E-file IRS Tax Forms Securely & Accurately

File ALL Your IRS Forms:

Information Returns

W-2, 1099, W-2G, 1097, 5498, 3921, 3922, 1098, and 1095 Forms

Employment Tax Forms

941, 941-X, 941 Schedule R, 940, 943, 943-X, 944, 945, 945-X, 94X PIN Request

Exempt Org. Forms

990-N, 990-EZ, 990, 990-PF, 990-T, 5227, CA 199

Business Tax Forms

1120-S & 1065

Extension Forms

7004, 4868, 8868, 8809, 15397

Excise Tax Forms

2290, 8849, 2290 Amendments

Essential Forms

Form W-9, Form W-8BEN, Form 8655, BOI Report

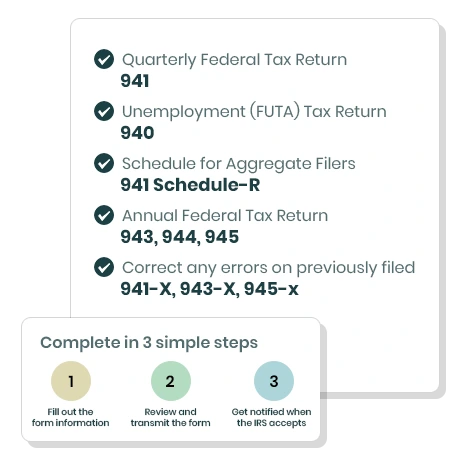

Fast & Easy: Submit your return in just 3 simple steps.

Simplify Your Taxes

Easily file your IRS forms with confidence by using TaxZerone

TaxZerone is an authorized e-file service provider that supports a wide range of IRS forms.

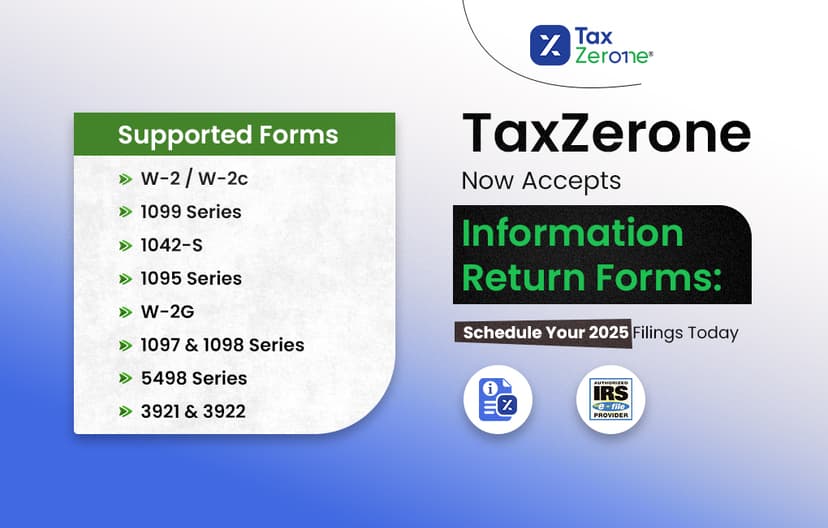

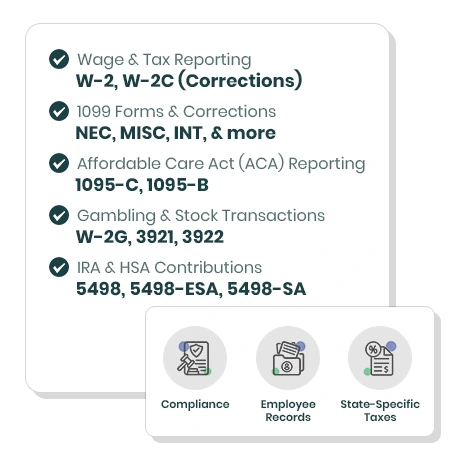

Information Returns

W-2, W-2C, 1099, 1098, 1095, 3921, 3922, 5498, 1097-BTC and W-2G Forms

E-File All Your Information Returns in One Place

TaxZerone provides a secure IRS and SSA-authorized e-filing platform for reporting wages, payments, healthcare coverage, investments, and retirement contributions.

