E-file Form 5498-ESA for the Tax Year 2024

Report Coverdell ESA contributions to the IRS with TaxZerone’s IRS-authorized e-file service. Complete the process in just 3 easy steps!

Affordable Pricing

Starting at just $2.49, with bulk filing rates as low as $0.59 per form.

For your return volume

3 Easy Steps to File Your 5498-ESA Tax Form

With TaxZerone, filing is quick and secure—just 3 steps to complete.

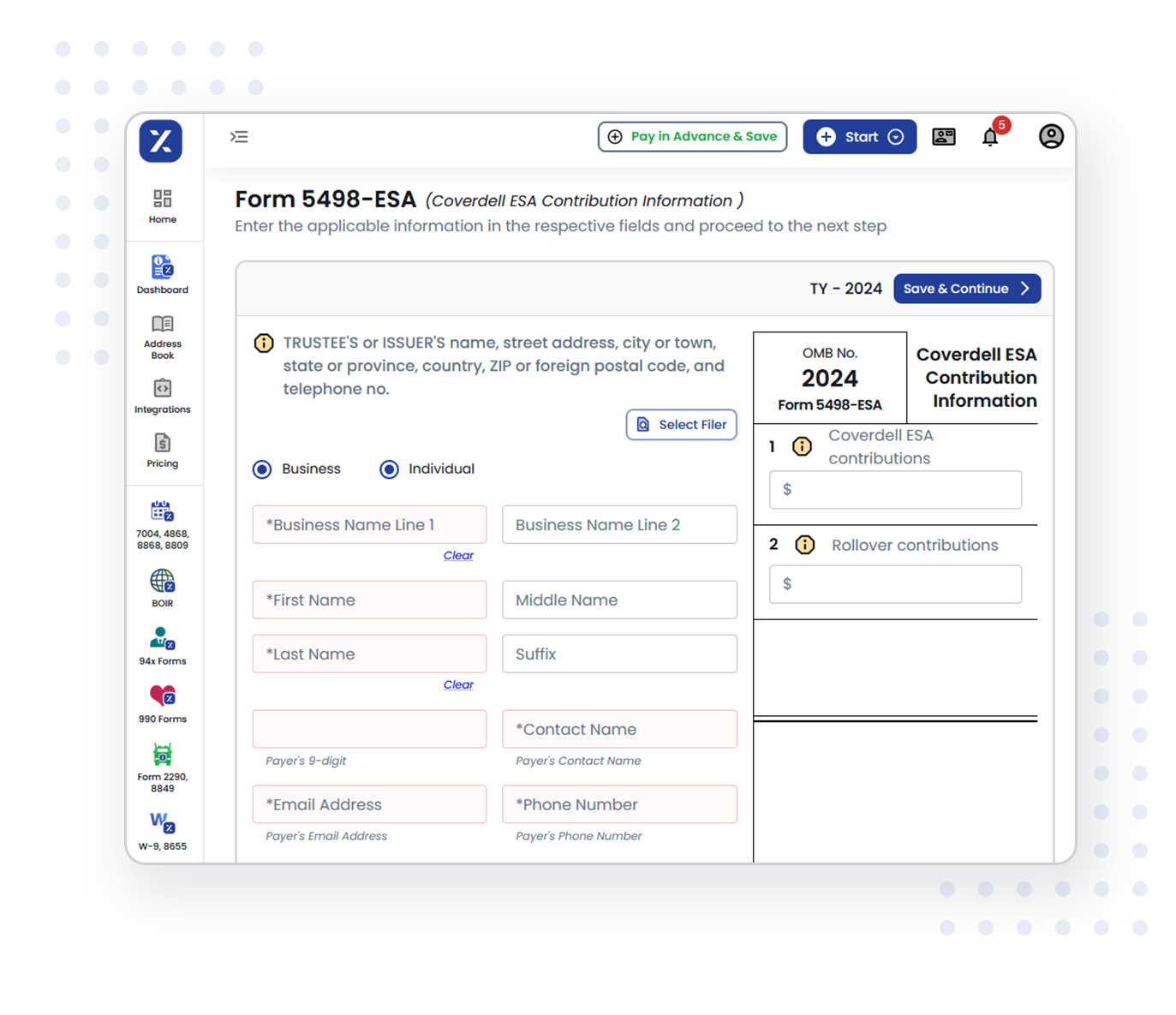

Enter Trustee & Beneficiary Information

Provide the trustee or custodian’s name, address, and TIN, as well as the beneficiary’s name, TIN, and address.

Report ESA Contribution Details

Enter the Coverdell ESA contribution amount for the year. Include any rollover contributions, such as trustee-to-trustee transfers or qualified military death gratuities.

Review & Transmit

Review the return for accuracy, then e-file it directly with the IRS. Send the recipient’s copy securely via ZeroneVault or postal mail.

Required Information for E-Filing IRS Form 5498-ESA

When e-filing Form 5498-ESA to report Coverdell Education Savings Account (ESA) contributions, be prepared with the following details:

- Trustee or Custodian Information - Name, TIN, Address

- Beneficiary (Participant) Information – Name, TIN (Social Security Number or ITIN), Address, and Account Number

- Contribution Details

- ESA Contributions

- Rollover Contributions

Powerful Features for Effortless 5498-ESA E-Filing

IRS-Authorized Provider

File with confidence through TaxZerone—an IRS-authorized e-file provider that ensures secure and accurate submission every time.

Recipient Copy Delivery

Choose how you'd like to deliver recipient copies—secure online access via ZeroneVault or reliable postal mail. We’ve got it covered.

Real-Time Filing Status

Stay in the loop at every step. TaxZerone provides real-time updates so you can track the progress of your filings with ease.

Bulk Filing Made Simple

Need to file multiple 5498-ESA forms? TaxZerone supports bulk filing, helping you save time and streamline your reporting process.

Industry-Low Pricing

Enjoy one of the most affordable options available—TaxZerone offers budget-friendly pricing for businesses and institutions of all sizes.

Friendly Support

Questions or need help? TaxZerone’s friendly team is always here to assist and make your filing process smooth from start to finish.

Deadline for filing Form 5498-ESA

File with the IRS (Paper)

Deadline: June 02, 2025

File with the IRS (e-file)

Deadline: June 02, 2025

Deliver Beneficiary copy

Deadline: April 30, 2025

File with TaxZerone to stay compliant with the IRS

File your 5498-ESA today for simple, secure and affordable pricing in the industry

Frequently Asked Questions

1. .What is tax form 5498-ESA?

Tax Form 5498-ESA is an IRS form used to report contributions made to a Coverdell Education Savings Account (ESA) and roll over contributions. The trustee will transmit this form to the IRS and issue a copy to the account holder of the tax year.

2. When are 5498-ESA form issued?

Form 5498-ESA is filed with the IRS before the deadline of June 02, 2025 and must issue a copy of this form to the beneficiary before April 30, 2025. If you failed to file within the deadline, the IRS may impose a penalty.

3. Difference between 5498 and 5498-ESA?

| Form 5498 | Form 5498-ESA |

|---|---|

| It is used to report contributions, rollovers and the fair market value of traditional IRAs, Roth IRAs, SEP IRAs, and SIMPLE IRAs | It is specifically to report Coverdell Education Savings Accounts (ESAs) and Rollover contributions to the IRS and to issue a beneficiary copy. |

| It is received by both IRS and IRA account holder. | It is received by both IRS and ESA account holder. |