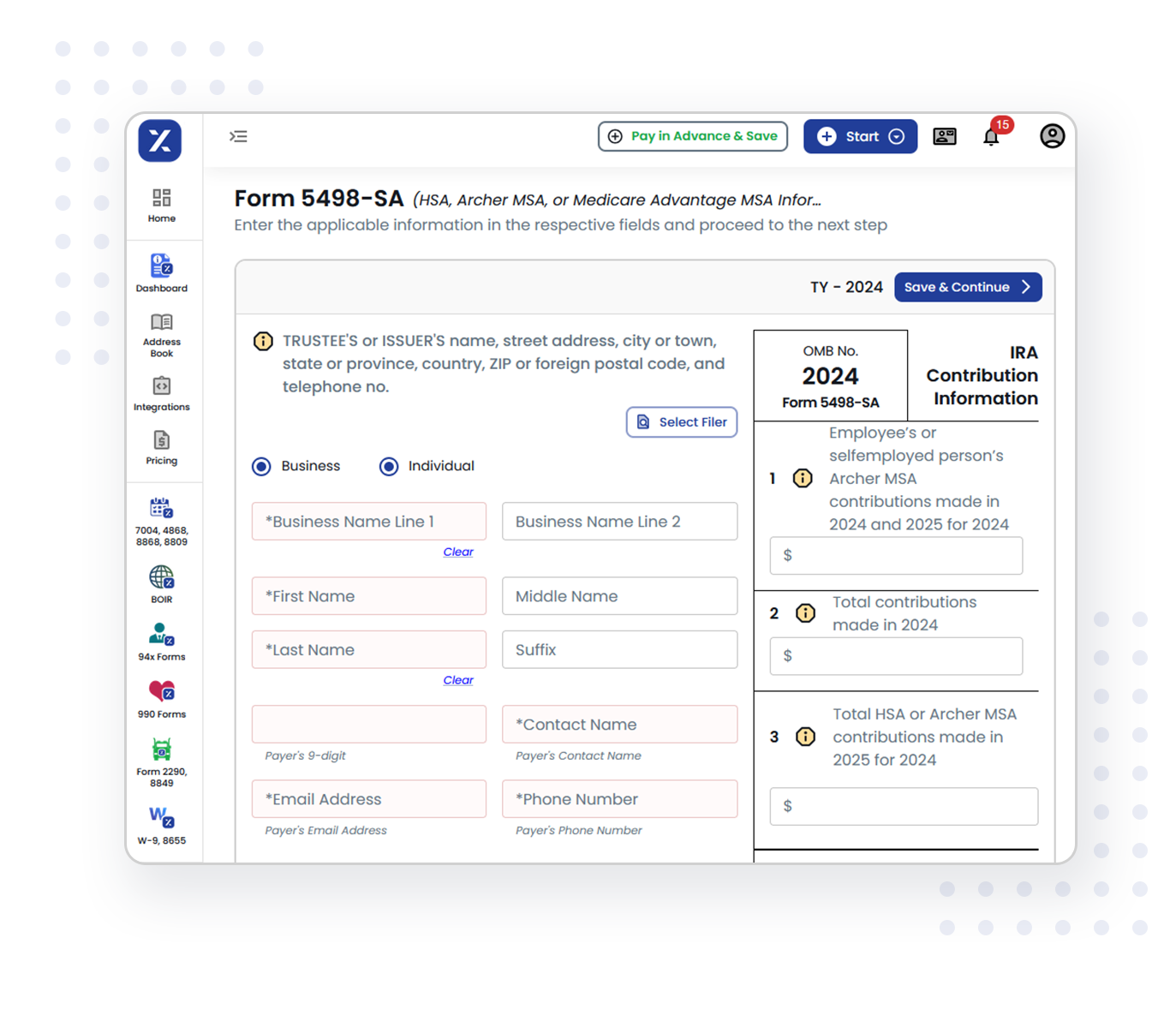

Easily File Form 5498-SA with TaxZerone securely

Report contributions made to Health SA, Archer MSA, or Medicare Advantage MSA during the tax year. TaxZerone ensures the filing is accurate and Comply with the IRS.

Affordable Pricing

Prices start at just $2.49 per form and drop to as low as $0.59 for bulk filings.

For your return volume

File Your 5498-SA in just 3 easy steps

TaxZerone makes IRS Form 5498-SA filing process simple and secure. Follow these steps to report with IRS.

Enter the required details

Provide the issuer’s and participant's name, TIN, address and Participant’s account number

Provide contribution details

Enter the total contribution details, Rollover contributions, Fair market value and choose the account type.

Review & Transmit to IRS

Review and transmit your tax form to the IRS, then issue a Participant’s copy via Zeronevault or postal mailing.

Information Required for filing Form 5498-SA

- Trustee’s information - Name, TIN, Address, Phone Number

- Participant's information – Name, TIN, Account number, Address and Account Type

- Contributions Details:

- Total contributions made

- Total HSA or Archer MSA contributions

- Rollovers Contributions

- Fair market value

Features that TaxZerone offers for filing 5498-SA

Enjoy the below mentioned benefits of tax Form 5498-SA with TaxZerone today

IRS Authorized

TaxZerone is an IRS-authorized e-file service provider, ensures your forms are filed accurately to get a faster acceptance

Fast and Easy E-Filing

TaxZerone’s user-friendly interface simplifies the filing process, allowing you to file Form 5498-SA quickly and easily.

IRS Compliance

To ensure IRS compliance, your given information is automatically verified for any errors and helping you to avoid penalties.

Real-Time updates

You can get real-time notifications about the status of Form 5498-SA at every stage after submission via Email and SMS

Secure Platform

TaxZerone uses advanced encryption and security measures to protect your personal and financial information.

Friendly Support

Need assistance to file form? Our dedicated friendly support team is here to help you via Phone (English & Spanish), Email and in live chat.

Deadline for filing Form 5498-SA

Send FMV statement

Deadline: January 31, 2025

Send a Fair Market Value statement of the account to each participant

File with the IRS (e-file)

Deadline: June 02, 2025

File electronically with IRS for faster and smooth processing

Send Participant Copies

Deadline: June 02, 2025

Ensure participant copies are delivered using Zeronevault or postal mailing

Stay IRS compliant by securely filing with TaxZerone.

TaxZerone provides quick and safe electronic submission of Form 5498-SA to the IRS.

Frequently Asked Questions

1. What is Form 5498-SA?

Form 5498-SA is an IRS tax form used to report contributions made to a Health Savings Account (HSA), Archer Medical Savings Account (MSA), or Medicare Advantage MSA including rollover and Fair market value of HSA, Archer MSA, or MA MSA. Trustee will file this form for each person to whom they have maintained an account.

2. Who receives Form 5498-SA?

Participants who have a Health Savings Account, Archer Medical Savings Account, or Medicare Advantage MSA and made contributions or had rollover amounts in a tax year receives this Form 5498-SA from trustee of their account.

3. When is the last date to file Form 5498-SA?

The last date to e-file Form 5498-SA with IRS and to send participant copy is May 31, 2025. Also, issue a Fair Market Value statement (FMV) of participants account before January 31, 2025.

4. What is the difference between Form 1099-SA and Form 5498-SA?

Form 1099-SA is to report distributions from a Health Savings Account (HSA), Archer Medical Savings Account (MSA), or Medicare Advantage MSA. The account holder receives 1099-SA from the HSA provider to know the distributions are taxable.

Form 5498-SA is to report contributions made to an HSA, Archer MSA, or Medicare Advantage MSA, including rollovers and fair market value. The HSA provider sends this form to both the IRS and the account holder.