1095-B/1094-B Instructions

Learn about Forms 1095-B /1094-B, and file them by following the instructions.

Excise Tax Forms

Employment Tax Forms

Exempt Org. Forms

Extension Forms

FinCEN BOIR

General

Form 1095-B is an information return form used to report individuals covered by Minimum Essential Coverage (including coverage for Spouse and Dependents). Minimum Essential Coverage includes government-sponsored programs, eligible employer-sponsored plans, individual market plans, and other coverage that the Department of Health and Human Services designates as minimum essential coverage. Form 1095-B should be filed along with Form 1094-B to stay compliant with IRS regulations.

Who must file Form 1095-B?

Health Coverage Providers

Organizations providing essential health coverage to individuals must file Form 1095-B, using Form 1094-B to submit these returns.

Self-Insured Employers

Employers with their own health plans (including individual coverage HRAs) must report coverage. Large employers (50+ employees) usually report this on Form 1095-C but can use Form 1095-B for nonemployees.

Small Employers with Self-Insured Plans

Small employers not subject to shared responsibility rules use Forms 1094-B and 1095-B to report coverage.

Health Insurance Issuers and Carriers

Insurers file Form 1095-B for most employer-sponsored and individual health plans, including coverage through the Small Business Health Options Program (SHOP).

Plan Sponsors of Self-Insured Employer Coverage

Employers, multiemployer plan sponsors, and employee organizations offering self-insured coverage must file Form 1095-B unless required to use Form 1095-C.

Government Employers

Government entities may be designated to report for a government employer providing self-insured plans.

Government-Sponsored Program Administrators

Agencies administering programs like Medicare Part A, Medicaid, CHIP, TRICARE, Veterans Affairs healthcare coverage, and Peace Corps coverage must file Form 1095-B.

State Agencies

State agencies report coverage for Medicaid, CHIP, and other government programs.

Designated Health Plans

Providers of designated essential coverage plans, such as Medicare Advantage, Refugee Medical Assistance, and Basic Health Programs, must file Form 1095-B.

Important dates for filing

Paper Filing with the IRS

IRS allows up to 10 information reports to be filed using the paper filing method for a tax year.

Deadline for the Tax year 2024 : February 28, 2025

Electronic Filing with the IRS

IRS encourages all to E-File form 1095-B/1094-B even if they are qualified for paper filing.

Deadline for the Tax year 2024 : March 31, 2025

Send Individual copies

Send recipient copies to the respective individuals, regardless of your filing method(Paper and E-filing).

Deadline for the Tax year 2024 : March 03, 2025

TaxZerone encourages E-filing to achieve more efficiency and accuracy

Form 1095-B Penalty

- If an employer does not file Form 1095-B by the deadline, the IRS will impose a penalty for failing to file accurate information returns and furnish correct payee statements. The penalty begins at $330 per return, with a maximum limit of $3,987,000 per year.

- If the requirement to file the returns and furnish recipient statements is intentionally ignored, the penalty per return increases to $660, with no annual maximum limitation.

Skip the last-minute hurry and E-file your taxes today!

instructions to file Form 1095-B and Form 1094-B

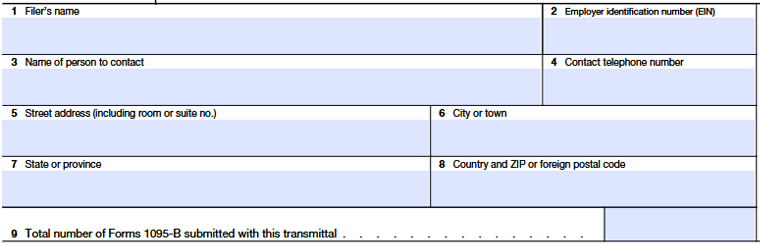

Form 1094-B: Transmittal of Health Coverage Information Returns

Form 1094-B, Transmittal of Health Coverage Information Returns, acts as a cover sheet for Form 1095-B submissions to the IRS.

Line 1: Enter the Filer’s Name (Full Name)

Line 2: Enter the Employer identification number (EIN)

Line 3 : Enter the Person’s Name to contact, if the IRS wishes to contact the individual about the filing errors and provide any additional information.

