Meet the 2024 W-2 Filing

Requirements for the District of Columbia.

Learn about the W-2 filing deadlines and rules in the District of Columbia for 2024. E-File your forms with ease — accurate and on time.

As low as $0.99 per W-2 state filing form

Key D.C. W-2 Form Information for Employers

| State Tax | Form | Filing Requirement | Filing Method |

|---|---|---|---|

| Yes, Wage and Tax Statement | Form W-2 Wage and Tax Statement | Yes, All withheld taxes should be filed through the W-2 Form | Electronic/Paper We recommend electronic filing. |

Who Needs to File W-2 Forms in the District of Columbia?

Any employer withholding D.C. state income tax must file W-2 forms for the 2024 tax year. Whether you're managing a small team or a larger group of employees, meeting these filing requirements is essential.

What Must Be Filed?

- Form W-2: Wage and Tax Statement for each employee

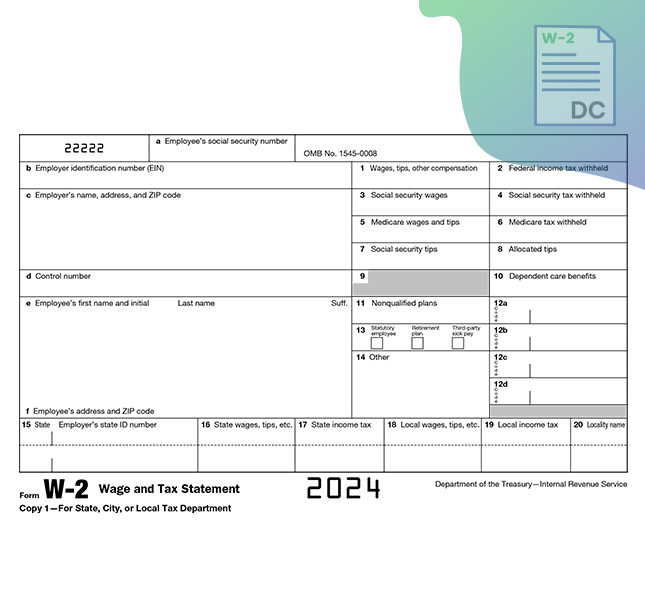

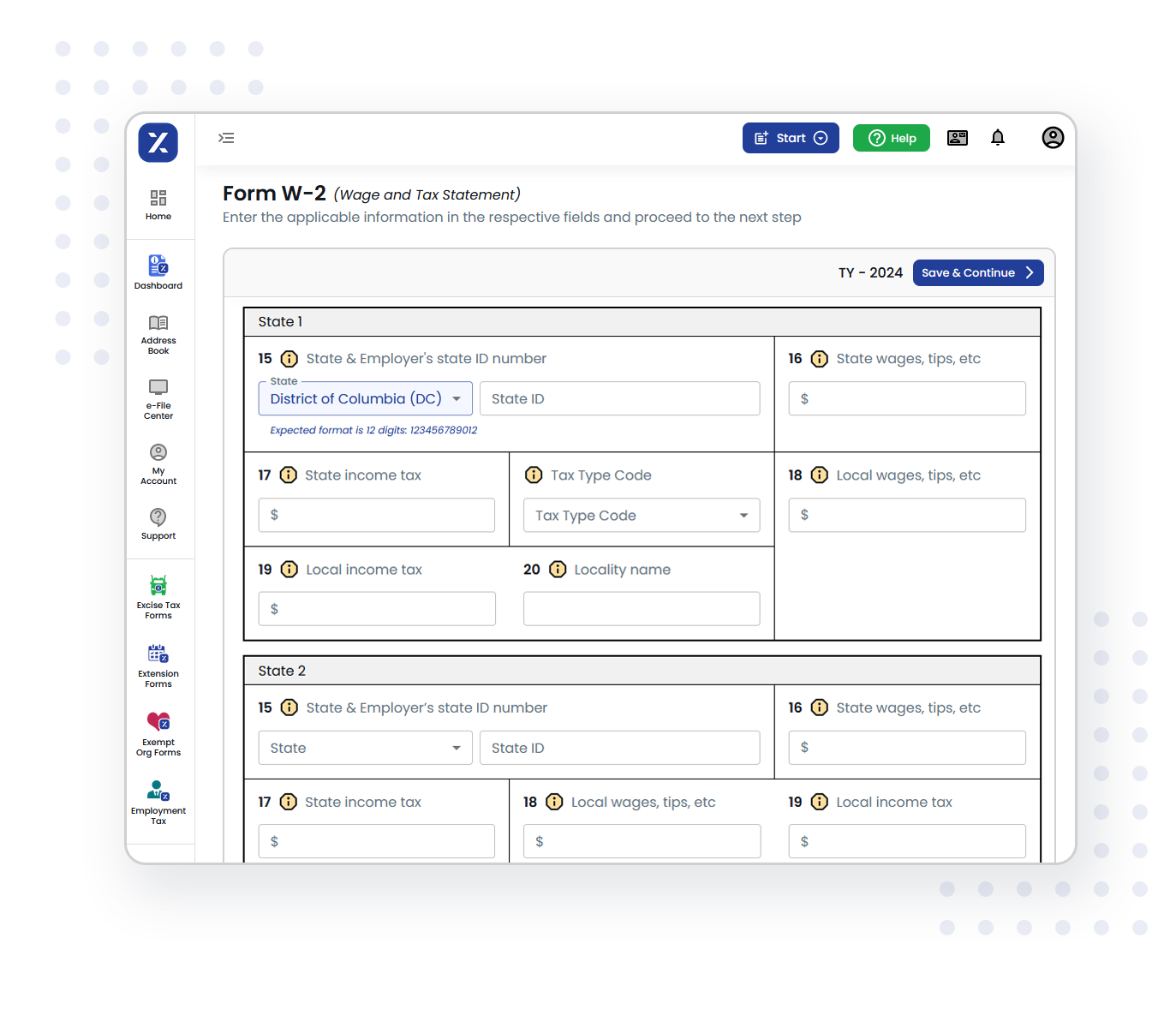

Important W-2 Form Fields for D.C. state Filings

Ensure the following key fields on the W-2 form are correctly filled:

Employer’s state ID number

Enter the state and employer's state ID number in Box 15. This is required if D.C. income tax is withheld from the employee’s wages.

State wages, tips, etc.

Enter the total wages, tips, or other compensation in

Box 16. This amount should reflect what is subject to D.C. income tax.State income tax

