E-File Your Form 943-X for the Tax Year 2025

Amend Your Agricultural Employer’s Annual Federal Tax Return Quickly and Accurately.

Ensure your agricultural employment tax returns are accurate and compliant with our easy-to-use platform.

File Form 943-X online with the IRS at the lowest price.

Get an affordable flat rate that ensures the best value without hidden fees. With us, what you see is what you get!

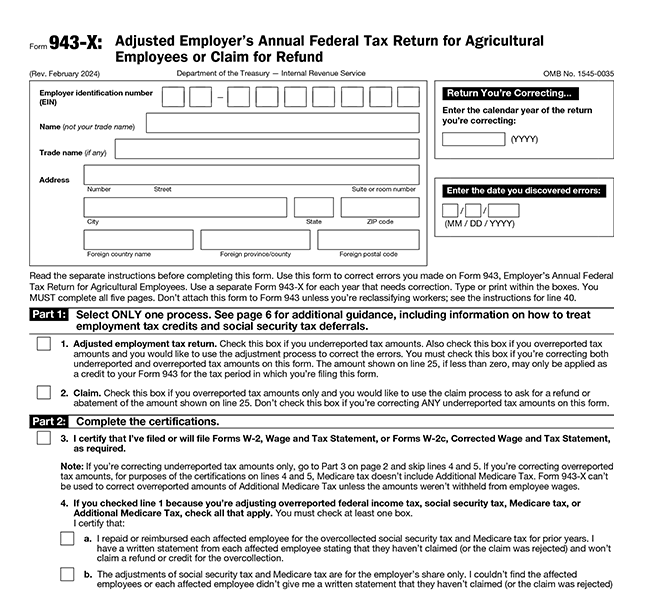

What is Form 943-X?

Form 943-X is a specialized IRS tax form called the Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refund. Employers use it to correct errors on previously filed returns, enabling them to make precise corrections to annual federal tax returns for agricultural workers, modify wage reporting, claim refunds, and resolve tax discrepancies specific to agricultural employment.

Why File Form 943-X?

Amend Errors

Correct the errors in the farm labor taxes recorded on the Form 943 you previously filed.

Claim Overpaid Taxes

Request a refund or credit for overpaid Social Security, Medicare, or withheld federal income taxes.

Avoid Penalties

Correcting errors on Form 943 before the IRS notices can help you avoid penalties and interest for incorrect or late filings.

