E-file Employment Tax Forms with the IRS

Save time and reduce errors in your employment tax filings with our secure and user-friendly e-filing solution.

File Employment Tax Forms Online

with the IRS using TaxZerone

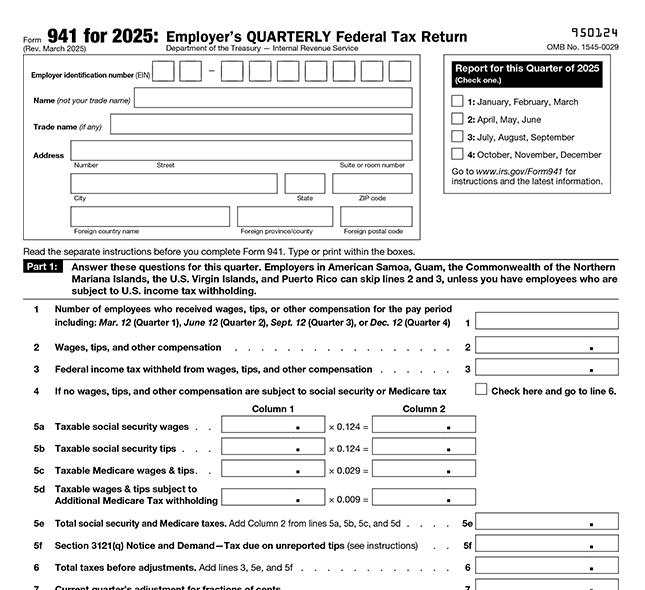

Form 941

Employer's Quarterly Federal Tax Return. Report employment taxes paid for the quarter

$6.99

Form 940

Employer's Annual Federal Unemployment (FUTA) Tax Return. Report your annual Federal Unemployment Tax Act (FUTA) tax.

$6.99

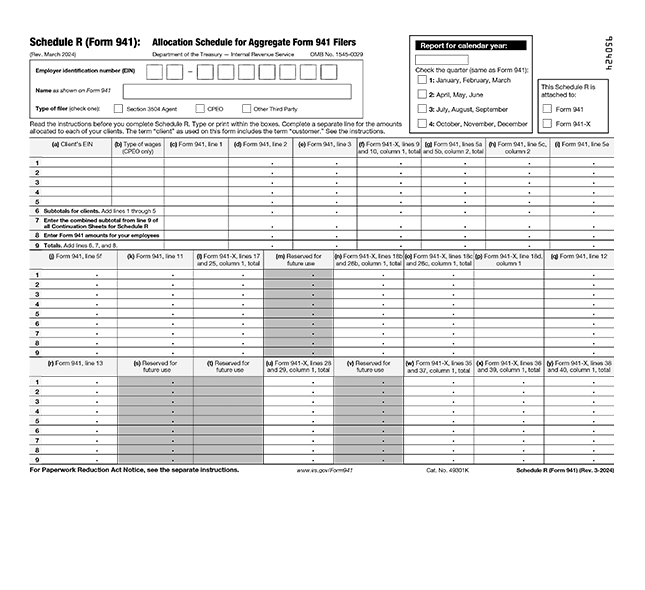

Form 941 Schedule R

Form 941 Schedule R: Employer's Quarterly Federal Tax Return Schedule R to report and allocate aggregate employment tax liabilities.

$9.99

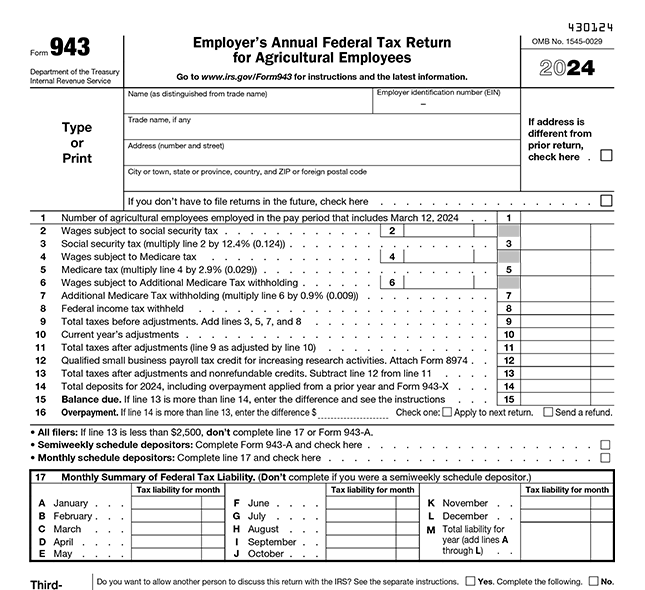

Form 943

Employer's Annual Federal Tax Return for Agricultural Employees. Report employment taxes for farm workers.