Enter the amount of D.C. state income tax withheld from the employee’s wages in Box 17.

TaxZerone makes state filing of W-2 forms for the District of Columbia straightforward and efficient,

allowing you to complete it in just a few simple steps.

Filing Methods for W-2 Forms in the District of Columbia

Electronic Filing

In the District of Columbia, Employers you must file W-2 forms electronically if submitting 25 or more. Make it simple by using TaxZerone for your filing needs!

Enter or upload your employee's data, review everything, and hit submit. After transmission, we’ll manage the details.

Paper Filing

Employers in the District of Columbia who are filing 24 or fewer W-2 forms have the option to submit them using the paper filing method to the Office of Tax and Revenue.

Mailing Address:

Office of Tax and Revenue,

1101 4th St., SW, FL4,

Washington, DC 20024

Recommendation: Even though paper filing is an option, E-filing through TaxZerone is encouraged for its accuracy, efficiency, and speedy processing.

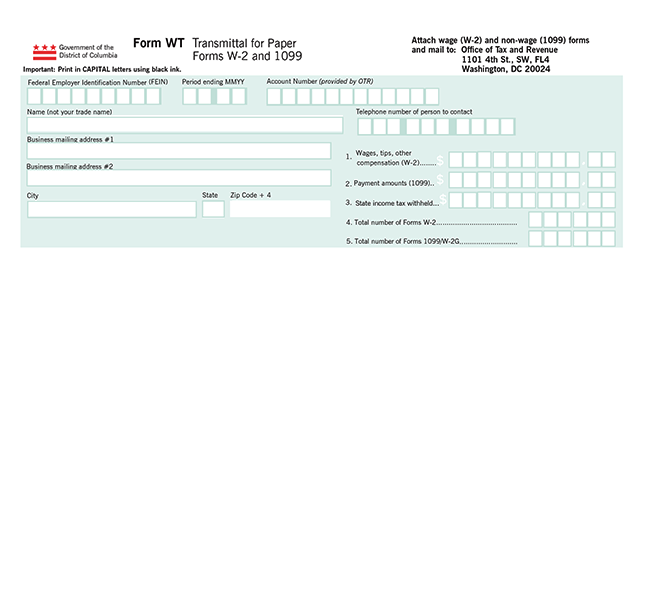

E-File Form W-2 Now!District of Columbia Form WT: W-2 Transmittal

Employers in the District of Columbia who file Form W-2 on paper must submit Transmittal Form WT along with the W-2 forms to the Office of Tax and Revenue for accurate reporting of wages and tax withholding. The forms should be sent to the following address:

Mailing Address:

