General Instructions for BOI Reporting

Instruction Essential for Reporting Beneficial Ownership Information of Your Organization

Excise Tax Forms

Employment Tax Forms

Information Returns

Exempt Org. Forms

Extension Forms

Business Tax Forms

General

What is Beneficial Ownership Information (BOI)?

Beneficial Ownership Information (BOI) refers to the details of individuals who are considered the beneficial owners of a company or entity. Beneficial owners are the people who have substantial control or ownership interest in the organization. As the Corporate Transparency Act requires, the details of the beneficial owners and company applicants must be reported to FinCEN by companies registered with the Secretary of State or a similar office.

Who Needs to Report? Understanding Reporting Companies

A company required to submit Beneficial Ownership Information (BOI) to FinCEN is called a "Reporting Company." There are two types of Reporting Companies:

- Domestic Reporting Companies: These include corporations, limited liability companies (LLCs), and other entities that are formed and registered to conduct business in the U.S. through the process of filing documents with the Secretary of State or a comparable office They are subject to BOI reporting requirements.

- Foreign Reporting Companies: These are corporations, LLCs, or other entities formed under foreign laws but registered to operate in the U.S. by filing documents with the Secretary of State or equivalent offices. They, too, are required to report BOI.

For details on when to submit your BOI report, visit our BOI filing due dates page

Who Are the Beneficial Owners of Your Company?

Beneficial owners are individuals who either possess a significant ownership interest in a reporting company or exercise substantial control over its operations. Below is detailed information on what is ownership interest and substantial control.

| Ownership interest | Substantial control |

|---|---|

An individual who owns or controls 25% or more of the ownership interest in a reporting company must be reported in the Beneficial Ownership Information (BOI) filed with FinCEN. Ownership interest can take many forms, including:

| An individual who has the power to influence or control a reporting company's decision-making, whether directly or indirectly, must be reported as a Beneficial Owner. This control can include decisions related to the company's structure, finances, or operations. Key indicators of substantial control include:

|

Different Types of BOI Reporting

Initial Report

Any reporting company submitting its Beneficial Ownership Information (BOI) to FinCEN for the first time should choose the 'Initial Report' option during the submission process.

Correct Prior Report

If a reporting company identifies an error in its previously submitted BOI report to FinCEN, the Correct Prior Report" option should be selected to amend and correct the information. Ensuring accurate data is provided to FinCEN is essential to avoid potential penalties.

Update Prior Report

A reporting company that has already submitted its BOI report but needs to update information—such as changes in Beneficial Owners—should select the "Update Prior Report" option. This may occur during events like leadership changes, the sale of the company, or changes in ownership.

Newly Exempt Entity

A reporting company that has previously submitted a BOI report but has since gained exempt status should choose the "Newly Exempt Entity" option when updating its BOI information with FinCEN.

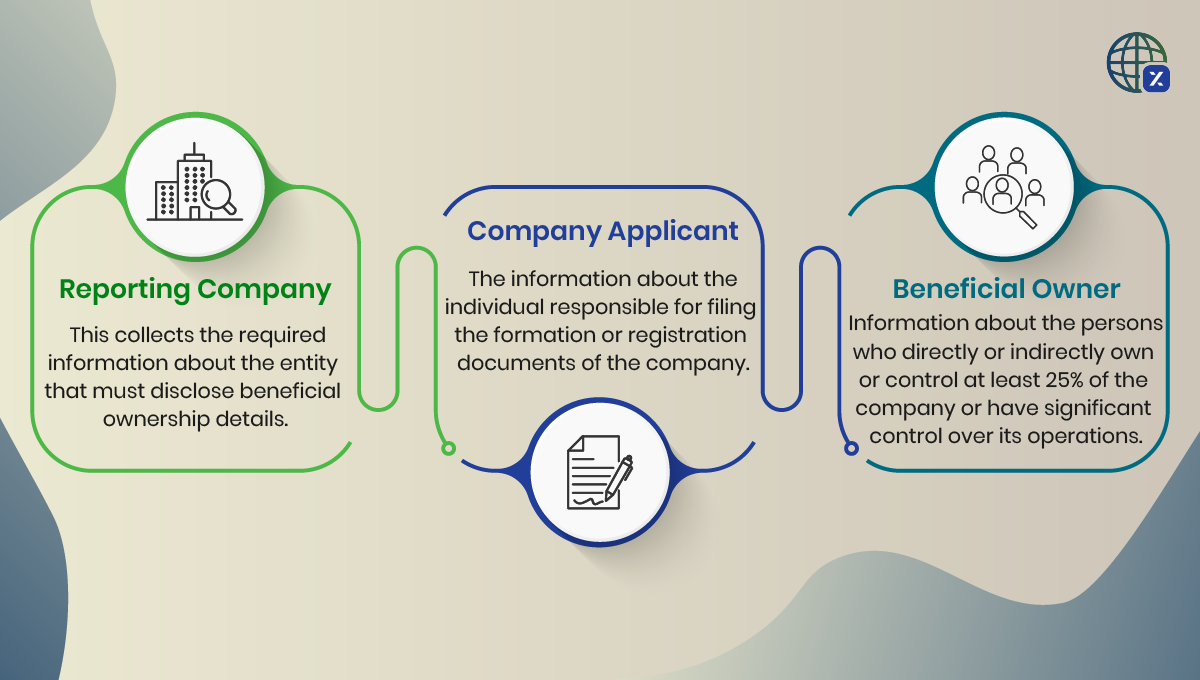

Understanding BOI reporting: The three key parts

BOI (Beneficial Ownership Information) reporting is divided into three essential parts:

- Reporting Company: This collects the required information about the entity that must disclose beneficial ownership details.

