📢 Attention Aggregate Filers! E-file Form 941 Schedule R for Q1 of the 2025 tax year by April 30, 2025.

File Form 941 Schedule R

for the 2025 Tax Year

E-filing platform for Section 3504 agents, CPEOs, and other third parties to submit Form 941 Schedule R with aggregate information.

File Form 941 Schedule R with the IRS online at the best price!

At TaxZerone, we make it quick, easy, and affordable to ensure compliance with the latest tax requirements.

A specialized payroll tax filing solution created for aggregate filers.

CPEOs

Certified professional employer organizations filing for their clients.

Third-Party Payers

Non-certified PEOs or other payers are reporting payroll credits for clients.

IRS Agents

IRS-approved agents under section 3504 filing aggregate returns.

Aggregate filers trust TaxZerone to file IRS Form 941 Schedule R through our easy-to-use platform, ensuring accuracy and compliance.

E-file Form 941 Schedule R

Existing user

Sign in to access your tax filing dashboard and manage your filings easily on TaxZerone.

Sign in Here

New user

Create a FREE TaxZerone account and start filing your taxes online with ease and reliable support.

Sign Up for FREEStep-by-Step Guide to Filing Form 941 Schedule R

Learn how to file Form 941 Schedule R for 2025 online with TaxZerone in just a few clicks.

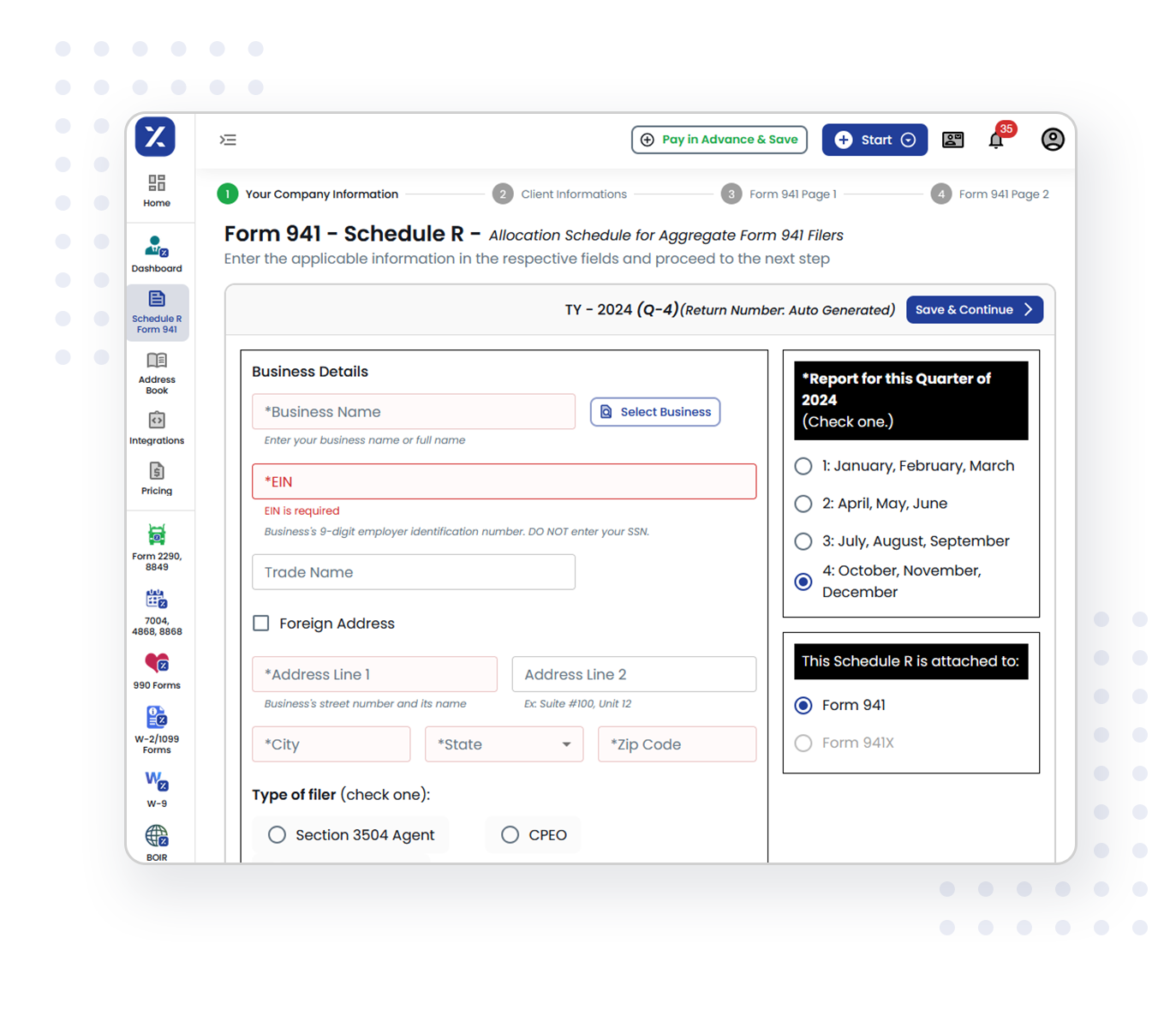

Enter the Information

Provide your business details, select your filer type, and enter the Form 941 amounts for your employees.

