E-file IRS Form 941 for 2025

File your quarterly payroll tax returns accurately and efficiently with TaxZerone. File Form 941 online with automatic calculations.

File Form 941 online with the IRS at the lowest price.

An affordable flat price that ensures you get the most value without breaking the bank. No complex pricing structures and surprise charges—with us, what you see is what you get!

$6.99

Transparent pricing with no hidden fees

Complete Form 941 in 3 simple steps

Follow these steps to complete your quarterly payroll tax filing with confidence and accuracy.

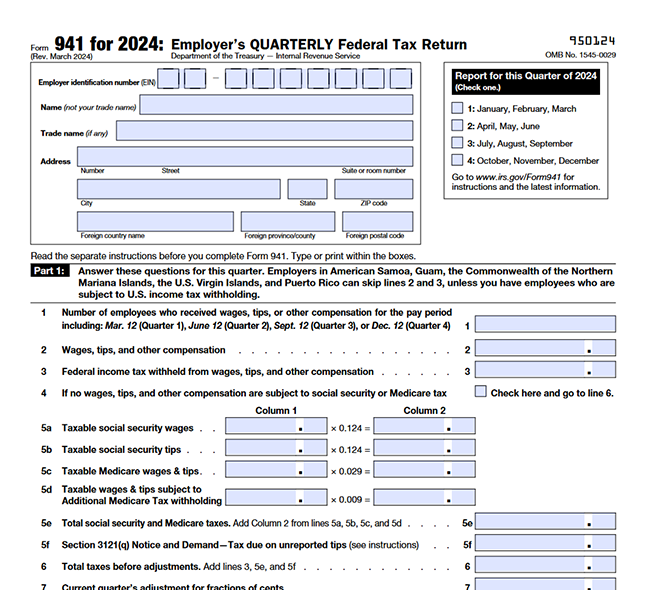

Enter your tax information

Fill out employer and employment information, tax liability information, federal income taxes, social security and Medicare taxes, and total deposits and payments made during the quarter.

Pay the balance due and sign the form

Choose the payment method for paying the balance due, e-sign the return, and review the form information to ensure it’s accurate.

Transmit the return to the IRS

Securely transmit your 941 form to the IRS and get notified as soon as your return is accepted.

Information Required to File 941 Online

- Employer Details:

- - Name, EIN, and Address

- Employment Details:

- - Employee Count

- - Employee Wages

- Taxes and Deposits:

- - Federal Income Taxes

- - Medicare and Social Security Taxes

- - Form 941 Worksheets

- - Deposit Made to the IRS

- - Tax Liability for the Quarter

- Signing Form 941:

- - Signing Authority Information

- - Online Signature PIN or Form 8453-EMP

Deadline to file Form 941 for 2025 Tax Year

This quarterly form is due on the last day of the month following the conclusion of the quarter.

If the 941 due date falls on a federal holiday, the filing deadline will be the next business day.

Why choose TaxZerone to e-file Form 941?

Check out how TaxZerone simplifies Form 941 filing for your business.

IRS-authorized

Your tax filings are processed securely and in compliance with all regulations. Confidently e-file your 941 form, knowing that it will be accepted and processed by the IRS without any issues.

Smart validations

Provided with intelligent validations that act as your virtual tax assistant. This feature not only helps you save time but also reduces the chances of errors, ensuring accurate and error-free submissions.

Instant notifications

Receive real-time notifications on the status of your filing, including confirmation of successful submissions and acceptance. Know exactly where your tax return stands at any given moment.

Lowest price

File quarterly payroll tax at the lowest price in the market, without any compromise on the quality of service. No hidden fees or unexpected charges. Get the most cost-effective solution for your payroll tax filing needs.

Supports Schedule B

& Form 8974

Supports Schedule B and Form 8974, allowing you to report any tax liabilities and tax credit amounts accurately. Comprehensive support for all your tax filing requirements.

Easy e-filing

Designed to be user-friendly. With a simple, easy-to-use interface, you can complete the entire filing process in a matter of minutes. Stress-free tax filing experience that saves you time and effort.

Ready to simplify your quarterly payroll tax filing?

