E-File IRS Form 944 for the Tax Year 2024

Easily file your Employer’s Annual Federal Tax Return with our user-friendly platform. Designed for small businesses, our secure e-file solution ensures accuracy and compliance with IRS requirements.

File Form 944 for your business at an affordable cost.

TaxZerone ensures your business stays compliant with the IRS by offering an easy-to-use e-filing platform at a nominal price.

$6.99

No hassle. No hidden charges

What is Form 944?

Form 944 is for small business owners with a tax liability of less than $1,000 in a tax year. This annual form helps small business owners report the taxes withheld from employees during the year, including income tax, Social Security tax, Medicare tax, additional Medicare tax, and more.

Why file form 944?

Report Payroll Taxes

Form 944 is crucial for small businesses to report employment taxes for the 2024 tax year.

Ensure Tax Compliance

Filing Form 944 helps your business stay compliant with IRS tax regulations.

Avoid Penalties

Filing Form 944 on time is essential to prevent potential penalties and maintain good standing with the IRS.

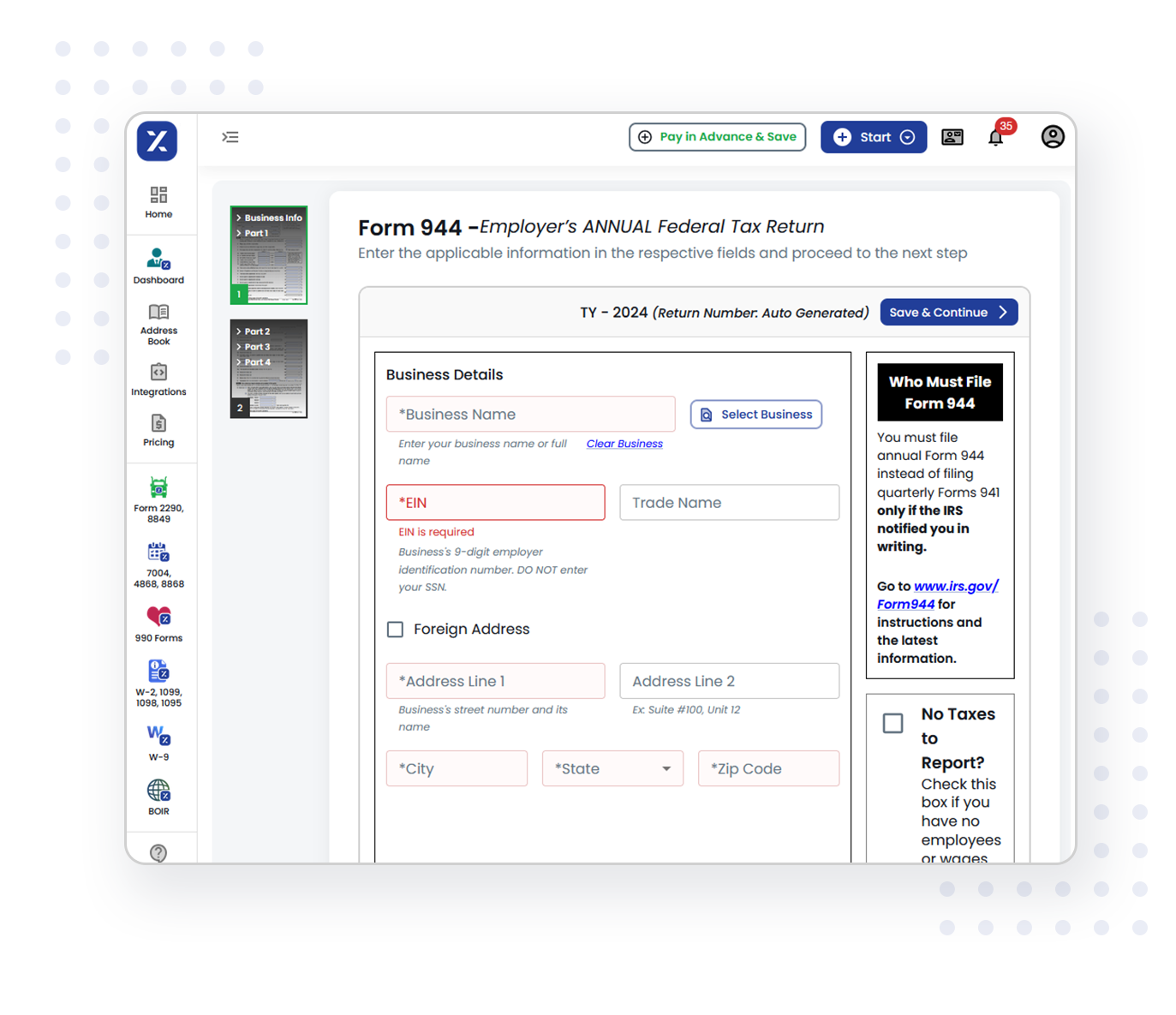

File your Form 944 in just three easy steps

Follow the below steps and file your Form 944 easily

Enter Your Details

Provide accurate information including your Employer Identification Number (EIN), employer details, total wages paid, and taxes withheld during the tax year.

Review and Correct

Carefully review your form before submission. Use our intuitive preview feature to identify and correct any errors to ensure compliance with IRS requirements.

