E- File Form 3921 with easy– Fast and Secure

Corporations can easily report Incentive Stock Option (ISO) exercises to the IRS and provide employee copies in just a few clicks.

Affordable Pricing

Starting at just $2.49, with prices as low as $0.59 per form for bulk filings

For your return volume

Information needed for Filing on IRS Form 3921

- Transferor information: Transferor name, TIN and Address

- Employee information: Employee name, TIN and Address

- Incentive Stock option Details:

- Grant Date of the Stock Option

- Exercise Date of the Stock Option

- Exercise Price per Share,

- Fair Market Value (FMV)

- Total Number of Shares Transferred to the Employee.

- Account Number (if applicable)

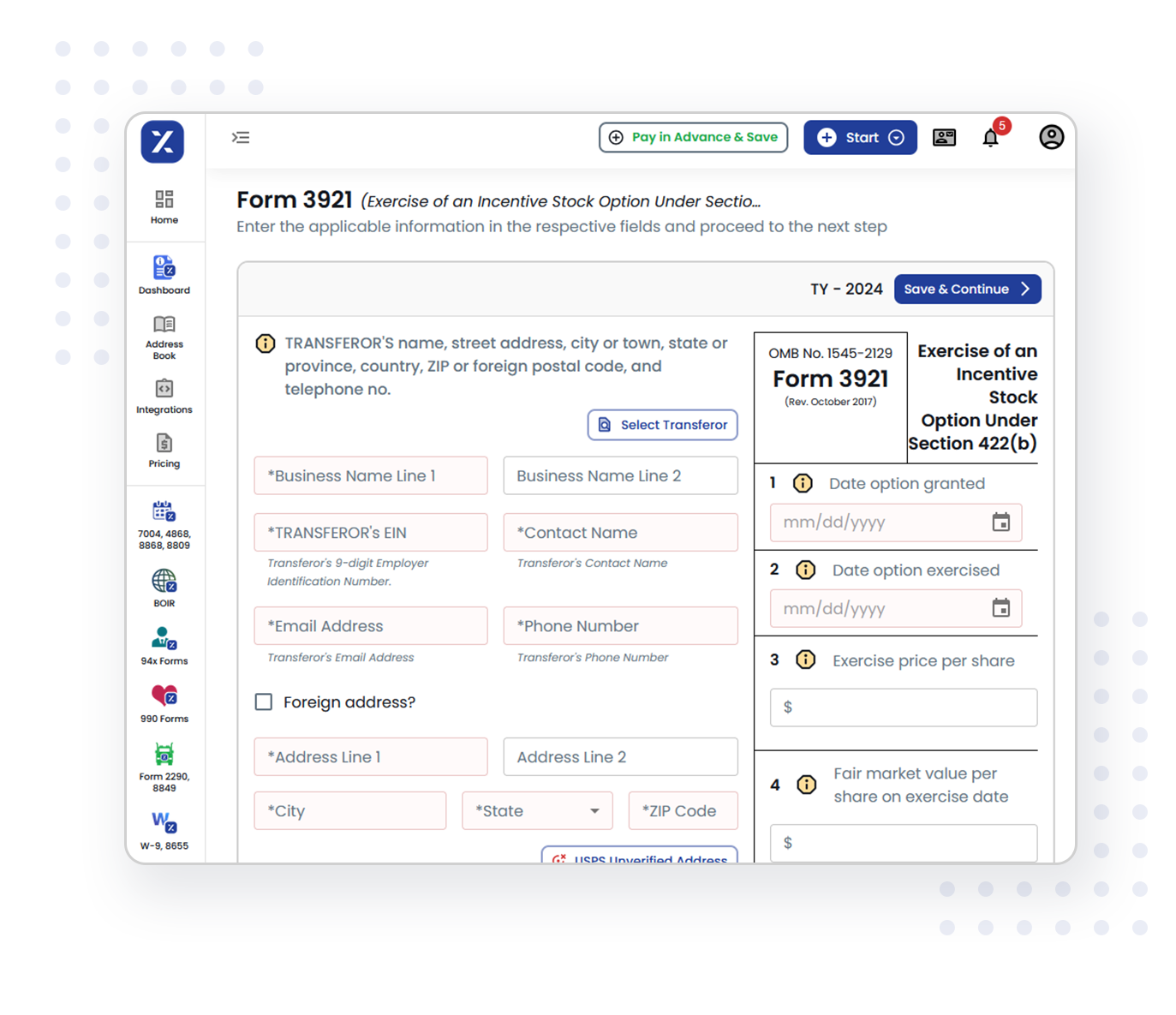

Simple Steps to File Your 3921 Tax Form with TaxZerone

Easily upload and submit your 3921 tax form with TaxZerone –easy and simple.

Fill out the Form 3921

Enter the required details, including the Transferor's name, TIN, and address, as well as the Employee's name, TIN, and address. Also, include the account number, stock option details, and exercise information of the employee.

Review and Transmit

Ensure the accuracy with TaxZerone’s IRS validation, then securely e-file your Form 3921 to the IRS.

Send Copy to Employee

Securely deliver the Employee’s copy via Zeronevault, ensuring safe sharing or opt for postal mail.

File your Form 3921 with TaxZerone today—ensure timely compliance before the deadline!

E-file Form 3921 Now!Why choose TaxZerone for filing 3921 form?

TaxZerone makes filing the 3921 form simple, accurate, and fully IRS-compliant.

User-Friendly Platform

TaxZerone offers an intuitive interface, making it easy to navigate and complete Form 3921 filings, even for first-time users.

IRS-Authorized

As an IRS-certified e-file provider, TaxZerone ensures compliance with IRS regulations and provides instant acknowledgment upon successful filing.

Cost-Effective Solutions

Competitive pricing and options for bulk filings make TaxZerone a budget-friendly choice for businesses of all sizes.

Accurate and Secure Filing

The platform ensures data accuracy with built-in error-checking tools and adheres to stringent security standards to protect sensitive information.

