Form 944 Instructions

Excise Tax Forms

Information Returns

Exempt Org. Forms

Extension Forms

FinCEN BOIR

General

IRS Form 944 is an Employer's Annual Federal Tax Return for small employers with $1,000 or less in annual payroll tax liability. It simplifies reporting federal income tax, Social Security, and Medicare taxes by letting you file once a year instead of quarterly (like Form 941).

Unlike Form 941, which is filed quarterly, Form 944 is filed annually.

Table of Contents

What’s New in Form 944 for 2024?

- Social Security Tax: The rate remains 6.2% for both employee and employer, with a new wage base limit of $168,600.

- Medicare Tax: The rate stays at 1.45% for both, with no wage base limit.

- Household & Election Workers: Social Security and Medicare taxes apply to household workers earning $2,700 or more, and election workers earning $2,300 or more.

Who must file Form 944?

Generally, if the IRS has instructed you to file Form 944, you must file this form annually instead of submitting quarterly Form 941. This form reports the following:

- Wages paid to employees

- Tips reported by your employees

- Federal income tax withheld

- Both the employer and employee portions of Social Security and Medicare taxes

- Additional Medicare Tax withheld from employees

- Adjustments for the current year related to Social Security and Medicare taxes, including fractions of cents, sick pay, tips, and group-term life insurance

- Qualified small business payroll tax credit for increasing research activities.

Exceptions

Certain employers are not eligible to file Form 944. These include:

- Household Employers: If you only employ household workers, Form 944 is not applicable.

- Agricultural Employers: If you only employ agricultural workers, you are not required to file Form 944.

- Employers Notified by the IRS to File Quarterly Forms 941: This applies if you’ve received confirmation from the IRS that your filing requirement has been changed from Form 944 to Form 941.

- Employers Not Notified by the IRS to File Form 944: If the IRS does not instruct you to file Form 944, do not file it. If you'd prefer to file Form 944 instead of quarterly Forms 941, refer to the section on Requesting To File Form 944 in 2025 Instead of Quarterly Forms 941.

When Is Form 944 Due?

Form 944 for the 2024 tax year is due by January 31, 2025. However, if you have fully paid your annual tax liability through timely deposits, you have until February 10, 2025, to file the form.

Ensure that Form 944 is filed only once per calendar year. If you file electronically, avoid submitting a paper version.

E-file Form 944 for 2024 with TaxZerone

Simplify your annual payroll tax filing. Report wages, taxes, and contributions with ease. Avoid penalties—file on time!

Where Should Form 944 be Filed?

The IRS encourages you to file Form 944 electronically, as it provides a streamlined method to fulfill your filing requirements. If you choose to file a paper return, the mailing address depends on whether a payment is included with your Form 944. Use the table below to determine the appropriate address for your location.

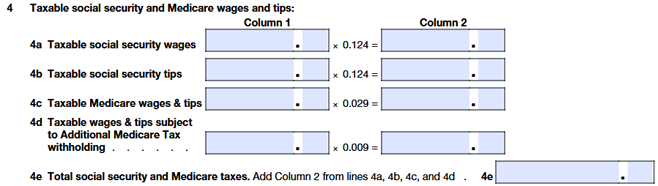

| If your location is... | Without a payment... | With a payment... |

|---|---|---|

| Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0044 | Internal Revenue Service P.O. Box 806532 Cincinnati, OH 45280-6532 |

| Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0044 | Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

| No legal residence or principal place of business in any state, including employers in American Samoa, Guam, the CNMI, the USVI, and Puerto Rico | Internal Revenue Service P.O. Box 409101 Ogden, UT 84409 | Internal Revenue Service P.O. Box 932100 Cincinnati, Louisville, KY 40293-2100 |

| Special filing address for exempt organizations; federal, state, and local governmental entities; and Indian tribal governmental entities, regardless of location | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0044 | Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

Must You Deposit Your Taxes?

If your total taxes after adjustments and nonrefundable credits (Form 944, line 9) are under $2,500, you can pay them directly with your return. To avoid penalties, pay in full and file on time. Depositing the taxes isn’t required, but you can choose to do so if you prefer. If your liability is $2,500 or more, you’ll need to deposit the taxes instead of paying them with your return. Refer to the Federal Tax Deposit Requirements for Form 944 Filers table below for more information. Failing to deposit taxes on time may result in penalties and interest.

Keep in mind, that the $2,500 threshold for federal tax deposits is different from the $1,000 threshold for filing Form 944. Even if your business grows during the year, you’ll still file Form 944 but may need to make federal tax deposits.

Federal Tax Deposit Requirements for Form 944 Filers

| Tax Liability | Deposit Requirement |

|---|---|

| Less than $2,500 for the year | No deposit is required. You may pay the tax with your return. If unsure your liability will be under $2,500, but you can still make deposits as outlined below. |

| $2,500 or more for the year but less than $2,500 for the quarter | You can deposit by the last day of the month following the end of a quarter. If your fourth-quarter tax liability is under $2,500, you may pay it with Form 944. |

| $2,500 or more for the quarter | You must make monthly or semiweekly deposits based on your deposit schedule. If your taxes reach $100,000 or more on any given day, you must deposit the tax by the next business day. See section 11 of Pub. 15 for details. |

Form 944 vs. Form 941: Key Differences

| Feature | Form 944 | Form 941 |

|---|---|---|

| Purpose | For small employers with annual tax liabilities of $1,000 or less. | For larger employers to report quarterly payroll taxes. |

| Filing Frequency | Filed once a year (Annually) | Filed four times a year (Quarterly) |

| Due Dates | January 31 (or February 10 if taxes are fully paid on time) | April 30, July 31, October 31, and January 31 |

| Tax Liability Threshold | Specifically for businesses with a total payroll tax liability of $1,000 or less annually | Designed for businesses with a higher payroll tax liability. |

| Tax Payment Frequency | Typically once a year unless liability exceeds $2,500 | Monthly or semi-weekly, based on total tax liability |

| Amended Form | Corrections are made using Form 944-X. | Corrections are made using Form 941-X. |

- Key Reminder: Verify with the IRS which form applies to your business before filing.

