E-file Form 5498 for the Tax Year 2024

Report IRA contributions, rollovers, and fair market values with TaxZerone’s IRS-authorized e-file service. Complete the process in just a few simple steps!

Affordable Pricing

Starting at just $2.49, with bulk filing rates as low as $0.59 per form.

For your return volume

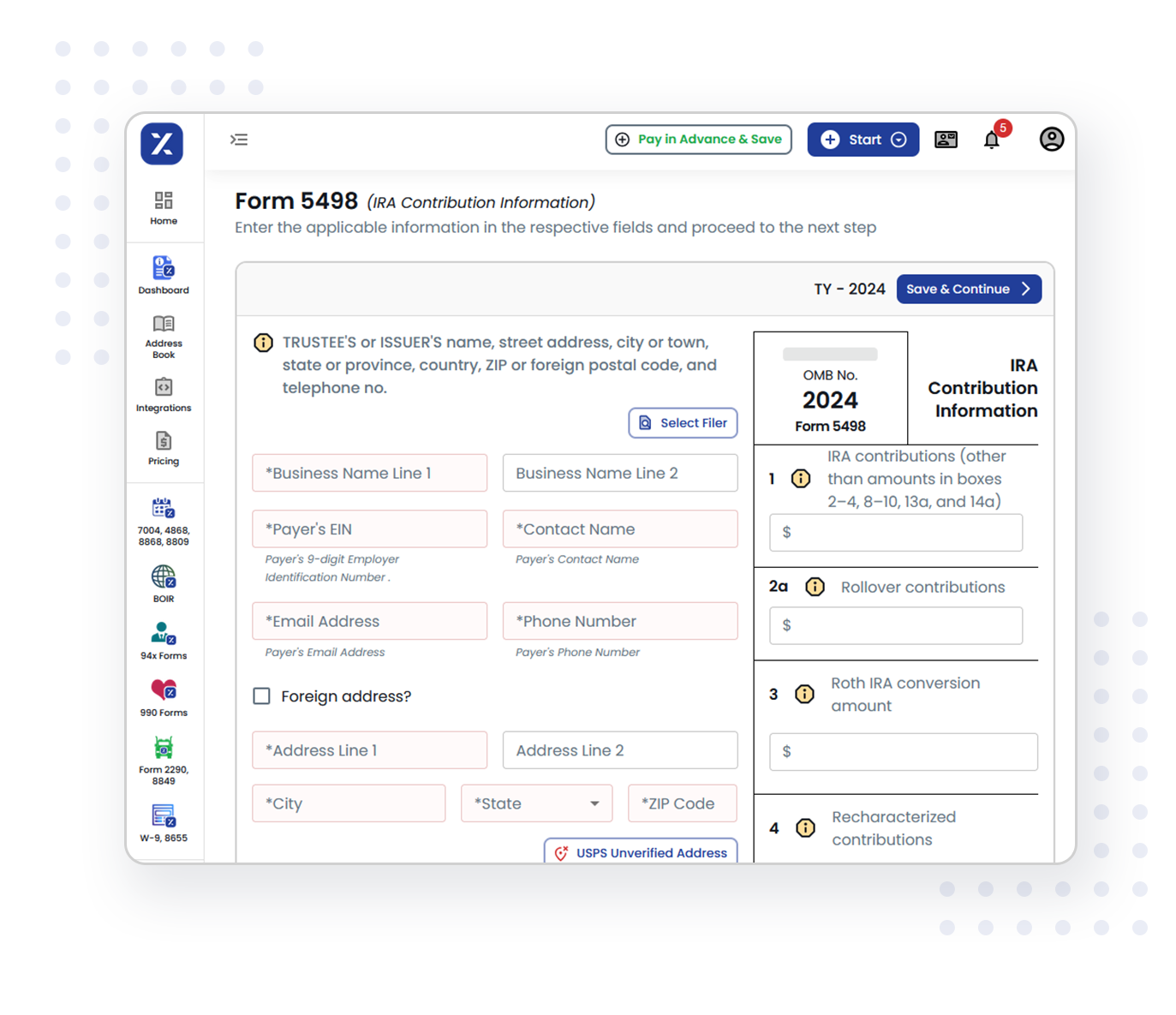

3 Easy Steps to File Your 5498 Tax Form

With TaxZerone, filing is quick and secure— just 3 steps to complete.

