Meet Alabama's 2024 W-2 Filing Requirements

Learn about Alabama's W-2 filing rules and deadlines, and easily e-file your W-2 forms quickly and accurately.

As low as $0.99 per W-2 state filing form

Key Alabama W-2 Form Information

| State Tax | Form | Filing Requirement | Filing Method |

|---|---|---|---|

| Yes, Wages are taxable | Form W-2 Wage and Tax Statement | Mandatory | Electronic |

| Form A-3 Annual reconciliation of W-2 forms | Mandatory | Electronic |

Who Needs to File W-2 Forms in Alabama?

Any employer that withholds Alabama state income tax is required to file W-2 Forms for the 2024 tax year. Whether you're managing a small team or a larger group of employees, it's essential to meet these filing requirements.

What Must Be Filed?

- Form W-2: Wage and Tax Statement for each employee.

- Form A-3: Annual reconciliation of W-2 forms

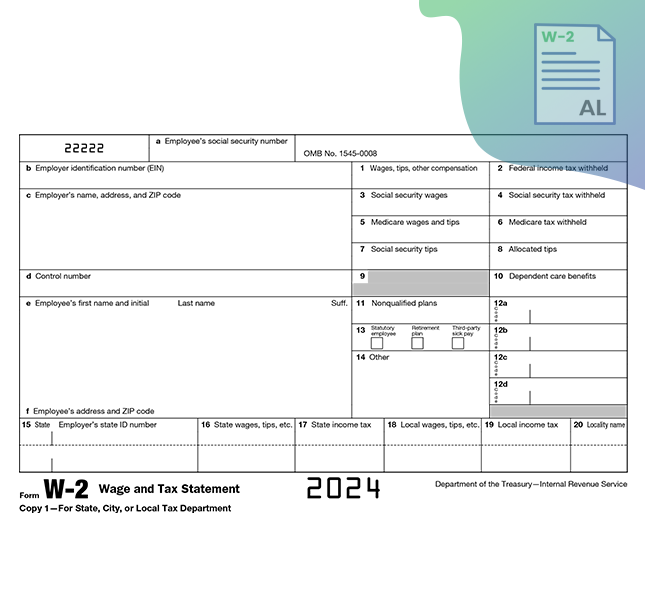

Important W-2 Form Fields for Alabama Filings

Ensure the following key fields on the W-2 form are correctly filled:

Employer’s state ID number

Enter the state and employer's state ID number in Box 15. This is required if Alabama state income tax is being withheld from the employee’s wages.

State wages, tips, etc.

Enter the total wages, tips, or other compensation in Box 16. This amount should reflect what is subject to Alabama state income tax.

State income tax

Enter the Alabama state income tax amount withheld from the employee’s wages in Box 17.