- Company Applicant: The information about the individual responsible for filing the formation or registration documents of the company.

- Beneficial Owner: Information about the persons who directly or indirectly own or control at least 25% of the company or have significant control over its operations.

Information Required from the Reporting Company in the BOI Report

When it comes to BOI reporting, the Reporting Company must provide FinCEN with all relevant details, including:

- Type of filing: Whether it's an Initial Report, a correction to a prior report, an update, or information for a newly exempt entity.

- Legal and alternate names: The company’s official legal name and any alternate names it may operate under.

- Form of identification: The specific identification details required for the entity.

- Jurisdiction of formation/registration: The state or jurisdiction where the company was formed or first registered.

- Current U.S. address: The company’s most up-to-date physical address in the United States.

Key details every Company Applicant should provide in the BOI filing

The Company Applicant is the individual responsible for submitting the entity's registration. Up to two Company Applicants can be reported for each entity. When filing BOI information, the following details about the Company Applicant must be provided:

- FinCEN ID (If applicable): A unique identifier issued by FinCEN, if the applicant has one.

- Legal name and Date of birth: The full legal name and birthdate of the applicant.

- Current address: The applicant’s current business or residential address.

- Form of identification and issuing jurisdiction: The type of identification provided, along with the jurisdiction that issued it.

- Upload identification document: A digital copy of the identification document must be uploaded for verification.

Details you must submit about Beneficial Owners

In the BOI reporting process, the Beneficial Owner's details must be provided for the reporting company. The required information includes:

- FinCEN ID (If applicable): A unique identifier issued by FinCEN, if the beneficial owner has one.

- Legal name and Date of birth: The full legal name and birthdate of the beneficial owner.

- Residential address: The residential address where the beneficial owner currently resides.

- Form of identification: The type of identification provided, along with the issuing jurisdiction.

- Upload identification document: A digital copy of the identification document must be uploaded for verification.

Important dates in BOI reporting

| S.No | Condition | Due Dates |

|---|---|---|

| 1 | Entity registered before January 1, 2024 | January 1, 2025 |

| 2 | Entity registered on or after January 1, 2024, and before January 1, 2025 | 90 days from the date of registration |

| 3 | Entity registered on or after January 1, 2025 | 30 days from the date of registration |

| 4 | Any updates to the entity, such as changes in beneficial owners, etc. | 30 days after the change happened |

| 5 | Any corrections to the BOI report already submitted | 30 days after identifying the error |

Who doesn’t count as a beneficial owner?

Under five categories an Individual can be determined as he is not the Beneficial Owner of the company.

| Nominees, Intermediaries, Custodians, or Agents Individuals who act on behalf of an actual Beneficial Owner do not need to be reported. However, the actual Beneficial Owner must still be listed in the BOI submission. | |

| Minor Child If the Beneficial Owner is a minor, their information does not need to be reported to FinCEN. Instead, the parent or legal guardian's details must be provided in the BOI report. | Inheritors Individuals whose only interest in the company is through the right of inheritance, such as those set to inherit the company in the future, do not need to be reported in the BOI. |

| Employees: Employees who do not hold senior positions, such as President, CFO, General Counsel, CEO, or COO, and whose control or benefits are solely tied to their employment can also be excluded from the | Creditors: Individuals who lend a specific sum to the company, and whose only right is to receive repayment, are not considered Beneficial Owners and are exempt from being reported. |

BOI Reporting: Entities that are exempt from filing

There are 23 categories of entities that are exempt from Beneficial Ownership Information reporting requirements.

| Exemption No. | Types of entities |

|---|---|

| 1 | Securities reporting issuer |

| 2 | Governmental authority |

| 3 | Bank |

| 4 | Credit union |

| 5 | Depository institution holding company |

| 6 | Money services business |

| 7 | Broker or dealer in securities |

| 8 | Securities exchange or clearing agency |

| 9 | Other Exchange Act registered entity |

| 10 | An investment company or investment adviser |

| 11 | Venture capital fund adviser |

| 12 | Insurance company |

| 13 | State-licensed insurance producer |

| 14 | Commodity Exchange Act registered entity |

| 15 | Accounting firm |

| 16 | Public utility |

| 17 | Financial market utility |

| 18 | Pooled investment vehicle |

| 19 | Tax-exempt entity |

| 20 | Entity assisting a tax-exempt entity |

| 21 | Large operating company |

| 22 | Subsidiary of certain exempt entities |

| 23 | Inactive entity |

File your BOI Report with TaxZerone

Submit your BOI Report to FinCEN at just $39.99 Per EIN