File the Form

E-file your form securely through our platform. With our affordable and IRS-compliant solution, tax filing has become easier.

Choose TaxZerone for IRS Form 944 E-Filling

Features of TaxZerone make 944 Form Filing simple and secure

IRS-Authorized

TaxZerone is an IRS-authorized e-filing provider, ensuring your Form 944 filing complies with all tax regulations and data security standards for a safe and reliable experience.

Accurate Filing

With TaxZerone’s advanced validation system, errors are significantly reduced, guaranteeing accurate and compliant filing of your tax forms every time.

On-Screen Help

Confused about any fields or boxes? Our on-screen guidance explains each requirement step by step, making the filing process straightforward and stress-free.

Instant Notifications

Stay informed at every stage of the filing process. Receive real-time updates on submission status, including confirmations for successful submissions and IRS acceptance.

Easy E-Filing

Filing taxes is simpler than ever with TaxZerone. Our user-friendly interface allows you to complete your filing in minutes, saving time and reducing hassle.

Supports Form 945-A and Form 8974

TaxZerone supports additional forms like 945-A and 8974, helping you report tax liabilities and credits seamlessly. Enjoy comprehensive support for your tax needs.

Lowest Price

Get the most affordable payroll tax filing solution in the market. With no hidden fees or surprise charges, TaxZerone delivers exceptional value without compromising on quality.

Secure and Reliable

Your data is safeguarded with cutting-edge security measures, giving you confidence in a filing process that prioritizes privacy and reliability.

Dedicated Customer Support

Our support team is always ready to assist. Whether you have questions or face an issue, we’re here to make your Form 944 filing smooth and hassle-free.

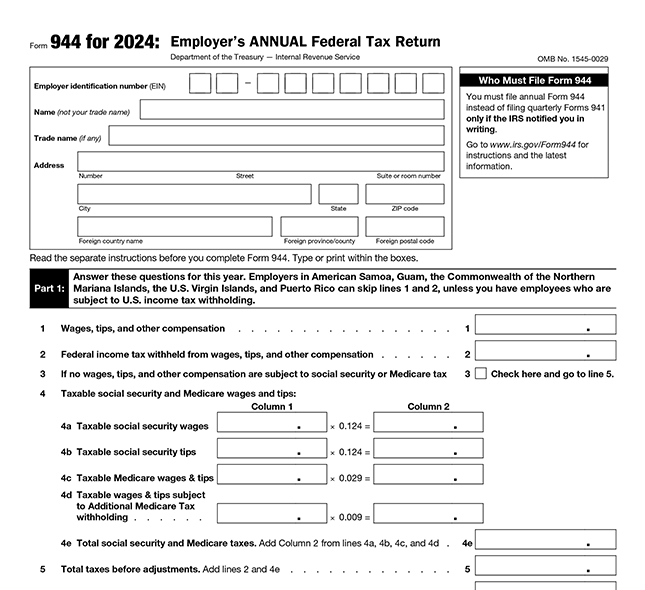

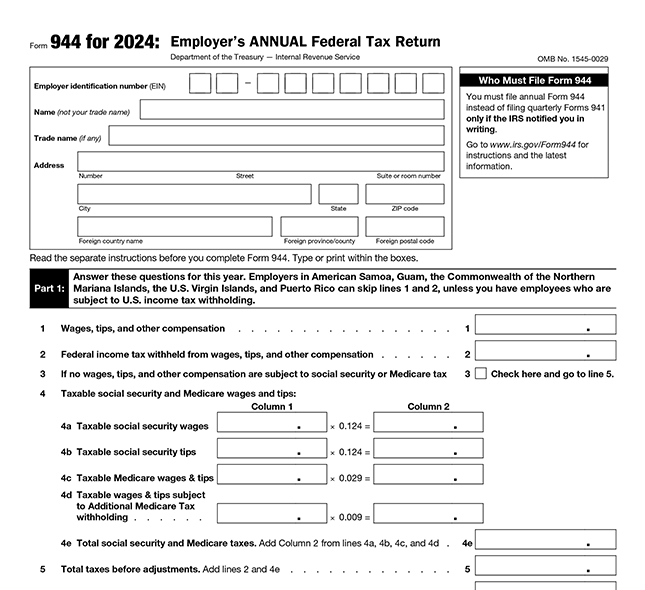

What details are required to submit Form 944?

- Business Details:

- - Legal Business Name

- - Employer Identification Number (EIN)

- - Business Address

- Form 944 Information:

- - Total wages paid to employees

- - Reported employee tips

- - Federal income tax withheld from employees

- - Employer and employee portions of Social Security and Medicare taxes

- - Additional Medicare Tax withheld (if applicable)

- - Adjustments to Social Security and Medicare taxes (e.g., fractions of cents, sick pay, tips, and group-term life insurance)

- - Qualified small business payroll tax credit for increasing research activities

Tax Year 2024: Form 944 filing deadline

Ensure that Form 944 is filed on or before the IRS deadline to avoid potential penalties and interest charges. Staying compliant helps protect your business from unnecessary financial burdens.

| Filing Condition | Deadline |

|---|---|

| General deadline to file Form 944 | January 31, 2025 |

| If deposits were made on time and in full for the year | February 10, 2025 |