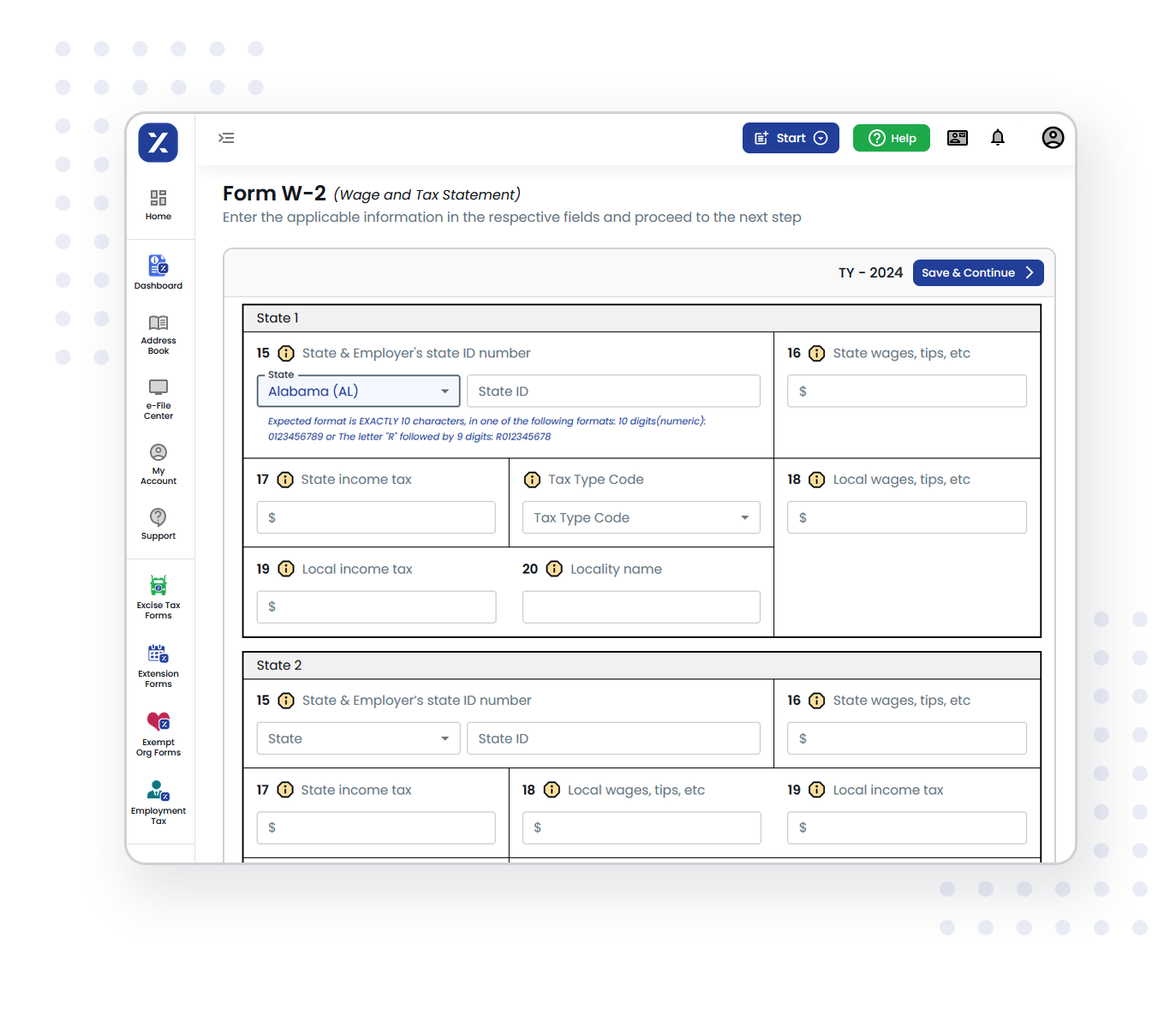

TaxZerone makes filing Alabama W-2 forms simple and efficient, allowing you to complete it in just a few easy steps.

File Alabama W-2 FormFiling Methods for Alabama W-2 Forms

Electronic Filing

Employers in Alabama must e-file W-2 Forms if they are submitting 25 or more. TaxZerone makes this process easy!

Enter or upload your employees' information, review it, and hit submit. We'll take care of the rest once it's transmitted.

Employers can trust TaxZerone to be the best choice for filing information returns, ensuring accuracy, efficiency, and compliance.

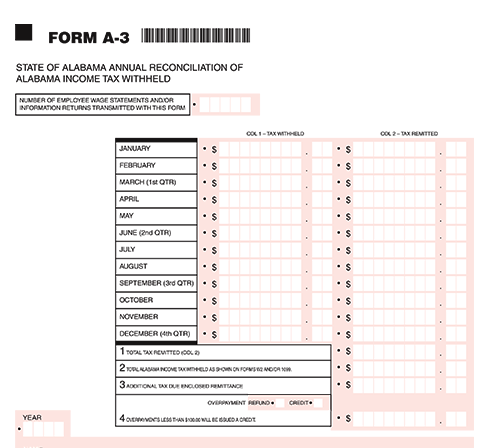

Alabama Form A-3:

W-2 Reconciliation

- Employers in Alabama must submit Form A-3 along with their W-2 forms. This annual reconciliation form is crucial for reconciling total tax withholdings reported on W-2s with the payments made to the Alabama Department of Revenue.

- It also allows employers to claim refunds for overpayments or make payments for any underpayment of taxes during the year.

