Meet Nebraska 2024 W-2 Filing Requirements

Understand the Form W-2 requirements and stay informed about the deadlines for the tax year 2024. File Form W-2 with ease and efficiency.

As low as $0.99 per W-2 state filing form

Key Nebraska W-2 Form Information

| State Tax | Form | Filing Requirement | Filing Method |

|---|---|---|---|

| Yes, Wages are taxable | Form W-2 Wage and Tax Statement | Yes, all employers must submit form W-2 | Electronic /Paper We recommend electronic filing. |

| Form W-3N Nebraska Annual Reconciliation of Withholding | Yes, all employers must file Form W-3N to reconcile the state taxes withheld | Electronic/Paper |

Who Needs to File W-2 Forms in Nebraska?

All employers who pay wages in Nebraska and withhold Nebraska state tax are required to file Form W-2 for each employee. Timely submission is crucial to remain compliant with the Nebraska Department of Revenue and to avoid potential penalties.

What Must Be Filed?

- Form W-2: Wage and Tax Statement for each employee.

- Form W-3N: Annual Reconciliation of Withholding for Nebraska

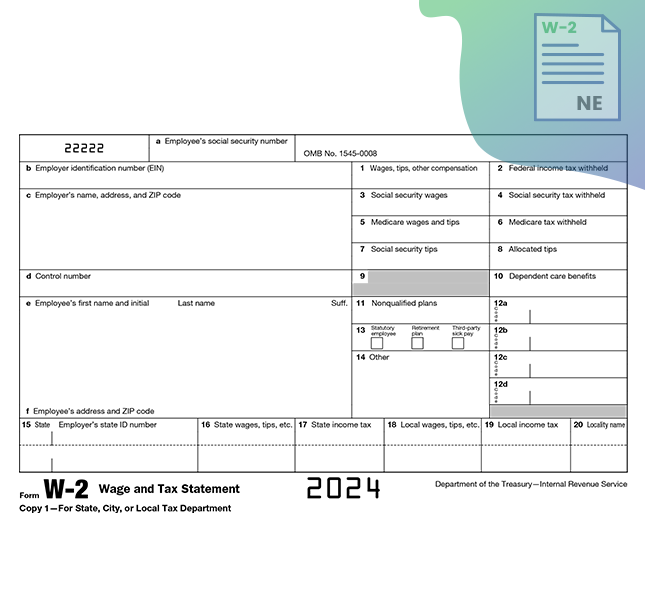

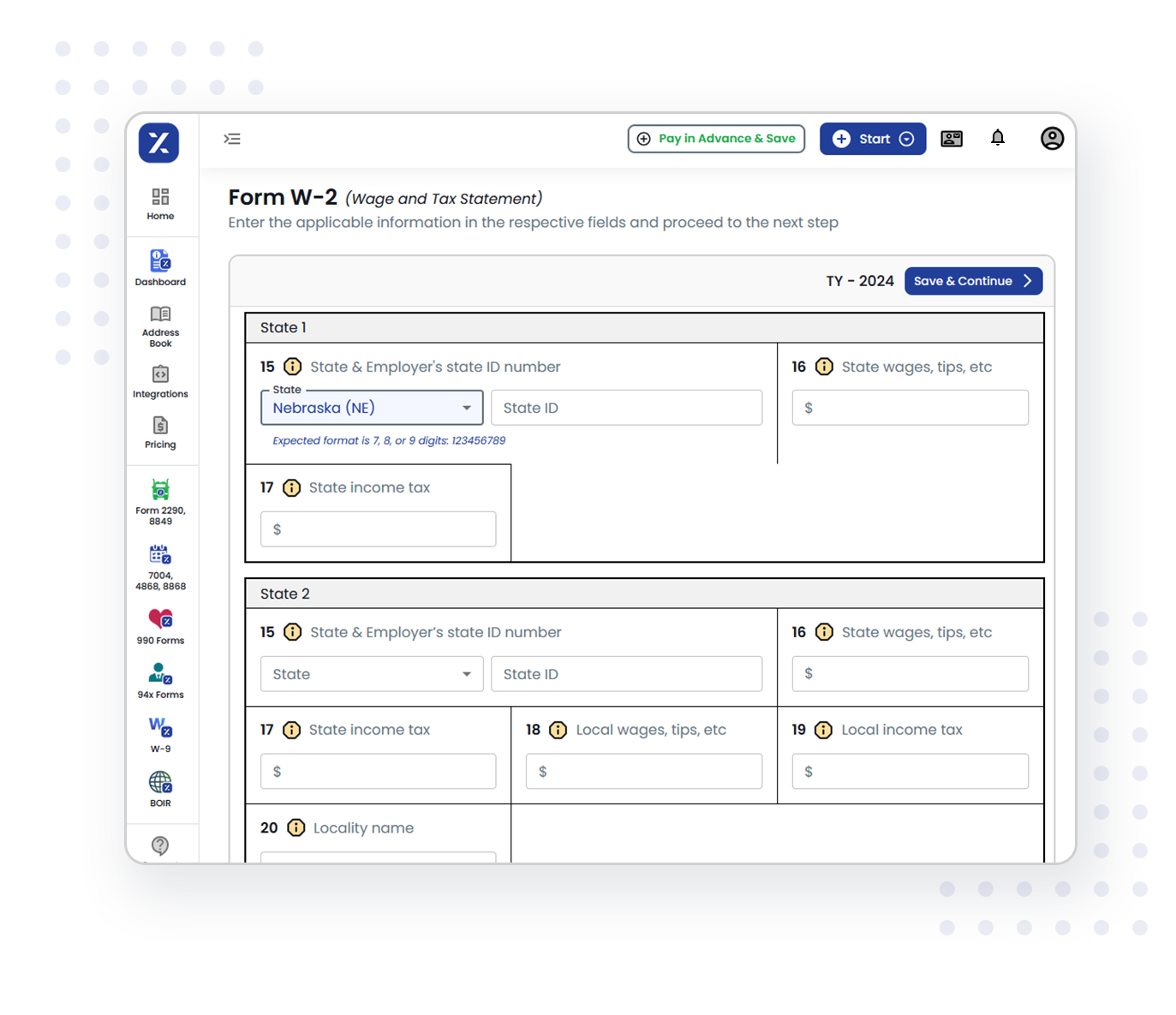

Important W-2 Form Fields for Nebraska Filing

Ensure the following key fields on the W-2 form are correctly filled:

Employer’s state ID number

Employer must enter the state name(Nebraska) and State Tax identification number in Box 15.

State wages, tips, etc.

Enter the total wages, tips, or other compensation in Box 16. This amount should reflect what is subject to Nebraska income tax.

State income tax

Enter the Nebraska state income tax withheld from the employee’s wages in Box 17.

File your Nebraska W-2 forms now with ease!TaxZerone is your trusted platform for W-2 form filing in Nebraska.

File Nebraska W-2 FormState Filing Methods for Nebraska W-2 Forms

Electronic Filing

All employers in Nebraska are required to file Form W-2 electronically. Employers filing 50 or more forms must use the electronic filing method.

Simply enter employee details and transmit the forms anytime, from anywhere.

Paper Filing

Employers with fewer than 50 W-2 forms may choose to file using paper forms with the Nebraska Department of Revenue.

Mailing Address:

Nebraska Department of Revenue

PO Box 98915,

Lincoln, NE 68509-8915.

Recommendation: While paper filing is an option, e-filing with TaxZerone is preferred for faster processing, greater accuracy, and user-friendly experience.

