E- File Form 3922 to report the Stock Transfer easily

Report Employee Stock Purchase Plan (ESPP) stock transfers with our seamless e-filing platform. TaxZerone simplifies the process, ensuring accurate reporting and IRS compliance in just a few clicks.

Affordable Pricing

Starting at just $2.49, with prices as low as $0.59 per form for bulk filings

For your return volume

Essential requirements for 3922 Form

- Corporation information: Corporation name, EIN and Address

- Employee information: Employee name, EIN and Address

- Stock purchase and Transfer Details:

- Date of Stock purchase

- Date of Stock Transfer

- Number of shares transferred

- Purchased Price per share

- Fair market value per share on Transfer date

- Account Number (if applicable)

E-File Your 3922 Form in Just 3 Easy Steps with Ease

Follow the steps to file Form 3922 with TaxZerone- clear and concise

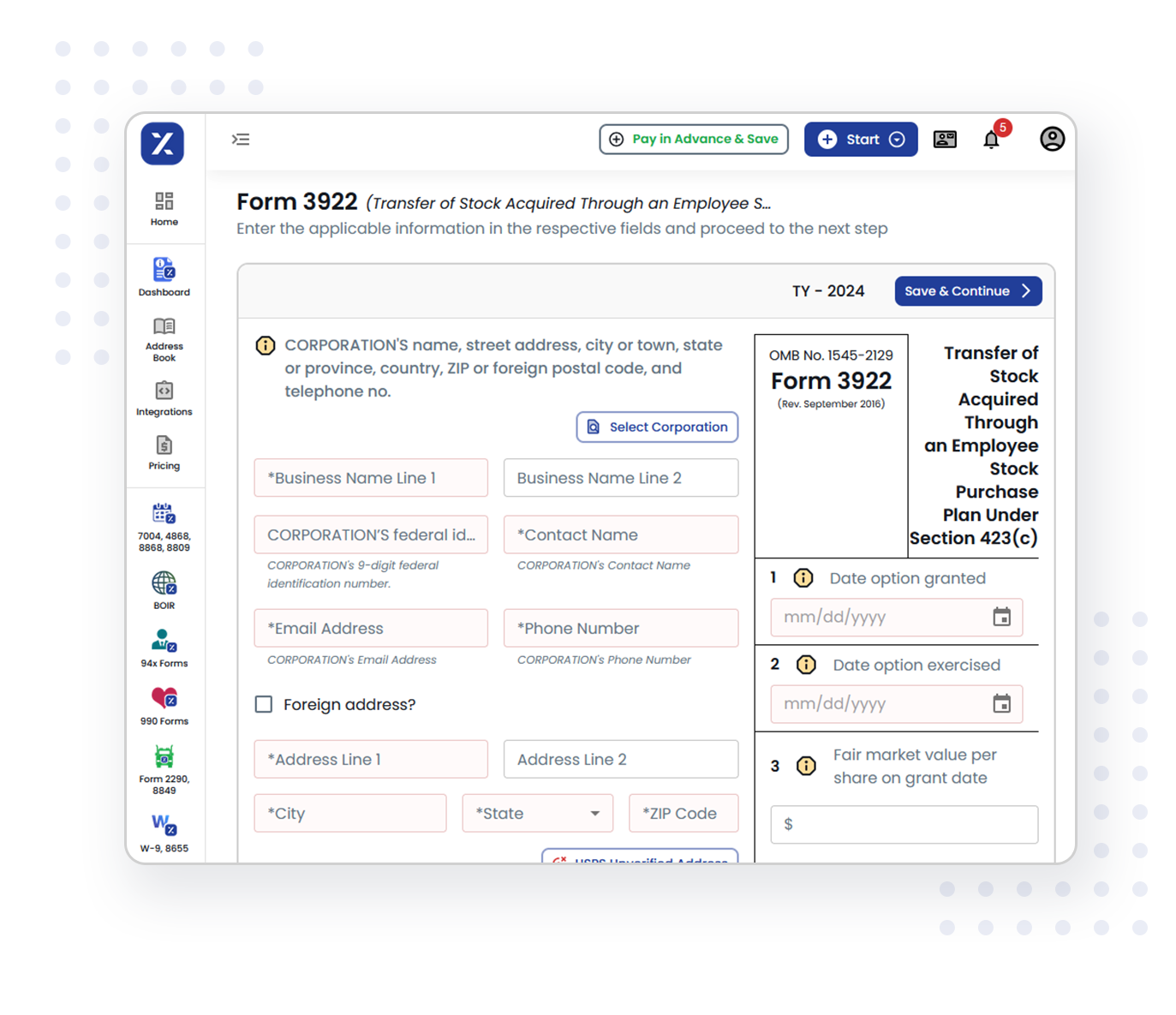

Fill out the form 3922

Enter the required fields including the corporation (name, EIN and Address), employee (name, EIN and Address) and Stock purchase & Transfer details.

Review and Transmit

Ensure the accuracy with TaxZerone’s IRS validations, then securely e-file your Form 3922 to the IRS

Send copy to Employee

Securely send the employee’s copy via Zeronevault, ensuring safe sharing or opt postal mail.

Don’t miss the deadline—ensure compliance by filing on time!

E-file Form 3922 Now!Why choose TaxZerone for Form 3922 Filing?

TaxZerone simplifies the process of filing Form 3922 with the following advantages

Form Validation

Form Validation Built-in form validation tools automatically check for errors, ensuring that your Form 3922 is accurate and compliant with IRS regulations.

User-Friendly Platform

TaxZerone offers an intuitive and easy-to-use interface, making the Form 3922 filing process smooth and straightforward, even for first-time users.

Securely Share Employee Copies

With ZeroneVault, securely store and share employee copies of Form 3922, whether sent digitally or by mail, maintaining privacy and protection.

Bulk Upload for Efficiency

