E-File Form 1095-B for Tax Year 2024 Made Simple

Simplify ACA compliance by filing Forms 1095-B and 1094-B with ease. TaxZerone’s secure e-filing platform ensures your IRS submissions are accurate and employee copies are distributed quickly, saving you time and effort.

Affordable Pricing

Start at $2.49 and goes as low as $0.59 per form!

For your return volume

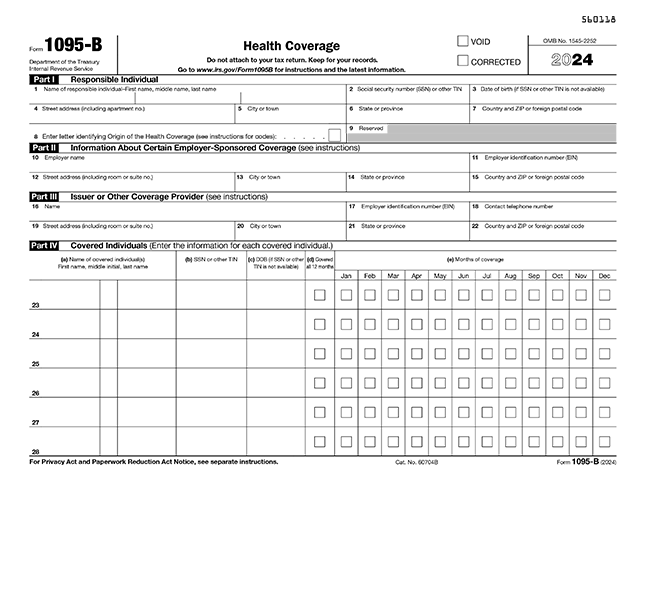

What needs to be filled?

- Form 1095-B: Health Coverage Information Returns

- Form 1094-B: Transmittal of Health Coverage Information Returns

Why File Form 1095-B?

Report Health Insurance

Report the individual health insurance provided by insurance companies, Employer’s self-insured group health plans, Government-Sponsored Programs

Compliance with IRS

File your form 1095-B along with form 1094-B and send recipient copies on time to stay in compliance with the IRS

Avoid Penalties

It’s important to file Form 1095-B along with Form 1094-B to the IRS and send out recipient copies on time to avoid penalties and unnecessary financial strain.

