Request Form W-9 Online for FREE

Quickly request, manage, and store Form W-9 from your vendors and contractors using TaxZerone's secure online platform.

Save time and reduce errors with TaxZerone

Why Choose TaxZerone for Form W-9 Requests Online in 2024?

Bulk Requests

Save time and effort by managing multiple W-9 requests efficiently with TaxZerone's bulk request feature.

Real-time Notifications

Get instant email notifications when vendors complete and e-sign their W-9 forms, keeping you updated throughout the process.

Easy and Secure Process

Streamline your Form W-9 requests with TaxZerone’s intuitive and secure online platform.

Easy E-Signature

Electronically sign W-9 forms hassle-free, simplifying the signing process for your vendors.

Automate W-9 to 1099 processing

Streamline your vendor tax process with automated W-9 collection, e-filing, and 1099 issuance.

Customer Support

Access dedicated customer support to assist with any queries or issues regarding Form W-9 submissions.

Choose TaxZerone for a simplified, secure, and accurate Form W-9 request process

Fill Form W-9Streamline Your W-9 Process with TaxZerone

Collecting W-9 forms can be a hassle, but not with Taxzerone. Our online platform makes it easy to request, collect, and manage W-9s.

How it works:

Step 1: Send W-9 Requests:

Easily send secure W-9 requests to your vendors through Taxzerone. They'll receive an email with a simple link to fill out the form.

Step 2: Vendor Fills Out W-9:

Your vendors can easily fill out the W-9 form with their information, including name, address, and taxpayer identification number (TIN).

Step 3: Instant Notifications:

Receive instant notifications when your vendors complete and submit their W-9 forms. Access all completed forms conveniently within your Taxzerone account.

Simplify your Form W-9 process with TaxZerone and experience seamless compliance

Frequently Asked Questions

1. What is a Form W-9?

2. When do I need to fill out a Form W-9?

3. What happens if I don't fill out a Form W-9?

4. What are the common mistakes to avoid when completing a Form W-9?

- Providing an incorrect or incomplete TIN.

- Failing to sign and date the form.

- Selecting the wrong federal tax classification.

- Not providing updated information if your circumstances change.

- Using a business name or disregarded entity name instead of your personal name when required.

5. Who needs to fill out a W-9 form?

- Independent contractors and freelancers who receive payments for their services.

- Individuals involved in real estate transactions.

- Recipients of mortgage interest payments.

- Those who receive certain types of income, such as dividends, interest, or retirement distributions.

6. What information do I need to fill out on a W-9 form?

7. What is the difference between a Form W-9 and a Form W-4?

8. How to Complete Form W-9 Online with TaxZerone?

- Enter Vendor Details: Input vendor info manually or import from QuickBooks/Xero.

- Send W-9 Request: Email vendors to complete their W-9 form online.

- Vendor Completion: Vendors e-sign their W-9; you're notified instantly.

- TIN Validation: TaxZerone verifies TINs from W-9 forms.

- File 1099 Forms: Use W-9 data to e-file 1099 forms and distribute copies.

