File Form 1099-Q for Tax Year 2024 with Ease

Report Payments from qualified education programs with TaxZerone’s efficient and user-friendly e-filing solution for Form 1099-Q.

Affordable Pricing

Start at just $2.49 with prices as low as $0.59 per form for bulk filings.

For your return volume

Filing Requirements for Form 1099-Q

Let's make your 1099-Q filing a breeze! Here’s what you’ll need:

- Payer Information: Payer’s Name, TIN and Address

- Recipient Information: Recipient’s Name, TIN and Address

- Payment Information: Total distribution from the qualified education program and Federal Tax Withheld (if applicable)

3 Simple Steps to Complete Your Form 1099-Q E-filing

Filing your Form 1099-Q with TaxZerone is fast, easy, and secure. Here’s how you can do it in just three simple steps:

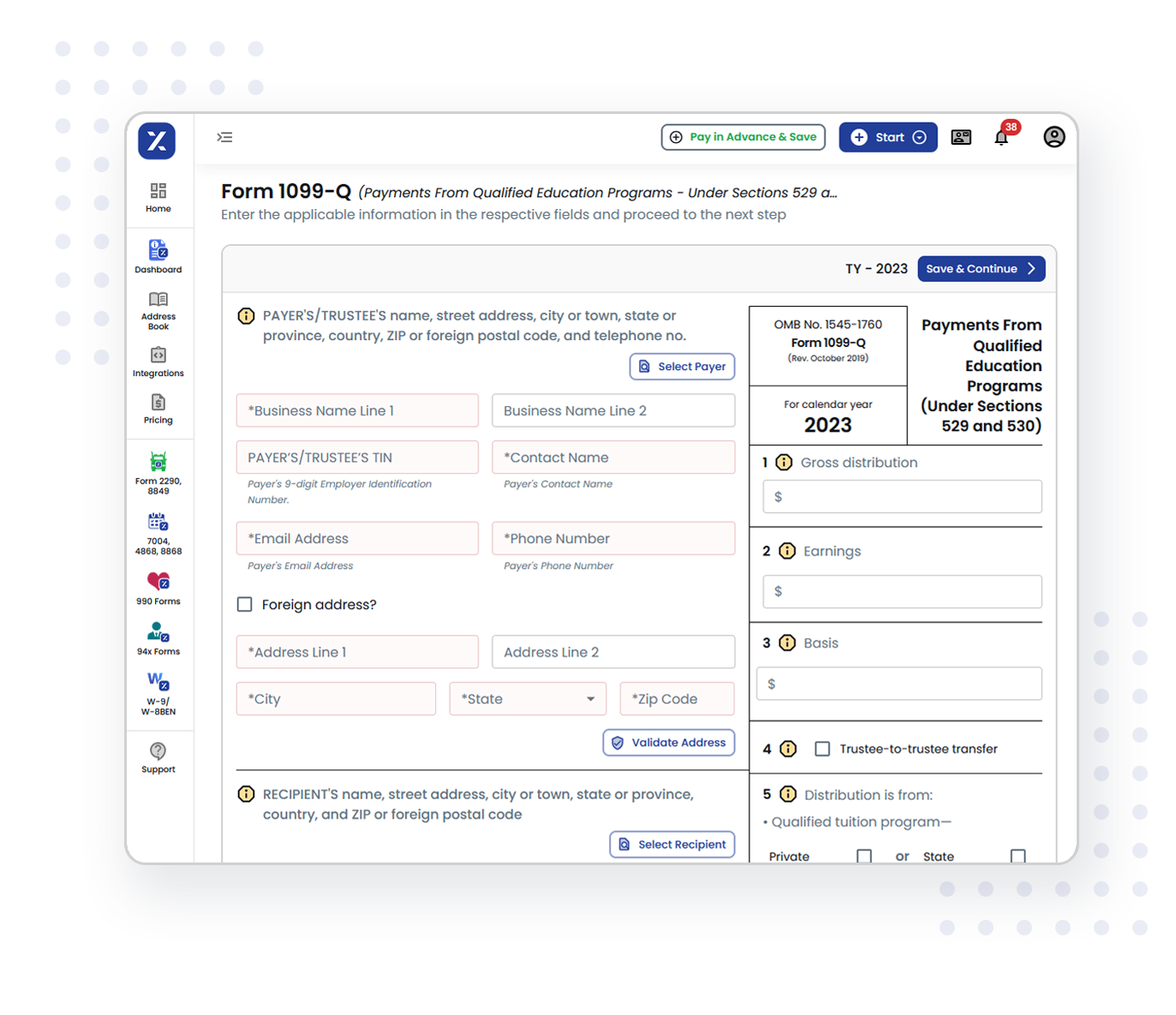

Enter Information for Form 1099-Q

Simply fill in your business details (EIN), recipient's information (name, address, TIN), and the total distribution paid from the qualified education program.

Review & Transmit

Ensure accuracy with TaxZerone’s IRS validations, then securely e-file your Form 1099-Q to the IRS.

Send the recipient copy

Securely deliver the recipient's copy via ZeroneVault, ensuring safe sharing, or choose postal mail for added convenience.

Why Choose TaxZerone for Form 1099-Q E-filing?

TaxZerone is the trusted e-filing solution for businesses of all sizes. Here’s why:

IRS Form Validations

TaxZerone performs automatic IRS form validations to ensure your

Form 1099-Q submissions are accurate and compliant. Our system checks for errors or missing information, reducing the risk of rejections and penalties from the IRS.

Supports Bulk Upload

If you have multiple 1099-Q forms to file, TaxZerone offers a bulk upload option. You can upload and file multiple forms in one go, saving you time and effort. Whether you have a handful of contractors or hundreds, we’ve got you covered.