Add client information

You can either manually enter client details or upload them in bulk to save time.

Aggregate Form 941

You can reconcile the total tax for your employees and clients, then update the tax deposit information accordingly.

E-sign and review your return

Electronically sign the return, carefully review the form details, and confirm everything is accurate.

Transmit your return to the IRS

Submit your completed Form 941 Schedule R through TaxZerone’s secure e-filing system and get notified as soon as your return is accepted.

Start your Form 941 Schedule R filing today!

TaxZerone makes employment tax filing convenient for you and your clients.

Start Filing Now!Why choose TaxZerone for filing 941 Schedule R?

IRS-authorized

Your tax filings are securely managed and fully compliant. E-file your 941 Schedule R form confidently, knowing it will be processed by the IRS without any issues.

Bulk Client upload

Provided with intelligent validations that act as your virtual tax assistant. This feature not only helps you save time but also reduces the chances of errors, ensuring accurate and error-free submissions.

IRS Business Validation

Verify your form details with the IRS Business Validation feature to minimize errors, reduce rejections, and achieve first-time submission approval.

Auto Calculation

Eliminate the hassle of manual calculations with automatic calculations built into the system, ensuring your Form 941 Schedule R is accurate and in compliance with IRS guidelines.

Supports Schedule B

& Form 8974

File additional required schedules like Schedule B and Form 8974 without any hassle, ensuring comprehensive and complete Form 941 filings in one seamless process.

Lowest price

Take advantage of affordable pricing, making it the most cost-effective option for filing your Form 941 Schedule R, without compromising on quality or reliability.

Form 941 Schedule R Filing Deadlinesfor the 2025 Tax Year

First Quarter

JAN

FEB

MAR

April 30, 2025

Second Quarter

APR

MAY

JUN

July 31, 2025

Third Quarter

JUl

AUG

SEP

October 31, 2025

Fourth Quarter

OCT

NOV

DEC

January 31, 2026

Aggregate filers must submit Form 941 Schedule R before the deadlines for each quarter in 2025 for your clients.

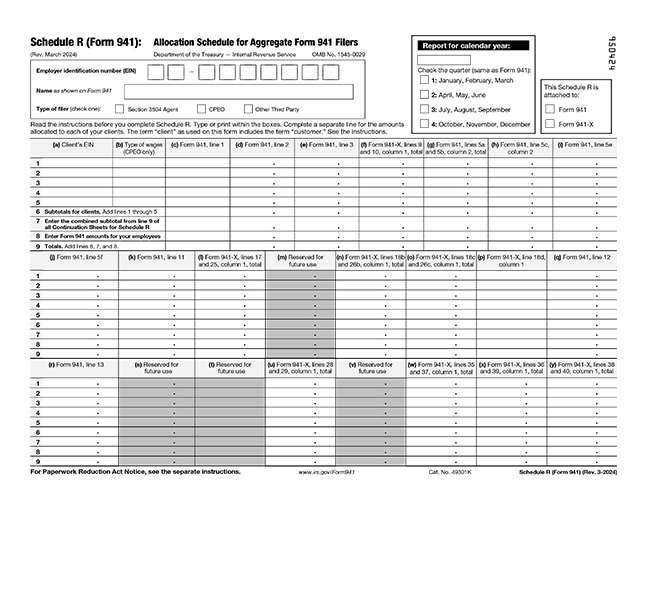

E-file Now!What details are required to submit Form 941 Schedule R online?

- Business Details:

- - Business Name, EIN, Address, and Type of Filer.

- Form 941 Information:

- - Employee Count

- - Wages

- - Fed Income tax withheld

- - Taxable Social Security & Medicare Wages

- - Pay Roll Tax Credit (Attach Form 8974)

- - Total Deposits

TaxZerone simplifies the filing process, ensuring accurate and timely submissions while keeping you compliant with IRS regulations.

File Form 941 Schedule RAggregate filers shared their feedback on TaxZerone

- Nagoh Williams

- Stacey E Foster

- Maria Crisp

Simplify Your Aggregate Form 941 Schedule R Filing

Trust TaxZerone for fast, secure, and accurate e-filing of your 941 Schedule R.

Frequently Asked Questions

1. What is the purpose of Schedule R for Form 941?

2. Who is required to file Schedule R with Form 941?

3. What is the deadline for filing Form 941 Schedule R?

- 1st Quarter (Jan-Mar): Due by April 30

- 2nd Quarter (Apr-Jun): Due by July 31

- 3rd Quarter (Jul-Sep): Due by October 31

- 4th Quarter (Oct-Dec): Due by January 31 of the following year