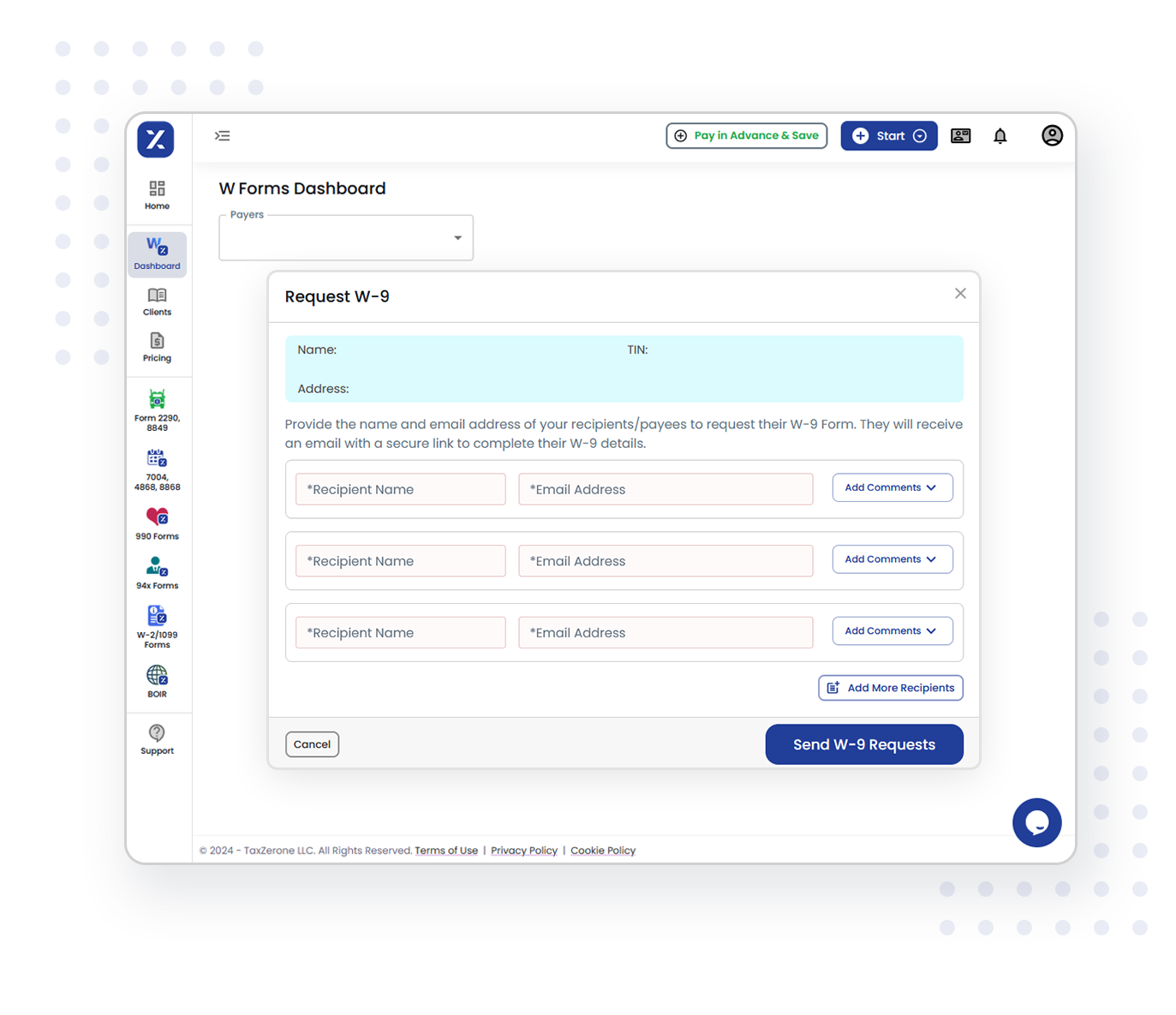

Steps to Request W-9 from Vendors and Contractors Using Taxzerone

Step 1: Choose Request W-9

- Navigate to the main dashboard on Taxzerone.

- Select the "Request W-9" option

Step 2: Enter Vendor Details

- Fill in the required details for the vendor or contractor:

- Name: Enter the name of the vendor or contractor.

- Email: Enter the email address where the W-9 request will be sent.

Step 3: Submit the W-9 Request

- Review the entered details to ensure they are correct.

- Click on the "Submit" button to send the W-9 request. A request link will be sent to the specified email address of the vendor or contractor.

Step 4: Notification of Submission

- You will receive an instant notification once the vendor or contractor submits the completed W-9 form through the provided link.

These steps will ensure a smooth and efficient process for collecting W-9 forms from your vendors and contractors using Taxzerone.