E-File IRS Information Returns with Ease for Tax Year 2024!

Filing information returns such as W-2s, 1099s, and 1098s can be tedious and time-consuming. TaxZerone simplifies the process, allowing you to submit these forms electronically to the IRS in just minutes.

E-file Information Returns with TaxZerone

Save time and effort, avoid costly mistakes, and stay secure and compliant

Form W-2c

Corrected Wage and Tax Statement - Report corrected wages and taxes withheld for employees.

$0.59

Form 1099-MISC

Miscellaneous Information - Report miscellaneous income, like payments to contractors, except compensation.

$0.59

Form 1099-INT

Interest Income - Report Interest Income for whom withheld and paid any foreign tax on interest

$0.59

Form 1099-DIV

Dividends and Distributions - Report dividends and other distributions to taxpayers.

$0.59

Form 1099-B

Proceeds From Broker and Barter Exchange Transactions - Report Proceeds from Broker and Barter Exchange Transactions.

$0.59

Form 1099-K

Payment Card and Third Party Network Transactions - Report Payment Card and Third Party Network Transactions.

$0.59

Form 1099-R

Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. - Report Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

$0.59

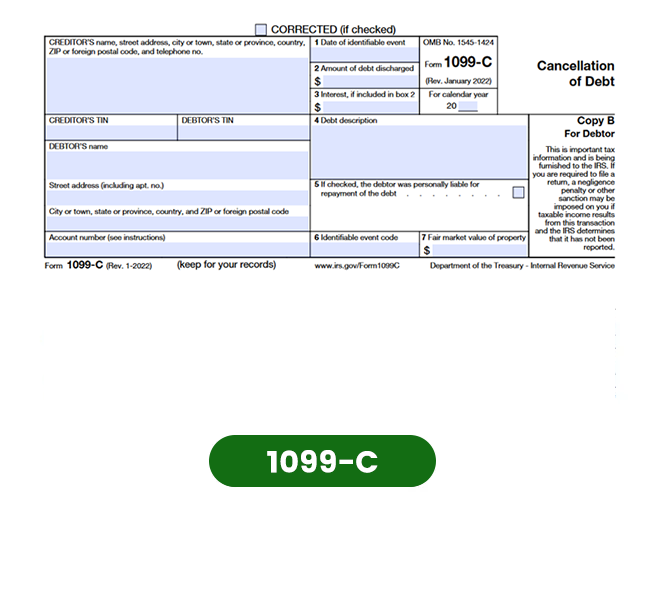

Form 1099-C

Form 1099-C, Cancellation of Debt - Report the debt for which you canceled $600 or more owed to you.

$0.59

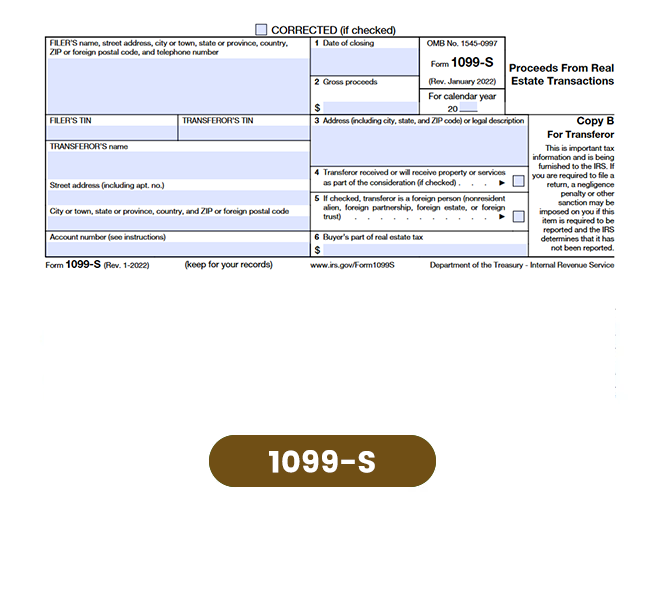

Form 1099-S

Form 1099-S, Proceeds From Real Estate Transactions - Report the gross proceeds from a real estate sale or exchange .