E-file your quarterly payroll tax form with the IRS using TaxZerone and get stay tax

Frequently Asked Questions

1. What is Form 941, and who needs to file it?

2. What are the deadlines for filing Form 941?

- Q1 (January to March): Deadline - April 30

- Q2 (April to June): Deadline - July 31

- Q3 (July to September): Deadline - October 31

- Q4 (October to December): Deadline - January 31

3. Can I file Form 941 electronically?

4. What should I do if I discover an error after filing Form 941?

5. What happens if I miss the deadline for filing IRS Form 941?

6. What are the penalties for not filing Form 941 on time?

| No. of days your deposit is late | Amount of the penalty |

|---|---|

| 1-5 calendar days | 2% of your unpaid deposit |

| 6-15 calendar days | 5% of your unpaid deposit |

| More than 15 calendar days | 10% of the unpaid deposit |

| More than 10 calendar days after the date of your first notice or letter or The day you get a notice or letter for immediate payment | 15% of your unpaid deposit |

Learn more about Form 941 penalties for not filing or not paying the taxes.

7. What changes have been made to Form 941 for the 2025 tax year?

- Social Security Tax: 6.2% for employees and employers, with a wage base limit of $176,100.

- Medicare Tax: 1.45% each for the employee and employer, with no wage base limit.

- Household & Election Workers: Social Security and Medicare taxes apply to household workers earning $2,800 or more in cash wages and election workers earning $2,400 or more in cash or equivalent compensation.

8. How to sign when filing 941 electronically?

- Practitioner PIN Signature Method—Form 8879

- Taxpayer Selection of PIN: The ERO contacts the taxpayer to choose a 5-digit PIN. The taxpayer can authorize the ERO to input the PIN or enter it directly.

- Completion of Form 8879-EMP: The ERO completes the form with their 11-digit PIN (6-digit EFIN + 5 numeric characters) and the taxpayer’s 5-digit PIN. The ERO must sign the form.

- Retention and Transmission: Retain the signed form for three years, provide a copy to the taxpayer, and do not send it to the IRS.

- Scanned Form 8453 Signature Method

- Signing Form 8453-EMP: The entity's authorized signer signs Form 8453-EMP.

- Scanning and Attaching: Scan the signed form and attach it as a PDF to the electronic return.

- Retention: Retain a copy of the signed form, but do not mail it to the IRS.

- Reporting Agent PIN Signature Method—Form 8655

- Obtaining a Reporting Agent PIN: Apply for a five-digit PIN through the IRS e-File application process.

- Submitting Form 8655: Authorize the Reporting Agent to sign the client’s return with the five-digit PIN.

- 94x Online e-Filer Signature Method (IRS Authorized Signer)

- Registration: The Owner or Principal Officer submits a 94x Online Signature PIN Registration Application using IRS Approved E-FIling software at least 45 days before the return due date.

- Receiving the PIN: The IRS issues a 10-digit 94x Online Signature PIN for signing 94x family tax returns through approved software.

9. What is Schedule B on Form 941?

- Federal income tax withheld from employees' pay

- Both the employer and employee share of social security and Medicare taxes

10. How to Claim Payroll Tax Credit for Increasing Research Activities?

- Eligibility Check:

- Ensure your small business qualifies for the research activities credit. Typically, this applies to businesses with gross receipts of less than $5 million for the current year and no gross receipts for any tax year before the five-year period ending with the current tax year.

- Calculate the Research Credit:

- Determine your research credit based on qualifying research expenses. The IRS provides guidelines for calculating this credit.

- Complete Form 8974:

- Fill out Form 8974, "Qualified Small Business Payroll Tax Credit for Increasing Research Activities." This form determines the portion of your research credit that can be applied against your payroll tax liability.

- Filing with TaxZerone:

- Use TaxZerone to complete your 2025 Form 941. TaxZerone simplifies the process by guiding you through each step.

- Attach Form 8974:

- Ensure that Form 8974 is properly completed and attached to your Form 941. In TaxZerone, you will be prompted to attach Form 8974 during the filing process.

- Enter the Credit on Form 941:

- On Form 941, enter the amount from Form 8974 on Line 11 (credit for qualified small business payroll tax credit for increasing research activities).