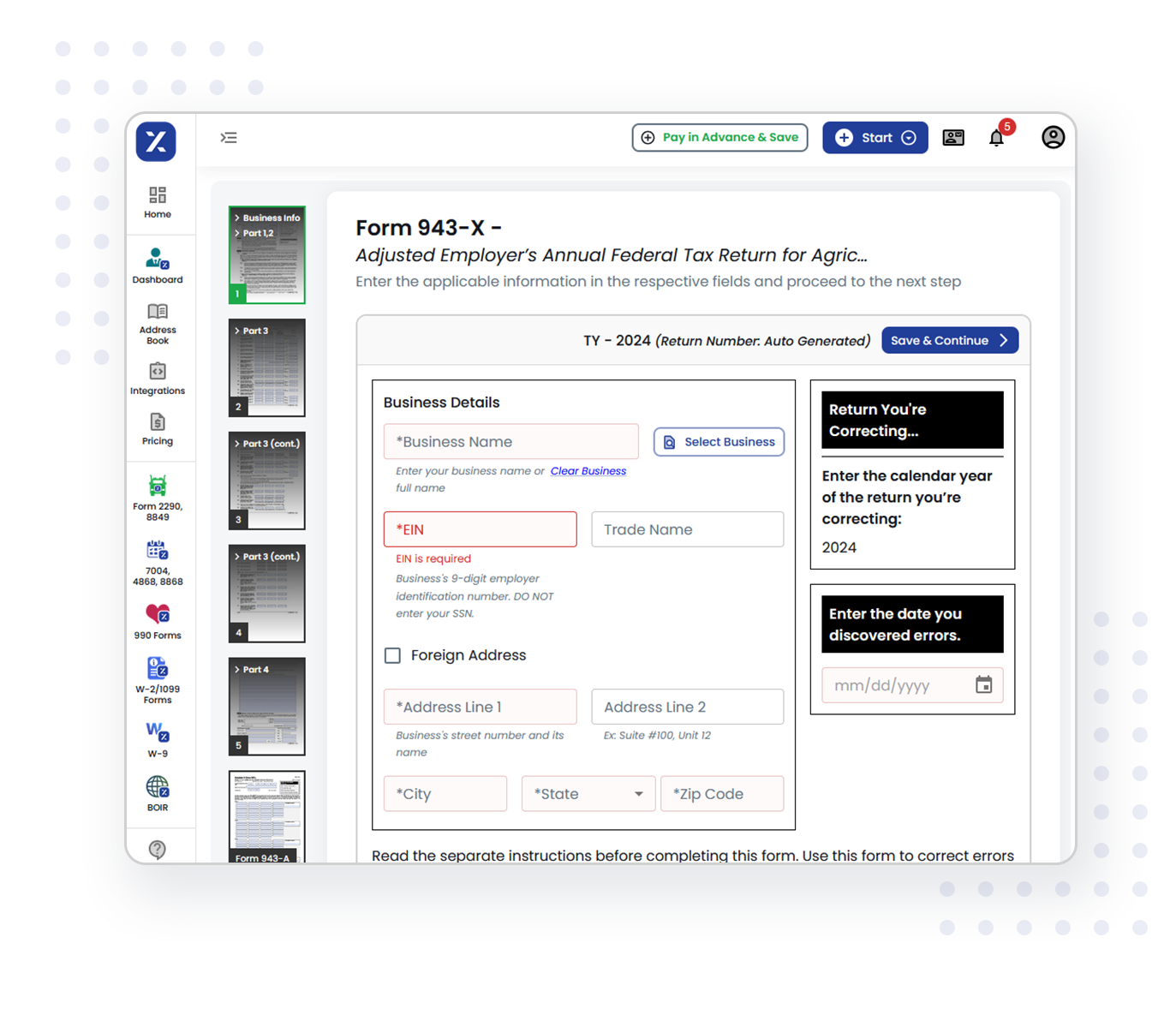

File Form 943-X Quickly in Just Three Steps

Follow these steps to quickly amend your IRS Form 943 errors and ensure compliance with the filing process.

Enter Required Information

Provide the details from your original Form 943 and any adjustments that need to be made.

Review and Verify

Check your entries and verify the corrections to ensure accuracy

Submit Your Form 943-X

File your Form 943-X with the IRS securely and efficiently through our platform.

Why TaxZerone is Your Best Choice for Form 943-X Filing

See how TaxZerone streamlines the filing of Form 943-X for your business.

IRS-Authorized Provider

As an IRS-authorized e-file provider, TaxZerone ensures that your corrections are processed professionally and accurately.

Error-Free Filing

Our comprehensive validation checks help reduce the risk of errors, ensuring precise filings every time.

Efficient Processing

Submit your corrections quickly and seamlessly with our streamlined processing system.

Secure and Trusted

Your data is protected with advanced security technologies, offering you peace of mind throughout the process.

Intuitive User Interface

Our platform is easy to navigate, providing step-by-step guidance through the entire correction process.

Real-Time Notifications

Get immediate updates on your filing status, with notifications for successful submissions and acceptance.

Ready to simplify your tax corrections?

E-file your Form 943-X with the IRS using TaxZerone and correct errors quickly.

Frequently Asked Questions

1. What is the purpose of Form 943-X?

2. When should I file Form 943-X?

3. Is there a deadline for filing Form 943-X?

4. Can I use Form 943-X to correct Form 941 or other forms?

5. Can I request a refund for overpaid taxes using Form 943-X?

6. What are the benefits of filing Form 943-X?

- Avoiding Penalties: By filing Form 943-X on time, you can prevent costly penalties, late fees, and the risk of an IRS audit due to misreported information.

- Refunds and Credits: If you overreported taxes, filing Form 943-X allows you to receive a refund or credit that can be applied to future tax filings.

- Accurate Employee Records: Filing the correction ensures your employee tax records remain accurate, supporting correct tax credits and deductions for your business.

- Simplified Future Filings: Correcting mistakes through Form 943-X improves the accuracy of future Form 943 filings, helping to avoid errors in upcoming tax years.