Meet Wisconsin’s 2024 W-2 Filing Requirements

Discover Wisconsin's W-2 filing requirements and deadlines, and seamlessly e-file your W-2 forms quickly and precisely.

As low as $0.99 per W-2 state filing form

Key Wisconsin W-2 Form Information

| State Tax | Form | Filing Requirement | Filing Method |

|---|---|---|---|

| Yes, Wages are taxable | Form W-2 Wage and Tax Statement | Yes, all employers should file form W-2 | Electronic /Paper We recommend electronic filing. |

| Form WT-7 Reconciliation of Form W-2 for Wisconsin | Yes, all employers should file form WT-7 | Electronic/Paper |

Who Needs to File W-2 Forms in Wisconsin?

In Wisconsin, employers are required to file Form W-2 for every employee who has received state-taxable wages during the tax year. The form must report the total wages paid to the employee and the amount of state income tax withheld. These details must be submitted to the Wisconsin Department of Revenue to ensure accurate tax reporting and compliance with state regulations.

What Must Be Filed?

- Form W-2: Wage and Tax Statement for each employee

- Form WT-7: Reconciliation of the total Wisconsin income tax withheld.

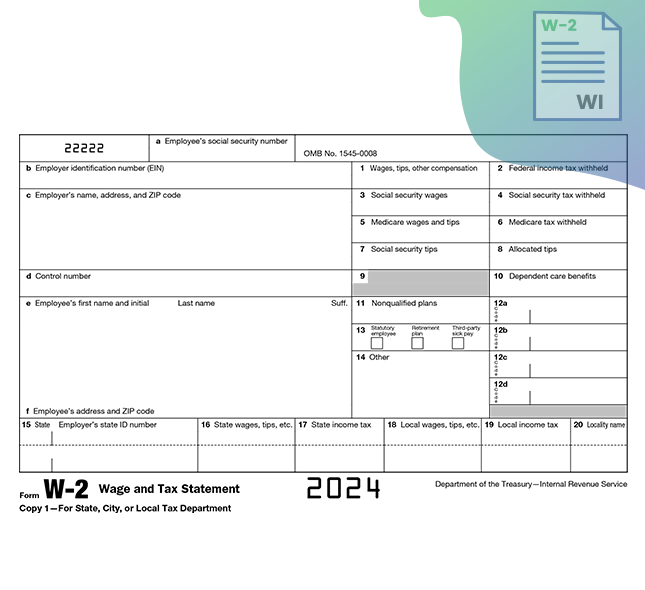

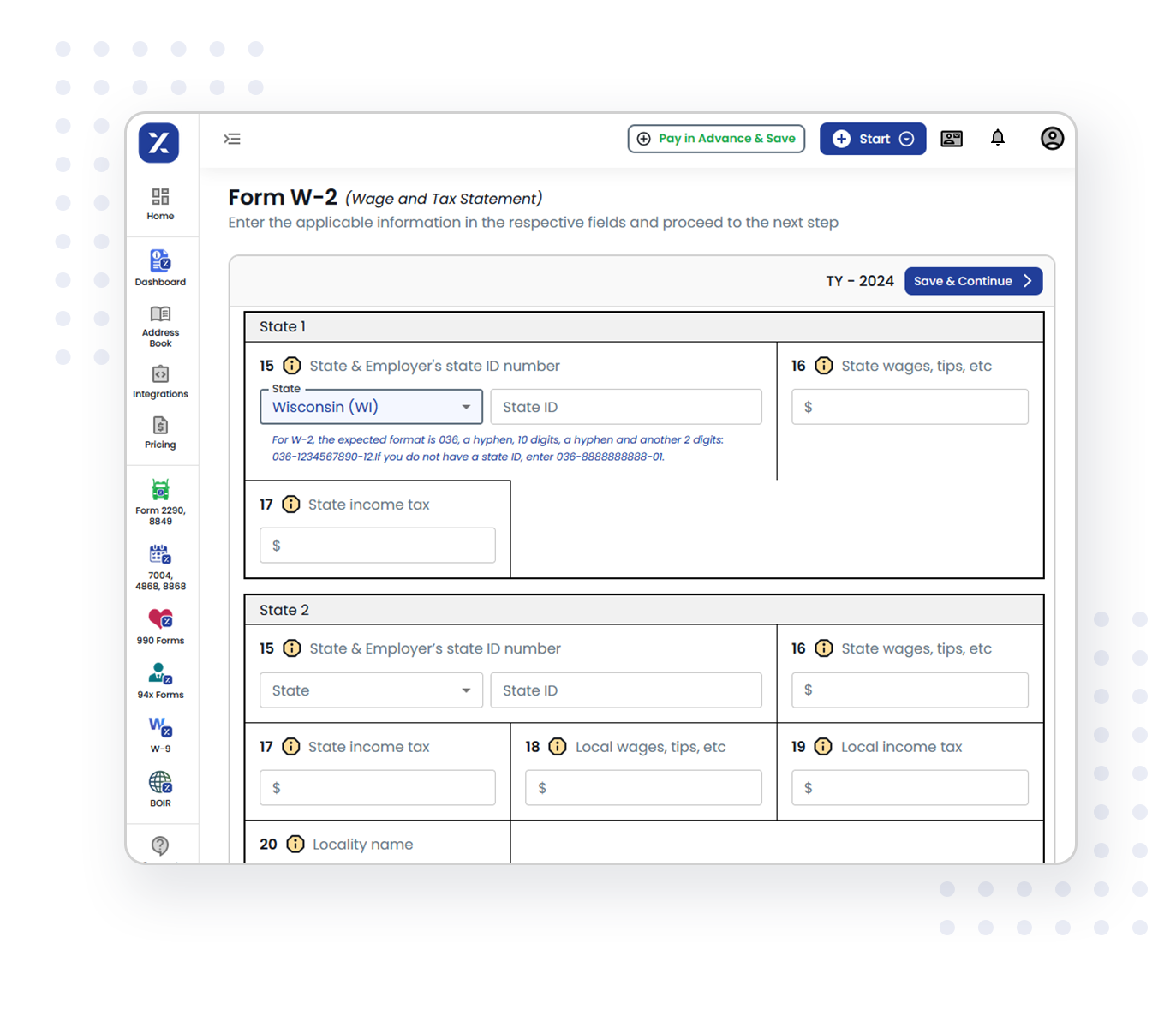

Important W-2 Form Fields for Wisconsin Filings

Ensure the following key fields on the W-2 form are correctly filled:

Employer’s state ID number

The state name(Wisconsin) and state tax identification number should be entered in Box 15.

State wages, tips, etc.

The wages paid to the employee subject to Wisconsin state income tax should be entered in Box 16.

