Time left to file before the deadline (Feb 02, 2026):

E-File Form 1095-C for the Tax Year 2025

Simplify ACA compliance by filing Forms 1095-C and 1094-C effortlessly. TaxZerone's secure e-filing platform ensures accurate IRS submission and provides hassle-free employee copy distribution, saving you time and effort.

Affordable Pricing

Start at just $2.49 and goes as low as $0.59 per form!

For your return volume

What needs to be filled?

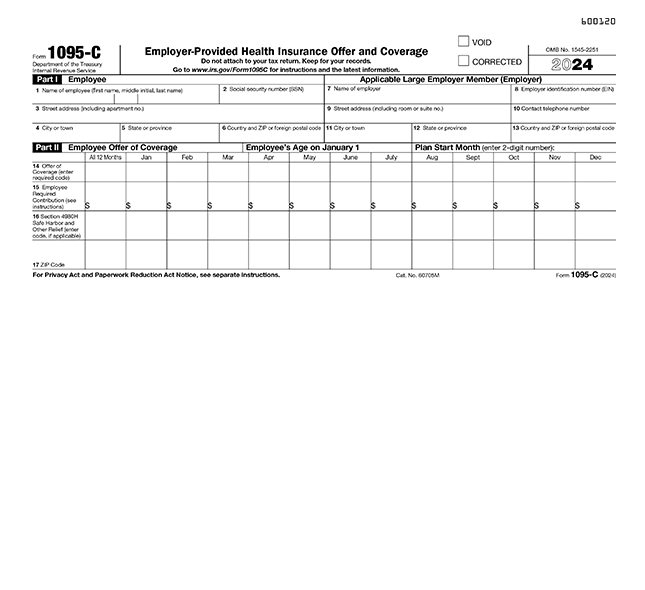

- Form 1095-C: Employer-Provided Health Insurance Offer and Coverage

- Form 1094-C: Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns

Why File 1095 C Form?

Report Employer Insurance

Report the employer-provided health insurance and coverage provided to their employees to the IRS

Compliance with IRS

File your Form 1095-C along with Form 1094-C to stay compliant with IRS

Avoid Penalties

Avoid unwanted financial troubles by filing form 1095-C along with 1094-c on time

Simplify your 1095-C forms filing in just Three steps

Below are the simple steps to file Form 1095-C

Step 1: Enter Details in Forms

Provide information about the employer in Form 1094-C and details of the responsible individual in Form 1095-C.

Step 2: Review and Correct Errors

Review your filing to ensure all information is accurate. Submit the form to the IRS.

Step 3: Send Employee Copies

Deliver the employer copies using ZeroneVault or send them via postal mail.

Completing Form 1094-C and 1095-C can now be done in minutes

E-File NowChoose TaxZerone for IRS 1095-C E-Filling

Features of TaxZerone make Form 1094-C and 1095-C Filing simple and secure

IRS-Authorized

TaxZerone is an IRS-authorized provider, ensuring your Form 1094-C/1095-C filings comply with all tax regulations and data security standards for a safe experience.

Accurate Filing

With our advanced validation system, TaxZerone minimizes errors, ensuring that every filing is accurate and compliant with IRS requirements.

On-Screen Help

Our step-by-step guidance makes filling out forms easier than ever. Each field is explained clearly, so you can complete your filing confidently.

Instant Notifications

Stay informed throughout the process. Receive real-time updates on your filing status, including confirmations and IRS acceptance notifications.

Easy E-Filing

TaxZerone’s user-friendly platform allows you to file quickly and efficiently, saving you time and reducing stress.

Efficient Electronic Delivery

Deliver recipient copies securely via ZeroneVault or traditional postal mail for peace of mind. Ensure compliance and privacy with our trusted delivery options.

Lowest Price Guarantee

Get the best value with TaxZerone’s affordable pricing. No hidden fees—just great service and unbeatable value.

Secure and Reliable

Your sensitive data is protected with the latest security measures, so you can file with confidence knowing your information is safe.

Dedicated Customer Support

Our team of experts is here to assist you every step of the way, ensuring a smooth and stress-free filing experience.