$0.59

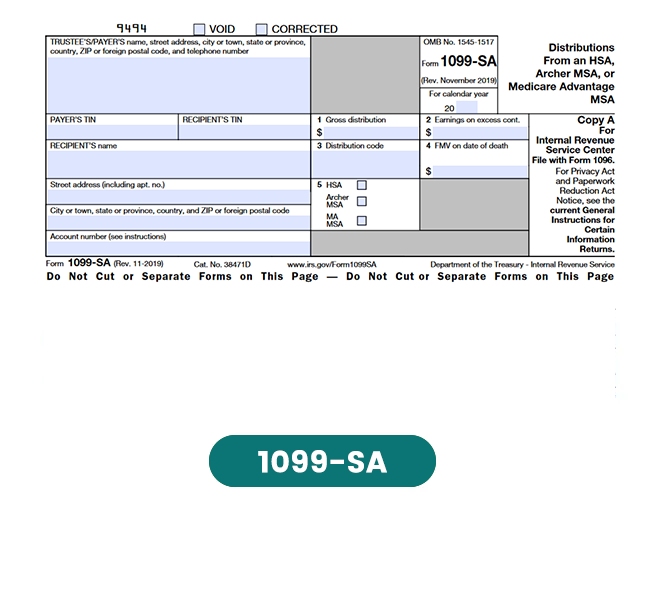

Form 1099-SA

Form 1099-SA, Distributions From an HSA, Archer MSA, or Medicare Advantage MSA - Report distributions made from a health savings account (HSA) , Archer medical savings account (Archer MSA), or Medicare Advantage MSA (MA MSA).

$0.59

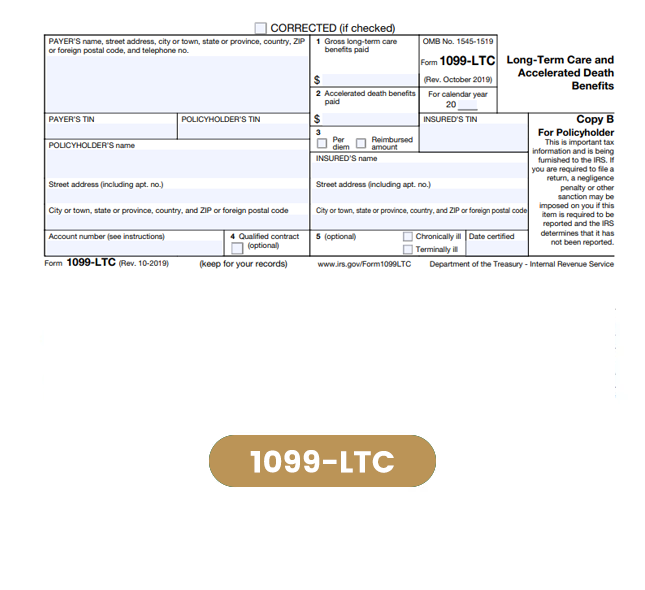

Form 1099-LTC

Form 1099-LTC, Long-Term Care and Accelerated Death Benefits - Report long-term care and accelerated death benefits paid to policyholders.

$0.59

Form 1099-OID

Form 1099-OID, Original Issue Discount - RReport original issue discount (OID) on certain debt instruments sold at a discount to the face value.

$0.59

Form 1099-PATR

Form 1099-PATR, Taxable Distributions Received From Cooperatives - Report taxable distributions of profits patronage dividends and certain other income to the patrons.