How to File Employer's Annual Federal Tax Return: Step-by-Step Guide

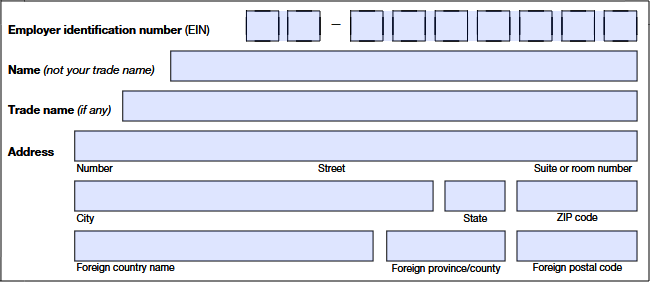

Step 1: Enter the Entity Information

- Employer Identification Number (EIN): Enter your unique EIN in the designated box.

- Name: Provide your legal business name.

- Trade Name: If your business operates under a different name, enter it here.

- Address: Fill in your business address, including street, suite, city, state, ZIP, and foreign address details (if applicable).

Step 2: Fill Out Part 1: Annual Tax Return Information

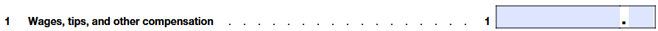

- Line 1: Enter total wages, tips, and other compensation paid to employees.

- Line 2: Enter federal income tax withheld.

- Line 3: If no wages are subject to Social Security or Medicare tax, check the box and proceed to Line 5.

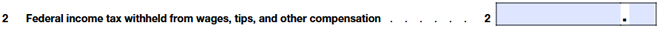

- Lines 4a–4d: Calculate Social Security and Medicare taxes based on taxable wages and tips, then total them in Line 4e.

- Line 5: Add Line 2 and Line 4e for total taxes before adjustments.

- Line 6: Adjust taxes for prior year corrections or other adjustments.

- Line 7: Combine Lines 5 and 6 for total taxes after adjustments.

- Line 8: Enter qualified small business payroll tax credit (if applicable, attach Form 8974).

- Line 9: Subtract Line 8 from Line 7 for total taxes after credits.

- Line 10: Enter total deposits for the year, including prior overpayments applied.

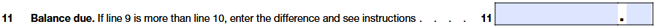

- Line 11: If taxes (Line 9) exceed deposits (Line 10), enter the balance due.

- Line 12: If deposits (Line 10) exceed taxes (Line 9), enter the overpayment and choose whether to apply it to the next year or request a refund.

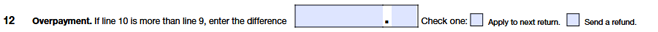

Step 3: Complete Part 2: Deposit Schedule and Tax Liability

- If Line 9 is less than $2,500, Go to Part 3.

- If Line 9 is $2,500 or more, enter your tax liability for each month.

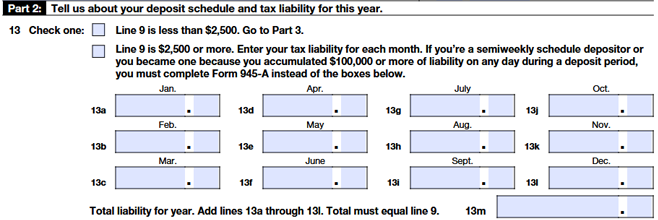

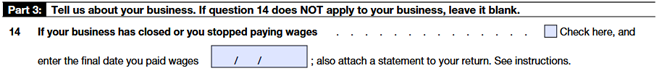

Step 4: Complete Part 3: Business Changes

Indicate if your business closed or stopped paying wages during the year, and provide the final payroll date.

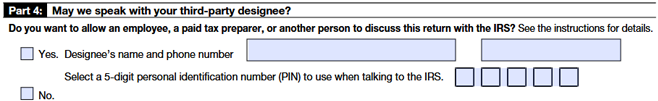

Step 5: Complete Part 4: Third-Party Designee

Indicate whether you allow a third party (such as a tax preparer) to discuss this return with the IRS, and provide their information if applicable.

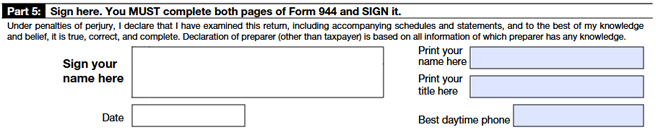

Step 6: Sign and Date the Form

- The business owner or authorized person must sign, date, and provide a daytime phone number.

- If a paid preparer completes the form, they must also sign and provide their details.

For additional details, refer to the Instructions for Form 944

Simplify Your Signature Process with TaxZerone!

With TaxZerone, you can choose to e-sign your return using Form 8453-EMP or your IRS-assigned 94X Online Signature PIN.

E-file Form 944 with TaxZerone

File IRS Form 944 quickly with TaxZerone for just $6.99 per return. Simply enter the required details, make your payment, sign, and submit your return to the IRS.TaxZerone also supports payments through EFTPS.

The entire filing process takes under 5 minutes, and you'll receive email updates once the IRS processes your return.