Office of Tax and Revenue,

1101 4th St., SW, FL4,

Washington, DC 20024

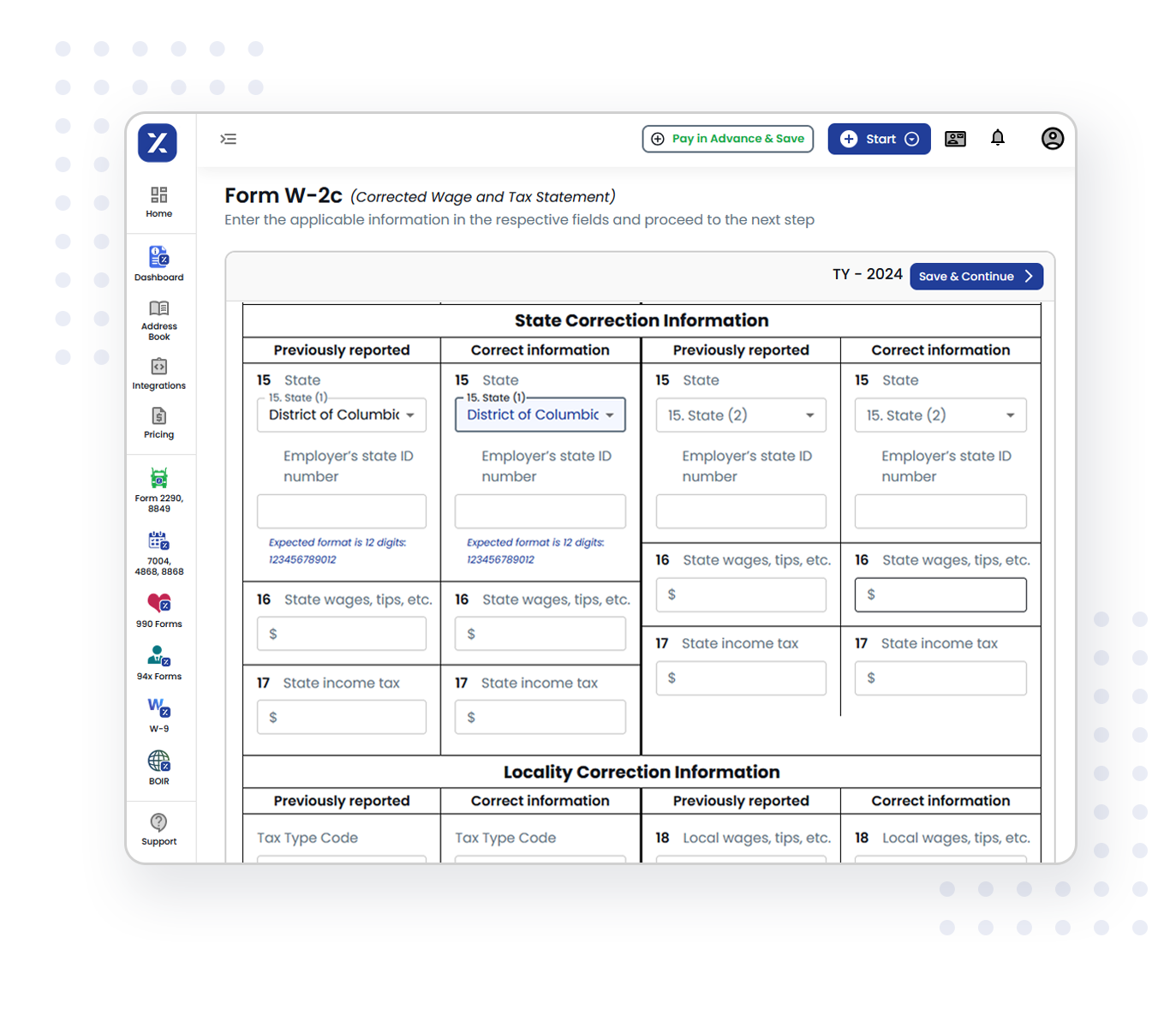

W-2c Corrections for D.C. State Filings

To correct errors on previously submitted W-2 forms in Washington, D.C., file Form W-2c. This form allows employers to amend mistakes in previously reported wages, taxes, or employee information. Filing a W-2c ensures accuracy in records and compliance with D.C. reporting requirements.

With TaxZerone, you can easily file Form W-2c to correct any errors on your W-2 forms.

Our online platform simplifies the process, ensuring your corrections are submitted accurately and on time.

State Filing Deadline for District of Columbia W-2 Forms

- Form W-2 (Wage and Tax Statement)

Why Choose TaxZerone for D.C. W-2 State Filing?

When it comes to e-filing W-2 forms, TaxZerone stands out as your go-to solution. Our platform is designed to make the filing process easy, accurate, and timely. Experience the following benefits:

Quick & Easy

Complete your W-2 filings in just three simple steps, taking less than five minutes!

Affordable Pricing

Each form costs only $0.99 for w2 state filings with absolutely no hidden fees.

Bulk Upload Feature

Save valuable time by uploading multiple forms in one go.

Dedicated Support Team

Have questions? Our expert team is available to help you navigate any filing challenges.

Ready to simplify your D.C. state W-2 filing process?

Sign up with TaxZerone today and file District of Columbia state W-2 forms for just $0.99 each!

Frequently Asked Questions

1. Does D.C. require W-2 filing?

2. Is a Reconciliation Form required when filing Form W-2 in D.C.?

3. What is the deadline for filing W-2 forms in the District of Columbia?

4. Can I file W-2s and W-2cs using CDs or other media with the DC OTR?

5. What forms are required when filing W-2s in the District of Columbia?

6. When should I submit a W-2c correction file?

Cookie Consent

This website uses cookies to personalize your experience. By clicking 'I Understand' or continuing to use our site, you agree to our cookie policy.