Form 941 Schedule R

Excise Tax Forms

Information Returns

Exempt Org. Forms

Extension Forms

Business Tax Forms

FinCEN BOIR

General

Table of Contents

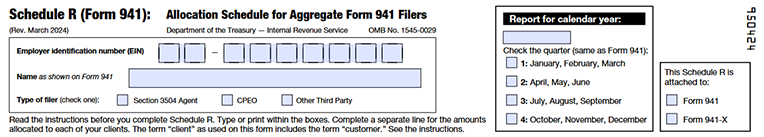

What’s New in Schedule R for 2024?

The March 2024 revision includes:

- A checkbox to indicate if it is attached to Form 941 or 941-X.

- Columns f, l, n, o, p, u, w, x, and y are used only with Form 941-X.

- The calendar year field is no longer pre-populated. This version should be used primarily for quarters after December 31, 2023.

Who Needs to File Schedule R?

- Agents approved by the IRS under section 3504 and CPEOs must complete Schedule R with each aggregate Form 941 filing.

- Non-certified PEOs and other third-party payers must file Schedule R if clients claim the qualified small business payroll tax credit for increasing research activities or other credits on Form 941-X.

Instructions for Completing Schedule R

Enter Your Business Information

- Enter your EIN and business name exactly as shown on the attached Form 941 or 941-X.

- Check the "Type of filer" box to indicate if you’re a section 3504 agent, CPEO, or other third party.

Calendar Year

- Enter the calendar year for Form 941 or 941-X to which Schedule R is attached.

- Check the box for the appropriate quarter to match the quarter checked on the attached Form 941 or 941-X.

Form Checkbox

- Indicate whether Schedule R is attached to Form 941 or 941-X.

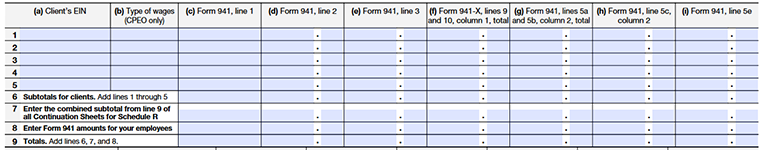

Client and Employee Information

For each client report:

- Column a: Client’s EIN.

- Column b (CPEO Use Only): Enter a code for the type of wages, tips, and compensation paid (codes A, B, C, or D).

- Code summary :

- A: Wages, tips, and other compensation paid under section 3511(a).

- B: Wages, tips, and other compensation paid under section 3511(c).

- C: Wages, tips, and other compensation not reported under code A or code B paid as a payor under a service agreement described in Regulations section 31.3504-2(b) (2).

- D: Wages, tips, and other compensation paid as an agent under Regulations section 31.3504-1.

- Column c : Number of employees who received wages, tips, or other compensation (Form 941, line 1).

- Column d : Wages, tips, and other compensation allocated (Form 941, line 2; Form 941-X, line 6, column 1).

- Column e : Total federal income tax withheld on Form 941, line 3 or (Form 941-X, line 7, column 1).

- Column f : Qualified sick leave and family leave wages for leave taken after March 31, 2020, and before April 1, 2021 (Form 941-X, lines 9 and 10, column 1, total).

- Column g : Social security tax on wages and tips on Form 941, lines 5a and 5b, column 2 or (Form 941-X, lines 8 and 11, column 1), multiplied by the applicable tax rate.

- Column h : Medicare tax on Form 941, line 5c, column 2 or (Form 941-X, line 12, column 1), multiplied by the applicable tax rate.

- Column i : Total social security and Medicare taxes, including Additional Medicare Tax withholding (Form 941, line 5e).

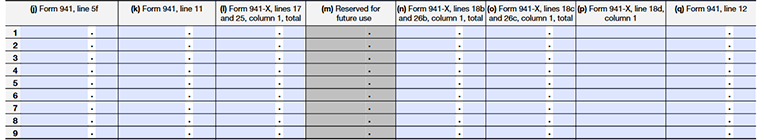

- Column j: Tax due on unreported tips from Form 941, line 5f or (Form 941-X, line 14, column 1).

- Column k: Qualified small business payroll tax credit from Form 941, line 11 or (Form 941-X, line 16, column 1). Attach Form 8974 for each client claiming this credit.

- Column l: Nonrefundable and refundable credit for qualified sick and family leave wages paid between March 31, 2020, and April 1, 2021, from Form 941-X, lines 17 and 25, column 1 total.