Line 4: Enter the contact person’s phone number

Lines 5 through 8: Enter the filer's Complete address, City, State, Country, and Zip Code. queries

Lines 9: Enter the total number of Form 1095-B submitted with Form 1094-B, Transmittal form.

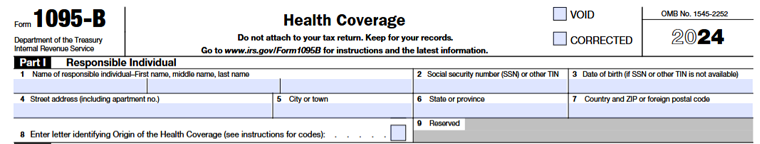

Form 1095-B: Health Coverage

Part I - Responsible Individual

Line 1: Enter the Responsible Individual&aps;s(Recipient of Health Coverage) First name, middle name, and Last name.

Line 2: Enter the 9-digit SSN (Social Security Number) of the responsible individual. If the SSN is not available, enter the other Taxpayer Identification Number(TIN.)

Line 3: Enter the Date of Birth in MM/DD/YYYY format of the individual, Date of Birth is needed only when Line 2 is blank.

Lines 4 through 7: Enter the complete mailing address including street address (including apartment number), city, state, country, and Zip code.

Lines 8: Enter the code to identify the origin of health coverage offered to you or other covered individuals. It is used to determine the type of coverage offered. Only one code should be entered on this line.

A- Small Business Health Options Program (SHOP)

B- Employer-sponsored coverage, except for individual coverage Health Reimbursement Arrangement (HRA)

C- Government-sponsored program

D- Individual market insurance

E- Multiemployer plan

F- Other designated minimum essential coverage

G- Employer-sponsored coverage including individual coverage HRA

line 9: Leave it blank, it is reserved for future use.

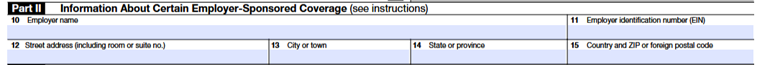

Part II – Information About Certain Employer-Sponsored Coverage

Only issuers or carriers of insured group health plans, including those whose coverage was purchased through the Small Business Health Options Program (SHOP), are required to complete this section.

line 10: Enter the Employer name

line 11: Enter the Employer Identification Number (EIN)

Line 12 through 15: Enter the complete address, city, state, country, and Zip code of the employer.

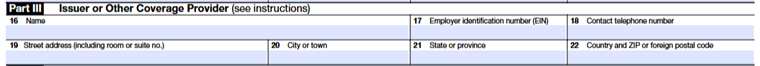

Part III – Issuer or Other Coverage Provider

Line 16: Enter the Name of the coverage provider

Line 17: Enter the Employer identification number (EIN)

Line 18: Enter the Contact number of coverage provider, so that the individual can call for any additional information.

Line 19 through 22: Enter the complete address, city, state, country, and Zip code of the coverage provider.

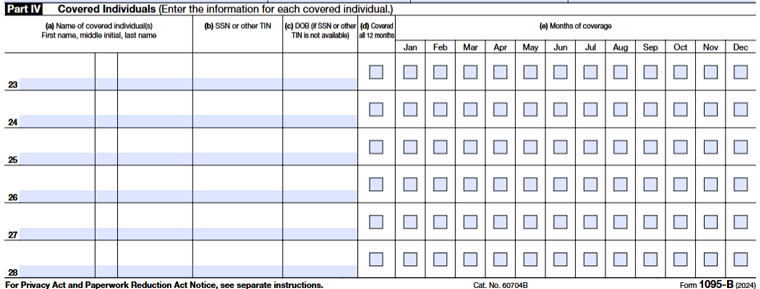

Part IV – Covered Individuals

Line 23 through 28: Enter all the covered individual details

Column (a) – Enter the complete name of the covered individual

Column (b) – Enter SSN or TIN

Column (c) – Enter date of birth, if SSN or TIN is not available

Column (d) – If the individual was covered for at least one day every month for each of the 12 months of the calendar year.

Column (e) – If the individual was not covered for the full 12 months, check the appropriate box(es) for the month(s) in which the person was covered for at least one day.

TaxZerone Simplify the form 1095-B for just $2.59

File more! Save Big!

The filing cost of each form can go down up to $0.59