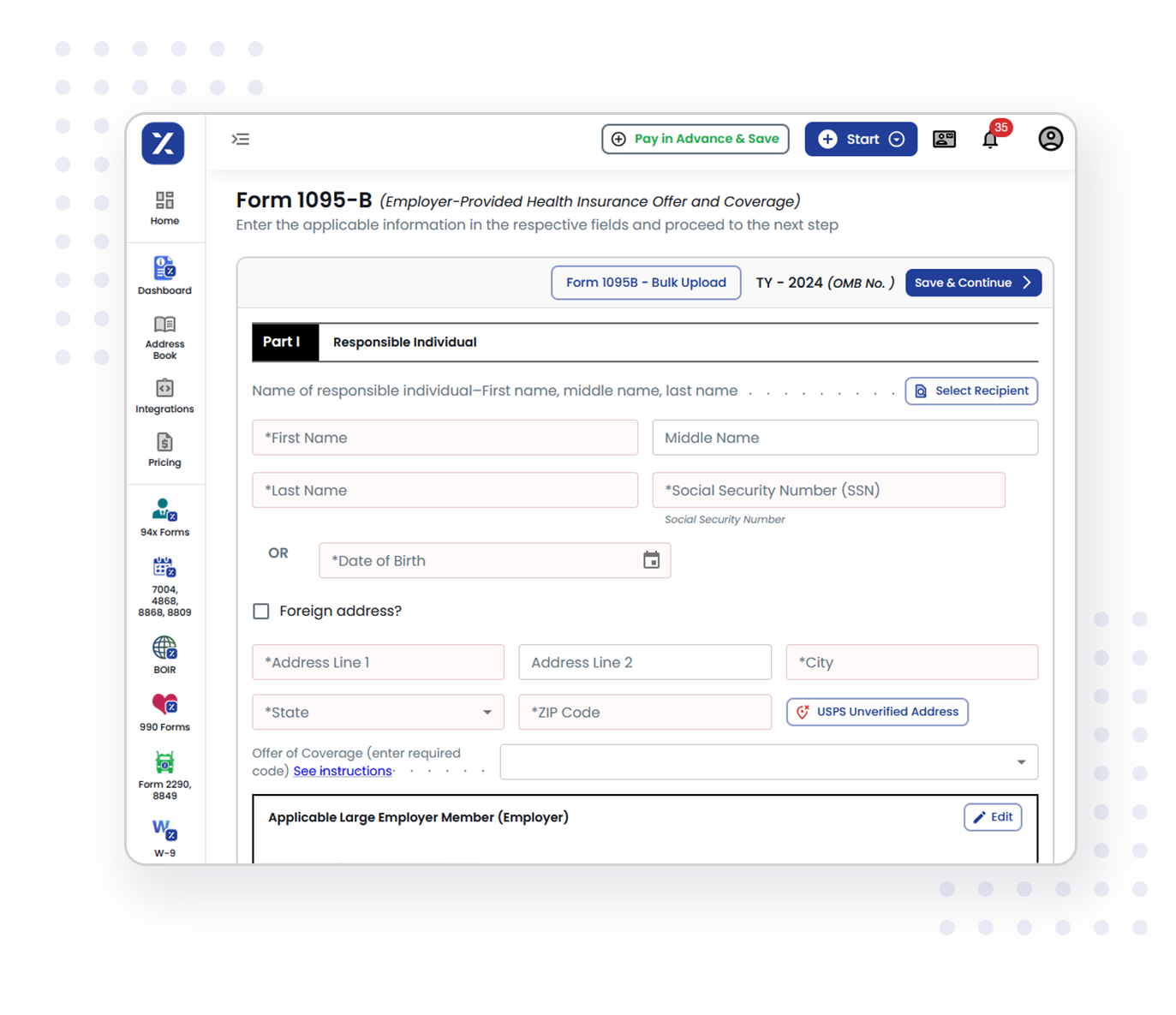

Simplify your 1095-B form filing in just Three steps

Below are the simple steps to file Form 1095-B

Step 1: Enter Details in Forms

Provide information about the insurance provider in Form 1094-B and details of the responsible individual in Form 1095-B.

Step 2: Review and Submit

Carefully review your filing to ensure all information is accurate. Submit the form to the IRS

Step 3: Send Recipient Copies

Deliver the recipient copies using ZeroneVault or send them via postal mail.

You can now complete Form 1095-B and 1094-B in just minutes.

E-File NowChoose TaxZerone for a simple and reliable way to e-file your IRS Form 1095-B.

Features of TaxZerone make Form 1095-B and 1094-B Filing simple and secure

IRS-Authorized Provider

TaxZerone is an IRS-authorized e-filing provider, ensuring your Form 1095-B/1094-B submissions meet all necessary tax regulations and data security standards.

Accurate Filing

With TaxZerone’s advanced validation system, we ensure your filings are precise and fully compliant with IRS requirements, reducing the risk of errors.

Step-by-Step Assistance

Our clear, step-by-step guidance simplifies the filing process. Each field is explained in detail, helping you file confidently and accurately.

Real-Time Updates

Stay informed with instant notifications at every stage of your filing. Receive timely updates and IRS acceptance confirmations as soon as your forms are processed.

Effortless E-Filing

TaxZerone’s user-friendly platform lets you file quickly and efficiently, saving valuable time and minimizing stress throughout the process.

Secure Electronic Delivery

Send recipient copies safely using ZeroneVault or traditional mail, ensuring privacy and compliance with reliable, trusted delivery options.

Affordable Pricing

TaxZerone offers competitive pricing with no hidden fees. Enjoy great service at the best value without compromising on quality.

Secure and Reliable

Your sensitive information is safeguarded with the latest security measures, so you can confidently file knowing your data is protected.

