Form 941-X Instructions

Need to Correct a Previously Filed Form 941? File Form 941-X Easily and Accurately with TaxZerone!

Excise Tax Forms

Information Returns

Exempt Org. Forms

Extension Forms

Business Tax Forms

FinCEN BOIR

General

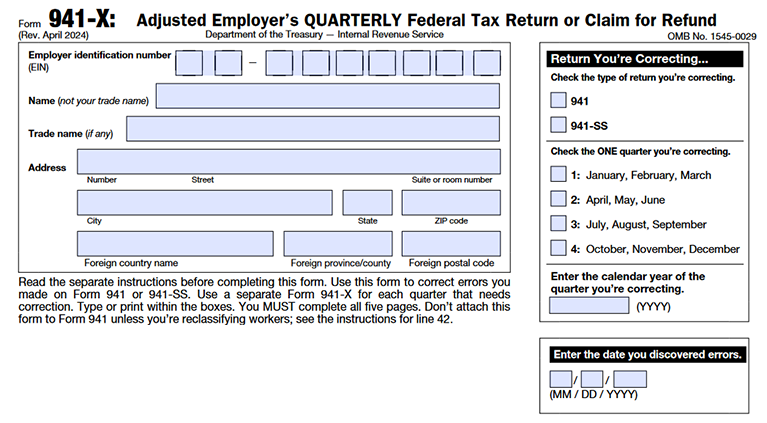

Form 941-X , the Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund Form, is crucial for correcting errors on previously filed Form 941. This guide provides detailed instructions on how to accurately complete and file Form 941-X for the 2025 tax year, ensuring compliance with the latest IRS updates and regulations

Table of Contents

Purpose of Form 941-X:

Form 941-X is used to correct errors on a previously filed Form 941. Corrections can include:

- Wages, tips, and other compensation

- Federal income tax withheld

- Taxable Social Security wages and tips

- Taxable Medicare wages and tips

- Additional Medicare Tax withholding

- Qualified small business payroll tax credit

- Credits for qualified sick and family leave wages (specific periods)

- Employee retention credit

- COBRA premium assistance credit

Employers must file a separate Form 941-X for each Form 941 being corrected. Ensure you have filed all applicable Forms W-2 and W-2c with the SSA before submitting IRS Form 941-X.

What’s New for the 2025 Tax Year?

General Updates:

- Electronic Filing: You can now file Form 941-X electronically using Modernized e-File (MeF).

- Reserved Lines: Lines 18a, 26a, 30, 31a, 31b, and 32 on Form 941-X are reserved for future use as the period of limitations for correcting these lines has expired for most employers.

- Period of Limitations: The timeframe for making certain corrections on Form 941 has expired for most employers. Corrections must be made within 3 years from the date Form 941 was filed or 2 years from the date the tax was paid.

- Reserved Lines: Lines 24, 33a, 33b, and 34 on Form 941-X are reserved for future use as the period of limitations for correcting these lines has expired for most employers.

Specific Changes:

- Deferred Social Security Tax: Lines 24 and 33b, used for correcting deferred Social Security tax, are reserved but can still be corrected using the April 2023 revision of Form 941-X within the period of limitations.

- Employee Retention Credit: Lines 33a and 34 for correcting qualified wages for the employee retention credit for March 13-31, 2020, are reserved.

- Qualified Sick and Family Leave Wages: Leave credits taken after March 31, 2020, and before October 1, 2021, have expired. If paid in 2024, claim the credit using Form 941-X after filing Form 941.

Discontinued Forms:

- Form 941-SS and 941-PR are discontinued after 2023. Employers in relevant U.S. territories should file Form 941 or the new Form 941 (sp) for Spanish instructions.

Reminders:

- Qualified small businesses can now elect up to $500,000 for the payroll tax credit for increasing research activities starting after December 31, 2022.

Expired Credits:

- Employee retention credit for wages paid before January 1, 2023, has expired.

- COBRA premium assistance credit period ended on September 30, 2021. Claims must now be made using Form 941-X.

Step-by-Step Instructions for Filing Form 941-X for 2025

- Separate Form for Each Quarter: File a separate Form 941-X for each Form 941 being corrected.

- EIN, Name, and Address: Enter your EIN, name, and address in the provided spaces. Ensure your information is on all pages and any attachments.

- Return You’re Correcting: Check the type of return and the quarter you’re correcting at the top of page 1. Enter the calendar year and quarter on pages 2-5.

- Date of Error Discovery: Enter the date you discovered the error. If multiple errors were discovered at different times, enter the earliest date and subsequent dates on line 43.