$6.99

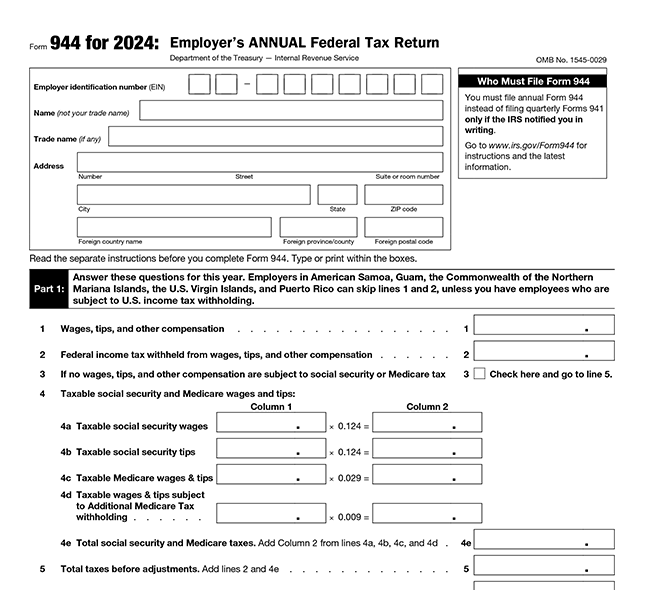

Form 944

Employer's Annual Federal Tax Return. Report annual employment taxes if you qualify for annual filing based on a lower payroll.

$6.99

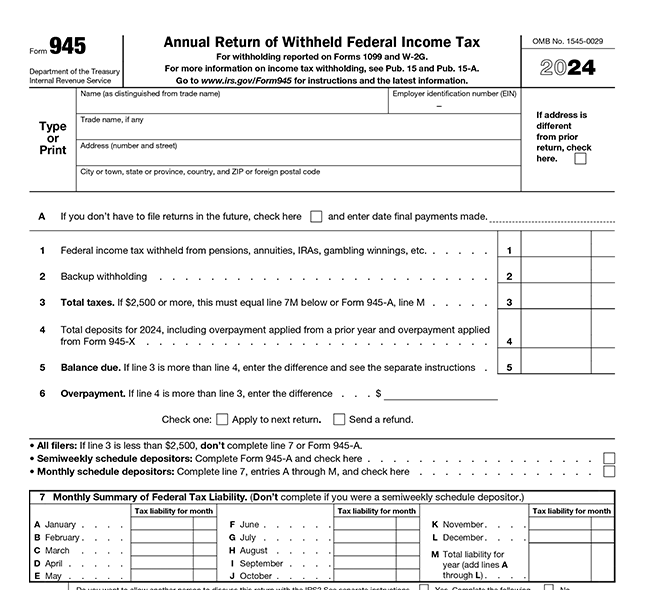

Form 945

Annual Return of Withheld Federal Income Tax. Report income tax withholding on nonpayroll items.