Understanding Forms 1095-C and 1094-C:

Employer Health Coverage Reporting

Form 1095-C and Form 1094-C are part of the reporting requirements under the Affordable Care Act (ACA) for applicable large employers (ALEs). Here's a detailed explanation:

| Form 1095-C | Form 1094-C |

|---|---|

| Purpose: Form 1095-C is used to report information about health insurance coverage provided to employees. Specifically, it informs both the IRS and employees about:

Employers must furnish a copy of Form 1095-C to each full-time employee, regardless of whether they accepted or declined the coverage. | Purpose: Form 1094-C serves as a transmittal form, meaning it summarizes and transmits the information from the accompanying Form 1095-Cs to the IRS. It provides details about the employer, including:

ALEs (employers with 50 or more full-time employees, including equivalents) must file this form along with all Form 1095-Cs they are submitting for their employees. |

Deadline for filing Form 1095-C

Send Recipient Copies

Deadline: March 02, 2026

Ensure timely delivery of recipient copies through ZeroneVault for secure electronic sharing, or choose postal mail.

File with the IRS (e-file)

Deadline: March 31, 2026

Submit your Form 1094-C and 1095-C electronically.

File with the IRS (paper)

Deadline: March 02, 2026

Mail your Forms 1094-C and 1095-C if filing on paper.

Additional Time to File? Request an Extension

Get additional time to file or send recipient copies by requesting an extension below.

Form 8809

Request an Extension to File Information Returns

- Need additional time to file ACA forms? File Form 8809 online to receive an automatic 30-day extension to submit 1095 c to the IRS.

Form 15397

Request an Extension to File Information Returns

- Need additional time to furnish ACA forms to recipients? File Form 15397 to request a one-time 30-day extension to furnish 1095 c recipient statements.

File Extension in Mins

Ready to simplify your 1095-C Forms FIling with just Three simple steps

Filing Form 1095-C online has never been more convenient. With TaxZerone, you can:

- File quickly and accurately.

- Simplify the process with a bulk upload.

- Benefit from the most competitive pricing in the industry.

- Ensure compliance with IRS regulations.

Get started today and complete your 1095-C Forms in just 3 simple steps!

Deliver Recipient Copies of Form 1095-C

TaxZerone makes it easy to deliver Form 1095-C copies to your recipients on time.Choose the delivery method that works best for your business:

Secure Delivery via ZeroneVault

Send recipient copies electronically through ZeroneVault, a safe and user-friendly platform.

- Recipients can access their forms immediately, with no need for printing or mailing.

- ZeroneVault ensures the protection of sensitive data, so you can share information with confidence.

Traditional Postal Mailing

Prefer a paper copy? TaxZerone also offers postal mailing services.

- Recipient copies will be delivered promptly, helping you stay compliant with IRS deadlines.

- Save time and avoid the hassle by letting TaxZerone take care of the mailing process for you.

Frequently Asked Questions

1. What is Form 1094-C?

2. What is Form 1095-C?

Form 1095-C is used to report details about offers of health coverage and employee enrollment in health coverage to both the IRS and the employee. The employer must complete this form separately for each full-time or full-time equivalent employee.

3. What is ALE?

- If a company had an average of 50 or more full-time (or equivalent) employees last year, it's an ALE for the current year.

- A new company is considered an ALE if it expects to and actually does employ 50 or more full-time (or equivalent) employees on business days during the current year.

- Employers with seasonal workers might have a special rule to determine ALE status. Check the final IRS regulations under section 4980H for details.

4. What is MEC?

Minimum Essential Coverage (MEC) refers to health coverage that satisfies the requirements of the Affordable Care Act (ACA). In this case, MEC includes coverage from an eligible employer-sponsored plan. An individual coverage Health Reimbursement Arrangement (HRA) is considered both a self-insured group health plan and an eligible employer-sponsored plan.

5. Can Form 1094-C be filed separately?

Yes, Form 1094-C can be submitted separately, but only if you are correcting the Authoritative Transmittal. When updating the Authoritative Transmittal information, you should file Form 1094-C by itself, marking the “CORRECTED” box.

6. Can Form 1095-C be filed separately?

No, Form 1095-C cannot be filed separately when making corrections. Whenever you file a corrected Form 1095-C, you must also file Form 1094-C along with it. Form 1094-C is used to transmit the corrected Form 1095-C to the IRS, and it should be filed even if you're only correcting Form 1095-C. Remember, a copy of the corrected form 1095-C must be given to the employee

7. When is the last date to file form 1095-C?

The deadline for e-filing Form 1095-C is March 31, 2026. However, it is important to provide recipient copies to employees before March 02, 2026. If you are submitting the form by paper, you must complete the filing before March 02, 2026. These deadlines are essential to ensure compliance with IRS requirements.