- Reporting Negative Amounts: Use negative numbers for reductions in tax (credits) and positive numbers for additional tax (owed amounts).

- Form Entries: Type or print entries using Courier font if possible. Complete and sign all five pages and staple multiple sheets in the upper-left corner.

- Penalties and Interest: Corrections of underreported tax amounts may not incur penalties or interest if filed on time, paid on line 27, and accompanied by a detailed explanation for the correction.

Specific Instructions for Correcting Errors on Form 941

Form 941-X consists of five parts. Follow the instructions to correct errors in previously filed Form 941:

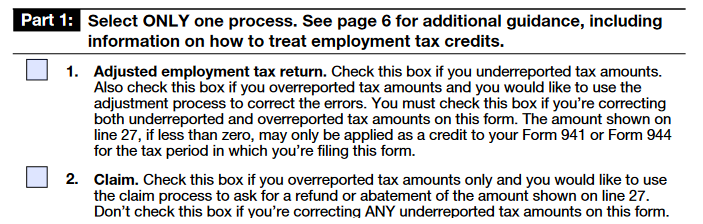

Part 1: Select ONLY One Process

1. Adjusted Employment Tax Return: Check this box if correcting underreported or overreported tax amounts and using the adjustment process.

2. Claim: Check this box if correcting only overreported tax amounts and claiming a refund or abatement.

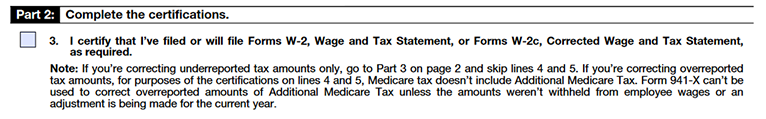

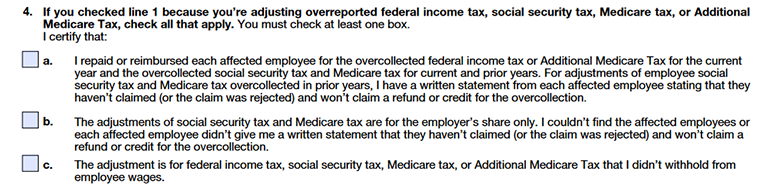

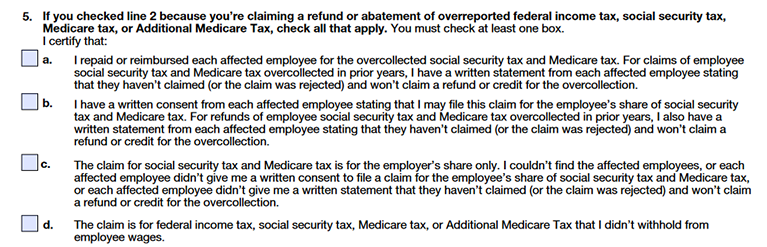

Part 2: Complete the Certifications

3. Filing Forms W-2 or W-2c: Certify that you have filed or will file corrected Forms W-2 or W-2c with the SSA.

4. Certifying Overreporting Adjustments: Certify overreporting adjustments for federal income tax, Social Security tax, Medicare tax, or Additional Medicare Tax.

5. Certifying Claims: Certify claims for refund or abatement of overreported amounts.

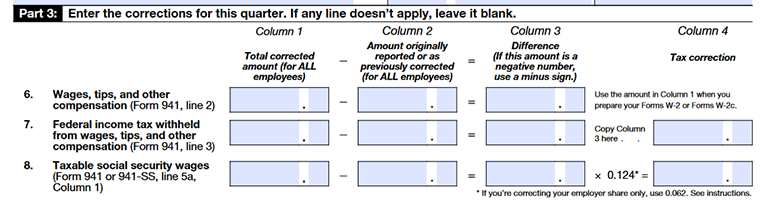

Part 3: Enter the Corrections for This Quarter

6. Wages, Tips, and Other Compensation: Correct errors in wages, tips, and other compensation.

7. Federal Income Tax Withheld Correct federal income tax withholding errors.

8.Taxable Social Security Wages: Correct taxable Social Security wages.