$0.59

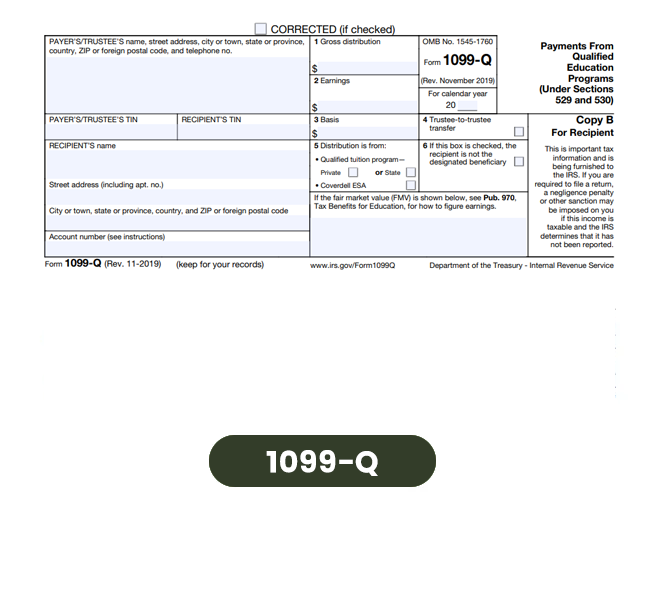

Form 1099-Q

Form 1099-Q, Payments From Qualified Education Programs (Under Sections 529 and 530) -Report distributions made from qualified education programs like Coverdell Education Savings Accounts (ESAs) sand 529 plans.

$0.59

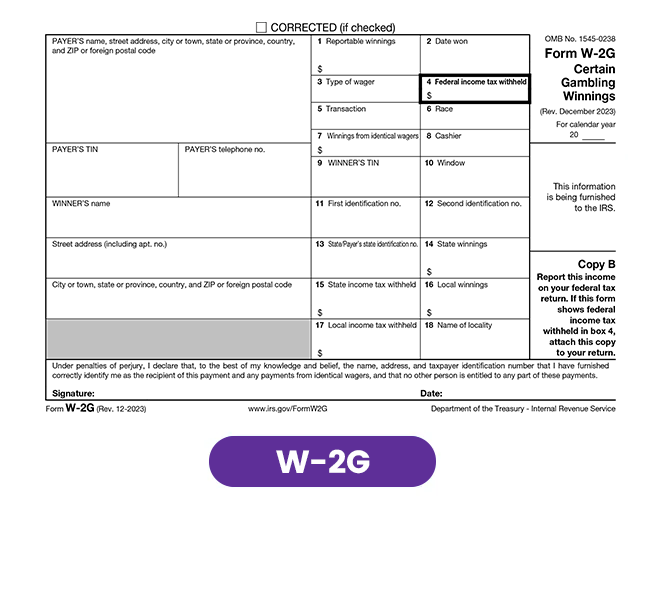

Form W-2G

Certain Gambling Winnings – Report gambling winnings and any taxes withheld.

$0.59

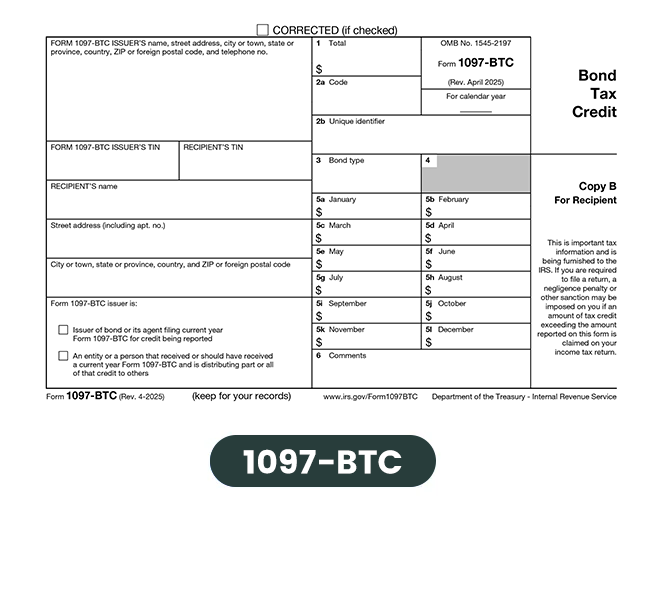

Form 1097-BTC

Form 1097-BTC, Bond Tax credit to report tax credit distributed to each recipient by bond issuers or agent.

