E-File Form 945 to IRS for the Tax Year 2024

File your annual return for non-payroll income tax withholding effortlessly. Stay compliant with the IRS by meeting the filing deadline and avoiding penalties.

E-file Form 945 for your nonemployment payments effortlessly with TaxZerone.

Stay IRS-compliant while enjoying an affordable and user-friendly e-filing experience tailored for your business!

$6.99

No hassle. No hidden charges

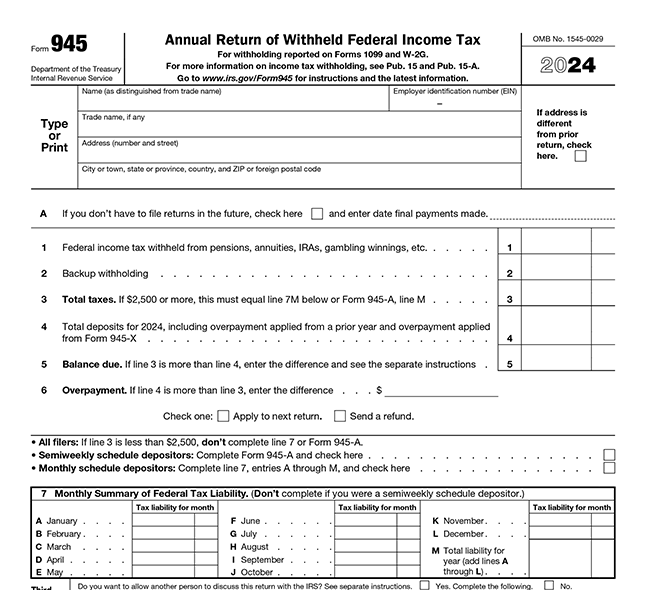

What is Form 945?

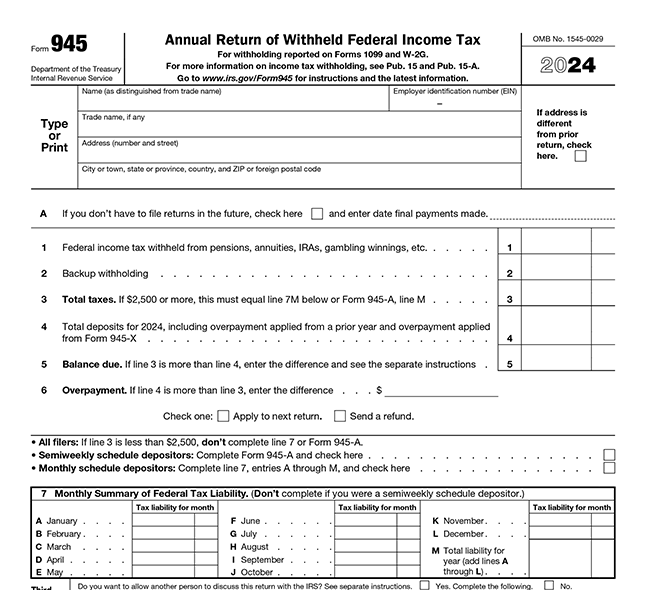

Form 945 is an annual tax form used to report federal income tax withheld from nonpayroll payments. Nonpayroll payments include pensions, IRA distributions, military retirement pay, gambling winnings, Indian gaming profits, and government payments subject to voluntary withholding. It also applies to backup withholding and specific distributions made by Alaska Native Corporations.

Why file form 945?

Report Nonpayroll Taxes

Form 945 is essential for reporting federal income tax withheld from nonpayroll payments for the 2024 tax year.

Ensure Tax Compliance

Timely filing of Form 945 ensures compliance with IRS regulations. With TaxZerone, e-filing is quick, accurate, and hassle-free.

Avoid Penalties

Submitting Form 945 on time helps you avoid penalties and maintain a strong compliance record with the IRS.