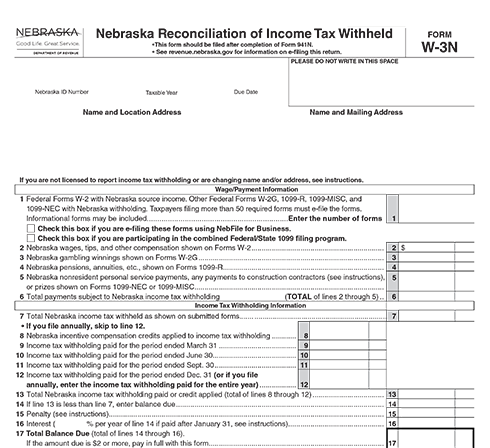

Nebraska Form W-3N: W-2 Reconciliation

Form W-3N is the annual reconciliation form that employers must file with the Nebraska Department of Revenue alongside their W-2 forms. This form ensures that the details reported on all W-2 forms align with the employer’s records for the tax year. Specifically, it reconciles the total wages paid to employees and the total Nebraska state taxes withheld. Filing Form W-3N accurately and on time is crucial to prevent discrepancies and avoid penalties. Employers can file Form W-3N either electronically or by paper, depending on how their W-2 forms are submitted.

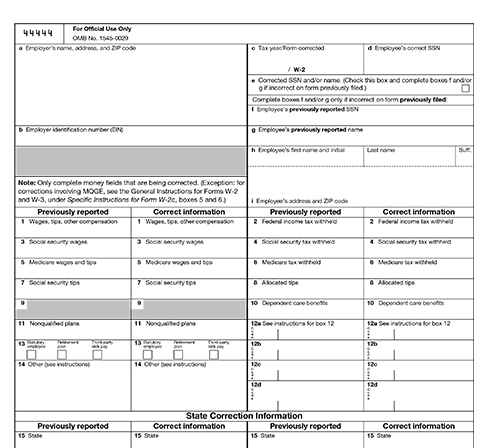

W-2c Corrections for Nebraska Filings

Errors in previously filed W-2 forms can be corrected by submitting a correction to the Nebraska Department of Revenue. The correction should be filed with the appropriate corrected document using the paper filing method

State filing Deadline for Nebraska W-2 Forms

- Form W-2 (Wage and Tax Statement)

- Form W-3N (Reconciliation Form)

Why Choose TaxZerone for Nebraska W-2 Filing?

When it comes to e-filing W-2 forms, TaxZerone stands out as your go-to solution. Our platform is designed to make the filing process easy, accurate, and timely. Experience the following benefits:

Quick & Easy

Complete your W-2 filings in just three simple steps, taking less than five minutes!

Affordable Pricing

Each form costs only $0.99 for w2 state filings with absolutely no hidden fees.

Bulk Upload Feature

Save valuable time by uploading multiple forms in one go.

Dedicated Support Team

Have questions? Our expert team is available to help you navigate any filing challenges.

Simplify your Nebraska W-2 filing!

E-file with TaxZerone at just $0.99 per W-2 form.

Frequently Asked Questions

1. Does Nebraska require W-2 filing?

2. What information is required on Nebraska Form W-2?

3. Can W-2 forms be filed electronically with Nebraska?

4. What is Form W-3N?

Employers are required to file Form W-3N, the Annual Reconciliation of Income Tax Withheld. This form reconciles the wages and Nebraska state taxes withheld, as reported on the W-2 forms for all employees filed by the employer.

5. What are the penalties for late filing of form W-2

A penalty of $2 per W-2 form, up to a maximum of $2,000, may be imposed by the Nebraska Department of Revenue for failing to file by the due date of 31st January 2025.