$0.59

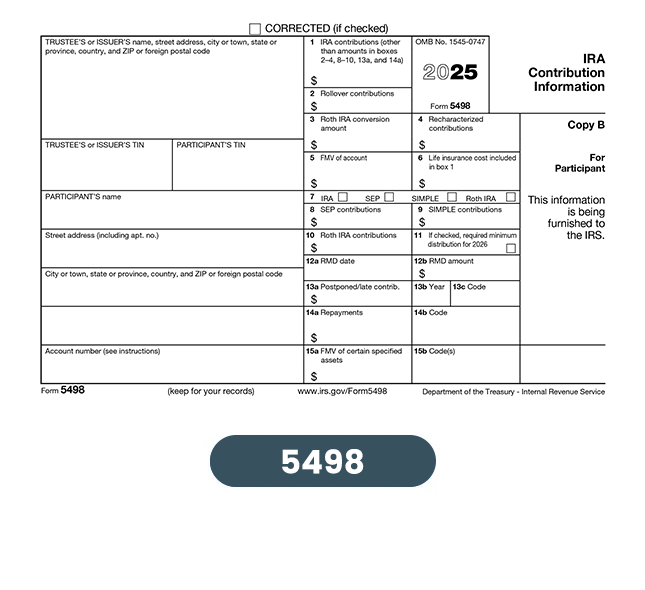

Form 5498

Report IRA contributions, rollovers, conversions, and required minimum distributions (RMDs) to the IRS and account holders.

$0.59

Form 5498-ESA

Report Coverdell ESA Contribution Information to the IRS and account beneficiaries.

$0.59

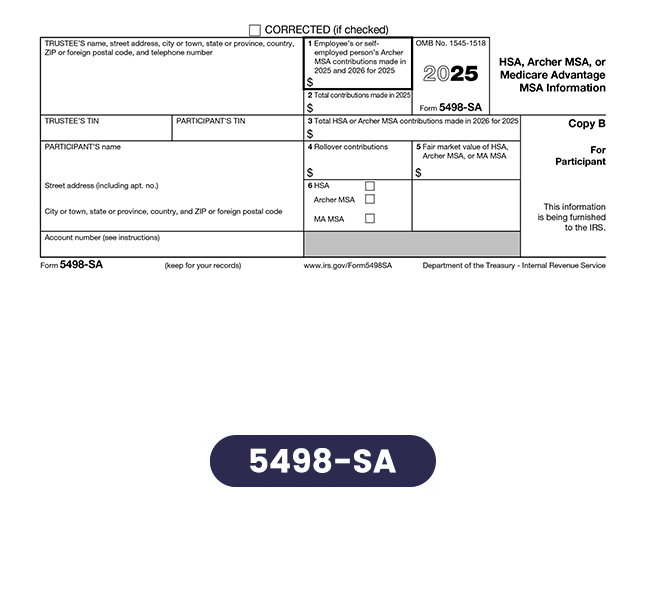

Form 5498-SA

Report contributions to an HSA, Archer MSA, or Medicare Advantage MSA to the IRS and account holders.

$0.59

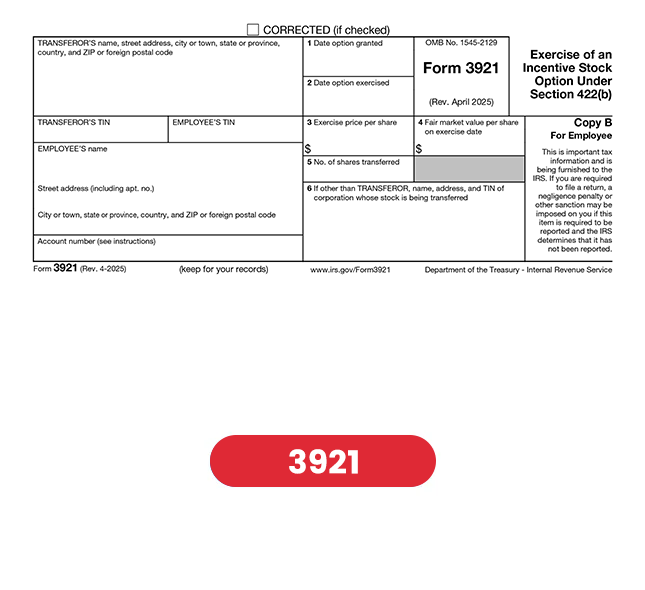

Form 3921

Exercise of an Incentive Stock Option Under Section 422(b) - Report on the exercise of an incentive stock option and any related adjustments.