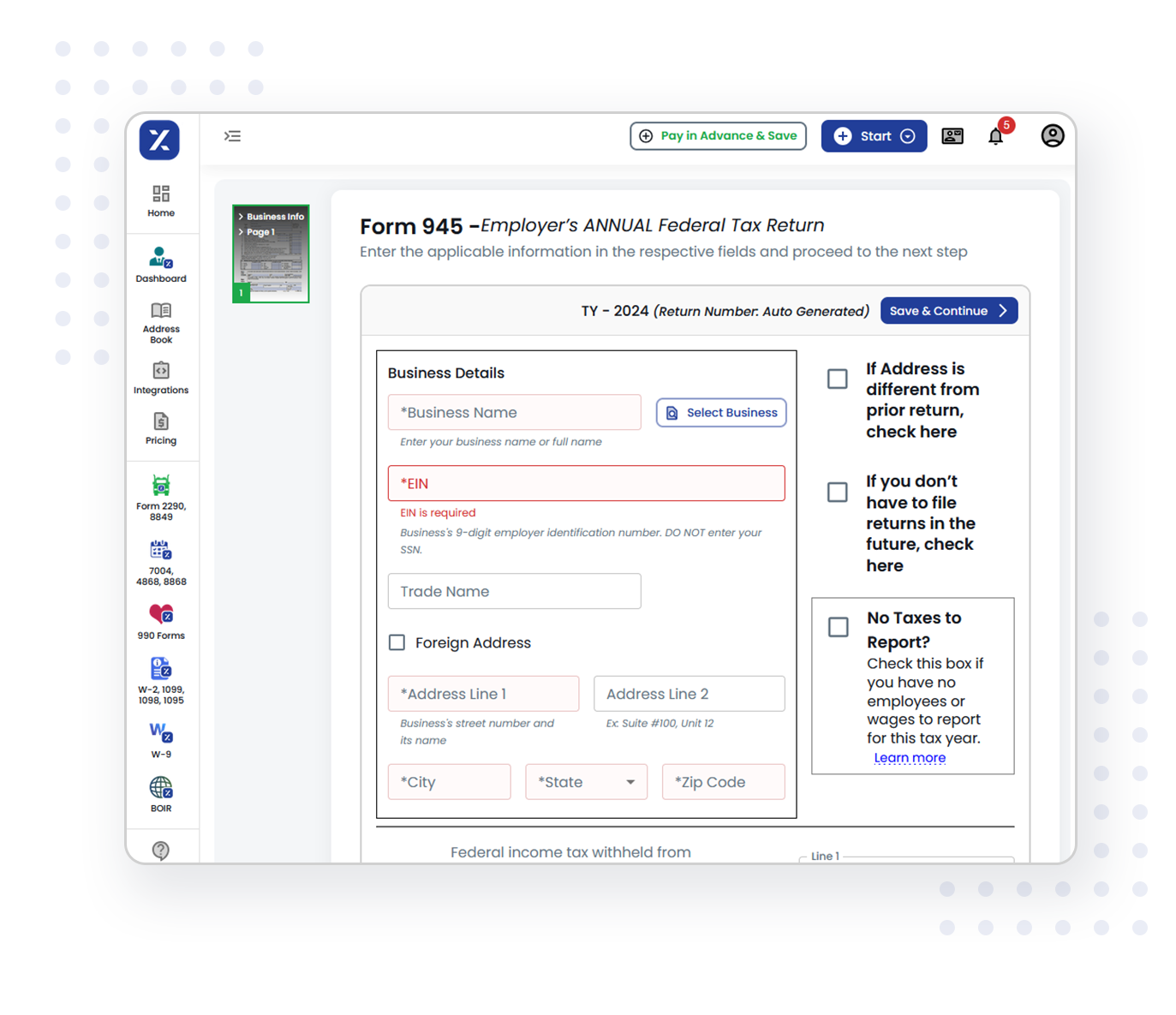

File your Form 945 in just three easy steps

Follow the below three steps to file your form 945

Enter Your Details

Enter accurate information such as your Employer Identification Number (EIN), name, address, and federal taxes withheld for the tax year.

Review and Correct

Thoroughly review your form using our intuitive preview feature. Correct any errors to ensure it meets IRS standards before submission.

File the Form

E-file securely through our platform. With an affordable, IRS-compliant solution, TaxZerone makes tax filing simple and stress-free.

Why Choose TaxZerone for IRS Form 945 E-Filing?

TaxZerone makes filing your Form 945 simple, secure, and efficient with these key features:

IRS-Authorized and Secure

As an IRS-authorized e-filing provider, TaxZerone ensures your filing meets all regulations while maintaining top-notch data security standards for a safe experience.

Accurate & Reliable Filing

Our advanced validation system minimizes errors, ensuring your Form 945 is filed correctly and in full compliance with IRS requirements.

Step-by-Step Guidance

TaxZerone offers on-screen instructions for each field, making the filing process clear and easy to follow, even if you're filing for the first time.

Real-Time Notifications

Stay informed with instant updates throughout the process, including submission confirmations and IRS acceptance alerts.

Effortless E-Filing

Our user-friendly platform simplifies filing, allowing you to complete your Form 945 quickly and accurately without the stress.

Affordable Pricing

Transparent Pricing TaxZerone offers the most cost-effective payroll tax filing solution with no hidden fees, delivering exceptional value for your business.

Comprehensive Form Support

In addition to Form 945, TaxZerone supports other forms like 945-A and 8974, helping you seamlessly report tax liabilities and credits.

Robust Data Security

Your sensitive data is protected with advanced security protocols, giving you confidence in a safe filing experience from start to finish.

Dedicated Customer Support

Our knowledgeable customer support team is available to assist you at every step, ensuring a smooth and efficient filing process.

What details are required to submit Form 945?

- Business Details:

- - Employer Identification Number (EIN)

- - Name

- - Address

- Form 945 Information:

- - Federal income tax withheld from pensions, annuities, IRAs, gambling winnings

- - Backup withholding

- - Total taxes

- - Total deposits for 2024

- - Balance due

- - Overpayment

- - Monthly Summary of Federal Tax Liability.

Tax Year 2024: Form 945 filing deadline

Make sure to file Form 945 by the IRS deadline to avoid penalties and interest charges.

Timely filing ensures compliance, protecting you from unnecessary financial risks.

| Filing Condition | Deadline |

|---|---|

| General deadline to file Form 945 | January 31, 2025 |

| If deposits were made on time and in full for the year | February 10, 2025 |

Frequently Asked Questions

1. Who Should File Form 945?

2. What Should I Do If I Discover an Error After Filing Form 945?

3. Can I File Form 945 Electronically?

4. What are the Differences Between Form 945 and Form 941?

5. What are the Deadlines for Filing Form 945?

Cookie Consent

This website uses cookies to personalize your experience. By clicking 'I Understand' or continuing to use our site, you agree to our cookie policy.