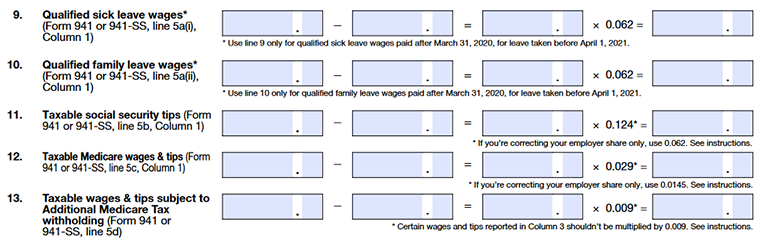

9. Qualified Sick Leave Wages: Correct qualified sick leave wages.

10. Qualified Family Leave Wages: Correct qualified family leave wages.

11. Taxable Social Security Tips: Correct taxable Social Security tips.

12. Taxable Medicare Wages & Tips: Correct taxable Medicare wages and tips.

13. Taxable Wages & Tips Subject to Additional Medicare Tax Withholding: Correct Additional Medicare Tax withholding errors.

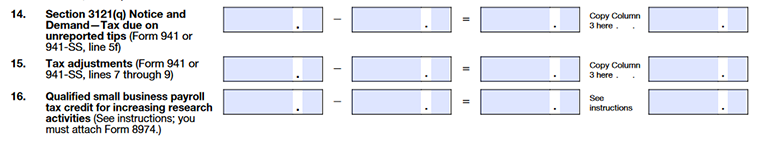

14. Section 3121(q) Notice and Demand—Tax on Unreported Tips: Correct any amounts reported on Form 941 line 5f for tax due from a Section 3121(q) Notice and Demand.

15. Tax Adjustments: Correct adjustments reported on Form 941 lines 7–9.

16. Qualified Small Business Payroll Tax Credit for Increasing Research Activities: Correct the payroll tax credit reported on Form 941 line 11a.

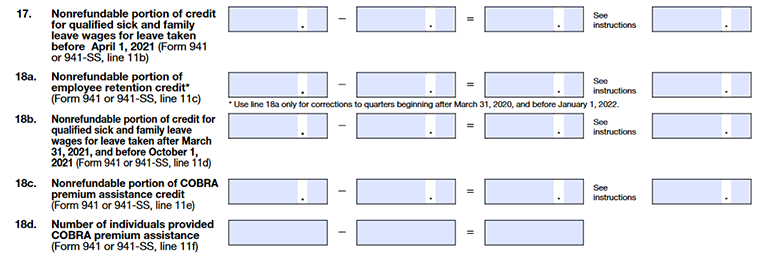

17. Nonrefundable Portion of Credit for Qualified Sick and Family Leave Wages: Correct the nonrefundable portion of the credit for qualified sick and family leave wages for leave taken after March 31, 2020, and before April 1, 2021.

18a. Reserved for future use

18b. Nonrefundable Portion of Credit for Qualified Sick and Family Leave Wages: Correct the nonrefundable portion of the credit for qualified sick and family leave wages for leave taken after March 31, 2021, and before October 1, 2021.

18c. Nonrefundable Portion of COBRA Premium Assistance Credit: Correct the nonrefundable portion of the COBRA premium assistance credit.

18d. Number of Individuals Provided COBRA Premium Assistance: Correct the number of individuals provided COBRA premium assistance.

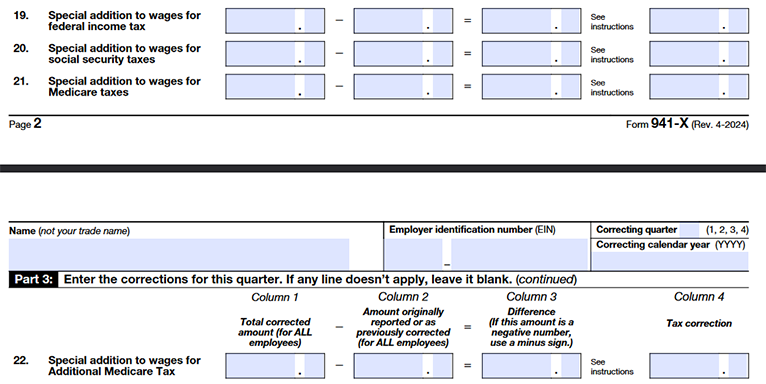

19. Special Additions to Wages for Federal Income Tax: Correct wages for workers reclassified under Section 3509 rules affecting federal income tax withholding.

20. Special Additions to Wages for Social Security Taxes: Correct wages for workers reclassified under Section 3509 rules affecting Social Security taxes.

21. Special Additions to Wages for Medicare Taxes: Correct wages for workers reclassified under Section 3509 rules affecting Medicare taxes.

22. Special Additions to Wages for Additional Medicare Tax: Correct wages for workers reclassified under Section 3509 rules affecting Additional Medicare taxes.