State income tax

The state income tax withheld from the employee should be entered in Box 17.

Maximize efficiency! TaxZerone simplifies Wisconsin W-2 form filings for your business.

File Wisconsin W-2 FormFiling Methods for Wisconsin W-2 Forms

Electronic Filing

Wisconsin requires all employers who are submitting 10 or more W-2 forms to file electronically with the Wisconsin Department of Revenue.

E-filing offers the convenience of submitting your forms from anywhere, at any time, with just a few clicks.

Paper Filing

Employers submitting fewer than 10 W-2 forms have the option to file using the paper method with the Wisconsin Department of Revenue.

Mailing Address:

Wisconsin Department of Revenue,

PO Box 8920,

Madison, WI 53708-8920.

Recommendation: Even though paper filing is still an option in Wisconsin, the state strongly encourages employers to use the electronic filing method. TaxZerone is preferred for its quick processing, accuracy, and ease of use.

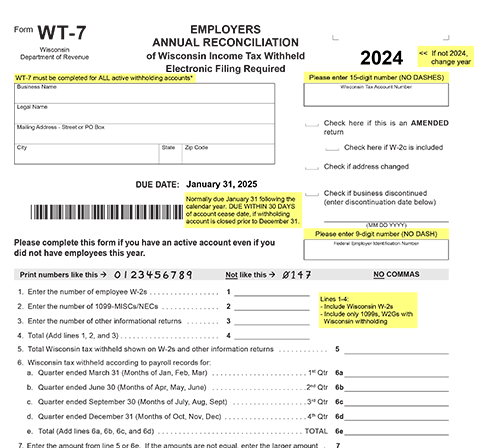

Wisconsin Form WT-7: Annual Reconciliation Of Wisconsin Income Tax Withheld

All Wisconsin employers are required to file Form WT-7, the Employer’s Annual Reconciliation of Wisconsin Income Tax Withheld, with the Department of Revenue. This form can be submitted for a quick and convenient filing experience. Alternatively, employers may use the paper filing method, which allows them to mail their annual reconciliation to the Department of Revenue.

Mailing Address:

Wisconsin Department of Revenue,

PO Box 8981 ,

Madison, WI 53708-8981.

