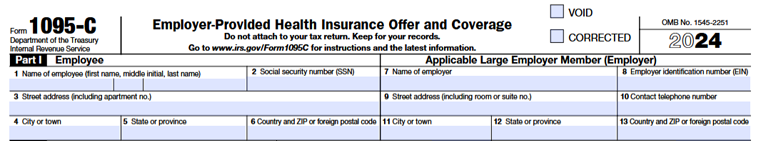

1095-C : Employer-Provided Health Insurance Coverage

Part I - Employee and Applicable Large Employer Member (Employer)

Line 1: Enter the full name of the employee

Line 2: Enter the Social Security Number (SSN) of the employee

Line 3 through 6: Enter the street address, city, state, Country, and Zip code of the employee in the appropriate field

Line 7: Enter the legal full name of the employer(ALE member)

Line 8: Enter the Employer Identification Number (EIN) of the employer

Line 9 through 13: Enter the street address, Phone number of the person the IRS can contact to report the errors, city name, state, Country, and Zip code of the employer in the given field.

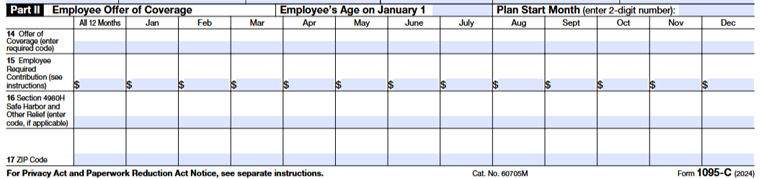

Part II - Employee Offer of Coverage

Employee’s Age on January 1: Enter the Employee's Age on January 1, 2025, if the employee was offered an individual coverage HRA.

Plan Start Month: Enter the 2-digit number of the calendar month when the plan is started and from when the employee is offered health coverage. If there is no health plan coverage offered to the employee, Enter “00”.

Line 14: Enter the coverage offered by the employer to the employee, dependent on the code format mentioned below. If the code is the same for all 12 months only enter the code in ‘All 12 months column’. If the code is different for any of the months fill the code for the respective month.

Code Format:

1A - It represents the Minimum essential coverage(MEC) with the Minimum value(MV) provided to you, your spouse, and dependents with an employee-required contribution for self-only coverage equal to or less than 9.5% (as adjusted) based on the single federal poverty line.

1B - It represents the minimum essential coverage provided and the minimum value offered only to employees.

1C - It represents the Minimum Essential Coverage provided Minimum value only to employees and other dependents(Spouse is not included).

1D - It represents the Minimum Essential Coverage provided Minimum value only to employees, and Spouse(Dependents are not included). Don’t use this code if coverage is conditionally offered to Spouse, instead use 1J

1E - It represents the Minimum Essential Coverage provided Minimum value to their employees, spouse, and dependents. Don’t use this code if coverage is conditionally offered to the Spouse, instead use 1K

1F - It represents the Minimum essential coverage NOT providing minimum value offered to the employee, or employee and your spouse or dependent(s), or employee, spouse, and dependent(s).

1G - During one or more months of the calendar year, you were enrolled in self-insured employer-sponsored coverage, but you were not a full-time employee during any of the months in the year.

1H - No coverage offered. This means either the employer has not offered any coverage or the coverage offered does not meet the requirement of Minimum Essential Coverage.

1I - Reserved

1J - It represents the Minimum essential coverage providing minimum value offered to employees, Minimum value conditionally offered to your spouse but not offered to employees dependent.

1K - It stands for the Minimum Essential Coverage that offers minimum value to the employee, and the employee's dependents, and Minimum Essential Coverage is conditionally offered to the employee's spouse.

1L - It stands for the individual coverage health reimbursement arrangement (HRA), which is only available to employees. Their affordability is assessed using the ZIP code of the employee's primary address.

1M - This code represents the Individual coverage HRA offered to employees and their dependents but not offered to their spouse. Employee affordability is determined by using the employee’s primary residence ZIP code.

1N - This code represents the Individual coverage HRA offered to employee, spouse, and dependents with affordability determined by using the employee’s primary residence ZIP code.

1O - This code represents the Individual coverage HRA offered to employees only using their primary employment site ZIP code affordability safe harbor.

1P - This code represents the HRA provided to employees and their dependents (but not their spouse) with individual coverage based on the affordability safe harbor for the employee's primary employment site ZIP code.

1Q - It represents the Individual coverage HRA offered to employees, spouse, and dependents using the employee’s primary employment site ZIP code affordability safe harbor

1R - This code represents the Individual coverage HRA offered is not affordable to employees; employees and spouse or dependents; or employees, spouse, and dependents.

1S - It represents the Individual coverage HRA offered to an individual employee who was not a full-time employee.

1T - The Individual coverage HRA offered to the employee and spouse (not to dependents) with affordability determined using the employee’s primary residence ZIP code.