Expert Support

Our customer support team is here to assist you at every step, providing expert guidance for a smooth and hassle-free filing experience.

Understanding Forms 1095-B and 1094-B:

Form 1095-B and Form 1094-B are part of the reporting requirements under the Affordable Care Act (ACA)for Health insurance providers. Here's a detailed explanation:

| Form 1095-B | Form 1094-B |

|---|---|

| Purpose: Form 1095-B is used to report information to the IRS and taxpayers about individuals who are covered by minimum essential coverage (MEC). This helps to determine eligibility for the premium tax credit under the Affordable Care Act (ACA). Who Must File: Any entity that provides minimum essential coverage must file Form 1095-B. This includes health insurance issuers, employers offering self-insured health plans, and certain government-sponsored programs. Employers offering self-insured coverage to nonemployees may also file Form 1095-B. | Purpose: Form 1094-B serves as a transmittal form that accompanies multiple Form 1095-B filings to the IRS. It provides summary information about the filings, including the total number of Form 1095-B returns submitted. Who Must File: Entities required to file Form 1095-B must also file Form 1094-B to transmit their filings to the IRS. This is the case for health insurance issuers, employers with self-insured health plans, and other entities providing MEC. |

Deadline for filing Form 1095-B

Send Recipient Copies

Deadline: March 3, 2025 Ensure timely delivery of recipient copies via ZeroneVault for secure electronic sharing or opt for traditional postal mail for delivery.

File with the IRS (e-file)

Deadline: March 31, 2025 Submit your Form 1094-B and Form 1095-B electronically to the IRS for efficient and secure filing.

File with the IRS (paper)

Deadline: February 28, 2025 Mail your Form 1094-B and Form 1095-B to the IRS if you are filing on paper.

Simplify Your 1095-B Filing in Just Three Steps

Filing Form 1095-B online is now easier than ever. With TaxZerone, you can:

- File quickly and accurately.

- Enjoy industry-leading competitive pricing.

- Streamline the process with bulk upload features.

- Stay compliant with IRS requirements.

Get started today and complete your 1095-B Forms iin just 4 simple steps!

Deliver Recipient Copies of Form 1095-B

TaxZerone makes it easy to deliver Form 1095-B copies to your recipients on time.Choose the delivery method that works best for your business:

Secure Delivery via ZeroneVault

Send recipient copies electronically through ZeroneVault, a safe and user-friendly platform.

- Recipients can access their forms immediately, with no need for printing or mailing.

- ZeroneVault ensures the protection of sensitive data, so you can share information with confidence.

Traditional Postal Mailing

Prefer a paper copy? TaxZerone also offers postal mailing services.

- Recipient copies will be delivered promptly, helping you stay compliant with IRS deadlines.

- Save time and avoid the hassle by letting TaxZerone take care of the mailing process for you.

Frequently Asked Questions

1. What is Form 1094-B?

2. What is Form 1095-B?

Form 1094-B is a transmittal form submitted to the IRS along with Form 1095-B filings. It acts as a cover sheet, summarizing the total number of 1095-B forms filed and providing essential details about the filer. This form ensures the accurate submission of health coverage reports required under the ACA.

3. What is MEC?

Minimum Essential Coverage (MEC) is health insurance that meets the standards set by the Affordable Care Act (ACA). MEC includes coverage provided through an eligible employer-sponsored plan. Additionally, an individual coverage Health Reimbursement Arrangement (HRA) qualifies as both a self-insured group health plan and an eligible employer-sponsored plan.

4. How to Correct Form 1095-B?

To correct Form 1095-B, complete a new form, check the "CORRECTED" box, and submit it with Form 1094-B (no need to correct Form 1094-B). Send the corrected form to the recipient. Make sure to file the correction as soon as you spot the error.

5. When is the last date to file form 1095-B?

The deadline for e-filing Form 1095-B is March 31, 2025. However, it is important to provide recipient copies to employees before March 3, 2025. If you are submitting the form by paper, you must complete the filing before February 28, 2025. These deadlines are essential to ensure compliance with IRS requirements.