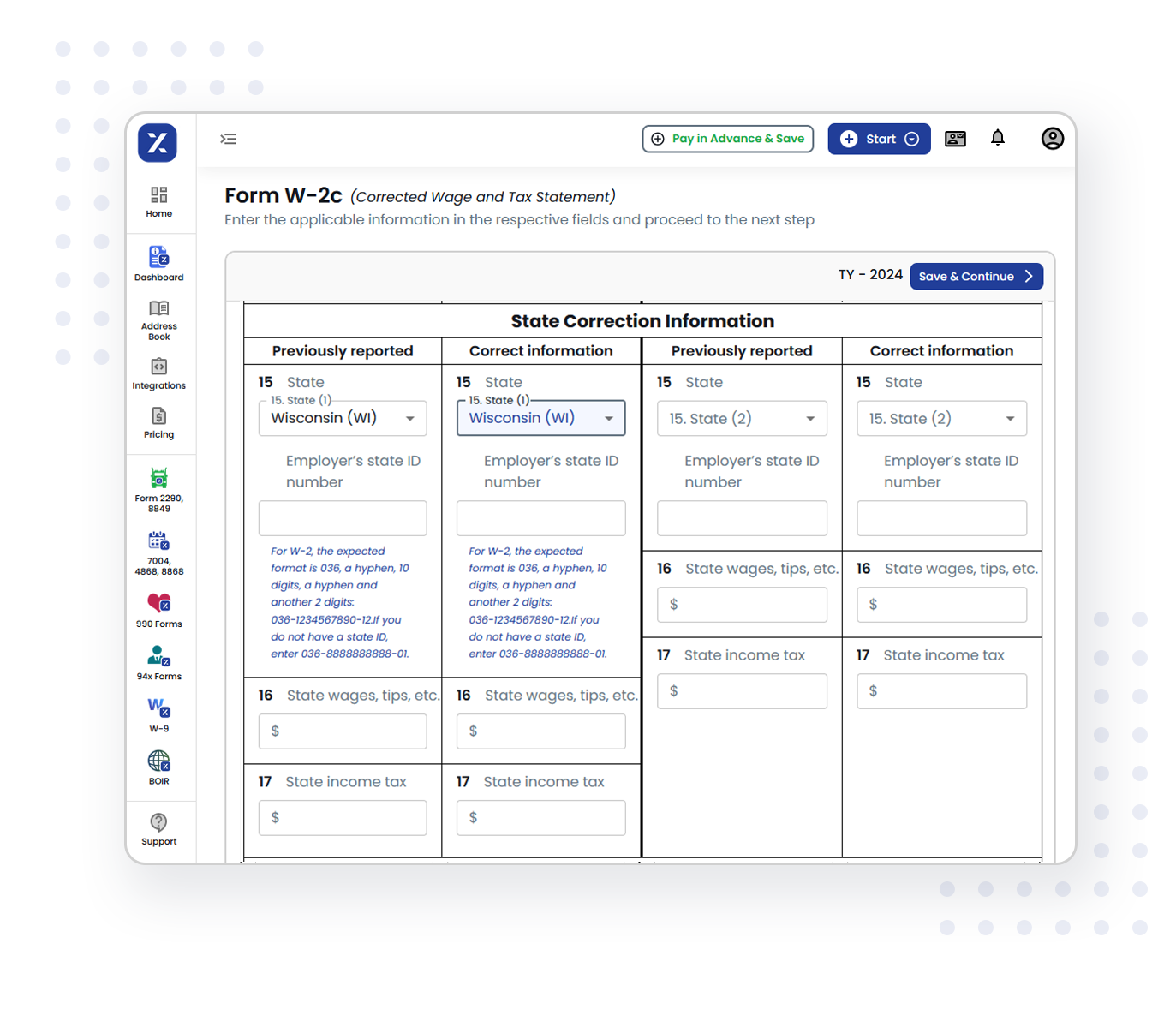

W-2c Corrections for Wisconsin Filings

If a mistake is found in a filed W-2 form, it should be corrected using Form W-2c, Corrected Wage and Tax Statement. The corrected W-2c form must be submitted to the Wisconsin Department of Revenue. In addition, the amendment to the W-2 should be accompanied by an amended Form WT-7. Employers can file both forms electronically or by paper, depending on their preference and the number of corrections needed. Amended WT-7 can be filed in the Wisconsin Tax portal

TaxZerone: Your partner for smooth and efficient Form W-2 corrections(Form W-2c) in Wisconsin

File W-2c Form NowFiling Deadline for Wisconsin W-2 Forms

- Form W-2 (Wage and Tax Statement)

- Form WT-7 (Reconciliation Form)

Why Choose TaxZerone for Your Wisconsin W-2 Filing Needs?

When it comes to e-filing W-2 forms, TaxZerone is your trusted solution. Our platform is designed to make the filing process simple, accurate, and timely. Enjoy the following benefits:

Quick & Easy

Complete your W-2 filings in just three simple steps, taking less than five minutes!

Affordable Pricing

Each form costs only $0.99 for w2 state filings with absolutely no hidden fees.

Bulk Upload Feature

Save valuable time by uploading multiple forms in one go.

Dedicated Support Team

Have questions? Our expert team is available to help you navigate any filing challenges.

Ready to make your Wisconsin state W-2 filing hassle-free?

TaxZerone makes it happen for just $0.99 per form in Wisconsin!

Frequently Asked Questions

1. Does Wisconsin have a W-2 filing requirement?

2. What information is required on Wisconsin Form W-2?

3. Can W-2 forms be filed electronically with Wisconsin?

4. What is Form WT-7?

Form WT-7, the Annual Reconciliation of Wisconsin Income Tax, is used to report the total wages paid to employees that are subject to Wisconsin state income tax, along with the amount of state income tax withheld from employees' wages.

5. Can we get an extension for filing form WT-7?

Yes, you can request a 30-day extension for filing Form WT-7 if you can demonstrate good cause. If granted, the extension also applies to corresponding wage statements and information returns. The extension request must be submitted by the original due date. You can request the extension via My Tax Account, email (WIWithholding@wisconsin.gov), or by mail.

Mailing Address:

Tax Operations Business, Mail Stop 3-80

Wisconsin Department of Revenue,

PO Box 8902,

Madison, WI 53708-8902.