Stay Compliant with Kentucky W-2 Filing Requirements for 2024

Understand Kentucky’s W-2 requirements, including the necessary tax withholding details and deadlines. Ensure timely e-filing to avoid penalties.

As low as $0.99 per W-2 state filing form

Key Kentucky W-2 Form Information for Employers.

| State Tax | Form | Filing Requirement | Filing Method |

|---|---|---|---|

| Yes, Wages are taxable | Form W-2 Wage and Tax Statement | Mandatory | Web filing/ CD submission We recommend Web Filing |

Who Needs to File W-2 Forms in Kentucky?

Employers in Kentucky must file W-2 forms for the 2024 tax year. This includes reporting employee wages and the corresponding state income tax withholdings. Whether you manage a small business or a large company, it's essential to comply with Kentucky's filing obligations.

What Must Be Filed?

- Form W-2: Wage and Tax Statement for each employee

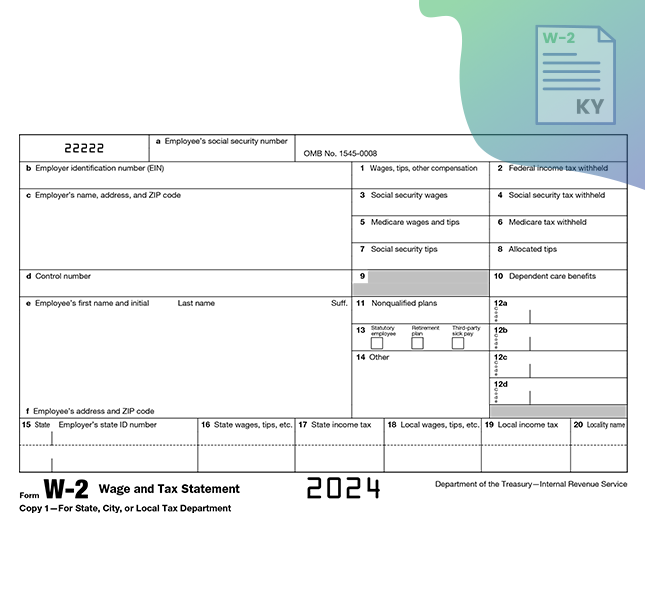

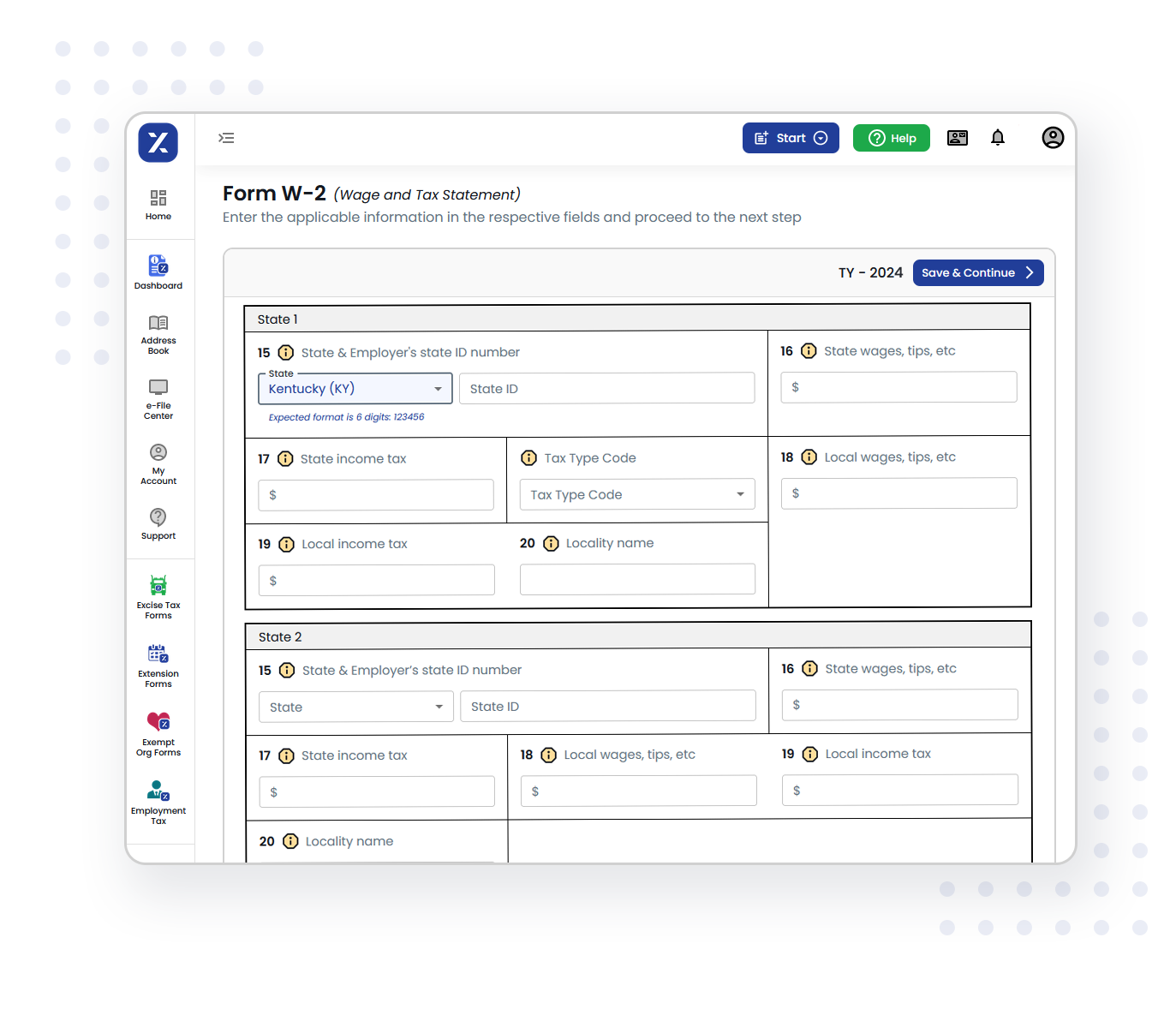

Important W-2 Form Fields for Kentucky Filings

Ensure the following key fields on the W-2 form are correctly filled:

Employer’s state ID number

Enter the state and employer's state ID number in Box 15. This is required if Kentucky income tax is withheld from the employee’s wages.

State wages, tips, etc.

Enter the total wages, tips, or other compensation in Box 16. This amount should reflect what is subject to Kentucky income tax.

State income tax

Enter the Kentucky state income tax amount from the employee's wages in Box 17.

TaxZerone simplifies and streamlines the process of filing Kentucky W-2 forms, making it efficient for you to complete state filings in just a few easy steps for your business.

File Kentucky W-2 FormFiling Methods for W-2 Forms in Kentucky

Electronic Filing

In Kentucky, Employers you must file W-2 forms electronically if submitting 26 or more. Make it simple by using TaxZerone for your filing needs!

Enter or upload your employees’ data, review everything, and hit submit. After transmission, we’ll manage the details.

CD submission

Employers in Kentucky have the option to file W-2 forms on CD when submitting at most 26 forms. Prepare your W-2 data, burn it onto a CD, and include the Transmitter Report Form 42A806.

Mailing Address:

Kentucky Department of Revenue

CD Processing

501 High Street, Station 57,

Frankfort, KY 40601

Recommendation: While CD filing is an option, using TaxZerone's web-based e-filing solutions ensures improved accuracy, efficiency, and faster processing.

