E-file Form 1097- BTC for the Tax year 2024

Report Bond Tax Credits to IRS and issue a copy to bondholder or investor easily. TaxZerone simplifies e-filing and securely delivers recipient copies with efficiency.

Affordable Pricing

Starting at just $2.49, with prices as low as $0.59 per form for bulk filings

For your return volume

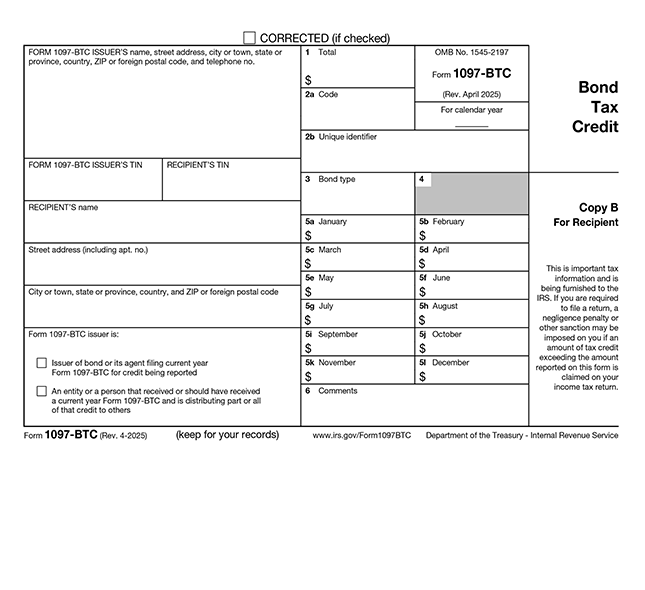

Form 1097-BTC

Form 1097-BTC is a tax form where the issuer of bond tax credit or any agent such as broker, nominee, mutual funds and partnerships are currently distributing credits to investor or bondholder must report to IRS annually and send a copy to recipients on quarter basis.

Details required to file Form 1097-BTC

- Issuer’s Detail

- Issuer’s Name

- Taxpayer Identification Number (TIN)

- Issuer’s Address

- Recipient’s Detail

- Recipient’s Name

- Taxpayer Identification Number (TIN)

- Recipient’s Address

- Form 1097-BTC information

- Unique Identifier Number of bondholder

- Total credits

- Monthly credits

File Form 1097-BTC in just 3 simple steps

Follow these steps to file your IRS tax form accurately

Enter the required details

Enter the required details of issuer, recipients, and credit details of every month

Review and submit the Form

Ensure the provided information is accurate and submit the form to IRS

Send recipient copies

Send recipient copies to bondholders securely via Zeronevault or Postal mail.

Choose TaxZerone for Filing 1097-BTC

IRS authorized

TaxZerone is authorized by IRS and ensures that Form 1097-BTC are filed accurately to comply with IRS tax regulations.

Simple filing

Filing made simple with our

easy-to-use platform. Filers can file Form 1097-BTC in just three steps.

Smart Validations

Our built-in Checks will analyze the form for any errors during submission. It will reduce the risk of getting rejections.

Secure Electronic Delivery

Send recipient copy easily and securely via ZeroneVault or traditional mail using TaxZerone

On-Screen help

Our on-screen help will give a detailed explanation about the fields which will be easier for filers during e-filing.

Friendly Support

Our friendly support team is here to help you via Phone (English &Spanish), Email and Chat.

Why file Form 1097-BTC?

Claim Credits

Investors who receive tax credits from bond investments need this form to properly report and claim their credits on their federal tax returns.

Comply with IRS

File your 1097-BTC and send recipient copies on time to stay in compliance with the IRS.

Avoid Penalties

It is important to file Form 1097-BTC to the IRS and send copies to recipient before the deadline to avoid penalties.

Important Deadline for filing Form 1097-BTC

The deadline to file Form 1097-BTC with the IRS is February 28 for paper filing and March 31 for electronic filing. The recipient copies must be furnished quarterly. The deadline is 15th day of the second calendar month after the end of the quarter.

| Quarter | Reporting period | Recipient deadline |

|---|---|---|

| 1st Quarter | January to March | May 15 |

| 2nd Quarter | April to June | August 15 |

| 3rd Quarter | July to September | November 15 |

| Annual/4th Quarter | October to December | February 15 |

Frequently Asked Questions

1. What is Form 1097-BTC?

Form 1097-BTC is used to report tax credit distributed to each recipient by bond issuers or agents such as nominee, broker, mutual bond, etc.

2. What type of bond is reported on Form 1097-BTC?

The below mentioned bonds should be reported on this form.

- New clean renewable energy bonds

- Qualified energy conservation bonds

- Qualified zone academy bonds

- Qualified school construction bonds

- Clean renewable energy bonds

- Build America bonds (Tax Credit).

3. When is the deadline for Form 1097-BTC?

Paper filing: The last date to file this form to IRS using the paper filing method is February 28 for the calendar year tax credits are distributed.

Electronic Filing: The deadline to file the form electronically is March 31. This applies to the calendar year in which the tax credit was distributed.

For Recipients:

- Q1 (January to March) – May 15

- Q2 (April to June) – August 15

- Q3 (July to September) – November 15

- Q4 (October to December) – February 15

These dates may change due to weekends or federal holidays.