Bulk upload options allow businesses to efficiently file multiple Form 3922 returns at once, saving time and simplifying the process.

Guided E-Filing

With guided e-filing, TaxZerone provides step-by-step instructions, ensuring you file Form 3922 correctly and efficiently, every time.

Best Price in the Industry

TaxZerone provides competitive pricing, offering the best value for businesses looking to file Form 3922 without exceeding their budget.

Important deadline Form 3922 for the Tax year 2024

Employee Copy deadline

Deadline: January 31, 2025

Send Form 3922 to your employees by the deadline so they can accurately report their ESPP stock purchases when filing their taxes.

IRS Paper Filing Deadline

Deadline: February 28, 2025

If you choose to file paper copies with the IRS, make sure to submit them by this date to avoid penalties.

IRS eFile Deadline

Deadline: March 31, 2025

Submit your Form 3922 filings electronically to the IRS by this specified date to avoid penalties.

Submit Form 3922 on time without Hassle!

Start Filing Form 3922 Now!Get Started today with TaxZerone!

Filing Form 3922 has never been easier. With TaxZerone you can:

- File effortlessly and accurately

- Easy to manage bulk upload

- Saves time and minimize the error

- AAffordable pricing

Start your e-filing today and complete Form 3922 in just 3 simple steps!

Frequently Asked Questions

1. What is Form 3922 used for?

2. When is Form 3922 issued?

Employers must issue Form 3922 if:

- An employee exercises an option under an ESPP,

- The option price was less than 100% of the stock's fair market value (FMV) on the grant date, or

- The option price was not fixed or determinable on the grant date

3. What do I do with Form 3922?

It helps you:

- Calculate your cost basis

- Report any capital gains or losses

- Determine if you owe any ordinary income tax

4. Where do find Form 3922?

You can find Form 3922 and file it with ease using TaxZerone. Simply visit the TaxZerone platform, where you can complete the form electronically and e-file it directly to the IRS, ensuring a smooth and secure filing process.