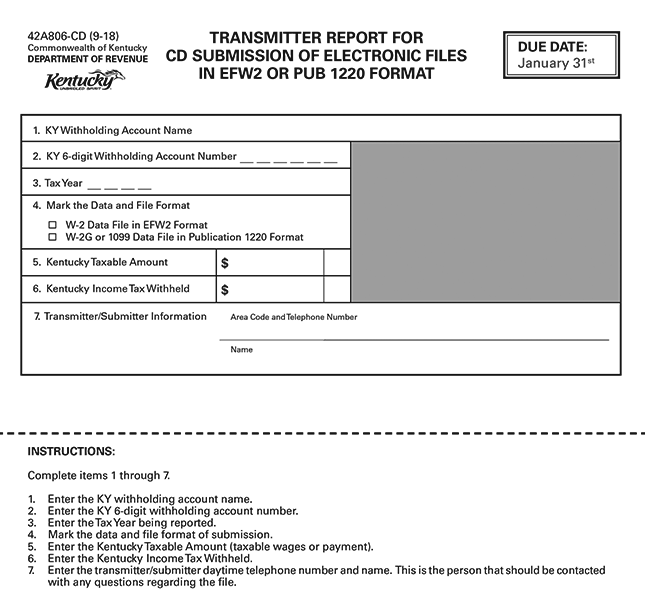

Kentucky Form 42A806: W-2 Transmitter Form

Employers in Kentucky who file Form W-2 on CD submission must submit Form 42A806 along with the W-2 forms. This form serves as a Transmitter Report for W-2 Forms and must be included with each W-2 submission to the Kentucky Department of Revenue, which should be sent to the following address:

CD Mailing Address::

Kentucky Department of Revenue

CD Processing

501 High Street, Sta. 57,

Frankfort, KY 40601

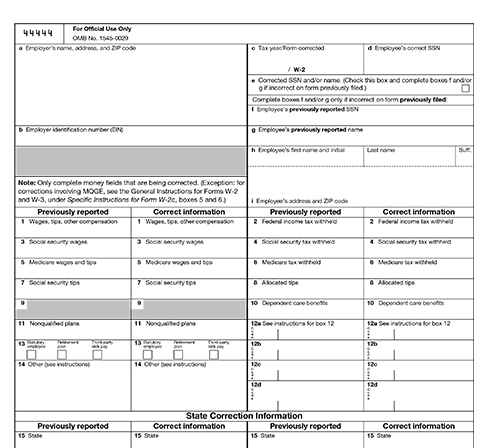

W-2c Corrections for Kentucky State Filings

To correct errors on W-2 forms previously submitted in Kentucky, employers must file Form W-2C. Corrections can only be made via paper submissions, as electronic filing of W-2C forms is not permitted. Complete the W-2C form accurately and submit it to the Kentucky Division of Revenue.

Paper Mailing Address:

Kentucky Department of Revenue,

Paper Processing P. O. Box 856950,

Louisville, KY 40285-6950.

Filing Deadline for Kentucky W-2 Forms

- Form W-2 (Wage and Tax Statement)

Why Choose TaxZerone for Kentucky W-2 Filing?

When it comes to e-filing W-2 forms, TaxZerone stands out as your go-to solution. Our platform is designed to make the filing process easy, accurate, and timely. Experience the following benefits:

Quick & Easy

Complete your W-2 filings in just three simple steps, taking less than five minutes!

Affordable Pricing

Each form costs only $0.99 for w2 state filings with absolutely no hidden fees.

Bulk Upload Feature

Save valuable time by uploading multiple forms in one go.

Dedicated Support Team

Have questions? Our expert team is available to help you navigate any filing challenges.

Ready to simplify your Kentucky W-2 filing process?

Sign up with TaxZerone today and file Kentucky state W-2 forms for just $0.99 each!

Frequently Asked Questions

1. Does Kentucky require W-2 filing?

2. What is the deadline for filing W-2 forms in Kentucky?

3. What are the state filing options for Form W-2 in Kentucky?

4. Can I file W-2 forms on paper in Kentucky?

5. Can I correct errors on W-2 forms for Kentucky state filings via TaxZerone?

No, you cannot correct W-2 form errors for Kentucky state filings via TaxZerone. Kentucky requires W-2C corrections to be submitted by paper, as electronic filing of W-2C forms is not permitted. You must complete and mail the W-2C form to the following address:

Paper Mailing Address:

Kentucky Department of Revenue

Paper Processing

P.O. Box 856950

Louisville, KY 40285-6950