1U - The Individual coverage HRA offered to the employee and spouse (not to their dependents) using the employee’s primary employment site ZIP code affordability safe harbor.

1V to 1Z - Reserved

Line 15: Fill Line 15, only if you entered 1B, 1C, 1D, 1E, 1J, 1K, 1L, 1M, 1N, 1O, 1P, 1Q, 1T, or 1U code in Line 14. Enter the amount of the Employee Required Contribution, which is the employee's share of the monthly cost for the lowest-cost, self-only, minimum essential coverage that is offered to the employee. If the employee required contribution is Zero, enter 0.00

Line 16: Enter the applicable ‘2’ code series from the below. If the code is the same for the month Enter the code in ‘All 12 Months’. If different codes are applicable for the different months then fill in the code for the respective month. Leave the month column blank if not applicable

Code series

2A- Use code 2A, if the employee was not worked on any day of the calendar month. Don't use code 2A, if the employee worked on any day of the ALE member or the employee terminates the employment with the ALE member.

2B- Use code 2B, if the employee is not a full-time employee for the month and not provided Minimum Essential coverage. Also, You can use Code 2B, if the employee was a full-time employee and their coverage was terminated before the month's end due to termination of employment.

2C- Use code 2C on line 16 if the employee was enrolled in the health coverage offered by the ALE Member for every day of the month. However, do not use code 2C in the following cases:

- If code 1G is entered on line 14.

- If the multiemployer interim rule relief applies (use code 2E instead).

- If the employee was terminated and enrolled in COBRA or post-employment coverage (use code 2A instead).

- If the coverage was not minimum essential coverage (MEC).

2D- Use code 2D, if the employee was in a Limited Non-Assessment Period or an initial measurement period. Don’t use code 2D if the multiemployer interim relief rule is applied to the employee, instead use code 2E.

2E- Use code 2E, For any month when the employee is subject to the multiemployer arrangement interim guidance.

2F- Use code 2F, if the ALE Member determines their employee's affordability using the section 4980H Form W-2 safe harbor under section 4980H(b). It must be used every month of the year when the employee is eligible for health Coverage.

2G- Use code 2G, if the ALE Member used the section 4980H federal poverty line safe harbor to determine their employee's affordability for any month.

2H- Use code 2H, if the ALE Member used the section 4980H rate of pay safe harbor to determine their employee's affordability for any month.

2I- Reserved

Line 17: Please enter the Zip code that the employer used to calculate the employee's affordability. This field is required only if the employee was offered an individual coverage Health Reimbursement Arrangement(HRA). This is required only when the code 1L, 1M, 1N, 1O, 1P, 1Q, 1T, or 1U in line 15

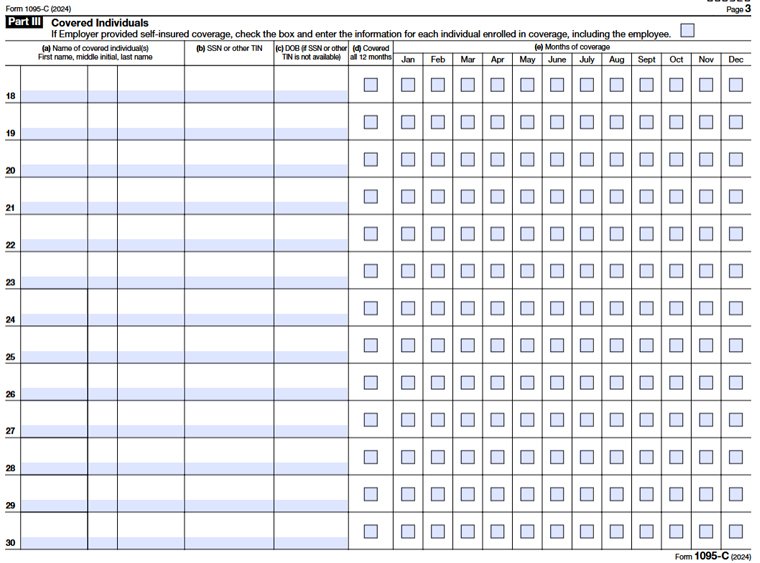

Part III - Covered Individuals

Line 18 through 30: Enter the details of the covered individual along with the employee

Column (a) – Enter the legal full name of the health coverage offered employee.

Column (b) – Enter employee SSN (Social Security Number) or TIN ( Taxpayer Identification Number)

Column (c) – Enter the employee's date of birth if SSN or TIN is not available.

Column (d) – Check this box if the employee was covered every month of the year.

Column (e) – Check the specific months the individual employee was covered, if the coverage offered was not for all 12 months.

Feeling Puzzled while filing Form 1095-C/1094-C?

File Your ACA Forms Now with TaxZerone - It's Easy & Fast!

Filing starts at $ 2.59/Per form and can go down up to $0.59/Per form