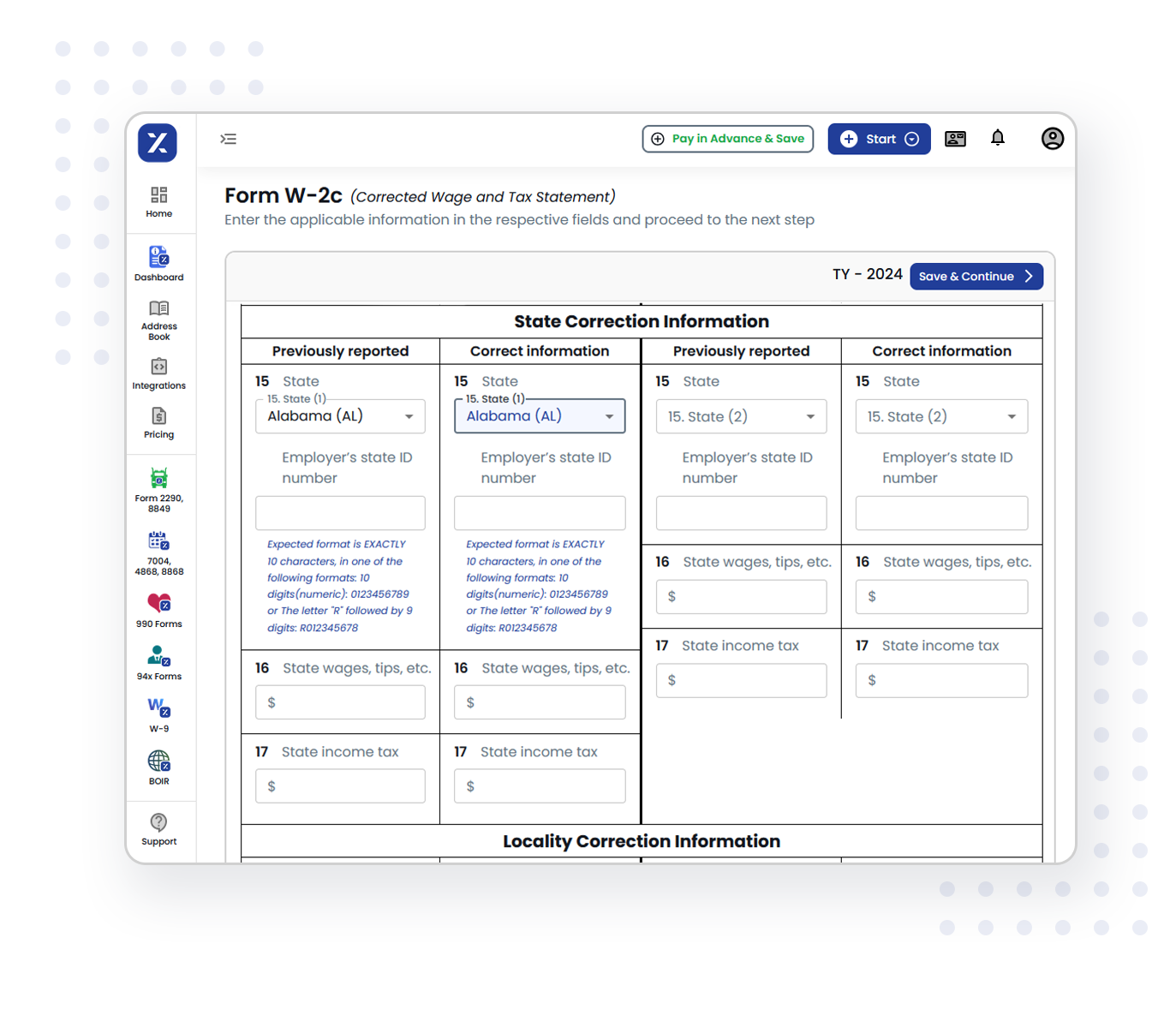

W-2c Corrections for Alabama filings

To correct errors on previously submitted W-2 forms in Alabama, file Form W-2c to update employee wage and tax information. Make sure the original W-2 has been processed and is in Complete Status before submitting the W-2c. The W-2c is crucial for maintaining accurate records and ensuring compliance with the Alabama Department of Revenue.

State filing Deadline for Alabama W-2 Forms

- Form W-2 (Wage and Tax Statement)

- Form A-3 (Reconciliation Form)

Why Choose TaxZerone for Alabama W-2 Filing?

When it comes to e-filing W-2 forms, TaxZerone stands out as your go-to solution. Our platform is designed to make the filing process easy, accurate, and timely. Experience the following benefits:

Quick & Easy

Complete your W-2 filings in just three simple steps, taking less than five minutes!

Affordable Pricing

Each form costs only $0.99 for w2 state filings with absolutely no hidden fees.

Bulk Upload Feature

Save valuable time by uploading multiple forms in one go.

Dedicated Support Team

Have questions? Our expert team is available to help you navigate any filing challenges.

Ready to make your Alabama state W-2 filing hassle-free?

E-file your W-2s with TaxZerone, and we’ll handle the A-3 reconciliation. Get started today for just $0.99 per W-2 form .

Frequently Asked Questions

1. Does Alabama require W-2 filing?

2. What is the deadline for filing Form W-2 in Alabama?

3. Does Alabama have any additional requirements when filing W-2 forms

4. What is the purpose of Form A-3?

The Alabama W-2 Reconciliation Form A-3 matches the total tax withholdings on W-2 forms with the actual payments submitted to the Alabama Department of Revenue. It allows taxpayers to request refunds for overpayments and correct any underpayments.