Share Employee Copies

You can share employee copies of Form 3921 using ZeroneVault, either electronically or by postal mail, for a smooth experience with TaxZerone.

Dedicated Customer Support

Responsive support teams are available to assist with any questions or issues, ensuring a smooth filing experience.

Important Deadlines for Filing 3921 Tax Form

Employee copy Deadline

Deadline: January 31, 2025

Send Form 3921 to your employees by this date, so employee can accurately report their ISO exercises when filing their taxes.

IRS Paper Filing Deadline

Deadline: February 28, 2025

If you file paper copies with the IRS, make sure to submit them by this date to avoid penalties.

IRS eFile Deadline

Deadline: March 31, 2025

Submit your Form 3921 filings electronically to the IRS by this date to avoid penalties.

Submit Form 3921 on time without Hassle

Start your Form 3921 filing today!Get Started today with TaxZerone!

Filing Form 3921 online has never been easier. With TaxZerone you can:

- File effortlessly and accurately

- Save time with bulk upload

- Ensure IRS compliance

- Affordable pricing

Start your e-filing today and complete Form 3921 in just 3 simple steps!

Frequently Asked Questions

1. What is IRS Form 3921?

2. Who issues Form 3921?

3. What is Form 3921 used for?

- The employee exercises an ISO during the tax year.

- The employer is a corporation issuing stock.

- The employee receives ownership of the stock after exercising the option

4. When is Form 3921 due?

The due date for Form 3921 is:

- To provide a copy to the employee, the recipient copy deadline is January 31, 2025.

- If filing by mail, the paper filing deadline is February 28, 2025.

- If filing electronically, the IRS e-file deadline is March 31, 2025.

5. What is the difference between form 3921 and 3922?

| Features | Form 3921 | Form 3922 |

|---|---|---|

| Purpose | Reports ISO exercise | Report ESPP transfer |

| Who Files? | Corporation granting the ISO | Corporation administering the ESPP |

| Who Receives? | Employee and IRS | Employee and IRS |

| Due date | January 31(to recipients), February 28(paper)/ March 31(e-file) (to IRS) | January 31(to recipients), February 28(paper)/ March 31 (e-file) (to IRS) |