Simplify Excise Tax Compliance: Manage Heavy Highway Vehicle Taxes

Simplify your excise tax filing process with TaxZerone and stay compliant. E-file and manage excise tax forms 2290, 8849, and 2290 Amendments on the move anytime, anywhere.

File Excise Tax Forms with the IRS using TaxZerone

Choose TaxZerone for simple, quick, and secure e-file.

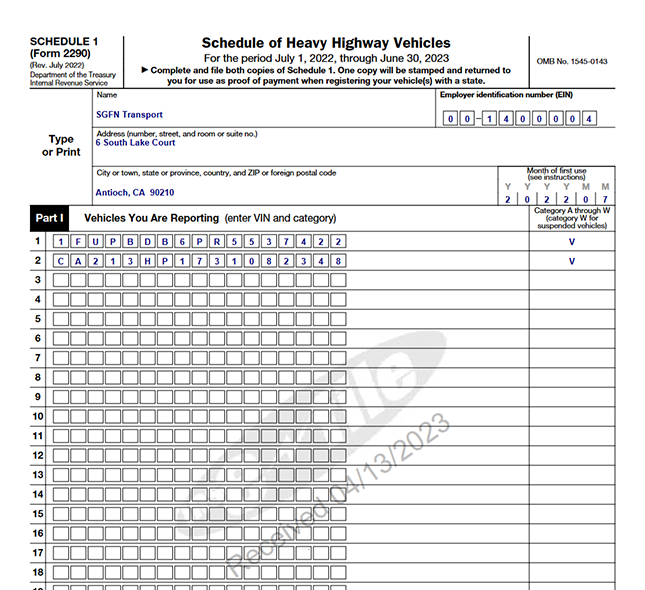

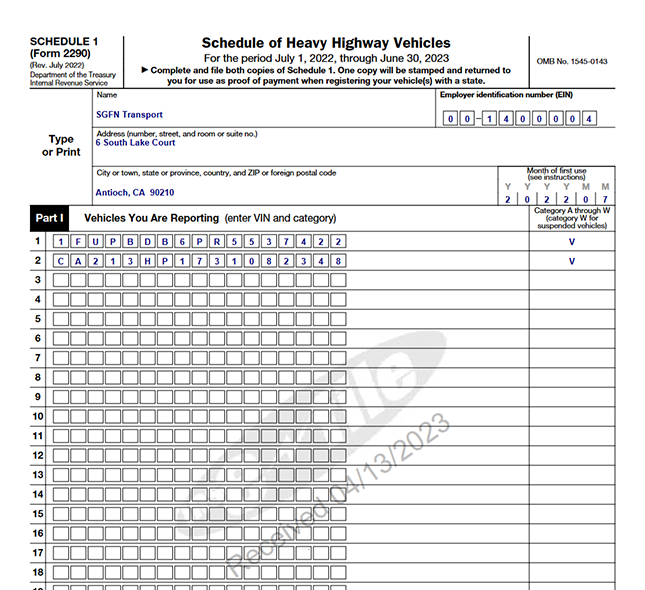

Form 2290

Heavy Highway Vehicle Use Tax Return File and pay the HVUT tax for your heavy vehicle and get IRS-stamped Schedule 1 in minutes.

$19.99

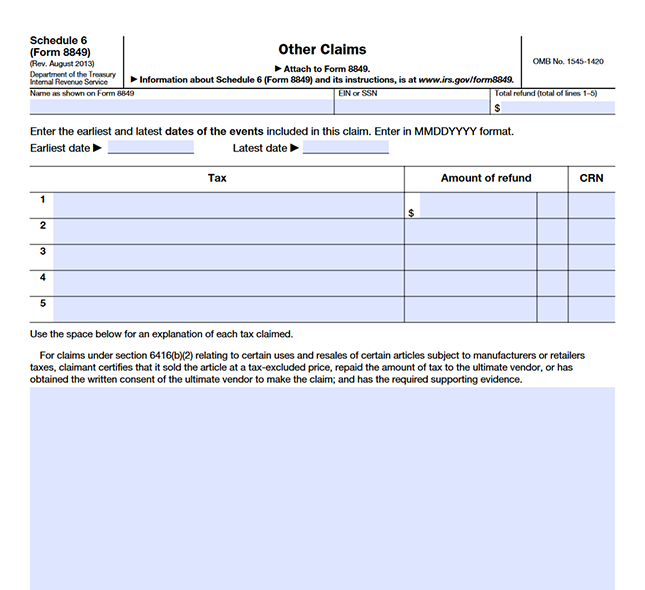

Form 8849 - Schedule 6

Use Schedule 6 to claim a refund or credit for Federal excise taxes you paid on form 2290.

$29.99

Form 2290 VIN Correction

VIN correction File a correction with the IRS if you have mistakenly reported your VIN in Form 2290 and get the updated Schedule 1 copy.

Form 2290 Amendment

Exceeded mileage limit File a Form 2290 correction with the IRS if your vehicle has exceeded the mileage limit, and get the updated Schedule 1 copy.

$24.99

Form 2290 Amendment

Taxable gross weight increased File a Form 2290 correction with the IRS if your vehicle's taxable gross weight has increased, and get the updated Schedule 1 copy.

$24.99

Get your stamped Schedule 1 in 3 simple steps

Whether you file Form 2290 or a VIN correction, all it takes is 3 simple steps.

To file Form 2290,

Enter Form Information

Review and pay the tax due

Transmit & get Schedule 1

To file a VIN correction,

Enter form information

Preview the return

Transmit & get updated Schedule 1

Ready to file form 2290?

Choose TaxZerone for Excise Form Filing

Here are the best benefits truckers get by filing excise tax forms with TaxZerone

Easy e-filing

File your excise tax returns easily and hassle-free. With our user-friendly interface, you can quickly enter your tax details and submit your return within minutes.

Guided filing

Follow our step-by-step instructions and complete your return accurately. Reduce the chances of rejection and ensure that your tax return is filed the first time correctly.

Smart validations

Get your returns validated for errors and discrepancies and correct any errors before transmitting them. No more rejections for basic items, as we'll get that sorted for you.

Quick and secure e-filing

File excise forms online with TaxZerone in just 5 minutes and transmit them to the IRS securely. It's that simple.

Instant Schedule 1

Get Schedule 1 as soon as you complete the filing process. No more waiting for the paper Schedule 1 to arrive in the mail.

Free retransmission of rejected returns

Even if the IRS rejects your return due to any reason, you can correct and retransmit it to the IRS for free. No additional charges.