$0.59

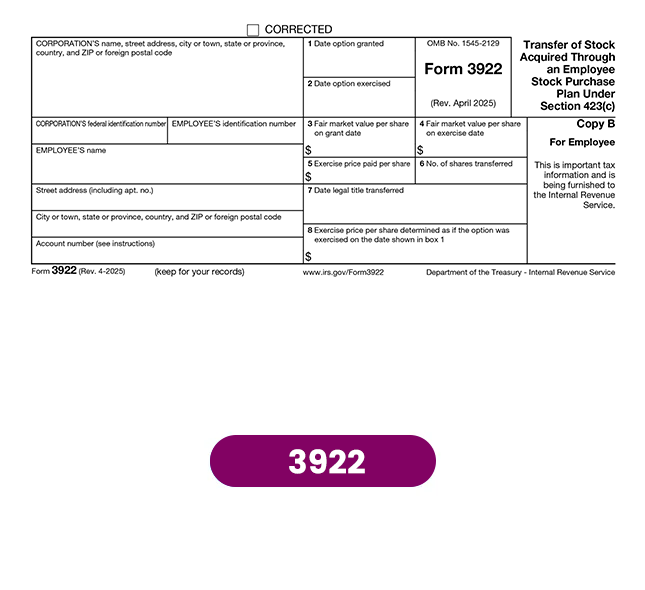

Form 3922

Report the transfer of stock acquired through an employee stock purchase plan under Section 423(c) to the IRS and employees.

$0.59

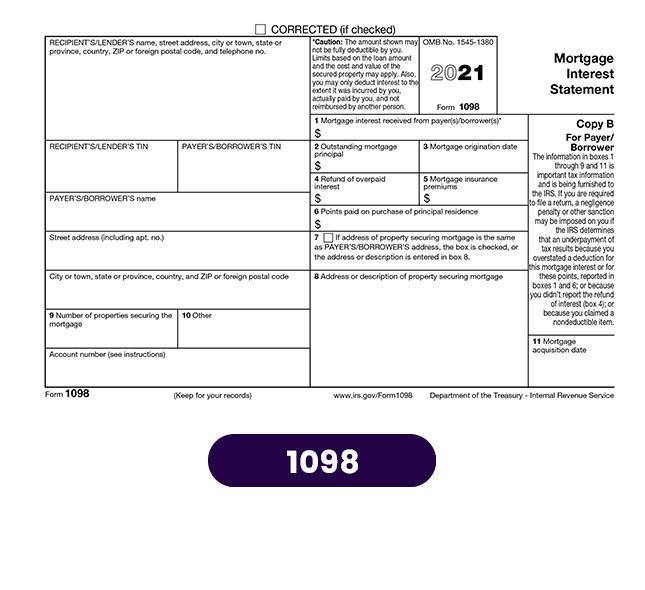

Form 1098

Form 1098, Mortgage Interest Statement Report mortgage interest received from an individual, including a sole proprietor.

$0.59

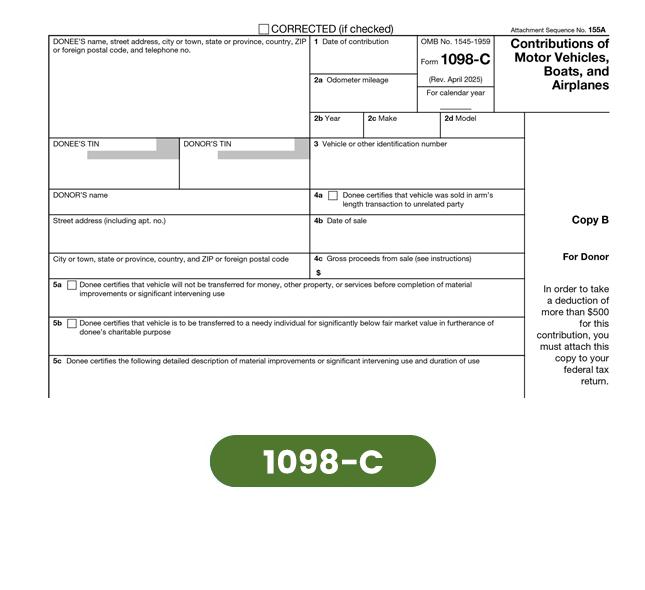

Form 1098-C

Report contributions of motor vehicles, boats, and airplanes to qualified charitable organizations to the IRS and donors.