- Column n: Nonrefundable and refundable credit for qualified sick and family leave wages paid between March 31, 2021, and October 1, 2021, from Form 941-X, lines 18b and 26b, column 1, total.

- Column o: Nonrefundable and refundable COBRA premium assistance credit from Form 941-X, lines 18c and 26c, column 1, total.

- Column p: Number of individuals provided COBRA premium assistance from Form 941-X, line 18d, column 1.

- Column q: Total taxes after adjustments and nonrefundable credits from Form 941, line 12.

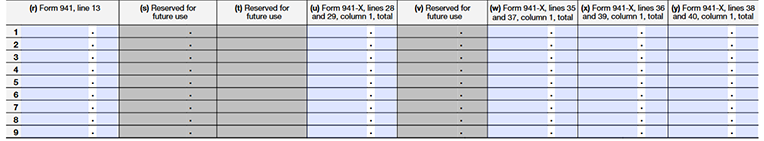

- Column r: Total deposits, including overpayments applied from prior quarters and current quarter overpayments from Form 941, line 13. Include any payments made with the return.

- Column u: Total qualified health plan expenses for sick and family leave wages paid between March 31, 2020, and April 1, 2021, from Form 941-X, lines 28 and 29, column 1, total.

- Column w: Total qualified sick leave wages and amounts under certain collectively bargained agreements for leave taken between March 31, 2021, and October 1, 2021, from Form 941-X, lines 35 and 37, column 1, total.

- Column x: Total qualified health plan expenses for sick and family leave wages from Form 941-X, lines 36 and 39, column 1, total.

- Column y: Total qualified family leave wages and amounts under certain collectively bargained agreements for leave taken between March 31, 2021, and October 1, 2021, from Form 941-X, lines 38 and 40, column 1.

- Line 6: Add lines 1 through 5 for each column (c through y) to calculate the subtotals.

- Line 7: Enter the combined subtotals from line 9 of all Continuation Sheets for Schedule R for each column (c through y).

- Line 8: Enter Form 941 amounts for your employees for the same column (c through y). This line consolidates any amounts for clients not reported individually on Schedule R.

- Line 9: Add the totals of lines 6, 7, and 8 for each column (c through y). Ensure that the totals for each column match the aggregate amounts reported on Form 941.

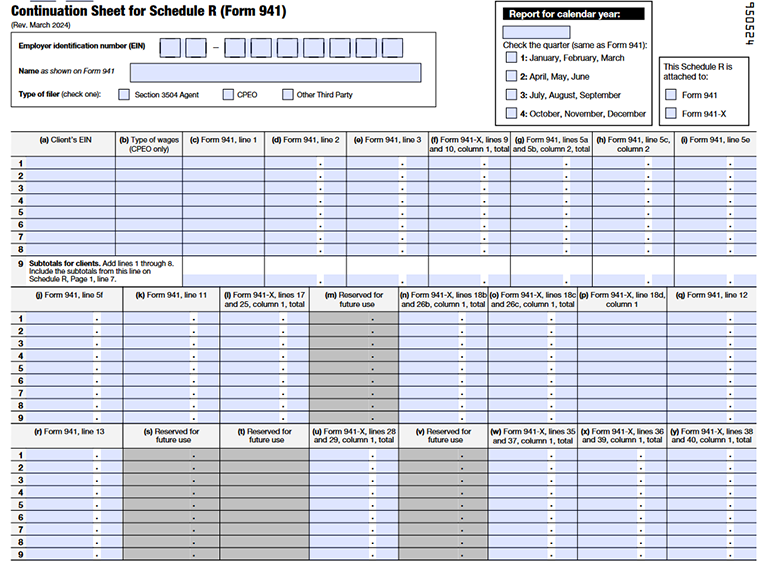

Continuation Sheet for Schedule R (Form 941)

Columns a through y.

See the instructions above.

- Line 9: Enter the subtotals for clients from lines 1 through 8 for columns c through l, n through r, u, and w through y.

When to file?

If you’re an aggregate Form 941 filer, you must file Schedule R along with your aggregate Form 941 each quarter.

| Quarter | Reporting Period | Due Date |

|---|---|---|

| Quarter1 | JAN, FEB, MAR | April 30, 2025 |

| Quarter2 | APR, MAY, JUN | July 31, 2025 |

| Quarter3 | JUL, AUG, SEP | October 31, 2025 |

| Quarter4 | OCT, NOV, DEC | January 31, 2026 |

Agents and non-certified PEOs may file Form 941 and Schedule R electronically or by paper. Certified PEOs (CPEOs) are generally required to file Form 941 and Schedule R electronically.