We Support:

- W-2 & W-2C

- 1099 Forms

- 1098 Forms

- 5498 Forms

- 3921 & 3922 Form

- 1097-BTC Form

- ACA (1094/95) Forms

- 1042-S Form

- W-2 State Filing

- 1099 State Filing

- W-2G Form

- 1099 Corrections

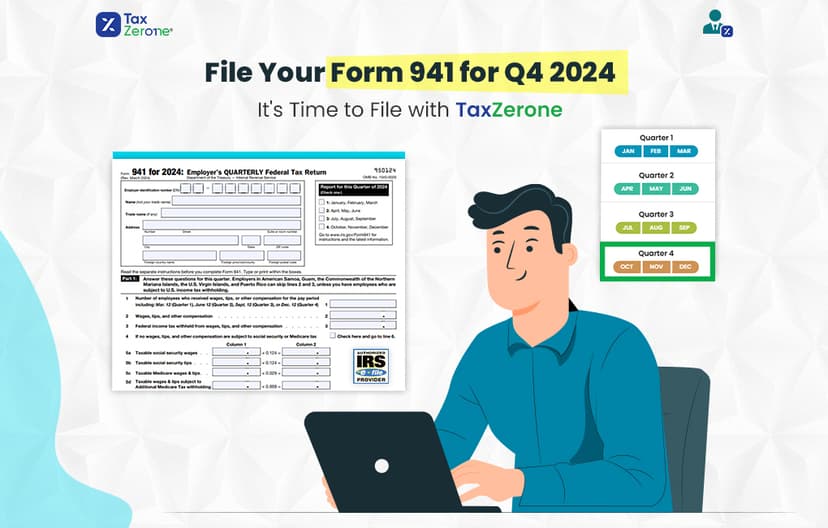

Employment Tax (94X) Forms

941, 940, 943, 944, 945 & Related Amendment Forms

Payroll Tax Filing Made Simple

Designed for small businesses, payroll providers, and tax professionals handle quarterly, annual, and amended employment tax filings through one centralized platform for federal payroll tax reporting.

We Support:

Tax Extension Forms

Form 7004, 4868, 8868, 8809 & 15397

Request Your Tax Extensions Online with Ease

TaxZerone allows individuals, businesses, exempt organizations, and transmitters to electronically submit IRS-approved extension requests when additional time is required to complete accurate filings.

We Support:

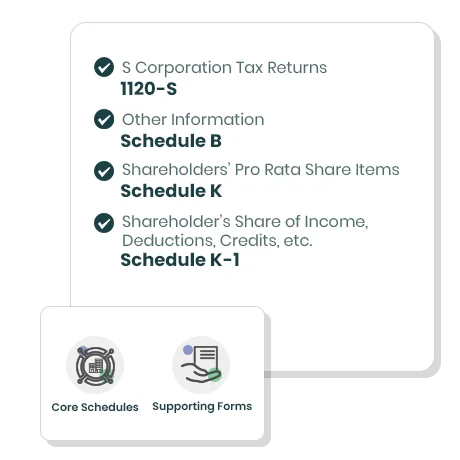

Business Tax Forms

1120-S & 1065

E-File Your S Corporation and Partnership Returns with Ease

File your S corporation or Partnership return, including Schedule K-1 forms for shareholders and partners, to report business income, deductions, credits, and ownership allocations accurately.

We Support:

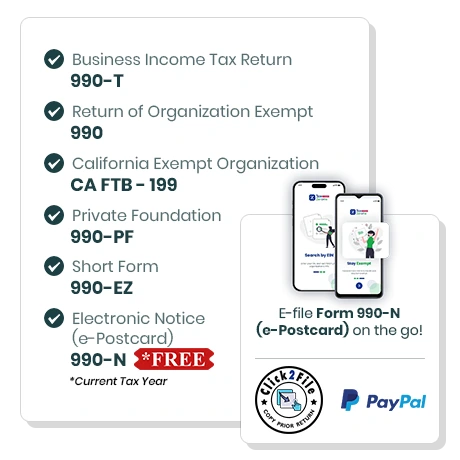

Exempt Org. (990 Series) Forms

990-N, 990-EZ, 990, 990-PF, 990-T, 5227, CA 199

Smart Online Filing for Tax-Exempt Organization

Nonprofits, charities, trusts, and other tax-exempt organizations can easily file their annual information returns. We support all exempt organization forms, state filing requirements, schedules, and related forms for FREE.

We Support:

Excise Tax Forms

Form 2290, Form 8849 (Schedule 6) & 2290 Amendments

File Your Heavy Vehicle Excise Taxes Online with Ease

Whether you operate a single truck or manage an entire fleet, TaxZerone makes HVUT filing simple and accurate. You can file, amend, or claim refunds online.

We Support:

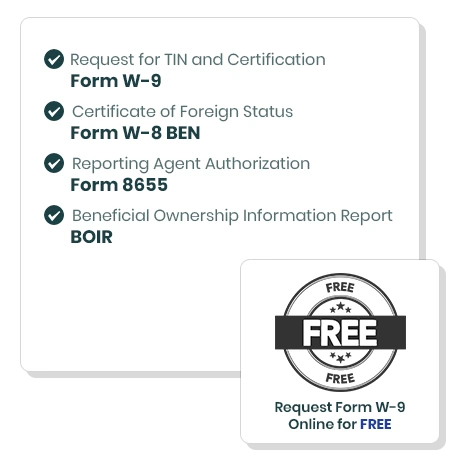

Essential Forms

Form W-9, Form 8655 & FinCEN BOI Report

Forms for Taxpayer Identification and Authorization

For businesses, individuals, reporting agents, and foreign entities, these forms simplify IRS and FinCEN reporting requirements, whether providing taxpayer information, authorizing reporting agents, or disclosing beneficial ownership.