$6.99

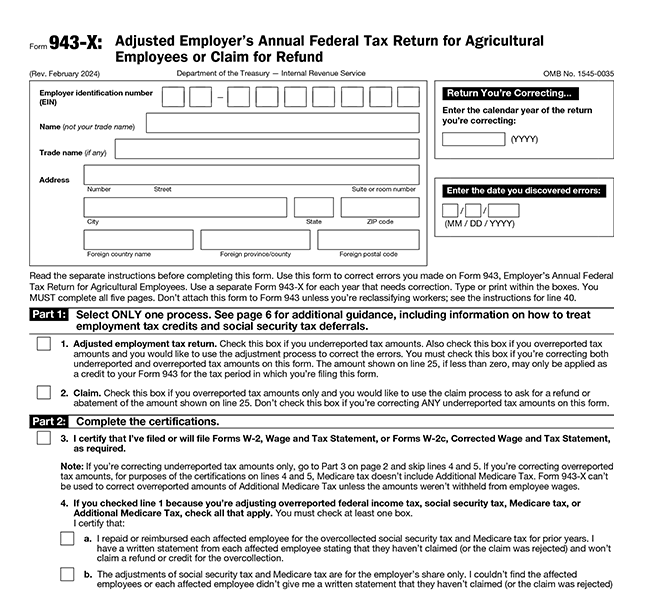

Form 943-X

Correct any errors on previously filed Form 943. Used to amend the agricultural employment tax return. if you qualify for annual filing based on a lower payroll.

$6.99

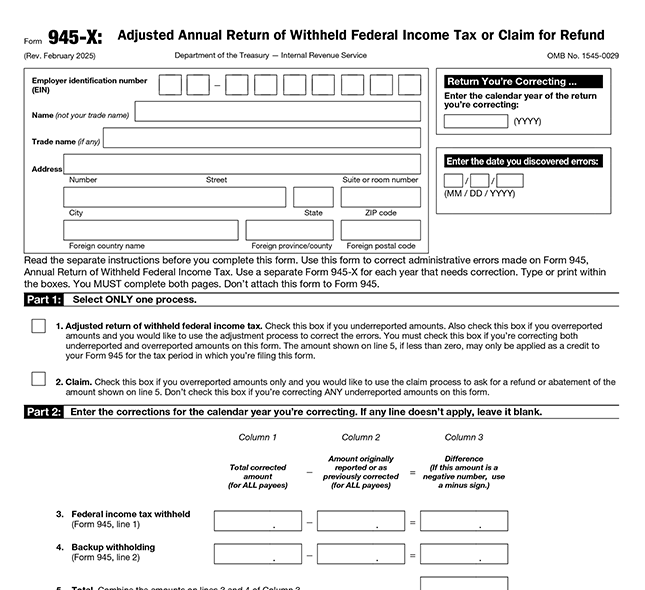

Form 945-X

Correct errors in a previously filed Form 945. You must amend the Annual Return of Withheld Federal Income Tax by filing a correction form.

$6.99

Form 94x On-Line Signature PIN

Apply for Form 94x On-Line Signature PIN to e-File Employment Tax Forms. Get a 10-digit signature PIN to e-File 94x Tax Forms.

FREE

How to e-file IRS employment tax forms for

your organization using TaxZerone?

Follow the simple steps below to e-file IRS employment forms.

Select the form you want to file

Fill out the form information

Review and transmit the form to the IRS

Get notified when the IRS accepts your form.

Ready to file employment taxes online?

Reasons to choose TaxZerone for employment tax e-filing

Choose TaxZerone for employment tax e-filing and experience a seamless, hassle-free process.

Easy e-filing

An intuitive and user-friendly platform that makes e-filing employment taxes simple and easy. Complete your filings quickly and accurately, even if you're not a tax expert.

Guided filing interface

We'll walk you through every step, prompting you for the necessary information and eliminating any guesswork. You'll feel confident knowing you're completing your tax filings correctly.

Smart IRS validations

Our system automatically checks your return for errors and inconsistencies and helps you avoid costly errors and IRS penalties. You can file with confidence, knowing your information is accurate.

Quick & secure

Experience a fast e-filing process and a secure environment. Stay assured that your data is protected through advanced encryption and security measures.

Instant IRS updates

You're always in the know. No more waiting anxiously for confirmation. We keep you informed every step of the way. You'll receive notifications as soon as the IRS processes your return.

Free retransmission of rejected returns

If your employment tax return is rejected, don't worry – we offer free retransmission. We'll help you identify and correct the issues and ensure your filings are accepted without additional charges.

Ready to Simplify Your Employment Tax Filing?

File your employment taxes quickly and confidently. Get started now and experience the TaxZerone advantage.

Frequently Asked Questions

1. What is employment tax, and who is required to file it?

2. Can I e-file employment tax returns with the IRS?

Yes, the IRS also recommends e-filing of employment tax returns. You can e-file tax returns using IRS-authorized e-file providers like TaxZerone.