Share Recipient Copies

Once your Form 1099-Q is filed, you can effortlessly share a copy to the recipient, ensuring timely delivery. There's no need to worry about printing, mailing, or handling physical copies. Enjoy secure electronic delivery of forms to recipients with ZeroneVault or choose postal mailing for physical copies.

Best Price in the Industry

We offer the best prices in the industry based on your filing volume. TaxZerone’s e-filing services are designed to save you both time and money. Whether you’re filing a single form or many, we offer affordable pricing without compromising on quality.

Form-based Filing

Filing your Form 1099-Q is easy with TaxZerone’s form-based interface. Simply fill out the necessary fields directly in our platform, and we’ll handle the rest.

Guided filing

Not sure about a particular field or requirement? No problem! Our guided filing process provides clear instructions, helpful prompts, and real-time assistance to make sure you complete your Form 1099-Q filing with confidence.

Important Deadlines for Filing Form 1099-Q

Send Recipient Copies

Deadline: January 31, 2025 Deliver recipient copies on time through ZeroneVault for secure electronic sharing or opt for postal mail.

File with the IRS (e-file)

Deadline: March 31, 2025 Submit your Form 1099-Q electronically.

File with the IRS (paper)

Deadline: February 28, 2025 Mail your Form 1099-Q if filing on paper.

Save time and stress with TaxZerone. File your Form 1099-Q on time and effortlessly.

Start Filing Now!E-file Form 1099-Q Pricing Calculator

| No. of Forms | Price Per Form |

|---|---|

| 1 to 25 | $2.49 |

| 26 to 50 | $1.99 |

| 51 to 100 | $1.59 |

| 101 to 250 | $1.29 |

| 251 to 500 | $1.09 |

| 501 to 1000 | $0.79 |

| 1001 and above | $0.59 |

Estimate Your Price

| Enter the number of to calculate your estimated cost | |

| Total Price: | $0.00 |

| W-2/1099/1095 Postal Mailing | Price Per Form |

|---|---|

| Per Form | $1.75 |

Estimate Your Price

| Enter the number of to calculate your estimated cost | |

| Total Price: | $0.00 |

| W-2/1099/1095 Electronic Delivery | Price Per Form |

|---|---|

| Per Form | $0.50 |

Estimate Your Price

| Enter the number of to calculate your estimated cost | |

| Total Price: | $0.00 |

State Filing Not Required for Form 1099-Q

There are no state-specific tax filing requirements for Form 1099-Q. TaxZerone ensures your federal filing iscomplete and compliant, so you don’t need to worry about any additional state-level reporting.

Schedule Filing: Plan Ahead and Stay On Track

Want to ensure your filings are submitted on time without the stress? With Schedule Filing, you can prepare your Form 1099-Q filings in advance, and we’ll take care of the submission when the time comes.

Choose Your Filing Date

Set your preferred filing date, and we’ll ensure your forms are submitted to the IRS promptly and accurately.

Ensure Accuracy

Recipients can review their 1099-Q forms before submission, allowing them to identify and correct any errors in advance.

Avoid the Need for IRS Correction Forms

Scheduling your filing provides an opportunity to validate all details beforehand, reducing errors and eliminating the hassle of filing IRS correction forms later.

Share Recipient Copies with Ease

TaxZerone makes it simple to deliver Form 1099-Q copies to your recipients securely and on time.Choose the method that works best for your business:

Secure Delivery via ZeroneVault

- Send 1099-Q copies electronically through ZeroneVault, a secure and user-friendly platform.

- Recipients can instantly access their forms without printing or mailing.

- Enjoy peace of mind with ZeroneVault’s robust data security.

Traditional Postal Mailing

- Need physical copies? TaxZerone provides reliable postal mailing services.

- Recipient copies are delivered promptly to meet IRS deadlines.

- Save time and let TaxZerone manage the mailing process for you.

Get Started with TaxZerone Today

Filing Form 1099-Q online has never been easier. With TaxZerone, you can:

- File quickly and accurately.

- Stay compliant with IRS requirements.

- Save time with bulk upload.

- File at the best price in the industry.

Start your e-filing process today and complete your Form 1099-Q in just 3 simple steps!

Takes 3 steps and less than 5 minutes

Frequently Asked Questions

1. What is Form 1099-Q?

- 529 Plans (Qualified Tuition Programs)

- Coverdell Education Savings Accounts (ESAs)

The form is issued by the program administrator or financial institution to the beneficiary or account owner to report the total distributions, earnings, and basis of the withdrawal for the tax year.

2. Who Needs to File Form 1099-Q?

- Banks

- Financial institutions

- Program managers

They are required to file Form 1099-Q when administering:

- 529 Plans (Qualified Tuition Programs)

- Coverdell Education Savings Accounts (ESAs)

The form reports distributions made during the tax year to the account owner or beneficiary.

3. When is the deadline to file Form 1099-Q?

- January 31: Last day to send recipient copies.

- February 28: Last day for paper filing.

- March 31: Last day to file electronically

4. What are the Penalties for Late Filing of Form 1099-Q?

- Filed within 30 days after the deadline: $60 per form, maximum penalty $664,500 per year ($232,500 for small businesses)

- Filed 31 days to 180 days after the deadline: $130 per form, maximum penalty $1,993,500 per year ($664,500 for small businesses)

- Filed more than 180 days after the deadline: $330 per form, maximum penalty $3,987,000 per year ($1,329,000 for small businesses)

To avoid these penalties, it’s essential to file Form 1099-Q on time.