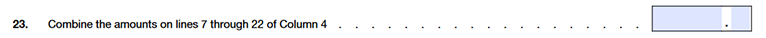

23. Subtotal: Combine the amounts from column 4 on lines 7–22.

24. Reserved for future use

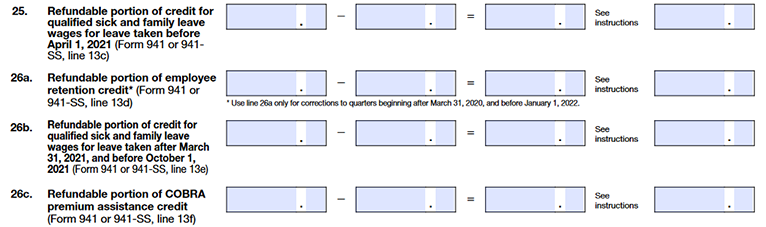

25. Refundable Portion of Credit for Qualified Sick and Family Leave Wages for Leave Taken After March 31, 2020, and Before April 1, 2021: Correct the refundable portion of the credit.

26a. Reserved for future use

26b. Refundable Portion of Credit for Qualified Sick and Family Leave Wages for Leave Taken After March 31, 2021, and Before October 1, 2021: Correct the refundable portion of the credit.

26c. Refundable Portion of COBRA Premium Assistance Credit: Correct the refundable portion of the COBRA premium assistance credit.

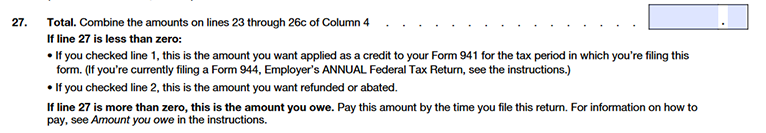

27. Total: Combine the amounts from column 4 on lines 23–26c.

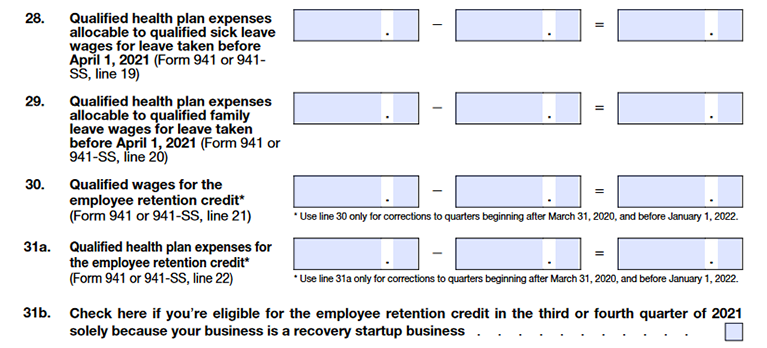

28. Qualified Health Plan Expenses Allocable to Qualified Sick Leave Wages for Leave Taken After March 31, 2020, and Before April 1, 2021: Correct the qualified health plan expenses.

29. Qualified Health Plan Expenses Allocable to Qualified Family Leave Wages for Leave Taken After March 31, 2020, and Before April 1, 2021 Correct the qualified health plan expenses.

Line 30 to 34 is reserved for future use.

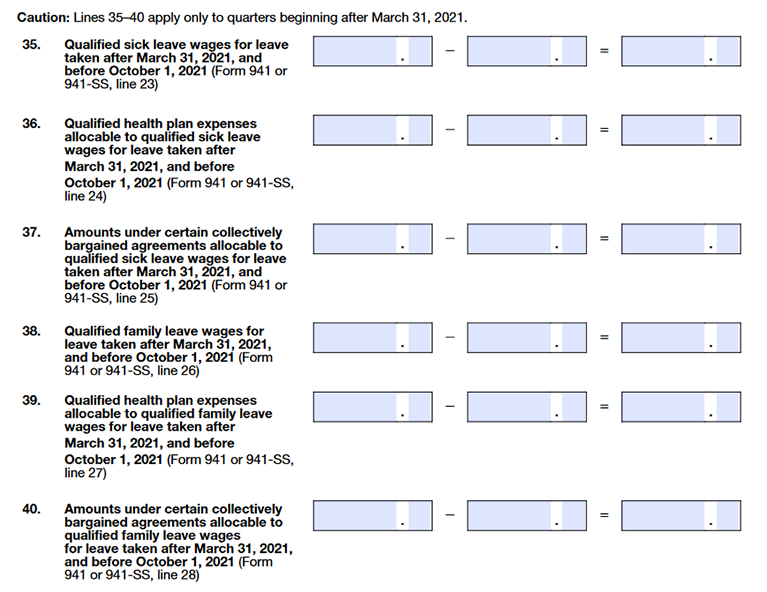

Caution: Lines 35–40 apply only to quarters beginning after March 31, 2021.