Enter Account Holder & IRA Information

Provide the trustee or issuer’s name, address, TIN, and the account holder’s name, TIN, and address.

Report Contribution & Account Details

Enter the contribution details, rollover, and Roth IRA conversions. Report the account’s fair market value and any required minimum distributions.

Review & Transmit

Review your return for accuracy, transmit it to the IRS, and deliver the recipient’s copy securely via ZeroneVault or postal mail.

Ready to e-file Form 5498 with the IRS? Get started today with TaxZerone’s secure e-filing!

E-File Form 5498 Now!Required Information for E-Filing IRS Form 5498

When e-filing, you will need to provide the following required information:

- Trustee or Issuer Information - Name, TIN, and Address.

- Participant Information – Name, TIN, Address, and Account Number.

- Contribution and Account Details

- IRA Contributions

- Rollover Contributions

- Roth IRA Conversions amount

- Recharacterized Contributions

- Fair Market Value (FMV)

- Required Minimum Distributions (RMDs)

Explore powerful features that simplify your e-filing process

IRS authorized

File your IRA Contribution Information Form 5498 with TaxZerone, an

IRS-authorized e-file provider, and rest assured your filing will be accepted.

Deliver Recipient Copies

Send recipient copies securely via ZeroneVault or postal mail for a smooth and convenient process with TaxZerone

Bulk filing

TaxZerone enables bulk filing, allowing you to easily submit multiple forms at once for greater efficiency.

Real-Time Updates

Get real-time updates to stay informed at every step of your filing process, ensuring accuracy and peace of mind.

Affordable Pricing

TaxZerone offers affordable pricing, making tax filing simple and

cost-effective for businesses of all sizes.

Expert Assistance

TaxZerone’s team of experts is always ready to assist, providing personalized support to make your filing process easy and stress-free.

Deadlines for Filing Form 5498 for the 2024 Tax Year

Provide Participant Statements (FMV & RMD)

Deadline: January 31, 2025

File with the IRS (e-file)

Deadline: June 02, 2025

Provide IRA Contribution Information to Participants

Deadline: June 02, 2025

Stay compliant and meet your IRS deadlines hassle-free. Start e-filing today with TaxZerone!

E-File NowSimplify Your Tax Filing with TaxZerone

TaxZerone simplifies tax filing with a fast, easy, and cost-effective solution.

- Ensure accuracy with built-in IRS compliance checks.

- Easily meet IRS reporting requirements.

- Save time by filing multiple forms at once.

- Benefit from the most competitive pricing in the industry.

Start e-filing now and finish in just 3 simple steps!

Create a Free Account NowFrequently Asked Questions

1. What is 5498 Form used for?

Form 5498 is used by IRA trustees or issuers to report contributions, rollovers, conversions, and the fair market value (FMV) of Individual Retirement Accounts (IRAs) to the IRS and account holders. It includes details on traditional, Roth, SEP, and SIMPLE IRA contributions, recharacterizations, and required minimum distributions (RMDs), helping the IRS track tax compliance and retirement savings.

2. When are 5498 forms issued?

Form 5498 must be filed with the IRS by May 31 following the tax year being reported. However, you must provide Copy B to the participant by January 31 for FMV and RMD information, and by May 31 for contribution information. Missing these deadlines can result in penalties.

3. What types of IRAs are reported on Form 5498?

- Traditional IRA

- Roth IRA

- Payroll Deduction IRA

- SEP IRA (Simplified Employee Pension)

- SIMPLE IRA (Savings Incentive Match Plan for Employees)

- SARSEP (Salary Reduction Simplified Employee Pension Plan)

4. What's the difference between reporting on Form 5498 vs Form 1099-R?

| Feature | Form 5498 | Form 1099-R |

|---|---|---|

| Purpose | Reports IRA contributions and account values | Reports distributions from retirement plans |

| Who Issues it | IRA custodians (banks, investment firms) | Financial institutions or plan administrators |

| Who receives It | IRA holders and the IRS | Recipients of distributions and the IRS |

| What it reports |

|

|

| Due Date | May 31 (to the IRS and recipients) | January 31 (to recipients), Feb 28 (paper) / Mar 31 (e-file) (to IRS) |

Form 5498 reports what goes into an IRA, while Form 1099-R reports what comes out of it.