$0.59

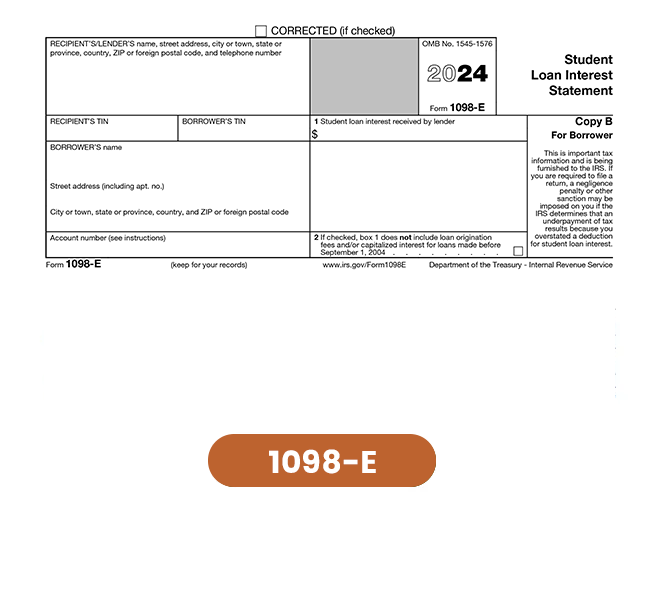

Form 1098-E

Form 1098-E, Student Loan Interest Statement Report student loan interest of $600 or more received from an individual.

$0.59

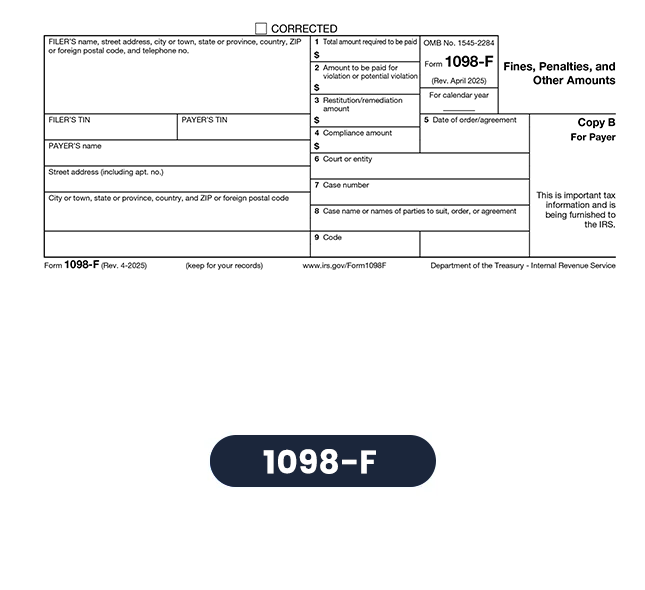

Form 1098-F

Reports fines, penalties, and other amounts paid to government entities for legal violations for taxpayers paying $50,000 or more.

$0.59

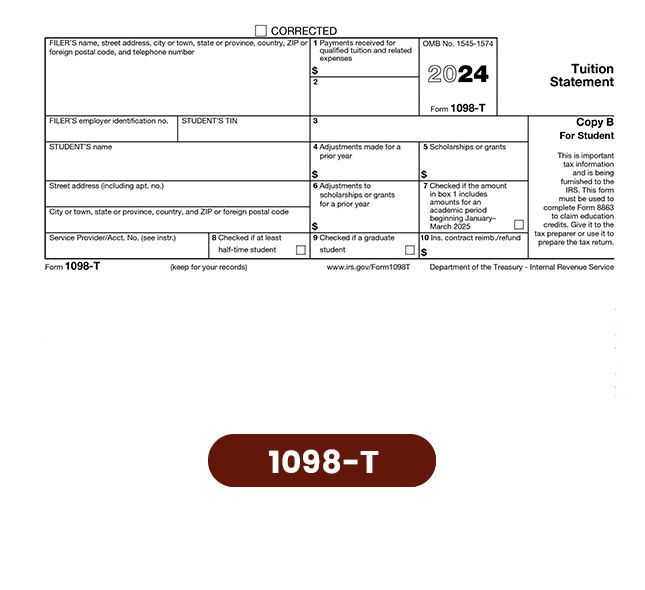

Form 1098-T

Form 1098-T, Tuition Statement Report all payments received from and refunds made to each enrolled student.

