Form 945-X Filing Instructions

Learn about Form 945-X and correct you form 945 error with Confidence

Excise Tax Forms

Information Returns

Exempt Org. Forms

Extension Forms

FinCEN BOIR

General

Form 945-X is used to correct the administrative mistakes made previously while filing the form 945. Administrative errors can happen when the filer calculated the amount withheld wrongly and reported the wrongly calculated amount to IRS through Form 945. This instruction will help you in understanding form 945-X and how to file the form to IRS.

This instruction contains

Form 945-X and its purpose

Form 945-X is the adjusted annual return of withheld federal income tax or claim for refund form used by the payer who made non payroll payment, to correct the mistakes made in the form 945. If Overreported tax, refund can be claimed. If underreported tax, tax owed should be paid immediately.

What is new in filing form 945-X?

IRS has recently added electronic filing option for 945 form correction. Now you can E-File Form 945-X to correct the mistakes made during filing Form 945

Type of filing methods

Paper filing

Payer who needs to correct the mistake in form 945 can use paper filing method to file form 945-X. But it is slow and tedious method.

Electronic Filing

While paper filing is an option IRS provide easy and fastest way to correct the errors in form 945. Now user can electronically file Form 945-X and correct mistakes in previously filed 945 forms.

File Form 945-X whenever you find errors in form 945 using TaxZerone

Important terms used in this instruction

Form 945-X has two terms that define whether you owe tax or eligible to get a refund, Let’s explore the term

Underreported

When filing form 945, if you reported the tax withheld or backup withholding lesser than the amount you actually withheld, it is called underreported. In this case you owe tax to the IRS, and it should be paid immediately. Generally, there will be no penalties if you corrected this error as soon as you noticed.

Overreported

When filing form 945-X, if you reported the tax withheld or backup withholding amount higher than the actually withheld amount, you are eligible for credit or refund, and this is called overreported. File form 945-X to correct the error and you can also claim refund using 945-X form.

Understanding the deadlines

To calculate the deadline, the first and foremost thing you need to understand is Succeeding April 15 from the date Form 945 is filed will be considered as filing date by the IRS.

Example: If you file Form 945 on January 25, 2025, the IRS will treat it as filed on

April 15, 2025.

Period of limitations

IRS consider the period of limitation as

- The correction form 945-X should be filed within three years of filing IRS 945 form or two years from the date of payment of wrongly reported tax on form 945. This applies to the Overreported employment taxes.

- The corrections should be filed within three years if the employment tax is underreported and tax owed should be paid immediately.

Guide to file form 945-X

Follow these step-by-step instructions to file correction form 945-X online.

Filer Details

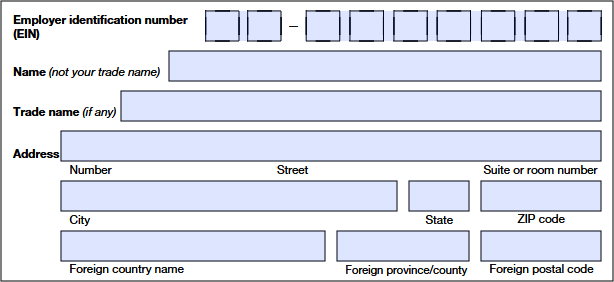

Enter the Employer Identification Number (EIN), Filer full name, Trade name, and address of the entity with Zip code

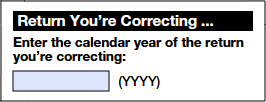

Enter the year for which the form 945 administrative error should be corrected.

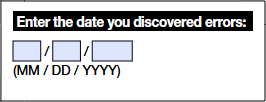

Enter the date on which the administrative error in the form 945 is first identified.

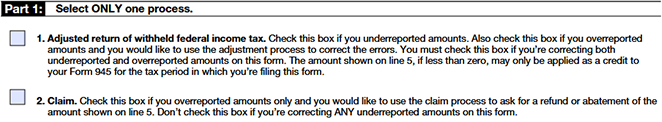

Part 1: Choose the tax adjustment option

Line 1: Check this box if you underreported the tax. Also check this box if you overreported the taxes and wishes to adjust the excess amount as tax credit in the next form 945 tax return filing.

Line 2: Check this box if you need refund of the overreported tax or abatement of the tax amount. If you have underreported the taxes, don’t check on this box.

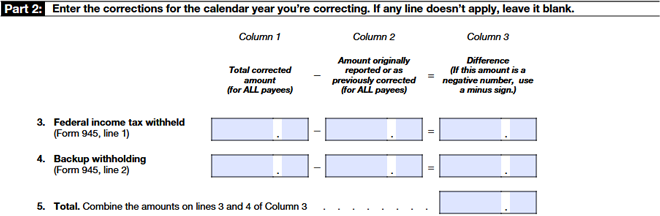

Part 2: Correct the administrative error

Line 3: Enter the Correct federal tax withheld in Column 1, previously entered amount in Colum 2 and difference between the Column 1 and Column 2 should be entered in column 3

Line 4: Enter the correct backup withholding amount in Column 1, previously entered amount in Colum 2 and difference between the Column 1 and Column 2 should be entered in column 3

Line 5: enter the total amount by combining the amount in Column 3 of Line 3 and 4

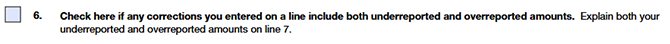

Part 3: Explain the correction

Line 6: Check the box, if the correction done on line 3 and line 4, have both underreported and overreported amount.

Line 7: Write the complete description of the correction mentioned in part 4, line 3 and 2. Mention the

- Form 945-X line number(s) affected.

- Date you discovered the error.

- Amount of the error.

- Cause of the error.

Example: There is $1800 difference in Column 3 of Line 4 is due to the typo error. Previously it is wrongly reported as 2000 on January 23, 2025, but the actual backup withholding is actually $200. This error was found on March 3, 2025, and we like to get the overreported taxes as refund.

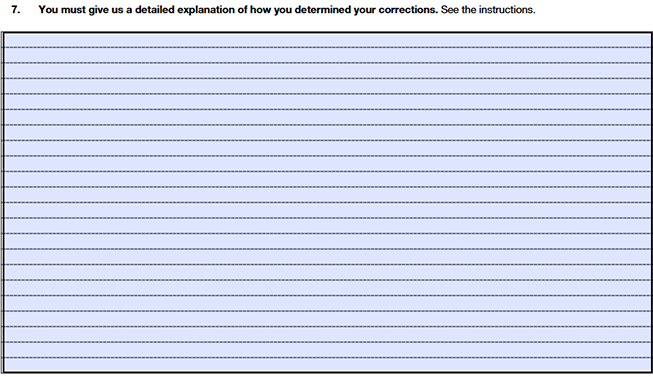

Part 4: Sign the form

The individual responsible for filing form 945-X should sign the form along with your name, title, date and contact number.

If the form is filled by paid preparer, enter the preparer name, sign, address along with the Zip code, PTIN, Date, EIN, and phone number.

Made error while filing form 945?

Just file form 945-X with TaxZerone

correct the mistakes for $6.99/Return