Ready to experience the ease and convenience of filing your IRS forms with TaxZerone?

Simplify IRS form filing and ensure that your forms are filed accurately and on time. Sign up now and enjoy a hassle-free filing experience!

Explore our Resource Center to find complete instructions and due dates for all IRS tax forms

Simplify Your Filing Process with TaxZerone's Advanced Features

Complete your IRS forms without any hassles with the help of these advanced features.

Form-Based Filing

Our form-based filing interface ensures you complete all the necessary fields in less time.

IRS Form Validation

Our system checks your forms for errors and missing information based on IRS rules, reducing the risk of rejection.

Address Book

Your business and form information is stored securely for future use, ensuring quick and easy filing next time.

Forms History

Access your previous forms filed with TaxZerone easily so that you can track your filing history.

Free Retransmission

If your return is rejected, we offer free retransmission, so you can quickly fix any issues and resubmit at no additional cost.

Complete Security

We take security seriously and protect your personal and financial information with the latest encryption technology.

E-File Center for Efficient Tax Filings

Centralized location for managing all your tax filings. Manage tax returns filed with the IRS with ease, ensuring accuracy and compliance at every step.

Bulk Upload Options

Save time by uploading multiple tax return info in one go. Quickly import and process large batches of tax return data, reduce manual effort significantly, and increase productivity.

Multi-user support

Add various roles with different permissions to handle your filings. Allow one person to create a return, another to review it, and a third person to approve it for filing.

Try TaxZerone today and experience the ease of filing your IRS forms.

E-File NowSimple. Quick. Accurate.

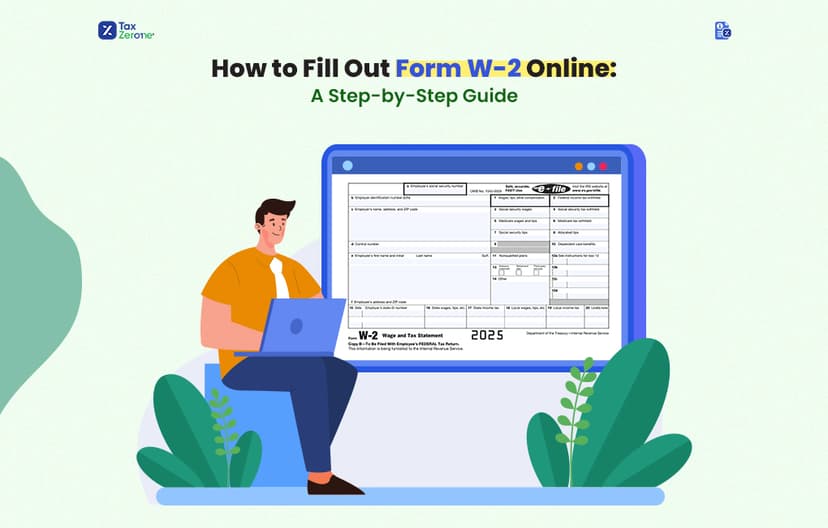

Easy as 1-2-3: Filing IRS Forms Made Simple with TaxZerone

Three simple steps to file your IRS forms easily and confidently.

Select the Form

Choose the form you need to file from our list of Extension, Excise truck tax, Nonprofit forms, Employment Tax and Information Returns.

Fill Out the Form

Enter your information on the form, and we’ll ensure you complete all the required fields accurately.

Transmit the Form

Once you've completed the form, simply transmit it to the IRS securely and quickly.

Hassle-free steps to complete your IRS form filing. Try it yourself.

Choose TaxZerone for Seamless IRS Form Filing and Real-time Updates

Here are the top 3 reasons to choose TaxZerone to e-file your IRS forms.

Easy E-Filing

We offer a user-friendly e-filing process that ensures you don't miss any crucial information. Our step-by-step approach makes filing your IRS forms a breeze.

IRS Authorized

TaxZerone is an authorized e-file service provider, so you can trust us to file your forms accurately and securely.

Real-Time Updates

With TaxZerone, you'll receive real-time updates on the status of your return, so you always know where you stand.

Our simple and secure e-filing process saves you time and effort so that you can focus on other things.

E-File NowSimple. Quick. Accurate.

Streamline Your Tax Filing Process with TaxZerone

Discover TaxZerone, an IRS-authorized e-file provider.

Hear what our customers have to say about us

FAQs

1. Why should I e-file IRS tax forms?

2. How does TaxZerone simplify e-filing?

3. What are the forms supported by TaxZerone?

- Excise tax forms

- Exempt Organization Forms

- Employment Tax Forms

- Extension Forms

- Business Tax Forms

- Information returns

- Essential Forms