$0.59

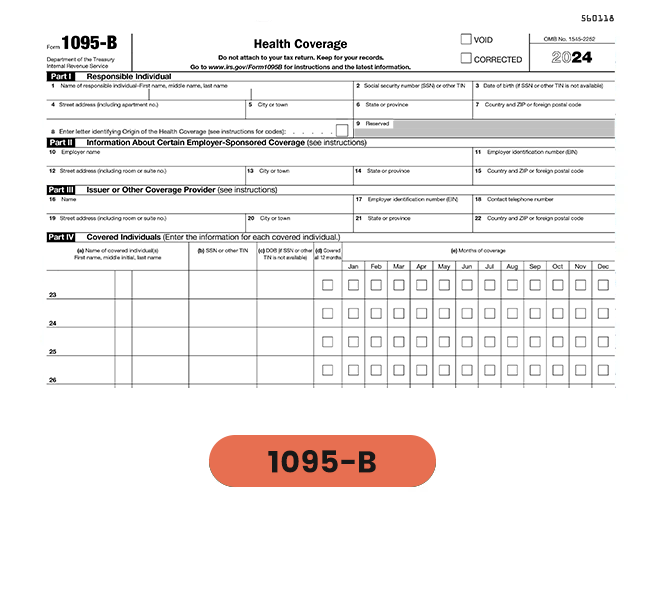

Form 1095-B

Report Health Coverage to the IRS and responsible individual to stay IRS compliant

$0.59

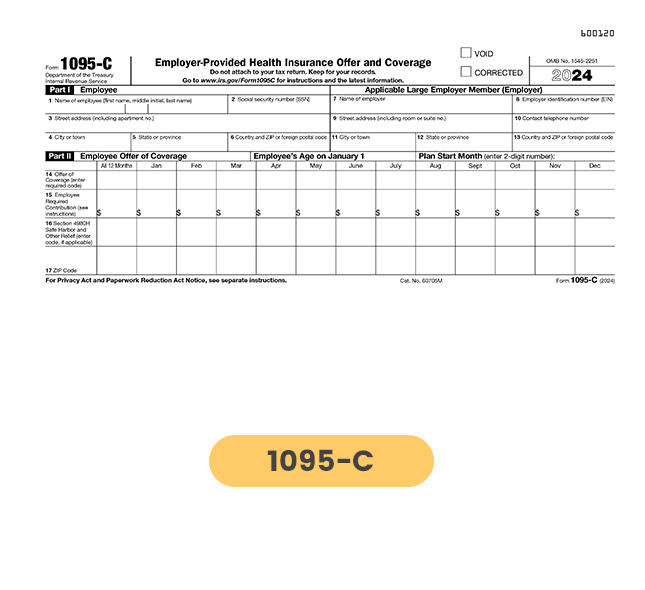

Form 1095-C

Report health insurance coverage under Employer-Provided Health Insurance Offer and Coverage to IRS and employees.

$0.59

Effortless E-filing for Information Returns

Follow the steps below to e-file your information returns with the IRS.

Select the form you want to file

Fill out the form information

Review and transmit the form to the IRS

Send the employee/contractor a copy

Ready to e-file with TaxZerone?

Why Choose TaxZerone to E-file Information Returns?

TaxZerone simplifies information return filing with these amazing features

Form-based filing

Form-based filing ensures you complete all the necessary fields in less time. Whether it's Form W-2, Form 1099-MISC, or Form 1099-NEC, we've got you covered.

IRS form validations

Built-in IRS form validations ensure that your submissions meet the necessary criteria for a seamless and accurate filing process.

E-file in minutes

Complete the entire process in a matter of minutes. Save time and effort, leaving you with more resources to focus on what matters most - your business.

Guided filing

Guided filing walks you through each step and makes the process simple and stress-free. We'll ensure you fill out the forms correctly every time.

Quick and secure e-filing

Speed and security are at the heart of our e-filing service. You can e-file your returns quickly and securely, with your data protected every step of the way.

Email return copies

Email copies of the returns to recipients, so you can ensure they have the information they need without delay.