35. Qualified Sick Leave Wages for Leave Taken After March 31, 2021, and Before October 1, 2021: Correct the amounts under certain collectively bargained agreements allocable to qualified sick leave wages.

36. Qualified Health Plan Expenses Allocable to Qualified Sick Leave Wages for Leave taken After March 31, 2021, and Before October 1, 2021: Correct the qualified health plan expenses.

37. Amounts Under Certain Collectively Bargained Agreements Allocable to Qualified Sick Leave Wages for Leave Taken After March 31, 2021, and Before October 1, 2021: Correct the amounts under certain collectively bargained agreements allocable to qualified family leave wages.

38. Qualified Family Leave Wages for Leave Taken After March 31, 2021, and Before October 1, 2021: Correct the qualified health plan expenses.

39. Qualified Health Plan Expenses Allocable to Qualified Family Leave Wages for Leave Taken After March 31, 2021, and Before October 1, 2021: Correct the qualified health plan expenses.

40. Amounts Under Certain Collectively Bargained Agreements Allocable to Qualified Family Leave Wages for Leave Taken After March 31, 2021, and Before October 1, 2021: Correct the amounts under certain collectively bargained agreements allocable to qualified family leave wages.

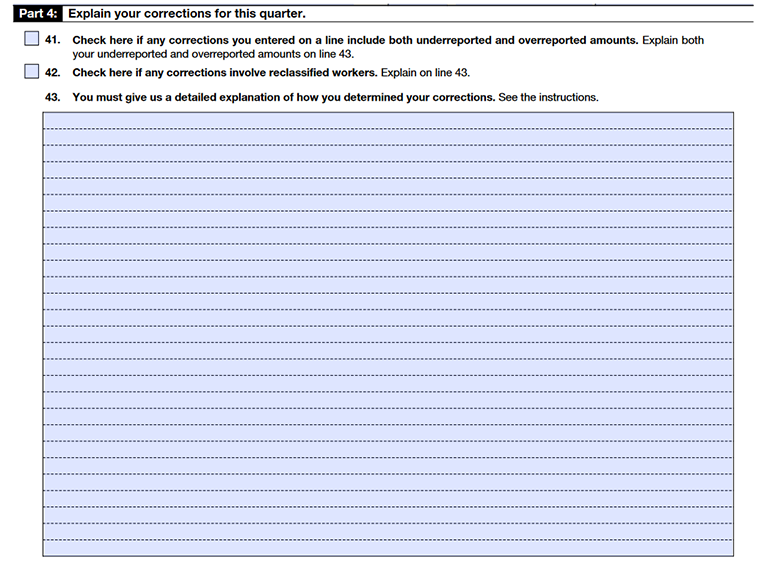

Part 4: Explain Your Corrections for This Quarter

41. Corrections of Both Underreported and Overreported Amounts: Provide a net change amount.

42. Reclassification of Workers: Explain the reclassification of workers if applicable.

43. Detailed Explanation: Provide detailed explanations for each correction, specifying the Form 941-X line numbers, the date the error was discovered, the amount of the error, and the cause of the error.

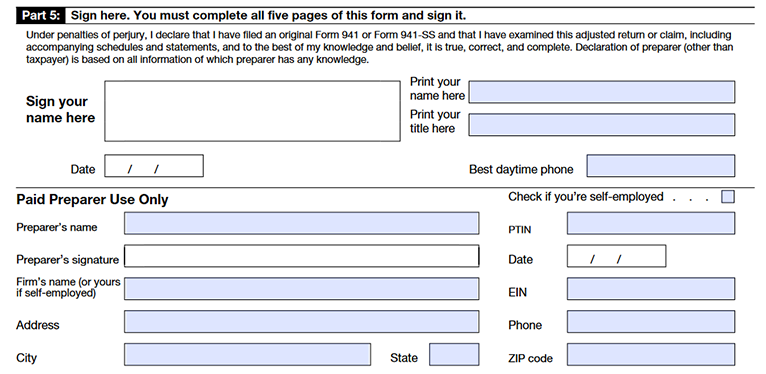

Part 5: Sign Here

Ensure all five pages of Form 941-X are completed and signed. The appropriate individual must sign the form based on the type of business entity. Failure to sign will delay processing.